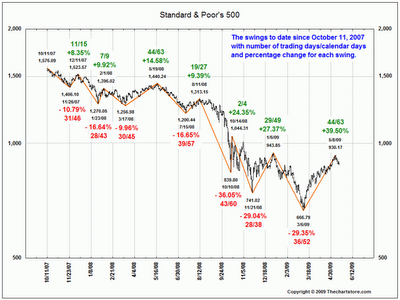

Great chart below from The Chart Store that illustrates just how volatile and seesaw-ish this market has been over the past 2 years. There have been rapid, massive declines and equally massive rallies. The current rally from the lows in March 2009 extends over 39%. Maybe we should highlight contrarian signals more often, as we did back in early March. Those signals we highlighted turned out to be a great barometer for a short-term turn in the markets.

Buy when there is blood in the streets and pessimism abounds. Sell/short when everyone is plunking money down in the market thinking they're invincible.

The ultimate question now is, what's up with the current action? Typical bear market rally? Foundation for something constructive? Time will tell.

(click to enlarge)