https://seekingalpha.com/article/4257592-dollar-market-breadth-high-yield-bond-market-health-vix

The S&P 500 closed within one point of September 2018 all-time last Friday.

I wouldn't be surprised to see a pullback here since the S&P 500 usually takes a few tries to poke through a longer-term high.

My own opinion continues to be that S&P 500 earnings will be fine and continue to show an improving y/y growth rate for Q1 '19 and beyond.

The S&P 500 closed within one point of September 2018 all-time last Friday. You'd have to think "everyone" is watching what happens this week.

I wouldn't be surprised to see a pullback here since the S&P 500 usually takes a few tries to poke through a longer-term high.

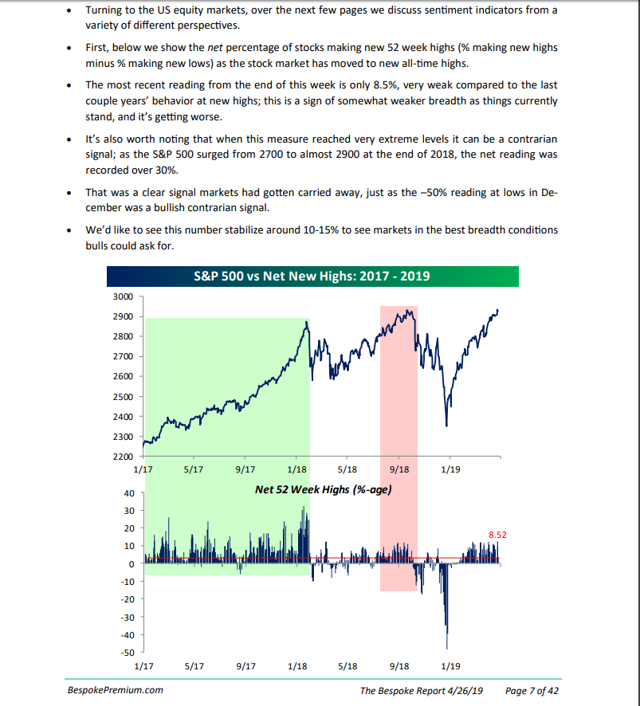

Market Breadth:

Bespoke thinks breadth could be a little better given the comments above from the Bespoke Report dated 4/26/19. Breadth waxes and wanes on occasion over shorter time frames, but I think we are still seeing institutional buying.

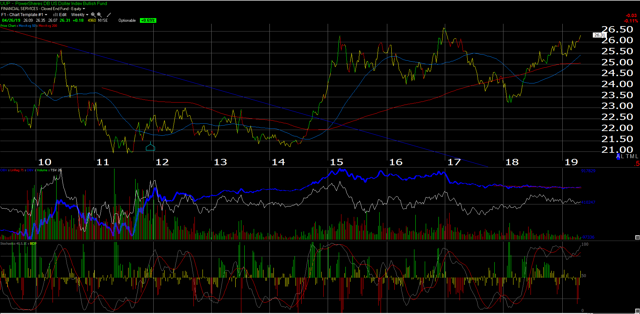

US Dollar:

This weekly chart of the UUP looks a lot like the S&P 500 chart.

While the dollar (DXY) was strong last week, it looked to have a reversal Thursday and Friday.

A weaker dollar would be a plus for the S&P 500, but I'm not sure what the catalyst would be. Note how overbought the UUP is (bottom quarter panel of the chart) so a "break" in the buck here would be well received by the US stock market.

This blog's dollar call in early 2018 was pretty good. The dollar was written about again in early 2019, but has yet to really weaken materially.

The problem with owning the UUP is that it generates a K-1. Clients hate that if it interferes with tax return preparation.

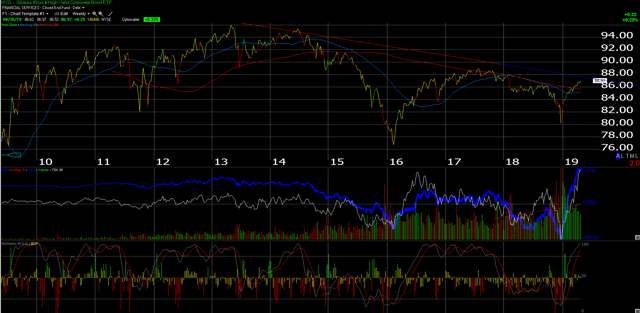

High-Yield Credit Market:

Looking at the weekly chart of the HYG, the high-yield ETF is nearing a critical trendline. That is important.

The HYG's total return has increased about 150 bps in the last 4 weeks to 8.66% YTD from 7.26% as of late March '19.

Up and through that HYG weekly trendline on the longer-term chart should provide significant support for the S&P 500.

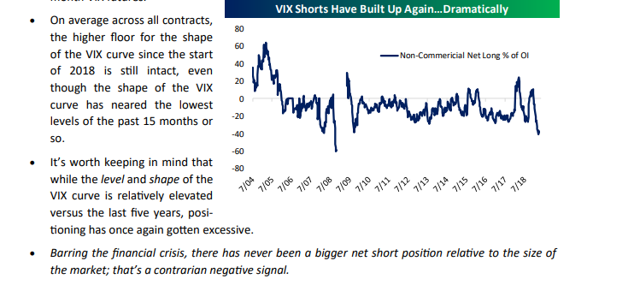

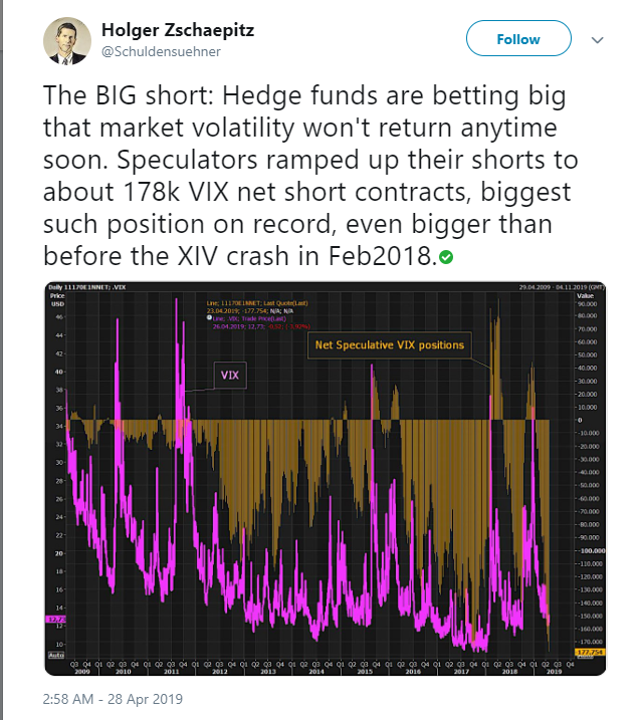

Vix Short position (could be major negative):

Summary/Conclusion: If we flip all these arguments, and get a strong dollar and weaker high-yield credit, then the S&P 500 could correct a decent amount here.

As Harry Truman, "two-handed" market commentary doesn't do readers much good.

Something picked up that is a little bit of a worry from the Bespoke Report (see the last bullet point in the first of the above two graphs) was the unusually high short position in the VIX that was also picked up by Samantha LaDuc's (@samanthaladuc) Twitter feed. (See both charts above.)

My own opinion continues to be that S&P 500 earnings will be fine and continue to show an improving y/y growth rate for Q1 '19 and beyond, and that should help the other factors involved, such as continued improvement in high-yield credit.

Take all of these opinions with a substantial grain of salt and a high degree of skepticism though. The VIX positioning could unwind the S&P 500 quickly.

Will today's capital markets look more like Q1 '16 in the next few months (slow, steady S&P rally from here) or more like January '18, when we saw the scary 10% drop in a few weeks?

Josh Brown also highlights the "volatility tsunami" as well as The Crucible that is the reason for this blog. Both very good articles - take a minute to read. (I am still amazed at Josh's production and intelligence. He and Barry's blogs are worth reading. His level of production/output is amazing and the majority of the articles are first rate. Listen to Barry Ritholtz's video about the RWM advisor that testified before Congress and her conclusions. Great stuff.)

Jeff Miller at a www.Dashofinsight.com with another great blog post this week. Jeff (as I do) tries to write once a week and make it count, but he is also writing more frequently as I am and as the markets demand.

This blog is written as a way to think through the possible catalysts for the capital markets and to evaluate the risks. Sometimes I get it right, and sometimes - like the correction last fall - I don't.

Remember, no one (and I mean no one) can predict what is going to happen in the market 100% of the time. There is no one person, firm, style or strategy, or fund that gets it right all the time.

It is the hardest concept for individual investors looking for an advisor or wealth manager to grasp and it usually means individual investors "fight the last war" (i.e., chase the last person/firm/strategy that had it right.)

Pay attention to long-term trends: it is just my opinion, but I think the S&P 500 is in a secular bull market similar to the 80s and 90s, just much more muted. I also think there will be an upward drift to bond yields over the next few years that will mute or reduce longer-term fixed-income returns, although the call for a 4%, Treasury 10-year yield expectation in early 2018 was too aggressive.

Thanks for reading.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.