如果还有机会再跟芒格共度一天,巴菲特想做什么?

杜玉

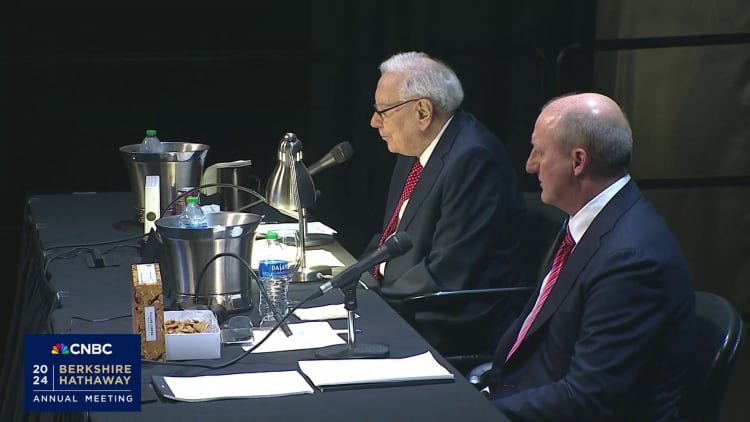

这是芒格因离世而缺席的第一年,但他的身影却无处不在。问答环节,巴菲特会不小心脱口而出“查理,该你回答了”,他也称,与芒格在一起的时间比独处要快乐。

可以说,虽然99岁的芒格因离世而缺席了2024年伯克希尔股东大会,但在著名的与巴老问答环节,芒格的身影无处不在。

不仅年会的神秘短片在史上首次公开放映就是为了致敬芒格,股东大会现场今年只卖一本书——最新版《穷查理宝典》,巴菲特也会不经意间把身边的人当成他的“查理老大哥”。

巴菲特:与芒格在一起比独处开心,每个人都应问问自己最后一天跟谁过

在上午场的提问环节,一个小朋友好奇,如果巴菲特还有机会再跟芒格共度一天,想做什么?

巴菲特称,他和芒格每天都在做令自己开心的事情。芒格很喜欢学习,对好多事情感兴趣,兴趣比巴菲特还要广泛,两人志趣相投,在一起度过的时间比各自独处要开心:

“我们的乐趣还在于一起犯错误,一起改正错误、吸取教训,这好像更令人开心,因为你的合作伙伴会帮助你摆脱困境,然后你看到你们十年前做的决策现在还能赚钱。”

巴菲特坦言,如果有机会再与芒格共度一天,“跟我们之前所有的日子都不会有太大区别”:

“我从来没见到哪个人像芒格这样,在99岁时活到人生巅峰,全世界人都想来找你。芒格曾称,要是知道自己哪天会去世就好了,这样他永远不会往那一天走去。”

说到这里,想起老朋友的幽默之处,巴菲特禁不住笑了起来。他还称,人总是越老越聪明,因为可以从错误中学习成长:

“我们仍认为世界还很有意思,到我们这么大了,我问芒格过去2000年你最想跟谁吃饭,查理说我都已经遇到过他们了。

每个人都应该问自己,你人生的最后一天想跟谁一起度过,那现在就去遇到他们,并跟他们一起做事。”

泪目一刻:巴菲特不小心脱口而出“查理,该你回答了”

颇为令人“泪目”的一幕出现在问答环节第三个问题,巴菲特说完了自己的答案,然后转向身旁的CEO接班人、伯克希尔除保险以外所有其他业务负责人阿贝尔,但却脱口说出了“查理”。

巴菲特马上解释称:“我都说习惯了,其实我好多次提醒自己别说错了,但我还是会说错,我又说错了,待会可能还会说顺嘴呢。” 阿贝尔则称,被当做芒格将是“一种莫大的荣幸”。

有分析指出,这一时刻突显了巴菲特与芒格之间的牢固友谊。有现场参会的网友称,这是年会最激动人心的时刻之一。

有网友摆出现场售卖的巴菲特与芒格玩偶,就好像他们曾经携手并肩坐在股东大会主席台上一样,并引用美国说唱歌手吹牛老爹(Puff Daddy)在《我会想念你》(I'll be missing you )一曲中的歌词:

“仿佛就在昨天,我们一起纵情摇滚,我系紧音轨,你锁定节奏,生活并不总是与从前一样,言语无法表达出你对我的意义,即使你走了,我们仍一起组队。”

还有网友发布了一张现场图片:巴菲特和芒格共同出现在短片中,但现实中的主席台上只有巴菲特一个人。

伯克希尔史上首次公开年会秘密短片,只为了缅怀芒格

在问答环节之前,本次年会发布短片详细介绍了芒格的生平。

包括他在美国内布拉斯加州奥马哈市的生活。芒格与巴菲特都在那里出生和长大,距离伯克希尔的年会举办地仅有两英里远,芒格甚至为巴菲特家族杂货店打过工,不过当时他并不认识巴菲特。

短片还展示了芒格参加过的股东大会历史影像,以及历年来著名的犀利点评合集。

例如,在2015年的一次会议上,他曾说:“如果人们不经常犯错,我和巴菲特就不会这么富有。”旁边的巴菲特后悔没有堵住芒格的嘴。

又比如,影片展示芒格在早年某次股东大会上说:“如果我在快要死的时候还能保持乐观,那么你们其他人肯定可以应对一点通货膨胀。”

还有一段影像显示芒格说:“在现实生活中做出决定的正确方法是基于你的机会成本。当你结婚时,必须选择最适合你的。你的余生也是同样的方式(做决策)。 ”

有分析称,巴菲特在这部感人至深且有点幽默的电影中,向他的长期朋友和商业伙伴致敬,重申芒格是“伯克希尔的建筑师”,是“提供蓝图的天才”,而巴菲特自己只是“干活的承包商”。

巴菲特赞扬芒格绝对诚实,推荐所有人都去买最新版《穷查理宝典》

在整场问答环节,巴菲特总是会不由自主地“Cue到”芒格。

当被问及“如何找到生活中的真偶像/人生导师,如何好好交友等经验”时,巴菲特表示,一个合适的人生偶像是很重要的,他和芒格都有:“很重要的是有人持续爱你,就算你打破了一些规则,我和芒格都被这么爱过。你需要有个合适的英雄去崇拜,取决于你想成为什么样的人,如果你选择的偶像正确就进入了正轨,不光说的是挣钱方面,而是说整个人生。”

当评价伯克希尔的投资策略时,巴菲特称,比亚迪和好市多(Costco)是芒格认为伯克希尔最需要购买的两只股票,巴菲特坦言可惜对芒格的倾听还不够。

巴菲特还随时随地赞赏芒格,称芒格是“真正的诚实”(truly honest),是值得信赖的商业伙伴: “我也完全信任我的孩子和妻子,但这并不意味着我会问他们买什么股票。在管理资金方面,几十年来,世界上没有人比查理更适合交谈。”

巴菲特称,芒格的“绝对诚实”是他成为巴菲特重要伙伴的原因之一。这种诚实贯穿于芒格的工作和个人生活:“当你在生活中遇到这样的事情时,你就会珍惜这种人,并忘记其他的人。”

还有股东发现,没有芒格在场“插科打诨”说俏皮话,巴菲特的发言似乎更加专注于围绕伯克希尔的业务来进行,有种“公事公办”的味道。

而在问答环节结束时,巴菲特还不忘营销芒格的“遗产”,推荐大家都去买《穷查理宝典》。

巴菲特称,为了缅怀芒格,最新版《穷查理宝典》将是今年伯克希尔股东大会现场唯一出售的书,周五已售出约2400册。巴菲特称,往年的年会通常会现场出售25种书。

巴菲特对问答环节的结束语似乎也在呼应芒格的不在场,他戏称,“希望你们明年也来,希望我明年也参加。”此前,巴菲特称,他不认为自己应该再签下四年的伯克希尔掌舵人工作合约了。

Berkshire Hathaway Chairman and CEO Warren Buffett will preside over the company’s annual meeting. Track all of the day’s news and analysis here.

Berkshire Hathaway’s annual shareholder meeting Saturday had some somber moments as Warren Buffett reflected on the passing of his longtime partner Charlie Munger last year and wrestled with the possibility of his own mortality.

“I know a little about actuarial tables,” he joked at one moment.

However, he reassured investors that a plan was in place and revealed for the first time that Greg Abel, his successor, would be making the call on investing decisions.

He also fielded numerous questions from Berkshire Hathaway shareholders. Notably, Buffett explained why Berkshire sold off some of its Apple stock and he revealed a losing bet on Paramount. The Berkshire chairman and CEO also reflected on developments in the quickly evolving field of artificial intelligence and praised Federal Reserve Chair Jerome Powell’s work steering the economy.

Here are some of the highlights:

Buffett ends Q&A: ‘I hope I come next year’

Warren Buffett wrapped up the Q&A portion of the annual meeting with a cheeky farewell remark.

“I not only hope you come next year. I hope I come next year,” he said, laughing.

The crowd once again gave the 93-year-old investing legend a standing ovation and a round of applause.

Yun Li

Buffett praises Powell

U.S. Federal Reserve Chair Jerome Powell holds a press conference following a two-day meeting of the Federal Open Market Committee on interest rate policy in Washington on March 20, 2024.

Warren Buffett praised Federal Reserve Chair Jerome Powell for his work steering the economy over the past few years.

At Berkshire Hathaway’s annual shareholder meeting, Buffett called Powell a “very wise man.” However, he noted the central bank needs help from lawmakers to rein in the growing U.S. deficit.

Powell “doesn’t control fiscal policy, and every now and then he sends out a disguised plea … because that’s where the trouble will be, if we have it,” Buffett said.

Fred Imbert

Lawsuits against Berkshire-owned PacifiCorp are ‘unfounded,’ Greg Abel says

Berkshire Hathaway will continue to fight lawsuits brought against electric power company PacifiCorp, more than 90% of which is owned by the Buffett-owned company.

“When I think of PacifiCorp, we’re in a place where, first and foremost, all that litigation will be challenged because the basis for it, at least we believe, there are places where it’s unfounded,” said Greg Abel, who is considered to be Warren Buffett’s successor and the future chief executive officer of the company. “And we’ll continue to challenge it.”

PacifiCorp is facing $30 billion in new claims made last month from 1,000 plaintiffs who blame the company for causing the 2020 Labor Day wildfires in Oregon. PacifiCorp has already paid or owes $825 million in claims due to other wildfire-related lawsuits, Reuters reported.

“The challenge we do have is, within PacifiCorp, as we go through both the litigation and through continuing to operate that entity, it generates a certain amount of capital and profits that will remain in that entity and be reinvested back into that business,” Abel said during the Saturday meeting, adding that both legislative and regulatory reforms are needed across the PacifiCorp states if Berkshire is going to make incremental capital contributions into the business.

“As Warren said, we don’t want to throw good capital after bad capital ... so we’ll be very disciplined there,” Abel said.

Pia Singh

Buffett says all of Berkshire’s Paramount holding has been sold

Warren Buffett said the entire Paramount Global stake has been sold at a loss.

“It was 100% my decision, and we’ve sold it all and we lost quite a bit of money,” he said.

Buffett added that the experience has made him think more deeply about what activities people prioritize in their free time.

Berkshire Hathaway owned 63.3 million shares of Paramount as of the end of 2023, after cutting the position by about a third in the fourth quarter of last year, according to the latest filings.

— Alex Harring

‘We missed a lot of things,’ Buffett says

Warren Buffett asserted on Saturday that he and Charlie Munger certainly missed investing opportunities over the years, but only regretted a select few.

“We missed a lot of things, and what we really regretted was missing something that turned out to be very big, we never worried about something that we didn’t understand,” Buffett said.

“Why should we be able to predict the future of every business any more than we can predict what wheat yields are likely to be in the next year?” he added.

— Brian Evans

Buffett says capital allocation decisions will eventually fall to Greg Abel

Berkshire Hathaway’s investing decisions, including those involving the stock portfolio, will fall to Greg Abel, Buffett’s planned successor, according to the “Oracle of Omaha.”

“I think the responsibility ought to be entirely with Greg,” Buffett said. “The responsibility has been with me, and I farmed out some of it, and I used to think differently about how that would be handled, but I think the responsibility should be that of the CEO.”

“Whatever that CEO decides may be helpful in effectuating that responsibility, that’s up to him or her to decide at the time that they’re running money. ... I would say my thinking has developed to some extent as the sums have grown so large at Berkshire,” he added. “We don’t want to try and have 200 people around that are managing $1 billion each, it just doesn’t work.”

While Buffett has made clear that Abel, vice chairman of non-insurance operations, would be taking over the CEO job, there were still questions about who would control Berkshire’s public stock portfolio.

Buffett has garnered a huge following by racking up huge returns through investments in the likes of Coca-Cola and Apple.

Berkshire investing managers, Todd Combs and Ted Weschler, both former hedge fund managers, have helped Buffett manage a small portion of the stock portfolio for about the last decade.

— Brian Evans, John Melloy

Why Berkshire Hathaway doesn’t pay a dividend

Warren Buffett’s Berkshire Hathaway doesn’t pay a dividend, even as it boasts a cash hoard of tens of billions of dollars. A company can use dividends to reward shareholders by distributing a portion of its earnings.

But the Oracle of Omaha expects that he can use his capital in more profitable ways. In fact, Buffett has said he would use a buyback program to return capital to shareholders, instead of dividends, if he felt he couldn’t use his capital efficiently.

“Dividends have the implied promise that you keep paying them forever and not decrease them,” Buffett said in a 2018 interview with CNBC, adding, “We would probably lean toward repurchase,” between the two.

— Sarah Min, Yun Li

Buffett honors Carol Loomis, longtime editor of his annual shareholder letters

Warren Buffett took a few moments during his morning session to honor Carol Loomis, a longtime financial journalist who edited Buffett’s revered annual shareholder letters for years.

“Carol is the best business writer ... nobody came close to her, and she started from scratch,” Buffett said about Loomis, asking the crowd to give a round of applause to her. “In 1977, I asked her to edit my report and she had turned out to be as good an editor as she was a writer. And all the way through this year, including this year, Carol has edited the Berkshire report.”

Loomis was a former senior editor-at-large of Fortune magazine, who also chronicled the start of the hedge fund industry.

— Pia Singh

Real estate agents remain key following settlements, Abel says

Real estate agents will continue to play a key role in the home-buying process, even after major settlements, according to Greg Abel.

The National Association of Realtors said in March it would end policies that set agent commissions and pay more than $400 million in compensation to home sellers across the U.S. Multiple lawsuits against the trade group had alleged that the rules tied to listings on the NAR-affiliated Multiple Listing Services elevated commission rates, according to the Associated Press.

In late April, Berkshire’s HomeServices of America said it would pay $250 million to settle lawsuits that alleged commissions were unnecessarily high. That’s the biggest sum paid by any individual brokerage so far, according to the Wall Street Journal.

“There’s no question the industry will go through some transitions because of that settlement,” said Abel, Buffett’s successor. But, “the real estate agent is still an important part of these transactions. It’s the one time in our lives where we make these massive investments, and having that counsel and guidance is critical.”

With the broader NAR settlement, Abel said essentially all players in the space were “swept up.”

Meanwhile, Warren Buffett said he’s encouraged the expansion of its real estate brokerage business, calling it “fundamental.” However, he acknowledged being surprised by the legal decision.

— Alex Harring

Berkshire shareholders meeting breaks for lunch

Warren Buffett has ended the morning question-and-answer session at Berkshire’s annual meeting to break for lunch.

CNBC will continue programing throughout the break.

—Christina Cheddar Berk

Buffett on his cash hoard: ‘We only swing at pitches we like’

Buffett is making good returns by putting his mountain of cash in Treasury bills yielding north of 5.4%.

“We only swing at pitches we like,” Buffett said when asked about why he hasn’t used his cash pile to make new investments. “We don’t use it now at 5.4% but we wouldn’t use it if it was at 1%. Don’t tell the Federal Reserve,” he said jokingly.

Berkshire’s cash reached a record high of $188.99 billion, up from $167.6 billion in the fourth quarter. Buffett previously revealed that he’s been buying 3- and 6-month Treasury bills every Monday.

— Yun Li

Buffett touches on succession plan, says investors ‘don’t have too long to wait’

Buffett briefly touched on Berkshire Hathaway’s future without him at the helm, and noted that his advanced age is top of mind despite his continuing to feel up to the job.

“We’ll see how the next management plays the game out at Berkshire, [but] fortunately you don’t have too long to wait on that. I feel fine, but I know a little about actuarial tables,” Buffett said.

“I shouldn’t be taking on any four-year employment contracts like several people are doing in this world at an age when you can’t be quite that sure where you’re going to be in four years,” he added.

Buffett will turn 94 in August, and has already named Vice Chairman of Non-Insurance Operations Greg Abel, who was sitting at his side Saturday, as the Berkshire CEO successor. But investors wonder if Berkshire shares would trade at the same valuation over the long-term without Buffett at the helm making the major investing decisions.

— Brian Evans

Berkshire is watching renewable energy, but thinks more time is required

Warren Buffett said renewable energy is of interest, but it needs time to be developed.

“There are certain things that just take a certain amount of time,” the “Oracle of Omaha” said. “My daughter hates it when I use this example, but it’s really true that you can’t create a baby in one month by getting nine women pregnant.”

But Buffett also said solar will likely never be the only electricity source.

Greg Abel, chair of Berkshire’s energy business, also said reliability and affordability are important factors to keep in mind.

— Alex Harring

Buffett teases a possible Canada investment

Warren Buffett hinted that the conglomerate was evaluating a possible investment opportunity north of the border.

“We do not feel uncomfortable in any way shape or form putting our money into Canada. In fact, we’re actually looking at one thing now,” said Buffett.

The Berkshire CEO did not reveal what the investment was and whether it was public or private.

Heading into the meeting there’s been a lot of speculation about which investments Berkshire is building. The company has been granted confidential treatment regarding one mystery stake it’s been buying for the last three quarters in the financial sector.

—John Melloy

Buffett found Munger to be truly honest

Warren Buffett said Charlie Munger was a trusted business partner, but he’s also been able to look elsewhere for personal support.

“I trust my children and my wife totally,” Buffett said. “But that doesn’t mean I ask them what stocks to buy.”

“In terms of managing money, there wasn’t anybody better in the world to talk to for many, many decades than Charlie,” he said. “That doesn’t mean I didn’t talk to other people.”

Still, “if I didn’t think I could do it myself, I wouldn’t have done it,” he said of business decision making. “So, to some extent, I talk to myself on investments.”

Buffett called Munger unfailingly honest, which is part of why he became a key companion. That applied to both his work and personal life, Buffett added.

“When you get that in your life, you cherish those people and you sort of forget about the rest,” he said.

— Alex Harring

Buffett says AI scamming could be next big ‘growth industry,’ likens technology to nuclear weapons

Warren Buffett said that artificial intelligence scamming could be the next big “growth industry,” likening the technology to nuclear weapons in its potential for great change.

The “Oracle of Omaha” said he doesn’t “know anything” about AI, but recounted a recent encounter with an AI-generated image of himself on screen that made him nervous about the technology.

“When you think about the potential for scamming people, if you can reproduce images that I can’t even tell, that say, ‘I need money,’ as your daughter, ‘I just had a car crash, I need $50,000 wired.’ I mean, scamming has always been part of the American scene, but this would make me, if I was interested in investing in scamming, it’s going to be the growth industry of all time,” he told a crowd of investors at Berkshire’s annual meeting.

“I said we let the genie out of the bottle when we developed nuclear weapons and that genie has been doing some terrible things lately, and the power of that genie is what, you know, scares the hell out of me,” he added. “And I don’t know any way to get the genie back in the bottle, and AI is somewhat similar.”

— Sarah Min

Geico is ‘still playing catch-up’ with data analytics compared with its peers in the insurance sector, Ajit Jain says

Ajit Jain, Berkshire Hathaway’s vice chairman of insurance operations, is well aware that Geico is lagging behind its peers when it comes to data analytics.

“As Warren has pointed out in the past, one of the drawbacks that Geico is faced with is it hasn’t been doing as good of a job on matching rate with risk and segmenting and pricing product based on the risk characteristics. … Geico hasn’t been that good at managing risk,” Jain told Berkshire investors.

“Technology is something that is unfortunately been a bottleneck,” he said, adding that Geico was “still playing catch-up.”

“But then again, we are making progress. … Yes, I recognize we are still behind, we are taking steps to bridge the gap and certainly by the end of 2025, we should be along with the best of players when it comes to data analytics,” he said.

— Brian Evans

Buffett accidentally refers to Greg Abel as Charlie Munger

In a slip-up, Buffett referred to Greg Abel, chair of Berkshire Hathaway Energy, as the late Charlie Munger.

“I’m so used to that,” Buffett said after the mix up.

The moment underscores the strength of Buffett’s relationship with Munger, who was viewed as a close friend and key business partner leading up to his death late last year.

Buffett admitted he would probably “slip again.”

“It’s a great honor,” said Abel, who is Buffett’s heir apparent, of being mistaken for Munger.

— Alex Harring

Buffett explains why Berkshire reduced its big Apple stake

When asked why Berkshire trimmed its Apple position, Buffett suggested it was for tax reasons following sizable gains on the investment and not any judgement of his long-term view of the stock.

He also suggested it could be tied to his view that tax rates may possibly be going higher to fund a ballooning U.S. fiscal deficit.

“It doesn’t bother me in the least to write that check — and I would really hope with all that America’s done for all of you, it shouldn’t bother you that we do it —and if I’m doing it at 21% this year and we’re doing it a little higher percentage later on, I don’t think you’ll actually mind the fact that we sold a little Apple this year,” Buffett said.