February 20, 2017

When Speculators Prosper Through Ignorance

John P. Hussman, Ph.D.

“No Congress of the United States ever assembled, on surveying the State of the Union, has met with a more pleasant prospect than that which appears at the present time.”

- Calvin Coolidge, December 4, 1928

“There can be little argument that the American economy as it stands at the beginning of a new century has never exhibited so remarkable a prosperity for at least the majority of Americans.”

- Alan Greenspan, January 30, 2000

“We believe the effect of the troubles in the subprime sector on the broader housing market will be limited and we do not expect significant spillovers from the subprime market to the rest of the economy or to the financial system.”

- Ben Bernanke, May 17, 2007

“Investors haven’t been this optimistic on the global economy since 2011... A full 23 percent of investors expect an outright ‘boom,’ according to a survey released Tuesday by Bank of America Merrill Lynch... ‘The U.S. economy is not only humming on all cylinders, but in our view the optimism associated with a clean sweep by the Republicans in Washington is likely to create a self-fulfilling period of strong markets and at least the potential for strong growth.’ The optimism comes amid forecasts global growth will pick up and as Donald Trump promises to cut taxes, boost fiscal spending and loosen regulations in moves that could boost corporate earnings. ‘Macro optimism is surging,’ wrote the team.”

- Bloomberg, February 14, 2017

The relationship between the economy and the stock market is a study in contradiction. It’s precisely when economic optimism is strongest, when caution is seen as misguided, and when bullish enthusiasm is most exuberant, that the stock market reaches its speculative apex and becomes most vulnerable to collapse. It’s precisely when economic pessimism is most dismal, when hope is set aside, and when bearish consensus is most dire, that market plumbs its deepest lows and carries the greatest potential for future returns.

If you think about the market as an equilibrium where every purchase has to be matched with a corresponding sale, this apparent contradiction vanishes. See, it’s precisely the untethered bullish enthusiasm of buyers, and the corresponding reluctance of sellers to part with their shares, that generates extreme overvaluation. Offensive valuation extremes could emerge no other way. Likewise, it’s precisely the wide-eyed fear of sellers, and the corresponding reluctance of buyers to absorb new shares, that generates extreme undervaluation.

Understanding this, it’s essential to resist the popular but misinformed impulse to believe that economic optimism itself is a useful or valid basis on which to invest in securities. What’s required instead is an insistence on recognizing that the long-term total returns that investors actually achieve from their investments are tightly linked to the valuations that they pay. As we’ve detailed in scores of prior commentaries, the most reliable market valuation measures we’ve identified have correlations of 90-94% with subsequent S&P 500 10-12 year total returns.

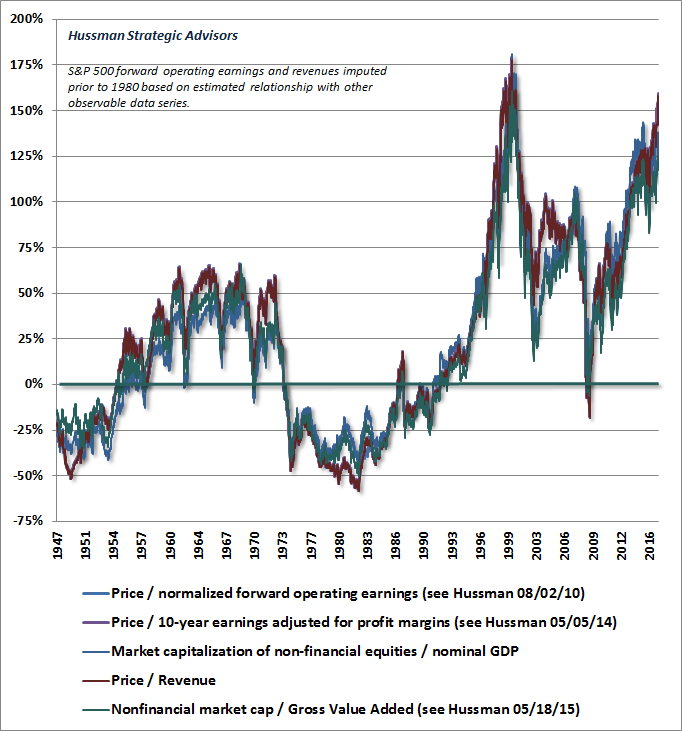

The chart below updates several of these measures as of last week. We continue to view recent market action as the likely final blowoff of one of the most extreme speculative episodes in U.S. history. The valuation measures we identify as most tightly correlated with actual subsequent S&P 500 total returns in market cycles across history range about 160% above (2.6 times) their historical norms, and more than 5 times the levels observed at points of secular undervaluation such as 1949 and 1982. This implies that a rather run-of-the-mill retreat to historical norms would now be associated with an expected market loss of about -60%, while a retreat even to a level still 25% above historical norms would be associated with a market loss exceeding -50%. That range of prospective market losses between -50% and -60% is in fact our expectation over the completion of the current market cycle, and neither would take reliable equity valuations below their long-term historical norms.

Of course, several popular and unreliable valuation measures are less extreme, but those measures also have generally weak correlations with subsequent market returns, invariably because they ignore the tendency of profit margins to fluctuate over the economic cycle. Investors should be particularly attentive to the fact that the median component of the S&P 500 is now far more overvalued than in 2000, 2007, or indeed in any prior point in history, and unlike 2000, small-capitalization indices are also breathtakingly overextended. As Benjamin Graham warned, “Observation over many years has taught us that the chief losses to investors come from the purchase of low-quality securities at times of good business conditions. The purchasers view the good current earnings as equivalent to ‘earning power’ and assume that prosperity is equivalent to safety.”

Presently, we estimate that the nominal total returns of the S&P 500 Index are likely to average less than 1% annually over the coming 12-year horizon. Since that estimated return is positive only because of expected dividend income, we project that the S&P 500 Index itself is likely to be 10-20% lower than its present level 10-12 years from today. That outcome would be quite similar to what we accurately anticipated, and observed, following the valuation extremes in 2000.

From a valuation standpoint, a 12-year total return estimate of less than 1% annually implies that it would take a further advance of less than 12% in the S&P 500 (over and above nominal economic growth of about 4% at an annual rate) to drive the our estimate of prospective 12-year total returns to zero, with any further market advance driving 12-year prospects into negative territory. Such an advance would bring the most reliable measures we identify to the same hypervaluation we observed at the 2000 extreme (we presently estimate that valuations have already eclipsed the 1929 extreme). We can’t rule that out, but we would expect any further gains to be wiped out as quickly as they were in the 2000 instance.

As Benjamin Graham observed decades ago, "Speculators often prosper through ignorance; it is a cliche that in a roaring bull market, knowledge is superfluous and experience is a handicap. But the typical experience of the speculator is one of temporary profit and ultimate loss."

I’ve often emphasized that valuation in itself is a rather poor measure of near-term return prospects. Instead, the primary driver of market returns over shorter segments of the market cycle is the preference of investors toward risk-seeking or risk-aversion. The best measure we’ve found of investor risk-preferences is the uniformity or divergence of market action across a wide range of individual stocks, industries, sectors, and security types. When investors are strongly inclined to speculate, they tend to be indiscriminate about it. Our inferences aren’t based on a single measure like the advance-decline line or some moving average or another, but instead on a much broader signal extraction which remains unfavorable here.