在观察了TD过去20十年的价格波动之后,我想用同样的方法来观察美股市场中的蓝筹股PH,PH和TD是不同国家市场中的股票,从事的行业也是完全不同,没有任何相关。

参考过去20年的股价波动,在每年的价格底部区域买入,持有二年到价格顶部区域时,

2000 77%

2001 52%

2002 127%

2003 113%

2004 70%

2005 129%

2006 101%

2007 18%

2008 179%

2009 259%

2010 71%

2011 119%

2012 89%

2013 54%

2014 45%

2015 115%

2016 156%

2017 ?

2000-2016年的均值是 104.35%,加二年分红和红利再投入大约是4-5%,综合回报均值是108%左右。

2017年的最低价格是140 x (1+2010-2016年的均值92.71%)= 92.07,2019的最高价可能会是269,目前的价格是170。

目前PH估值水平明显低于五年均值,所以下半年如果能回到均值水平,价格升幅会很大。

PH的长期投资回报率大致和TD相当,但是价格波动幅度要大得多。

巴菲特曾经说过如果自己管理小金额资金,可以做到一年50%的投资回报,从PH的价格波动,可以看到市场确实存在这样的机会。

2011年,老巴印度之行的谈话

“If you look at the typical stock on the New York Stock Exchange, its high will be, perhaps, for the last 12 months will be 150 percent of its low so they’re bobbing all over the place. All you have to do is sit there and wait until something is really attractive that you understand.”

“There’s almost nothing where the game is stacked more in your favor like the stock market”

“What happens is people start listening to everybody talk on television or whatever it may be or read the paper, and they take what is a fundamental advantage and turn it into a disadvantage. There’s no easier game than stocks. You have to be sure you don’t play it too often”

但是大幅度的价格波动除了带来机会以外,也带来了另一个问题,

The very liquidity of stock markets causes people to focus on price action. If you buy an apartment house, if you buy a farm, if you buy a McDonald's franchise you don't think about what it's going sell for tomorrow or next week, or next month, you think about how is this business going to do. But stocks with this huge liquidity suck people in and they turn what should be an advantage into a disadvantage." - 芒格

从实战结果看,少数人会像巴菲特说的那样从股市波动中获益,

“There is almost nothing where the game is stacked more in your favor like the stock market”

大多数人会像芒格说的那样,

But stocks with this huge liquidity suck people in and they turn what should be an advantage into a disadvantage.

谈谈美股Parker-Hannifin Corporation (PH)

(2019-01-06 09:31:28)

目前美国市场长期优秀蓝筹股市场估值性价比较高的股票有一大把,Parker-Hannifin Corporation (PH)是其中之一。

之所以想谈谈PH,因为几年以前就多次谈论过,而且有一位大千的网友在我的建议下写过一篇完整的投资分析,我曾经多次转贴过该篇投资分析。因为这是我们大千的网友写的,所以我们有一个更好的理由来探讨。

首先,过去5年,10年,20年,30年投资PH,都可以取得非常好的投资回报。参考老朽开始投资房产的时间,10万本金到今天大约是250万,要是每次金融危机时加一倍金融杠杆,现在也可以有1000万,理论上这个机会是存在的,在市场低迷时使用一倍金融杠杆的风险要小于出租房平均财务杠杆的风险。

Monday, April 6, 2015

大千网友的投资分析文章是写在2015年4月6号,在之后的2016年1月市场波动中(石油价格波动),PH与整体市场都出现了一个投资机会,在市场上涨过程中,PH的涨幅超过了100%,即使是到今天也有70%的涨幅。

目前PH的估值比长期均值水平低许多,已经显示了相当不错的性价比,在未来的市场波动中,很有可能再次出现入2016年1月这样级别的投资机会。

2011年,老巴印度之行的谈话

“If you look at the typical stock on the New York Stock Exchange, its high will be, perhaps, for the last 12 months will be 150 percent of its low so they’re bobbing all over the place. All you have to do is sit there and wait until something is really attractive that you understand.”

“There’s almost nothing where the game is stacked more in your favor like the stock market”

“What happens is people start listening to everybody talk on television or whatever it may be or read the paper, and they take what is a fundamental advantage and turn it into a disadvantage. There’s no easier game than stocks. You have to be sure you don’t play it too often”

在大千网友发表PH的投资文章之后,这是第2次市场出现投资机会,所以平均是1.5年一次重大投资机会,如果查看过去20年的股价波动,可以看出平均每二年有一次重大机会。房地产投资能够每二年出现一次重大投资机会吗?(至少50%的涨幅。),在今后二十年里,大致依然是每2年一次重大投资机会,房地产的投资机会能够达到相同的频率吗?PH有未来20年上涨10-20倍的潜质,房价从今天的价格上涨10-20倍的可能性有多大。

“There’s almost nothing where the game is stacked more in your favor like the stock market”

在现实中,有许多人更适合做房地产投资,但是一个合格的股市投资者是没有任何理由去羡慕出租房生意的。

我要再强调一次,有许多人更适合做房地产投资,这是客观事实,不要浪费精力探究股市房产哪个更好,对个人而言,最适合的只有一个。

PH在过去二十年出现了多次的好的投资机会,在今后二十年也将出现多次的投资机会,但是我们只可能在实战中把握其中的2,3机会,但是已经足够了,这是查理芒格的投资经验总结。

It's not given to human beings to have such talent that they can just know everything about everything all the time. But it is given to human beings who work hard at it ? who look and sift the world for a mispriced be that they can occasionally find one. And the wise ones bet heavily when the world offers them that opportunity. They bet big when they have the odds. And the rest of the time, they don't. It's just that simple.

That is a very simple concept. And to me it's obviously right based on experience not only from the pari-mutuel system, but everywhere else. And yet, in investment management, practically nobody operates that way. We operate that way ? I'm talking about Buffett and Munger. And we're not alone in the world. But a huge majority of people have some other crazy construct in their heads And instead of waiting for a near cinch and loading up, they apparently ascribe to the theory that if they work a little harder or hire more business school students, they'll come to know everything about everything all the time. To me, that's totally insane.

The way to win is to work, work, work, work and hope to have a few insights.

How many insights do you need? Well, I'd argue: that you don't need many in a lifetime. If you look at Berkshire Hathaway and all of its accumulated billions, the top ten insights account for most of it. And that's with a very brilliant man Warren's a lot more able than I am and very disciplined devoting his lifetime to it. I don't mean to say that he's only had ten insights. I'm just saying, that most of the money came from ten insights. So you can get very remarkable investment results if you think more like a winning pari-mutuel player. Just think of it as a heavy odds against game full of craziness with an occasional mispriced something or other. And you're probably not going to be smart enough to find thousands in a lifetime. And when you get a few, you really load up. It's just that simple.

这里我使用了投资TD银行一样的投资思想和策略,所以我投资加国市场可以成功,如果我投资美国市场也可以用同样的方法取得同样的成功,就是到了A股市场,也是一样的结果。

因为“There’s almost nothing where the game is stacked more in your favor like the stock market”

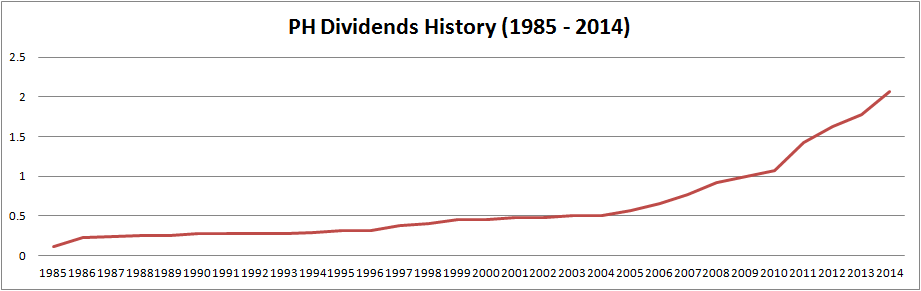

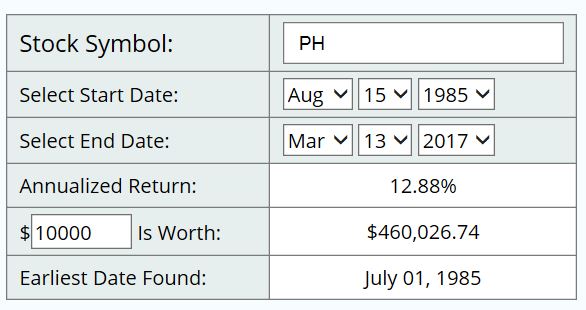

Parker-Hannifin Corporation是美国的著名长期红利蓝筹股,从1985年至今,年均回报是12.88%。如果只是单独的看12.88%的回报,是非常普通的,大约是每个月1%, 这比起不少人一天或几分钟的百分之几十的回报,实在是微不足道,但是一个普通的投资者如果能有机会坚持长期的投资于这样一个投资回报微不足道的股票,却可以得到非常理想的结果,这里就体现了复利在长期投资中的威力。老巴的长期投资成绩是年均20%多一些,这个成绩已经可以使他问鼎世界首富了。

像PH这样成功的长期红利蓝筹股在美国市场是很多。

这里的网友bigcatwx曾经在二年前在我的提议写过一篇关于PH的分析文章,当时他提出的投资价位是105-110之间。

Monday, April 6, 2015

http://moneyunbinding.blogspot.ca/2015/04/stock-analysis-parker-hannifin.html