Market Outlook: Where to Now? by David I. Templeton

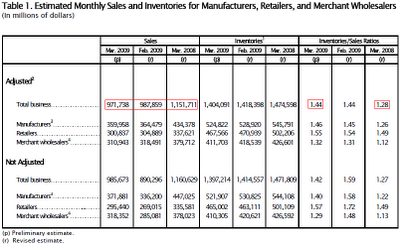

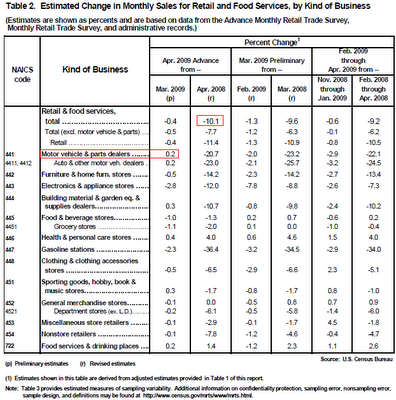

Wednesday's April retail sales release seems to be cited as the cause of today's market sell off. I am not sure the .4% decline in April is the only reason for the market pullback. Retail sales were expected to show a .1% increase so the April sales figure did fall short of the estimate.

(click to enlarge)

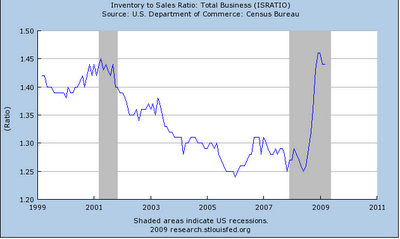

(click to enlarge)

I believe the slightly negative results contained in the above two economic data points provided the catalyst for the sell off. As noted in yesterday's post, stocks had advanced in a nearly uninterrupted pace since early March. The market needed to consolidate these recent gains.

(click to enlarge)

All of the above data points are rear view mirror-looking. On a going forward basis what might impact the direction of the market?

Investors still have large amounts of cash on the sidelines. A large number of these investors will use the pullback to add to equities. The market decline has resulted in investor's equity allocation to fall below target levels; consequently, this pullback could be short lived and a more significant contraction could occur in mid to late summer after the cash has been pulled off the sideline.

On a longer term basis, the yield curve suggests positive market returns ahead. I have written several earlier posts on the predictive power of the yield curve. Today, a post appeared at Crossing Wall Street that discussed market returns and the shape of the yield curve. Embedded in the post was a link to a Bloomberg article written by Caroline Baum (Dr. Yield Curve) titled Curve Watching Beats Room Full of Forecasters. It is an interesting article and I suppose, using the new terminology, could be called a green shoot.

It would have been nice to go all in on March 9th, but that activity goes against the emotional side of investor behavior. At this point in the cycle, being selective and focusing on high quality dividend paying stocks for the foundation of ones equity portfolio should pay off in the longer term.