Frank Stronach: Out-of-control government spending hurts average Canadians

Canada 'fairly close' to a debt crisis, warns Magna founder Frank Stronach

加拿大非常接近希腊式破产 从骨子里感受到债务

据National Post报道,加拿大最大跨国公司之一的创始人Frank Stronach表示,加拿大“非常接近”一场公共债务危机,加拿大人需要迫使政客们控制支出。

他还呼吁立法防止政府的支出超过税收收入。

麦格纳国际公司(The Magna International Inc)的创始人本周为National Post撰写了一篇专栏文章后,接受了彭博社的采访。

当被问及加拿大距离1990年代的债务危机有多近时,Stronach说:"我认为很近,你知道,我们的债务每天增加约4亿元,对吧?所以这应该是一个很大的担忧。”

Stronach在他的专栏文章中写道,加拿大并不能幸免于阿根廷和希腊等国面临的破产危机。

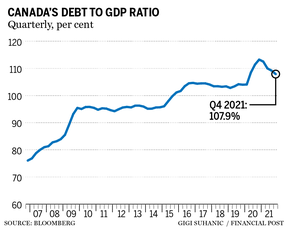

“相反,以我们目前的速度,我们正越来越接近这种情况。2021年,加拿大的债务与国内生产总值(GDP)之比约为109%,这与希腊在接受纾困前的比例相同。

换句话说,加拿大欠的钱比我们生产的商品和服务的数量多。这绝不是一个好迹象,”他写道。

在BNN的采访中,Stronach举了一个例子。他1980年代为联邦自由党竞选后,不得不整顿自己公司的资产负债表。

“我离开了一年,你知道,我想从政,在那期间,Magna的债务增加了大约15亿元,按今天的价值计算,大约是150亿元。所以我采取了措施,我们在5年后还清了债务。然后我们发布了一项政策,规定公司不允许有任何债务。然后我们积累现金,最后银行里可能有10亿左右的现金。”

图源:canadaautonews

Magna是一家为汽车制造商服务的加拿大技术公司,在27个国家拥有342个制造业务和91个产品开发、工程和销售中心,员工15.8万人。总部位于安省约克区Aurora。

Stronach呼吁加拿大人游说立法,防止政府支出超过税收收入。

他写道,另一种选择是经济崩溃,这将对中低收入阶层造成最大的伤害,因为政府会被迫削减社会福利。

Stronach在National Post上写道:“每个公民都能从骨子里感受到,这个国家不断增长的债务是一个问题。”

他说:“我们的政治领导人正把我们推入越来越深的债务之中,我们可能永远无法偿还我们所欠的债务。现在是迫使我们的政治领导人停止入不敷出的时候了。”

Frank Stronach: Out-of-control government spending hurts average Canadians

It’s high time that we forced our political leaders to stop spending more than they take in

Frank Stronach, National Post Mar 22, 2022 • 27 Comments

Every farmer, homeowner and small business owner knows this one inescapable truth: you can’t spend more money than you bring in or you will eventually go bankrupt.

The only group that doesn’t appear to abide by this fundamental law of economics is our politicians, who are pumping out billions of borrowed dollars to prop up our pandemic-ravaged economy. Unless we severely curtail the debt-fuelled spending of the past several years, and unless we start paying it down, we will be headed for trouble. Just paying the interest on the current sky-high debt is the equivalent of swimming with a big cement block tied around our ankles, and the higher our interest payments get, the less money there is in the federal budget for programs like health care.

Because countries are able to print money, they can postpone the process of going broke for a long time. But eventually even countries do go bankrupt, with Argentina being one of the more prominent examples in recent history. That country’s bankruptcy decimated the wealth and savings of millions of citizens. Or consider Greece. Following the economic meltdown in 2010, Greece was rescued with one of the biggest financial bailouts in history, but in turn the country was forced to adopt a number of austerity measures that included higher taxes and reduced pensions for seniors.

Canada is not immune from experiencing the same sort of slide into bankruptcy. On the contrary, at the rate we’re going, we’re moving closer and closer toward that scenario. Canada’s debt-to-GDP ratio in 2021 was approximately 109 per cent — the same percentage as Greece just a few short years before it was bailed out. In other words, the amount of money Canada owes is more than the amount we produce in goods and services. That’s never a good sign.

Governments have the power to raise all the money they need through taxation. So why do governments borrow money? And why do financial institutions not only willingly lend governments money but encourage them to borrow even more? The truth of the matter is this arrangement suits both governments and financial institutions. Banks prefer the safety and security of government bonds over riskier investments in private industry, and governments prefer spending borrowed money rather than raising taxes and risking the wrath of voters. As a result, I believe we need to handcuff the ability of governments to borrow money by lobbying for legislation that will permanently prevent politicians from spending more revenue than they collect in taxes.

In any sort of national economic collapse, like the one that happened in Greece, the wealthy will be hurt the least, since they will have the greatest number of opportunities to protect their assets and move their money to safe havens. The poor and those living on welfare assistance will get poorer, as the state will inevitably have to start cutting social benefits because of falling tax revenues and because a higher percentage of the government budget will have to go toward paying the interest needed to finance the debt.

The middle class will also be hit hard. These are the people who will also have the most to lose, from personal retirement funds and government pensions, to devalued properties, higher tax burdens and reduced buying power. The decline in the value of a country’s currency — one of the inevitable consequences of debt – means a decline in purchasing power, especially for a country that imports most of the products its citizens buy.

But the ones who will hurt most are our children and grandchildren — the people who will be shackled with the obligation to pay back money that we borrowed.

Every citizen can feel deep down in their bones that the country’s growing mountain of debt is a problem. Our political leaders are driving us deeper and deeper into debt and we’re getting to the point where we may never be able to repay the debt we owe. It’s high time that we forced our political leaders to stop spending more than they take in.

There is no escaping the consequences of runaway government spending and debt: one way or another, we will all have to pay for it. In the final analysis, we’re harming our children’s and our grandchildren’s futures.

Frank Stronach is the founder of Magna International Inc., one of Canada’s largest global companies, and an inductee in the Automotive Hall of Fame.

Canada 'fairly close' to a debt crisis, warns Magna founder Frank Stronach

Calls for legislation that would prevent governments from spending more than they collect in taxes

Frank Stronach, founder of one of Canada’s largest global companies, says the country is “fairly close” to a public debt crisis and Canadians need to force politicians to rein in spending.

Who the rate hike will hit the hardest

The Magna International Inc founder was speaking on BNN Bloomberg Wednesday after writing an op-ed for the National Post this week.

When asked how close Canada was to a debt crisis similar to the one that threatened the country in the 1990s, Stronach said: “I think fairly close, you know, our debt rises about $400 million every day, right? So that should be a great concern.”

In his op-ed, Stronach wrote that Canada is not immune to the slide toward bankruptcy seen by other countries such as Argentina and Greece.

“On the contrary, at the rate we’re going, we’re moving closer and closer toward that scenario. Canada’s debt-to-GDP ratio in 2021 was approximately 109 per cent — the same percentage as Greece just a few short years before it was bailed out. In other words, the amount of money Canada owes is more than the amount we produce in goods and services. That’s never a good sign,” he wrote.

During the BNN interview, Stronach used an example of how he had to fix the balance sheet of his own company after he took time off to run for the federal Liberal Party in the 1980s. “I stepped away for a year, you know, I was seeking political office and during that time [Magna’s] debt grew by about a billion and a half, which in today’s dollars, it will be about $15 billion. So I put in [measures] and we had the debt paid up five years later. And then we issued [a policy] that the company wasn’t allowed to have any debt. So we were building up cash — when all was said and done, maybe a billion or so of cash in the bank,” he said.

Frank Stronach: Out-of-control government spending hurts average Canadians

'Bottom line, more spending:' What business leaders think of the Liberal, NDP alliance

Deal with NDP gives Trudeau a majority government in all but name

He is calling for Canadians to lobby for legislation that would prevent governments from spending more revenue than they can collect in taxes.

The alternative is an economic collapse that will hurt the lower and middle classes the most as government is forced to cut social benefits, he wrote.

“Every citizen can feel deep down in their bones that the country’s growing mountain of debt is a problem,” Stronach wrote in the National Post.

“Our political leaders are driving us deeper and deeper into debt and we’re getting to the point where we may never be able to repay the debt we owe. It’s high time that we forced our political leaders to stop spending more than they take in.”