Co-Written by Patrick Kirts

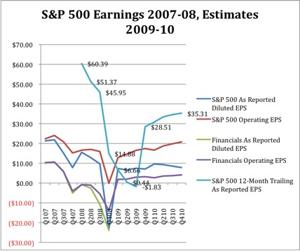

Standard and Poor’s is predicting that, for the first time, the S&P 500 will have a negative twelve-month trailing price-to-earnings ratio in the third quarter of 2009. The following chart compares five sets of data for the S&P 500 and its financial sector constituents, with actual earnings for 2007-8 and estimated earnings for 2009-10, in both as reported diluted earnings per share (with top-down estimates) and operating earnings per share (with bottom-up estimates).

While financials had negative earnings for over a year, the index as a whole did not really start to sink until the fourth quarter of 2008. Losses were sustained in several sectors that quarter, but none so heavy as in the financial sector, with losses of ($23.91) for the quarter—almost matching the diluted EPS of the entire index—and ($37.95) for the year, almost three times the losses per share of the next most damaged sector, discretionary consumer goods. We also note that, starting in the third quarter, but most pronounced in the fourth, operating earnings significantly diverge from reported earnings, reflecting the fact that many of the losses were due to a ballooning number of supposedly one-time charges, impairments, and write-downs. In addition, we see that the losses of the fourth quarter were drastic enough that the trailing 12-month diluted EPS does something rare in 2009: assuming the current index price, it drops to $0.44 in Q2, and then becomes negative in Q3, ($1.83), before a rally in Q4. We will return to these estimates, but first let’s look at another chart that more fully illustrates this price-to-earnings anomaly.

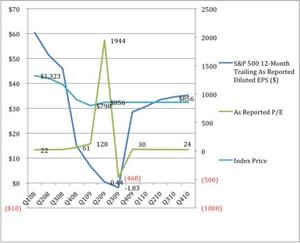

The left axis denominates the 12-month trailing as reported diluted earnings per share. The right provides a unit-neutral comparison of the as reported diluted price-to-earnings ratio and S&P 500 price. We see clearly the P/E disturbance caused by the effect of the fourth quarter 2008 losses on the trailing year. As earnings fall toward zero, the P/E first shoots up to 1944 (after slowly rising during 2009), and then just as dramatically falls to (468), a historic event.

Turning to Standard and Poor’s earnings estimates, we see that they expect corporate earnings to continue with a slow climb throughout 2009, leading to a significant rebound in the trailing P/E in the fourth quarter, once 2008 losses are completely purged from the system. A miraculous turnaround is not expected, and 2010 is poised to see some turbulence, with a retrenchment in the P/E and fluctuating earnings. A sober picture, to be sure, but nevertheless perhaps too optimistic.

The scenario presented here for 2009-10 seems to assume that, once the 2008 losses are absorbed, a sort of muted business-as-usual will take over. In Part II of S+P 500: There is NO P/E! we will analyze the validity of Standard and Poor’s outlook.

Disclosure: No Positions.