Research Oil Peak:Supply vs Demand

I'm going to let my peak oil research simmer on the back burner until oil clears $150 (hopefully not next week!). However, I had these graphs on hand so I thought I'd share them with you guys at DQ.

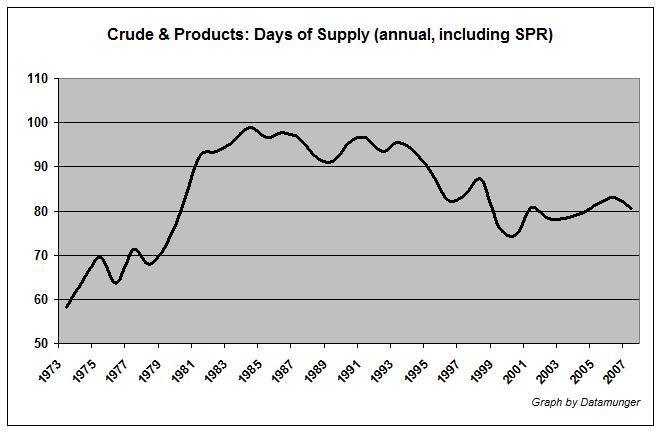

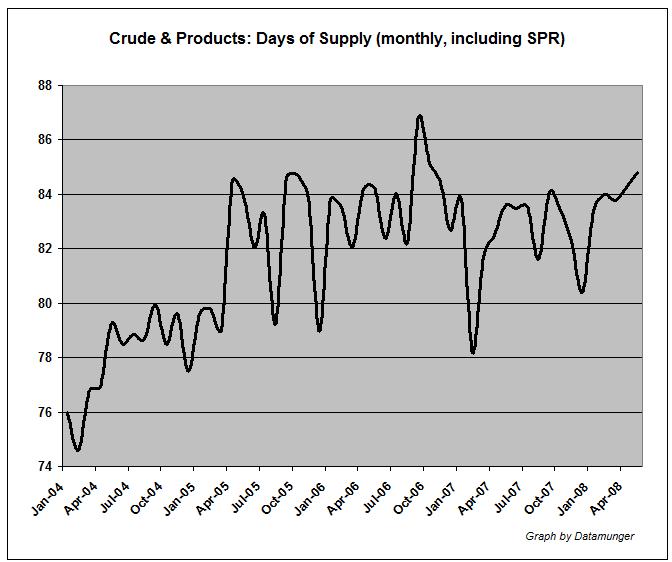

A key measure of the amount of oil on hand is "Days of Supply". By that measure there has been no deterioration in recent years in the US. In fact, there has been a slight improvement. Below is an annual chart for the past few decades followed by a monthly chart which includes the recent data (available to May 2008).

Using less oil has the pleasant side effect of automatically increasing the days of supply that existing inventories represent.

These charts were generated by dividing inventory data....

http://tonto.eia.doe.gov/dnav/pet/pet_stoc_wstk_dcu_nus_w.htm

by consumption data.....

http://tonto.eia.doe.gov/dnav/pet/pet_cons_psup_dc_nus_mbbl_m.htm

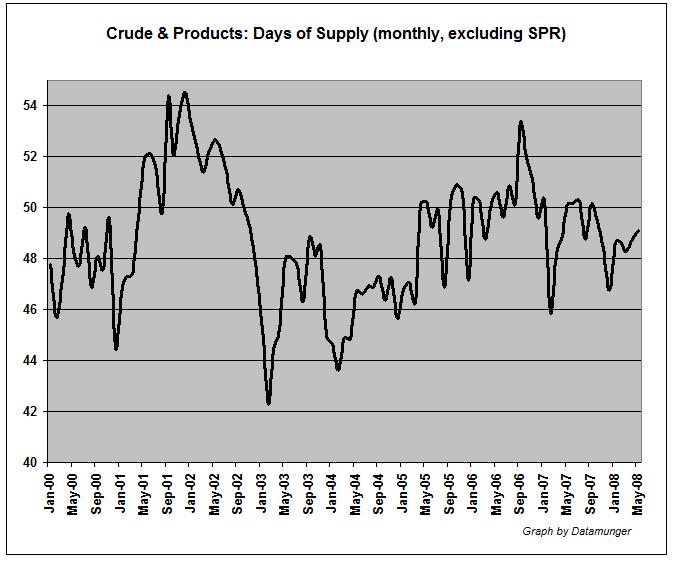

Here's a monthly chart going back to the beginning of 2000.

No deterioration...

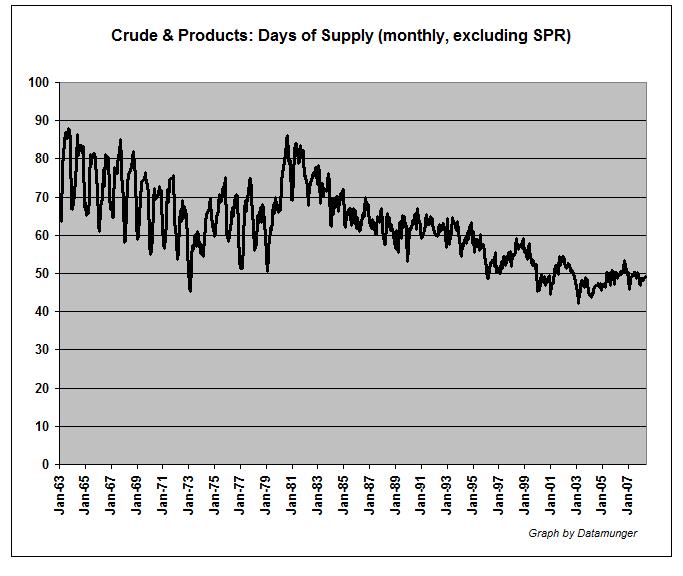

For perspective, here's a monthly chart going back all the way to 1963

In the olden days there was a very obvious seasonal fluctuation that is less obvious now.

If you take a look at the diagram below, I think the petro-dollar effect is clearly visible.

Oil fell 15% while the exchange rate did not change at all. After the price of oil seemed stabilized at this new, much lower level, confidence in the dollar grew. This, paired with negative news coming from Europe led to the strengthening of the dollar.

In the last few days, the price of oil followed the exchange rate. The price of oil is moving the dollar, making it stronger at the moment.

Me thinks after oil goes back up again the dollar will weaken -- again. No wonder: oil is priced in dollars and if you have to put a substantially bigger amount to the market to get your oil, that creates an oversupply of dollars, this weakening the currency.

Imagine the following: We have to scenarios. Oil costs USD 150 or USD 120. Net exports stand at roughly 45 mbpd. So:

If WTI (or FOB) = USD 150, that's 6.75 billion dollars per day

If WTI (or FOB) = USD 120, that1s 5.4 billion dollars per day

You buy the same thing (oil) with more or less of the same dollars. But there is a more than 1 billion USD difference there. So what happens?

Oil trades for USD 150 ---> lot1s of dollars into the pockets of the exporters. It means there is an oversupply of dollars on the market, that tends to devalue the dollar. On the other hand, the exporters are still either spending or investing all these dollars. So what happens when oil goes to 120? There is a relative scarcity of dollars on the market in comparison with a few weeks earlier. Scarcity means the value is bound to go up: Hence the dollar strengthens.

You can follow this on the above diagram, I think.

WTI spot traded for USD 145 on July 11th. It was 116 yesterday. In the meantime, the dollar strengthened, too. So what happened? Here is the full period:

Exchange rate adjusted oil lost almost 20%, while the dollar strenghtened 3.6%

But how did this happen? Let's see 3 different periods:

1) July 11th - July 25th

2) July 25th - August 4th

3) August 8th - August 9th

It is clearly visible from the numbers, that in period 1) the exchange rate didn't change at all but the dollar fell. In periods 2 and 3 the dollar strengthens (the above mentioned petrodollar effect), and oil changes in parallel with the euro. See the tables below.

So basically there was a sudden change in supply and demand between July 11th and July 25th? What was that? Supply remained basically the same. So it has to be demand then. May and June data for the US economy? The Chinese buying less oil (diesel) on the import markets due to the Olympics? I don't know.

But it's pretty obvious to me that demand weakened before the 25th of July, and the strengthening of the dollar is a result of this (and the negative news coming from the EU). Later on ,the strengthening dollar is pulling down oil.

Just my 2 cents. I see no speculative effect here. At all. Only supply and demand and some changes in the exchange rates.

So what's next? I'm not sure. But I think:

1) After the games China comes back into play

2) Lower prices will make people and nations buy more oil

3) There is an OPEC meeting in early September

4) Heating oil comes into play in early October

All in all I think prices will remain relatively low in August and early September, but we will see a sudden jump come October. I don't rule out USD 150 in November.

****************************************************************************

The man behind the curtain became confused as to which string he was pulling ?

:-)