财政部说“2018年国企利润总额3.39万亿元 同比增长12.9%”。这结果政府欢呼,习近平得意。民企惨不忍睹,却不让发牢骚。

那那个是给政府带来最多钱的行业?

基建?交通运输如高铁?通讯如移动?石油化工?汽车?军工?电讯?

都不是。

国企给政府上缴的,三分之一来自烟草。够意思。

酒业【注1】呢?好像不那么够格。还没有消息,我估计了一下。去年利润一千亿【2】,茅台好像难做大,2018才赚了1.6亿【3】,“完成年计划的148.25%”,超额完成任务。按此推算,酒业不会超过2千亿,也可以,不比烟草业。

大家多抽烟,还能带同医保行业,如果不够,在喝点酒,又是一个增加总产值的招数。

【注】

【1】大家熟悉的名酒,好像都是国企,参见:白酒行业哪些是国企

【附录】

《金融时报》论中国经济

Growth has tripled that of comparable countries — but few can follow its lead

Steve Johnson January 10, 2019

China’s economic slowdown, with growth tipped to fall to around 6.1 per cent this year, the lowest rate since 1990, is often the subject of excited, breathless reporting.

But far less noted is how remarkable the country’s development has been in recent decades — and that even growth in the order of 6 per cent is striking for what is now a middle-income country.

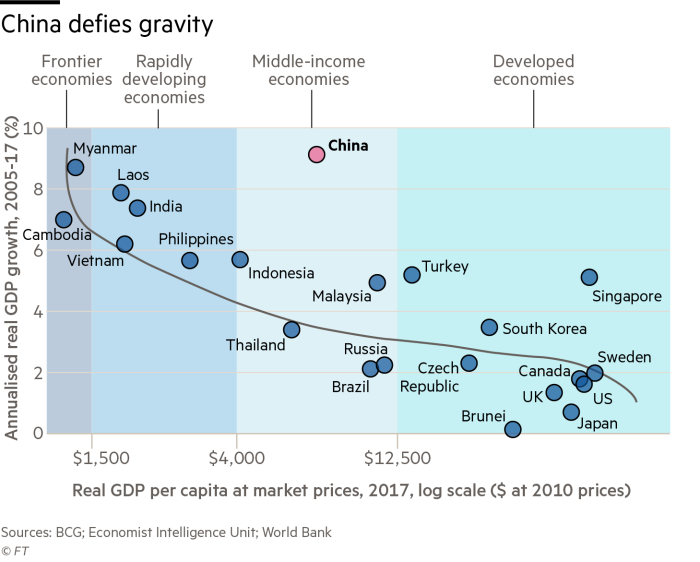

It is commonly accepted that poorer countries have the most scope for explosive catch-up growth, and that richer, more productive countries are more likely to eke out modest incremental gains.

This pattern had indeed unfolded in recent years, with one glaring exception: China, whose economy expanded at a compound annual growth rate of 9.1 per cent between 2005 and 2017, when a rate nearer 3-4 per cent might have been more in line for a country with per capita GDP of $7,368 (in 2010 dollars) as of 2017. This is illustrated in the first chart, based on analysis by Boston Consulting Group.

While many commentators doubt the accuracy of China’s notoriously smooth GDP growth figures, few would dispute that, whatever the precise figures, Beijing has managed to defy the odds.

This leads to some obvious questions: how has China managed to do this, can it continue, and can other developing countries follow its lead?

Erik Lueth, global emerging markets economist at Legal & General Investment Management, said the key to understanding China’s rapid growth is that it was following in the footsteps of some of its smaller neighbours.

“They are doing something that no one has managed to do recently, but it’s not completely out of the ordinary. The Asian tigers of Korea and Taiwan, and before them Japan, managed similar feats. China has emulated what they did. They took a leaf out of their book,” he said.

One similarity between the growth spurts in these countries was that they “put the financial sector at the service of industry”, Mr Lueth said “so you have massive financial repression and you channel savings into the industrial sector”. In China’s case, this has involved low bank deposit rates and a closed capital account to prevent money leaving the country.

“Savers do not earn a lot on their deposits and China has a very high savings rate, so all this ends up in industry,” he added.

Mr Lueth also argued that impressive growth spurts were more likely “if you have a dictatorship, or at least a very authoritarian system, that Japan and Korea had when they were at a similar level of development.

“That means you are willing to lose money in your state-owned enterprises because you want to master new technologies and you have to learn how to use them. That’s easier than if you have a liberal democracy,” he added.

Allied to this is protection of infant industries from foreign competition, even as the country pursues growth through exports.

“No country other than Britain has industrialised without protecting its own industries, and the reason Britain didn’t is that it was leading the Industrial Revolution and so there was no one to protect them from,” Mr Lueth said.

“We saw that in Japan and Korea and we have seen it in China; otherwise you will never be able to learn these technologies, others will always be better at it than you.”

Overall, Mr Lueth argued this recipe for rapid growth “flies in the face of the IMF and liberal economic thinking”.

“It’s more development economics, that’s not something that the IMF knows very much about,” he added. “Western economists focus on how can you increase efficiency but when you are at these levels it’s about development, you need to master technologies.”

Christian Kettels, chief economist at Boston Consulting Group, pointed to three further factors behind China’s rise.

First, China has enjoyed a demographic dividend, with its rapidly falling birth rate, driven in part by its now loosened one-child policy, meaning the working-age population has accounted for a rising share of the overall population, and importantly China has been able to make productive use of these workers.

Second, Mr Kettels argued China had made “huge strides” in terms of competitiveness and productivity, thanks to improvements in infrastructure, skills and the ease of doing business, helping it “unlock the potential for convergence” much more successfully than most other countries.

Last, he pointed to “the piling up of a huge amount of debt”, which has helped push demand higher.

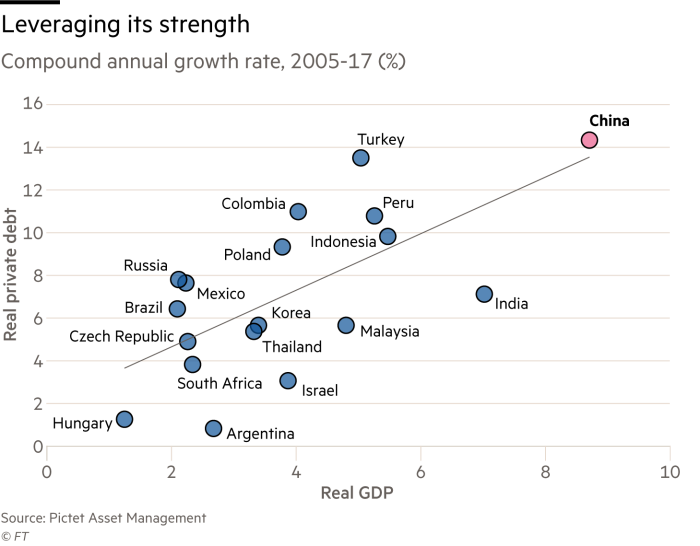

Patrick Zweifel, chief economist at Pictet Asset Management, agreed that “significant excess leverage” had been a prime driver of China’s outperformance. His analysis of major emerging markets since 2005 (see second chart) indicates a strong correlation between rising private sector debt (corporate and household) and GDP growth, with China well ahead on both measures.

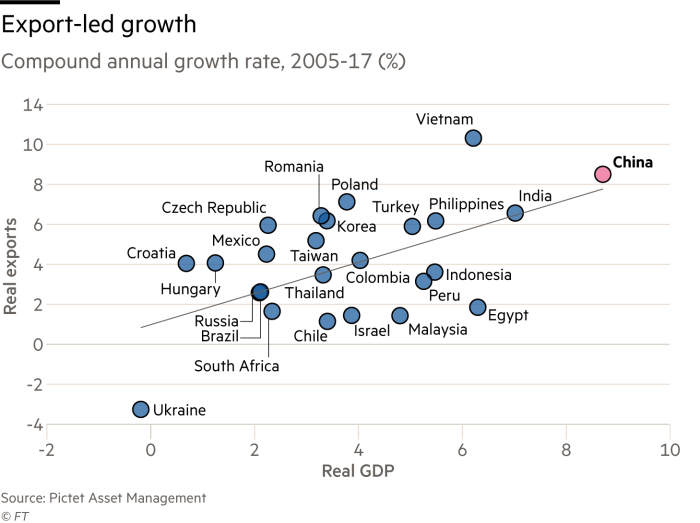

To Mr Zweifel, the second major engine of growth in emerging markets has been through rising exports. Similar analysis here shows that only Vietnam, among large EMs, has seen a larger rise in exports than China over the period, as depicted in the third chart.

Both of these prognoses lead Mr Zweifel to believe China’s growth rate, which has already slipped from 14.2 per cent in 2007 to around 6.5 per cent last year, is set to continue falling.

“This outperformance is unlikely to last since periods of excess leverage tend to be a drag on future growth,” he said, while China’s ongoing rebalancing from an investment, manufacturing and export-heavy growth model towards a more consumption and services-oriented economy would inevitably sap export growth.

Mr Kettels also argued China had taken some growth from the future in terms of its demographic dividend: while the sharp decline in the birth rate turbocharged this dividend for a generation, the impact will now start to turn negative as China’s workforce peaks even as the number of retirees is set to rise fast.

Andy Rothman, investment strategist at Matthews Asia, believed that the growth of China’s workforce since the 1990s accounted for around a third of its GDP growth, making a slowdown almost inevitable now, while the hectic pace of infrastructure development to support a rapidly urbanising population bolstered growth further.

However, he saw scope for further beneficial demographic shifts, with a third of workers still in the primary sector, in areas such as mining and agriculture. And with consumption and services increasingly dominant in China, “the quality of growth will be higher” even as its pace declines, he argued.

Given the protectionism and purloining of intellectual property that he sees as inherent to the east Asian growth model, Mr Lueth believed China will inevitably run into greater resistance, as illustrated by US president Donald Trump’s campaign against its trade practices.

“China is much bigger than Japan and Korea, so the world is much less willing to have them compete in global markets while closing down their domestic markets,” he said. “The US allowed this in Japan and Korea because they were smaller, but also because they were allies in the Cold War.

“If you have someone the size of China, and which also doesn’t share your political system, you are not so happy. The world will make it harder for China to steal technology.”

As to whether other countries could, or indeed should, try to follow China’s path, Mr Rothman argued that one prerequisite would be a “one-party authoritarian regime that has the political power to do some wrenching things”.

He pointed to Beijing’s ability to lay off 46m workers from state-owned enterprises in the period from 1996, noting “not everybody can get away with that”.

However, he believed many African countries should selectively follow Beijing’s development model, such as prioritising spending on education and healthcare to push up literacy and high school graduation rates.

Mr Kettels also recommended that poorer countries should invest in skills and infrastructure and open up to the global economy, although “I wouldn’t take the conclusion that you should have a policy of trying to manage population growth”.

One thing no other country, with the possible exception of India, could hope to reproduce though is the sheer size of China’s local economy, which acts as a magnet for global companies.

Despite this, Mr Lueth was downbeat about the prospects of India following in China’s footsteps — and indeed whether developing countries in general could.

“The key reason I don’t get overly optimistic about India is that there is no industrial sector to speak of and we have never seen a country develop without that,” he said.

“You can take farmers who are not skilled and move them to industry and they can be hugely productive. A waiter can only serve so many people. Where you do have efficiency [in the services sector], eg lawyers, you can’t use farmers, you need polished urbanites.”

Worryingly, from this perspective, many emerging countries appear to be suffering from “premature deindustrialisation”.

In the west, the manufacturing sector’s share of employment peaked at around 25-30 per cent at a point where GDP per capita (in 2005 dollars) was between $11,000 and $21,000. Yet Brazil and India have already seen their share of manufacturing employment peak below 15 per cent when GDP per capita was less than $5,000 in Brazil and $1,000 in India, while in much of sub-Saharan Africa manufacturing’s share of output has persistently declined over the past 25 years and accounts for just 6 per cent of jobs.

“It is a phenomenon that we see across many emerging markets,” Mr Lueth said. “It shows that many of these EMs are not able to industrialise. One reason is that they are following the western consensus and so have liberalised everything.”

Yet even if they broke away from this consensus, Mr Lueth feared it would not be long before robots started replacing workers wholesale in light manufacturing.

“You have a lot of countries that are being left behind,” he warned.

Gillian Tett(《金融时报》美国主编), January 10, 2019

Growth in service sector jobs belies the president’s vision of American ‘carnage’

If you were to ask most ordinary American voters what has happened to their country’s manufacturers in recent years, they might howl with horror or mutter about “carnage”. After all, Donald Trump swept to power alleging that Chinese competitors have “killed” American factories and jobs. Hence the simmering US-China trade war, and this week’s high-stake talks in Beijing.

But if you want a more accurate picture of what Chinese competition has done to US industry, it is worth looking at some material presented at last weekend’s American Economics Association’s convention in Atlanta. In recent years, an army of economists has analysed the issue that sparks Mr Trump’s ire: the impact of Chinese competition on America.

And while this number-crunching supports the president’s rhetoric in some areas, the data also suggest it is time to reframe the debate — away from manufacturing to services. Let us start with the place where the facts back Mr Trump. Yes, in recent decades, the US has seen traditional manufacturing jobs shrivel dramatically.

Moreover, studies by economists such as David Autor show this decline was most stark in regions and industries exposed to Chinese competition.

Sometimes this was because American factories closed their doors, or moved overseas. But, as the economists Teresa Fort, Justin Pierce and Peter Schott told the AEA, US companies have also replaced human workers with robots at home, often to cut costs because of overseas competition (and, as they stress, it is often hard to disentangle precisely whether it is robots or trade displacing most jobs).

This process often inflicts enormous local pain, or the economic “carnage” that Mr Trump talks about.

A second paper co-authored by Prof Autor and presented to the AEA shows that this shock is correlated with a collapse in marriage rates (because it is mostly the men, not women, who lose work, making them less attractive partners). Other research also shows correlations with rising opioid addiction and child poverty rates.

Worse still, the impact of a “China shock” is magnified across the economy by house prices, as the economists Robert Feenstra, Hong Ma and Yuan Xu told the AEA. This all makes for grim reading.

But there is also a big caveat — more accurately, a silver lining to this cloud — that Mr Trump has hitherto ignored: while so-called manufacturing jobs have shrivelled, this does not capture what has happened to “manufacturing firms”.

Calculations from Profs Fort, Pierce and Schott show that between 1977 and 2012, the number of “manufacturing firm workers” employed in “manufacturing plants” halved from just under 20m to nearer 10m. However, the employees in “non-manufacturing plants” that were owned by “manufacturing firms” rose from 13m to 23m, primarily due to an explosion in service sector jobs such as design and IT.

As a result, by 2012 the US’s “manufacturing” companies employed slightly more workers than in 1977. Moreover, that was not because of business churn: 75 per cent of the “manufacturing” job losses in this period occurred at companies which remained in business, and it was the incumbents which opened most of the non-manufacturing plants. In plain English, this means that as Chinese competition hit, America’s “manufacturing” groups quietly re-engineered themselves.

Yes, they might call themselves “manufacturers”, and be defined that way in the data. But they increasingly hire service-sector workers, as their output soars. This week’s announcement from Apple that it is shifting its focus from hardware to services is symptomatic of a significant trend.

That will not comfort old-style “manufacturing” workers. Research by Nicholas Bloom, Kyle Handley, Andre Kurman and Philip Luck shows that in parts of America, vanishing manufacturing jobs have been replaced by new service work. Not so, however, in the poorer regions of the American south and midwest.

Hence the pockets of economic pain — and voter fury — that Mr Trump has played on.

But for the US as a whole, the moral is clear: if the president is to help the workers in American “manufacturing” companies, he should spend less time raging about widgets, and more time talking about services.

That may not make for a good photo opportunity, but it reflects the real future of American “manufacturing” growth.

Beijing’s policy moves have left companies that are key to economic output worried

Tom Mitchell and Xinning Liu in Beijing and Gabriel Wildau in Shanghai JANUARY 20, 2019

Qin Nan, the chief executive of a Beijing-based manufacturer, needs to borrow at least Rmb5m ($740,000) to expand production of his company’s air purifiers and air conditioners. But because his company lacks an equivalent amount of collateral in property and other assets, Chinese banks were willing to lend only Rmb2m.

“We didn’t have any more collateral to offer so [bank financing] was a dead end,” Mr Qin told the Financial Times. “We borrowed bridge financing from private channels at interest rates as high as 3 per cent a month [or 36 per cent a year] but paid back the money quickly.” He said he was now exploring “all possible channels” of additional funding, including private equity firms.

Mr Qin’s grievances, which he recently aired on social media, are increasingly common among private sector companies in the world’s second-largest economy, which have been hit by a squeeze on lending as Beijing has worked to reduce the economy’s dependence on debt-fuelled stimulus. If their complaints are not addressed, the consequences could be disastrous for Chinese officials as they try to avoid a precipitous deceleration in economic growth, which last year slowed to a 28-year low of 6.6 per cent, according to data released on Monday.

Non-state companies, including foreign-invested enterprises, account for more than half of total economic output in China, and anywhere between 50 and 90 per cent of tax revenues, spending on research and development, urban employment and exports.

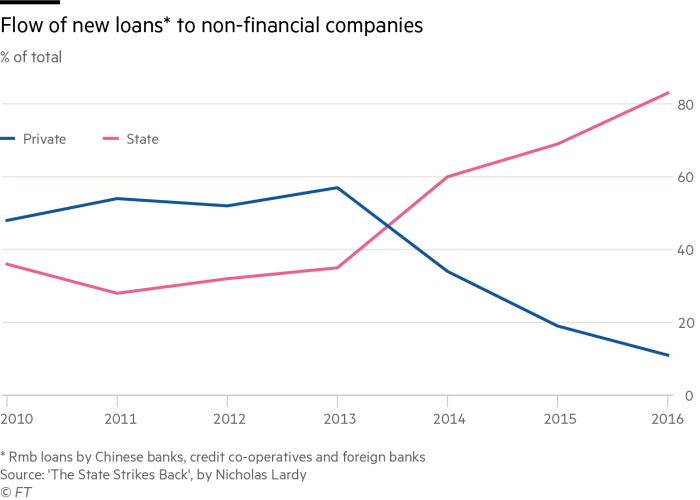

But according to official bank data cited by Nicholas Lardy in The State Strikes Back, his most recent book on the Chinese economy, in 2016 they received just 11 per cent of new loans issued by the official bank sector, while more than 80 per cent flowed to state-owned enterprises. In 2012, the year before President Xi Jinping assumed power, private sector companies and SOEs received, respectively, 52 per cent and 32 per cent of new loans — with the remainder going to collectively owned groups and other companies that do not fit clearly into state or private.

This imbalance, as well as Mr Xi’s enthusiasm for ever bigger, stronger SOEs and his repeated admonishments that the Communist party is the “ruler of all”, have demoralised many private sector entrepreneurs and other proponents of bolder economic reforms.

Until recently, privately owned companies in China could survive by tapping funds from the country’s enormous shadow banking sector. But shadow financing began to dry up as Chinese officials, led by Vice-Premier Liu He, ramped up a campaign to stabilise debt at non-financial companies, which is estimated at about 300 per cent of GDP.

Mr Xi and Mr Liu appear to have underestimated US President Donald Trump’s willingness to launch an all all-out trade war with China, which has sapped investor and private-sector investment, and also their ability to force the country’s state-controlled banking sector to direct more lending to non-state companies.

“In an economy that is 50 per cent private, Xi cannot repress the private sector without limit,” said Andrew Batson, China research director at Gavekal. “It seems like we reached that limit some time in late 2018.”

An increasing number of influential economists now think that the officials driving China’s economy need to take pressure off the brake and instead feather the accelerator, albeit without resorting to “flood-like” stimulus measures that Beijing employed during the depths of the 2008-2009 global financial crisis.

“Yes we should try to stabilise the [overall] leverage ratio, but you can’t cut the [overall debt] ratio in a hurry,” said Yu Yongding, an economist at the Chinese Academy of Social Sciences and a former central bank adviser. “That’s wrong. Growth is still very important for China. Without growth, everything will get worse. We can only tolerate a certain slowdown.”

Senior officials appear to agree. “We will keep the economy operating in a reasonable range, which means we allow economic growth to fluctuate,” Premier Li Keqiang said on January 17. “But there cannot be big ups or downs. It cannot fall off a cliff.”

In an extraordinary salvo earlier this month, Mr Li and Mr Liu visited staff at the Beijing headquarters of three of China’s four largest state banks, lecturing them on “inclusive finance” and the need to support small and medium-sized enterprises.

Mr Li and Mr Liu’s hectoring received blanket state media coverage. Within hours, China’s central bank, in an effort to stimulate such lending, announced an Rmb800bn ($117bn) cut in the level of reserves banks are required to hold.

Mr Li and Mr Liu’s admonishments came just two months after Mr Xi, in a similarly hyped meeting with some of the country’s richest entrepreneurs on November 1, pledged “unswerving support” for the private sector. In the weeks that followed that encounter, a financial regulatory commission headed by Mr Liu dispatched inspectors across the country to figure out why the credit “transmission mechanism” between state lenders and private borrowers was not working.

Wu Hai, founder of the Beijing-based Crystal Orange hotel chain, said one problem was that even when a bank’s risk control committee approves a loan, ultimate responsibility still rested with the loan officer who brought it to them. “If the loan defaults, it’s the loan officer who gets blamed,” he said. “So [loan officers] just follow the rule book.”

Like Mr Qin, Mr Wu had difficulty dealing with state banks because Crystal Orange rented rather than owned its hotel premises and could only borrow against its cash flow. Mr Wu instead sought outside private equity investors such as Carlyle Group, which became Crystal Orange’s largest shareholder before its Rmb3.65bn sale last year to a rival Chinese hotel chain.

Now flush with his own cash from that sale, Mr Wu is investing in a chain of upscale karaoke parlours and other ventures. Across town, however, a worried Mr Qin is still struggling to raise money, even as the country’s most senior leaders seek to reassure him and other entrepreneurs.

“It takes time for policies [supporting the private sector] to be implemented,” Mr Qin said. “So, for now, we do not feel at ease.”

Beijing is discovering that market sentiment is hard to predict

Tom Mitchell

China’s economic slowdown — Communist party and government officials insist both in public and in private — is all going according to plan.

From 6.8 per cent annual growth in 2017 to 6.6 per cent last year and an expected target range of 6-6.5 per cent next year, slower but “higher quality” growth that leaves, for example, a cleaner environment in its wake is indeed a good thing.

There is, these officials argue, also comfort to be taken from the ever greater “quantum” of growth that China’s economy throws off every year. A bigger but slower growing economy creates more additional demand than a smaller economy that is expanding more rapidly.

Last year China’s economy expanded by about $1.2tn, or twice what it did when it was growing at double-digit rates more than a decade ago. That in turn creates enough urban employment (10m or more new jobs or more a year) to ease official concerns about their greatest fear — “social instability” and any loosening of their ever tighter grip on China’s body politic.

Not even US President Donald Trump and his determination to pursue an all-out trade war worries Beijing too much. If a truce cannot be negotiated by March 1, as negotiators from both countries are now trying to do, Chinese officials will not welcome the escalation that will follow. But they believe they can withstand it and are planning for that eventuality.

It is instead things that Beijing was not planning for — and that takes it by surprise — that really scare China’s communist rulers. For them, the unknown is where the real threats lie.

China’s economic tsar, Vice Premier Liu He, and his advisers knew that both their determination to crack down on risky financial practices and an escalating trade war with the US would damp market sentiment. But did they know how many credit-starved private sector companies had pledged shares to secure financing? And did they know, as share prices fell, how many of those shares would end up in state hands, reinforcing the impression that the private sector that has driven China’s remarkable growth over the past four decades is, as one saying has it, “in retreat”?

Based on how quickly President Xi Jinping, Mr Liu and other top officials are now scrambling to reassure private sector entrepreneurs that they are in fact loved, the answer to both these questions is “no”. Like many communist regimes before it, China is discovering that the hardest thing of all to control is sentiment, especially market sentiment.

【评论】

Credit is flowing to state-owned companies, not more productive private ones

Nicholas Lardy January 15, 2019

It used to be said that when the US sneezes Canada catches a cold. Now China is sneezing and many economists fear that its weaknesses are contagious for the rest of the world.

China’s problems are variously attributed to weak domestic demand, to a natural maturing of its economy, and, of course, to its tariff war with America. These factors appear to be eroding China’s previous outsized contribution to global growth, rattling markets, and leading some multinational companies to downgrade their earnings forecasts.

But even if the trade dispute with the US is solved, China’s role as the locomotive of global economic growth is threatened by a far more fundamental factor — President Xi Jinping’s rollback of the market-oriented reforms that served China so well for 35 years.

The adoption of market-oriented reforms under Deng Xiaoping and other leaders, starting in 1978, allowed private companies to flourish. Initially such businesses were illegal, but they were soon legitimised and later recognised as an essential element of a mixed economy. As a consequence, they gained increased credit over time from a state-dominated banking system.

These reforms allowed private companies to make a disproportionately large contribution to China’s stellar output, employment and export growth. This enabled it, in time, to become an economic superpower.

When Mr Xi became general secretary of the Chinese Communist party in the autumn of 2012, many analysts expected him to build on this impressive legacy. Indeed, only a year later, he presided over an important party meeting that endorsed a far-reaching reform programme. This stated that “the market must become the decisive force in the allocation of resources”.

However, Mr Xi has since largely abandoned this approach in favour of concentrating on his anti-corruption campaign. He has also repeatedly emphasised the role of state industrial policy and state-owned companies, despite overwhelming evidence that the latter are inefficient.

Even after receiving various direct subsidies, the Chinese ministry of finance acknowledges that more than two-fifths of these state companies

persistently rack up losses. They are kept afloat with massive increases in bank credit that are almost entirely responsible for the increase to record levels of leverage in China’s corporate sector.

Because of Mr Xi’s repeated admonition that state-owned companies should be bigger, the government has organised multiple mergers of large enterprises in particular industries. This ill-advised consolidation has reduced competition, weakening the incentive for innovation and cost control.

Predictably, the return on assets of the largest state-owned companies has fallen by more than half since the merger mania began. At the same time, the productivity of private companies has increased, and in the industrial sector is now almost three times that of their state-owned counterparts.

While these unwieldy state behemoths soak up a larger and larger share of bank credit, they are doing so mostly at the expense of more productive private companies. The share of bank lending to the private sector has shrunk by 80 per cent since 2013. Despite the rapid growth in credit overall, the absolute amount of bank lending to private companies has also fallen sharply.

This has reversed a long-term trend — the share of investment undertaken by private companies first plateaued and then fell in recent years. Similarly, whereas private industrial companies had previously expanded their output at twice the pace of their counterparts in the state-owned sector for more than a decade, since 2017 the situation has reversed.

This reflects both the squeeze on the bank credit accessible by private companies and the more recent crackdown on the shadow banking system, which had previously been a source of credit as bank loans started to dry up. The failure of the state to protect private property rights has also played a significant role, undermining the trust and confidence that many entrepreneurs have in the system.

The combination of the precipitous decline in the return on assets of state-owned enterprises, which control about $30tn in assets (the equivalent of well over twice last year’s gross domestic product), and declining investment by private companies is dragging down China’s average annual growth by an estimated two percentage points.

Perhaps Mr Xi accepts this as the price of maintaining a state sector that he believes is an important element in sustaining political control. But without a return to a more marketed-oriented economic policy, even if bilateral trade disputes with the US are resolved, the likelihood is that China’s growth will slow further — with unpleasant consequences for the global economy.

The writer is senior fellow at the Peterson Institute for International Economics and the author of ‘The State Strikes Back: The End of Economic Reform in China?’

《经济学人》Headlines about China’s weak growth are somewhat misleading

Slowness is in the eye of the beholder

AMERICA’S PRESIDENT knows a catchy number when he sees one. Like much of the world’s media, Donald Trump tweeted this week that China’s growth in 2018 was its slowest in nearly three decades. This, he said, ought to compel it to make a “Real Deal” on trade with America. China’s growth of 6.6% last year was indeed the weakest since 1990, and it does want to end the trade war. But a closer look at the data shows why its leaders are less panicked than Mr Trump might think.

First, the sheer size of its economy means that China’s growth last year generated a record amount of new production. Nominal GDP increased by 8trn yuan ($1.2trn), well above the 5.1trn yuan added in 2007, when it notched up 14.2%, its fastest growth rate in recent decades. The point is simple—China is now growing from a much larger base—but it was overlooked in the flurry of headlines about its slowdown.

The changing nature of China’s growth also gives it some cushioning from the trade war. American tariffs are starting to inflict pain: Chinese companies have reported a sharp drop in export orders. But for the broader economy, foreign sales matter less than they used to. Although the falling trade surplus lopped half a percentage point from the growth rate last year, domestic demand more than plugged the shortfall (see chart). Consumption accounted for three-quarters of the growth rate last year, the most since 2000.

Finally, China has made modest progress towards cleaning up its financial system. The government had sought to rein in debt, which had soared over the past decade. Critics have observed that it has failed to deliver any real deleveraging, because debt-to-GDP levels have continued to creep up. But stabilisation, rather than outright deleveraging, was China’s real goal. It has had some success: the pace of debt accumulation slowed sharply. In 2015 it took more than four yuan of new credit to generate each yuan of incremental GDP. In 2018 that multiple fell to 2.5, in line with China’s average over the past 15 years.

Alongside these positives, however, there were some worrying signs. Nominal growth has slowed sharply, from an annual rate of 11.2% in the third quarter of 2017 to 8.1% in the final quarter of last year. It will slow further this year as inflation decelerates. Since nominal growth is closely correlated with corporate revenue growth, companies could be in for a tough year.

As for consumption, this year looks less promising than last. Companies have started cutting back on hiring and incomes are growing more slowly, weighing on consumer sentiment. The middle three quintiles of China’s population by income distribution saw earnings increase by only about 2% last year in real terms. Those of the richest quintile rose by 6.6%. Given that lower earners tend to spend more of their wages than the rich do, that is a poor basis for sustained growth in consumption. Sales of cars fell last year for the first time in more than two decades. Sales of mobile phones were also sluggish.

China has already pivoted towards more supportive economic policies. It has sped up spending on infrastructure, trimmed income taxes and relaxed some restraints on bank lending. This does not add up to a big stimulus package, but the direction is clear. If growth slows further, as seems likely, the government will move more boldly still.

There is no doubt that China would like to persuade Mr Trump to roll back tariffs on Chinese goods, which would both help its exporters and boost market sentiment. Bilateral talks are grinding on ahead of a March 1st deadline. Chinese negotiators are working on an offer that will satisfy their American counterparts, combining pledges to buy more American goods with reforms to treat foreign companies more fairly. But if Mr Trump truly believes what he tweets about the Chinese economy, he is at risk of overestimating the strength of America’s hand. China wants a trade deal, certainly, but it is not desperate.