观点:经济学家表示,经济衰退是不可避免的。这就是他们错的原因。

作者:加里·N·史密斯 2024 年 1 月 22 日

https://www.marketwatch.com/story/recession-was-inevitable-economists-said-heres-why-they-were-wrong-2edac573

对基于货币政策的预测持怀疑态度

约翰·霍普金斯大学经济学教授史蒂夫·H·汉克 (Steve H. Hanke) 在 2022 年 8 月接受 CNBC 采访时预测:“2023 年我们将经历一场严重的经济衰退。” 2023 年 4 月,他再次发出警告:“我们知道经济衰退已经是板上钉钉的事情了,”他说。许多其他经济学家也预测 2023 年将出现经济衰退。他们错了。

大多数衰退预测都是基于合理的假设,即美联储将采取一切必要措施将通胀降至央行 2% 的目标水平。在美联储1979年开始的通货膨胀大战期间,美联储主席保罗·沃尔克被问及紧缩货币政策是否会导致经济衰退。他立即回答:“是的,而且越快越好。”

在 1980 年的另一次谈话中,沃尔克表示,“直到最后一声锯齿声平息”他才会满意——指的是高利率对住宅、工厂和办公楼建设造成的破坏性影响。

到 2022 年,随着通货膨胀率有可能达到两位数水平,就像 1979 年的情况一样,美联储观察人士自然认为美联储将再次将利率提高到足够高的水平,从而引发足以压垮通货膨胀的衰退。令他们惊讶的是,美联储实现了软着陆,降低了通胀率,但没有引发经济衰退。

阅读:通胀“远未消亡”:为何一位大型资产管理公司怀疑美国能否达到 2%

汉克的推理更加教条,关注的是美国的货币供应量而不是利率。他长期以来一直认为货币数量论在货币与通货膨胀之间提供了紧密的联系。因此,举例来说,如果直升机在全国各地飞行,从天而降的钱,从而使货币供应量增加一倍,价格也会增加一倍,而生活将继续不受干扰。

这个简单化的模型存在几个问题。一是它假设速度——国内生产总值与货币供应量的比率——是恒定的。例如,如果这个比率为 5,那么平均每一美元每年将被用于购买国内生产的商品和服务五次。这个比率没有理由应该是5或任何其他特定数字,特别是因为货币被用来购买许多不包含在GDP中的东西,包括中间产品、进口产品、股票和其他金融资产,以及房地产和其他现有的实物资产。

第二个问题是,没有明确的最佳衡量货币的方法。与许多其他货币主义者一样,汉克青睐 M2,这一衡量标准包括现金、各种银行存款和零售货币市场基金。 M2 的想法是衡量人们可以根据需要支出的现成资金。房间里的大象是,许多购买是通过信用卡、消费者和商业贷款进行的。没有好的方法来衡量这些限制支出的程度。

尽管如此,汉克经常依靠货币数量论来论证 M2 与通货膨胀之间存在紧密的一一对应的联系。例如,他在 2023 年写道,“速度和实际产出增长非常接近恒定,而且……货币供应增长率和通胀几乎是一对一的关系。”

这个结论显然是错误的,但我在这里担心的是汉克在 2022 年 8 月基于 M2 增长放缓对 2023 年“严重衰退”的预测。

我们让市场变得有意义

通过 MarketWatch 的实时新闻和分析,了解当今的全球商业实践、市场动态、经济政策等如何影响您。

货币主义者喜欢指责美联储。

汉克并不是最后一个坚持的货币主义者。 Motley Fool 1 月 7 日的一篇文章指出,M2 在过去一年中下降了 2%,并警告说,“M2 的下降历来是经济衰退的先兆”。尽管文章确实指出历史事件有点过时了(1878年、1893年、1921年和1931-1933年),但它仍然发出了不祥的警告:“前四次事件都导致了美国经济的通货紧缩萧条,失业率大幅上升。”

货币主义者喜欢指责美联储,但美联储并不直接控制M2等货币总量。美联储利用公开市场操作来控制基础货币——银行外货币加上银行准备金。 M2 和其他货币总量是由公共决定内生决定的,即如何在 M2 中包含或不包含的事物之间分配其财富。

另一个复杂的因素是美元是一些国家的官方货币

在许多其他国家,它是一种非官方的交换媒介,并被中央银行广泛持有作为外汇储备。现在几乎一半的美元都存放在美国境外。

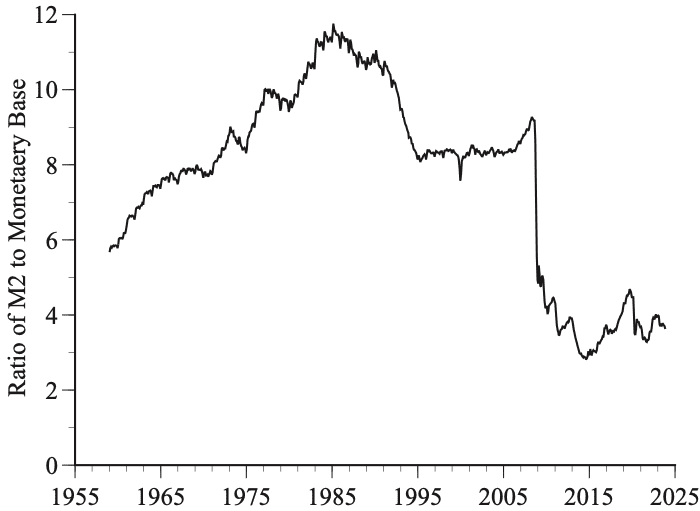

底线是,没有任何有说服力的理由说明M2应该与基础货币紧密挂钩。但实际上并非如此。从M2与基础货币的比率这个数字可以看出,这种联系是多么的松散。 2008年M2与基础货币的比率急剧下降,是因为美联储为防止大衰退演变成第二次大萧条而增加基础货币,而M2却几乎没有变化。将 M2 称为货币供应量是一种严重的误导,就好像它是由美联储控制的一样。

这些不同的考虑并不意味着美联储无能为力。只要央行官员认为失业符合我们的最佳利益,他们当然可以缩减流动性并提高利率,从而引发经济衰退。这些考虑的真正含义是,认为 M2 与通胀或产出之间存在紧密联系的想法是愚蠢的,并且根据 M2 的波动做出预测是危险的。

加里·N·史密斯 (Gary N. Smith) 是波莫纳学院 (Pomona College) 弗莱彻·琼斯 (Fletcher Jones) 经济学教授,发表了数十篇研究文章和 17 本书,其中包括最近与他人合着的《现代价值投资的力量:超越指数、算法和阿尔法》与玛格丽特·史密斯(帕尔格雷夫·麦克米伦,2023)。

Opinion: Recession was inevitable, economists said. Here's why they were wrong.

Most recession predictions were based on the reasonable assumption that the U.S. Federal Reserve would do whatever was necessary to bring inflation down to the central bank’s 2% target level. During the Fed’s great war on inflation that began in 1979, Fed Chair Paul Volcker was asked if the tight money policies would cause a recession. He answered immediately, “Yes, and the sooner the better.”

In another conversation in 1980, Volcker said that he wouldn’t be satisfied “until the last buzz saw is silenced” — a reference to the devastating effects of higher interest rates on the construction of homes, factories and office buildings.

In 2022, with the rate of inflation threatening to reach double-digit levels, as had been the case in 1979, Fed watchers naturally assumed that the Fed would again jack up interest rates high enough to cause a recession large enough to crush inflation. To their surprise, the Fed engineered a soft landing, bringing down the rate of inflation without causing a recession.

Read: Inflation is ‘far from dead’: Why one large asset manager doubts U.S. can hit 2%

Hanke’s reasoning was more dogmatic, focusing on the U.S. money supply rather than interest rates. He has long held that the quantity theory of money provides a tight linkage between money and inflation. So if, for example, helicopters were to fly around the country dropping money from the sky, thereby doubling the money supply, prices would also double, and life would proceed otherwise undisturbed.

There are several problems with this simplistic model. One is that it assumes that velocity — the ratio of gross domestic product to the money supply —is constant. If this ratio were 5, for example, then, on average, each dollar would be used five times a year to purchase domestically produced goods and services. There is no reason why this ratio should be 5 or any other particular number, especially since money is used to purchase many things that are not included in GDP, including intermediate goods, imports, stocks and other financial assets, along with real estate and other existing real assets.

A second problem is that there is no clearly best way to measure money. Along with many other monetarists, Hanke favors M2, a measurement that includes cash, a variety of bank deposits and retail money-market funds. The idea is that M2 measures readily available funds that people can spend if they want to. The elephant in the room is that many purchases are made with credit cards and consumer and business loans. There is no good way to measure the extent to which these constrain spending.

Nonetheless, Hanke has often relied on the quantity theory of money to argue that there is a tight one-for-one link between M2 and inflation. For example, in 2023 he wrote that “velocity and real output growth are very close to being constant, and … the money supply growth rate and inflation have a near one-to-one relationship.”

That conclusion is demonstrably wrong, but my concern here is with Hanke’s August 2022 prediction of a “whopper of a recession” in 2023 based on a slowing of M2 growth.

We Make The Markets Make Sense

Monetarists love to point accusatory fingers at the Fed, but the U.S. central bank does not directly control monetary aggregates like M2. The Fed uses open-market operations to control the monetary base — currency outside banks plus bank reserves. M2 and other monetary aggregates are determined endogenously by public decisions about how to allocate their wealth among things that are or are not included in M2.

Another complicating factor is that the U.S. dollar is the official currency in several countries, is an unofficial medium of exchange in many others, and is widely held by central banks as foreign-exchange reserves. Almost half of all U.S. currency is now held outside of the United States.

The bottom line is that there is no persuasive reason why M2 should be tightly linked to the monetary base. In practice, it isn’t. This figure of the ratio of M2 to the monetary base shows how loose the connection is. The precipitous drop in the ratio of M2 to the monetary base in 2008 was due to the Fed pumping up the monetary base to keep the Great Recession from turning into the second Great Depression while M2 barely budged. It is deeply misleading to call M2 the money supply, as if this were controlled by the Fed.

These various considerations do not mean that the Fed is impotent. Central bankers can certainly shrivel liquidity and jack up interest rates in order to cause a recession whenever they feel it is in our best interests to be unemployed. What these considerations do mean is that it is foolish to think that there is a tight link between M2 and either inflation or output, and that it is hazardous to make predictions based on wiggles and jiggles in M2.

Gary N. Smith, Fletcher Jones professor of economics at Pomona College, is the author of dozens of research articles and 17 books including, most recently, “The Power of Modern Value Investing: Beyond Indexing, Algos, and Alpha,” co-authored with Margaret Smith (Palgrave Macmillan, 2023).