No doubt about it, this has been a good market year for gold bugs. But it turns out it's been a bad one for a manager of a gold-based portfolio.

After a year in which spot gold rose 24%, GoldLink Capital Asset Management Ltd. is being kicked to the curb. And for good reason.

Oh, you've not heard of GoldLink? Then bend your ear.

The GoldLink IncomePlus Fund (ASX: GLI) was supposed to be innovative. And it was. GoldLink was the first publicly traded gold portfolio to pay its Aussie holders a regular dividend. GoldLink pulled this off by borrowing gold cheaply, selling it through the futures market and investing the proceeds.

Well, not exactly the futures market. GoldLink's dividends came from options on gold futures. Options, in this sense, are derivatives of derivatives. Trading them as GoldLink did was essentially a volatility bet. Simply put, GoldLink wagered that fluctuations in gold prices would remain constant or increase.

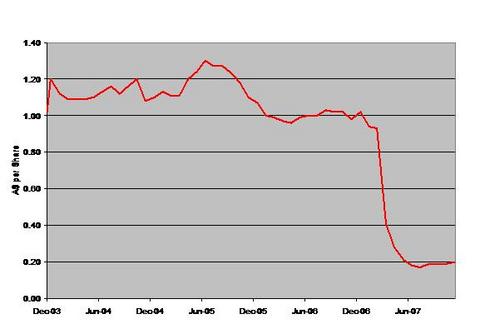

The gold market played into GoldLink's hand beautifully until mid-2005 when gold started soaring. Funny thing about bull markets: Volatility, more often than not, drops as prices rise. And drop it did, falling fitfully through 2006 and into 2007. That brought losses. BIG losses. Fully 86% of the A$150 million raised since the company was founded in 1998 evaporated.

As company founder Richard Kovacs says, GoldLink navigated "seven really good years and one bad year."

Investors, not surprisingly, are up in arms. So many pitchforks and torches were spotted before the recent shareholders' meeting that the entire board resigned before the opening gavel.

And the investment manager's contract? It's going to be allowed to expire un-renewed today as the company "repositions" itself.

GoldLink IncomePlus Fund (GLI)