ZT - for weekend reading:

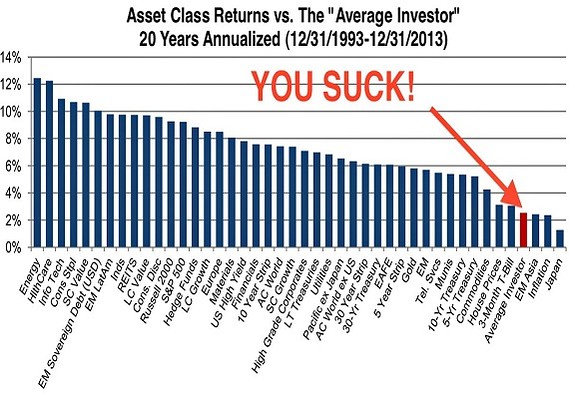

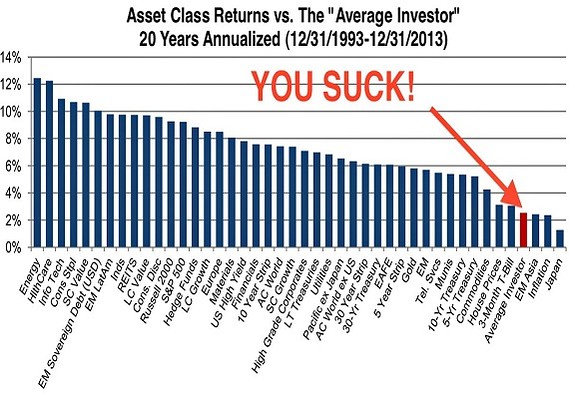

As this chart from Richard Bernstein Advisors shows, mom and pop stink it up on a pretty steady basis and have lagged gains in every asset class, with the exceptions of Asian emerging markets and Japanese equities, over the last 20 years. The average investor has even managed to underperform cash – represented in the chart by 3-month T-bills.

As this chart from Richard Bernstein Advisors shows, mom and pop stink it up on a pretty steady basis and have lagged gains in every asset class, with the exceptions of Asian emerging markets and Japanese equities, over the last 20 years. The average investor has even managed to underperform cash – represented in the chart by 3-month T-bills.

The chronic underperformance confirms that investors' are generally plagued by emotional behaviors (i.e. buy high/sell low). Despite the recent media deluge of "buy and hold" advice,"passive beats active" investing, etc., the reality is that individuals never survive the long game. The evidence is pretty clear that for most, putting money into bonds and cash is actually the best choice. The problem is that such advice doesn't generate fees for WallStreet, viewership for the media or feed our personal "greed."