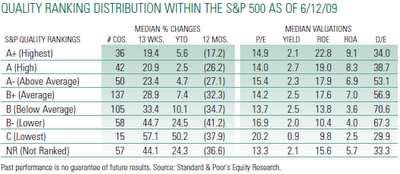

In an update on the performance of stocks based on their quality ranking, Standard & Poor's shows the higher quality rated stocks outperform in down markets. The short term downside to the outperformance in down markets is the highest quality stocks tend to lag the market when the market moves rapidly higher like the market performance since March 9, 2009.

As the below table notes, for the 12-months ending June 12, 2009, the A+, A and A- rated stocks have far outpaced the stocks rated B+ and lower.

As the below table notes, for the 12-months ending June 12, 2009, the A+, A and A- rated stocks have far outpaced the stocks rated B+ and lower.

(click to enlarge)

However, year to date in 2009, the lowest rated stocks in the S&P 500 Index have generated the higher return. At the end of the day though, what harms an investor's total return the most is the size of the loss incurred in down markets. Generally, if an investor loses less when the market contracts, they have a better chance of outperforming in the long run due to the fact they have more capital at work when the market recovers.

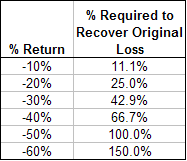

However, year to date in 2009, the lowest rated stocks in the S&P 500 Index have generated the higher return. At the end of the day though, what harms an investor's total return the most is the size of the loss incurred in down markets. Generally, if an investor loses less when the market contracts, they have a better chance of outperforming in the long run due to the fact they have more capital at work when the market recovers.The below table notes the return an investor needs in order to recover losses at various rates of return.

Source:

A Quest for Quality ($)

Sam Stovall, Chief Investment Strategist

Standard & Poor's, The Outlook

June 24, 2009