2010 Investing: A Tale of Two Economies

It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of Light, it was the season of Darkness, it was the spring of hope, it was the winter of despair, we had everything before us, we had nothing before us, we were all going direct to Heaven, we were all going direct the other way–in short, the period was so far like the present period, that some of its noisiest authorities insisted on its being received, for good or for evil, in the superlative degree of comparison only." - Charles Dickens, 1859

Dickens' famous novel (which was originally written as a weekly series in 31 installments) depicts life in the time of the French revolution but was also a parable, meant to warn the British aristocracy that they should not ignore the parallels to the social inequities that existed at the time in England. Dickens warned the nobles that the seeds of revolution were planted through unjust acts and surely there would be a time of reaping yet to come.

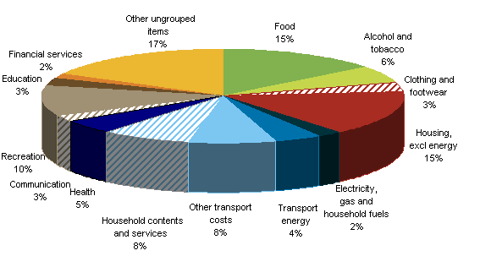

It is said that the French Revolution was sparked by outrage over a statement by the Queen Marie Antoinette who, when told that the peasants had no bread to eat, supposedly replied (she never actually said this) "Qu’ils mangent de la brioche" or "Then let them eat cake." It’s hard for us to imagine the impact of this statement in modern times but "peasants" were 90% of the population at the time. Bread was 90% of what they ate, consuming 50% of the average family’s income. People weren’t silly enough to pay for housing back then - they just found a bit of land, bought some wood and nails and built their own homes. Brioche was a luxury combination of bread enriched with flour and butter so the statement "Qu’ils mangent de la brioche" implies both lack of caring and cluelessness on the part of the Queen.

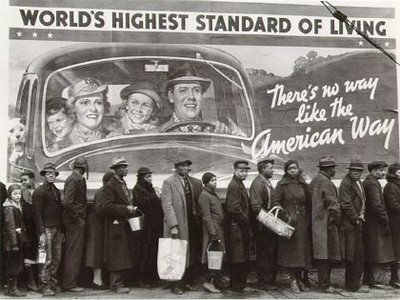

The United States had what passes for a revolution between 2006 and 2008 as we threw out the Republicans and went with a Democrat-controlled government. While the Bush administration, the Republican Congress and Fox News may have been as clueless as a French Queen to the plight of the people - the fact of the matter is that the base pay of top management rose 78% from 2002-2007 while the pay for workers went up just 24%. The top 10% of executives and professional workers drew 33% of all income paid in the U.S. ($2.1Tn) and that does not take into account stock options and bonuses that more than doubled that figure. [click on images to enlarge]

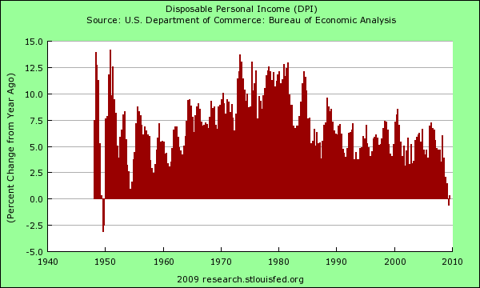

At the same time as the income gap was widening to historic levels, commodity prices doubled, taking the cost of food and fuel from 12% to 20% of household income. Add in skyrocketing health care costs and you can see where the seeds of revolution had been sown long before the 2008 election. Disposable income has fallen from 8% in 2000 to actual negative numbers in 2009 (families must borrow just to survive). Is it any wonder that people in America were hungry for change as the decade, and their incomes, wound down?

At the same time as the income gap was widening to historic levels, commodity prices doubled, taking the cost of food and fuel from 12% to 20% of household income. Add in skyrocketing health care costs and you can see where the seeds of revolution had been sown long before the 2008 election. Disposable income has fallen from 8% in 2000 to actual negative numbers in 2009 (families must borrow just to survive). Is it any wonder that people in America were hungry for change as the decade, and their incomes, wound down?

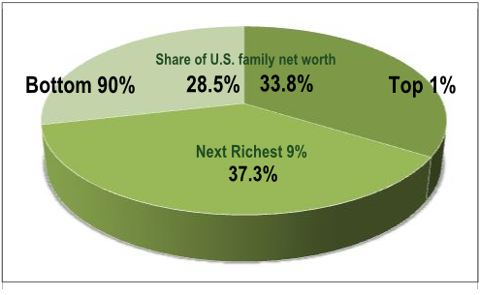

Despite the change in leadership, 2009 has not been kind to the American proletariat. There has been a $539Bn decrease in real income and, since 2006, Americans have lost $3.7Tn housing value (15%). Homes represent 42% of the average family’s total net worth but it’s worse than that because home mortgage debt is at $10.4Tn, which is 57% of total home worth. U.S. home equity has dropped from 58% in 2003 to 43% this year, a loss of over 25% in 6 years. This is reality for American peasants, the 300M people who aren’t in the top 10% and don’t read the Wall Street Journal (as they have nothing to invest) and don’t shop at Williams-Sonoma (WSM) or Tiffany's (TIF) or Saks (SKS) or Nordstrom's (JWN) - all stocks that have been off to the races in the second half of 2009 as the rich grow far, far richer.

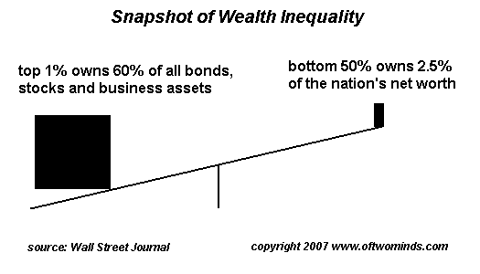

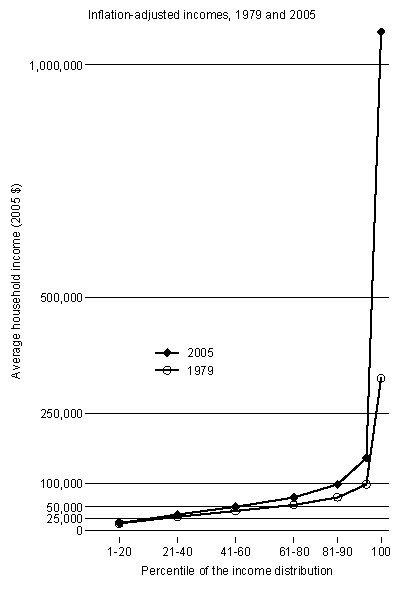

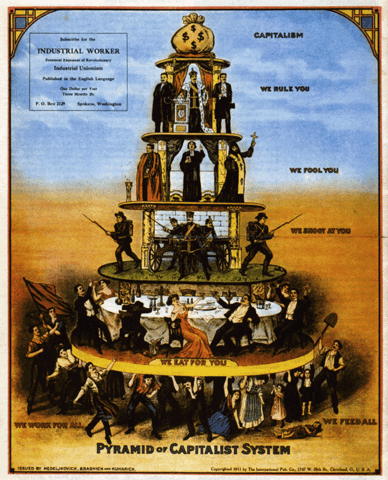

How much richer, you may ask? Well, the chart on the right says it all. In the past quarter century, the inflation-adjusted household income for the top 3% of Americans has tripled while the other 97% have gained about 50%, roughly 2% per year over inflation. Since 1979, 80% of the vast GDP growth in the United States has been diverted to less than 10M of its citizens, while the other 295M people struggle to maintain their lifestyles. Forcing the vast majority of Americans into a life of wage slavery has, of course, been an economic renaissance for those of us fortunate enough to be at the top of the economic pyramid.

How much richer, you may ask? Well, the chart on the right says it all. In the past quarter century, the inflation-adjusted household income for the top 3% of Americans has tripled while the other 97% have gained about 50%, roughly 2% per year over inflation. Since 1979, 80% of the vast GDP growth in the United States has been diverted to less than 10M of its citizens, while the other 295M people struggle to maintain their lifestyles. Forcing the vast majority of Americans into a life of wage slavery has, of course, been an economic renaissance for those of us fortunate enough to be at the top of the economic pyramid.

Since 1979, the hourly earnings for 80% of American workers (those in private-sector, nonsupervisory jobs) has risen by just 1 percent, after inflation. The average hourly wage was $17.71 at the end of 2007. For male workers, the average wage has actually slid by 5 percent since 1979. Worker productivity, meanwhile, has climbed 60 percent. If wages had kept pace with productivity, the average full-time worker would be earning $58,000 a year; $36,000 was the average in 2007. The nation’s economic pie is growing, but corporations by and large have not given their workers a bigger piece but have instead, kept that 60% gain almost entirely for themselves.

The typical American worker toils 1,804 hours a year, 135 hours more per year than the typical British worker (3.5 weeks), 240 hours more than the average French worker (6 weeks), and 370 hours (or nine full-time weeks) more than the average German worker. No one in the world’s advanced economies works more for less. A 2007 report by the Congressional Budget Office found that the top 1 percent of households had pre-tax income in 2005 that was 140% larger than that of the bottom 40 percent.

So let’s not kid ourselves, America, we have effectively re-created a slave-driven economy but we’ve wrapped it in the flag and keep the slaves in line by providing them with cheap beer, happy meals and 200 channels of corporate entertainment while drumming into their heads that all they need is a dollar and a dream and they too can step right over the fallen bodies of their fellow workers to join us at the top of the pyramid.

With the fall of Communism, the global economy has become more and more like us. One of the great accomplishments of capitalism is that we have made the rich into heroic figures while the working man or the soldier is just the anonymous cog in the great machine. Two thousand years ago, the masses were kept in line with tales of Hector and Achilles as any man with a sword that was strong enough could gain immortality. A thousand years later, ordinary men could aspire to be knights or saints. But, after the Dark Ages that mythos was lost as the noble class tightened their grip and denied upward mobility to the masses which, of course, led to revolution. America, France, Russia, China - all went through revolutions and England even had one in the mid 1600s and many small revolutions swept through Europe in the mid 1800s (around the time of Dickens' writings).

With the fall of Communism, the global economy has become more and more like us. One of the great accomplishments of capitalism is that we have made the rich into heroic figures while the working man or the soldier is just the anonymous cog in the great machine. Two thousand years ago, the masses were kept in line with tales of Hector and Achilles as any man with a sword that was strong enough could gain immortality. A thousand years later, ordinary men could aspire to be knights or saints. But, after the Dark Ages that mythos was lost as the noble class tightened their grip and denied upward mobility to the masses which, of course, led to revolution. America, France, Russia, China - all went through revolutions and England even had one in the mid 1600s and many small revolutions swept through Europe in the mid 1800s (around the time of Dickens' writings).

The cure for all this revolutionary nonsense in the Western World was Capitalism, which was embodied by another writer in the late 1800s called Horatio Alger, who became famous for writing over 100 books along the lines of "rags to riches" stories. By leading exemplary lives, struggling valiantly against poverty and adversity, Alger’s protagonists gain both wealth and honor, ultimately realizing the American Dream. The characters in his formulaic stories sometimes improved their social position through auspicious accidents instead of hard work and denial but the bottom line is the myth of upward mobility that lets us all aspire to be modern economic heroes like Rockefeller, Hughes, Buffett, Gates, Oprah, Soros and Pickens - sure there’s only 1,000 of those guys on the planet but we all like to believe it could be us too, right?

Capitalism is so good at keeping the masses in line that even China and Russia have now adopted our model as it turns out you can effectively squeeze much more out of your workers with carrots than with sticks. The dream of modern capitalism also has the added benefit of relieving the wealthy of the burden of guilt by envisioning a level playing field in which they have triumphed through their own hard work and perseverance making it poor people’s own damn fault if they can’t be motivated enough to improve their lot in life. It is necessary to engender this feeling amongst the rich lest the conscience of some may lead them to "overpay" their workers, which makes their fellow entrepreneurs look bad so we have devised a system (the stock market) in which only the most ruthless practices of capitalism are rewarded over time.

OK, liberal rant over now - I feel better having indulged my Dickensian side and identifying with the plight of the workers but workers don’t buy stock market newsletters so f**k them, right?

We are investors and we shouldn’t be worried about if it’s fair or right that we have established an economic engine that funnels the wealth of the nation to the top. If you are reading this article, then chances are you are on or near the top. Our job is to figure out how to maintain or improve our position. My biggest failing of 2009 has probably been worrying about the long-term repercussions of impoverishing 295M people when really it’s just us (me and my 9,999,9999 economically close friends) that we need to worry about. We have jobs and money and assets and stocks so, once again - F**k those people!

Now that we have Russia and China on board with this Capitalism thing, we are more efficient at exploiting the global labor force than ever. Corporate profits, other than 2008, have climbed an average of 13% a year without increasing wages a single cent over that same time period.

Now that we have Russia and China on board with this Capitalism thing, we are more efficient at exploiting the global labor force than ever. Corporate profits, other than 2008, have climbed an average of 13% a year without increasing wages a single cent over that same time period.

Corporate profits have climbed to their highest share of national income in sixty-four years, while the share going to wages has sunk to its lowest level since 1929 - Perhaps there has never been a better time to invest in Corporate America than right now. Our global GDP has climbed to about $55Tn, up 100% in 20 years and, the best news of all is that we’ve made sure that over $21.5Tn (71%) of that growth went to the top 10% of the population. By keeping the money amongst ourselves, we can be sure that it goes where we want it to.

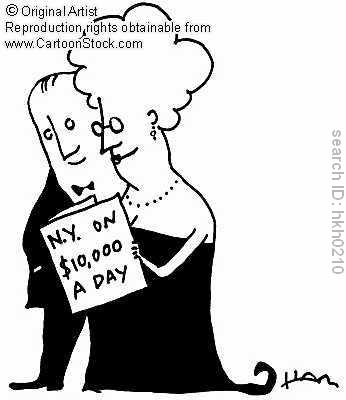

What does it matter if the capital allocation to the great unwashed masses barely keeps up with their population growth when our cut grows by leaps and bounds? We only need them to have just enough to eat and to be able to dress and transport themselves to a place where we can get that 1,800 hours of highly-productive work out of them. This makes good, economic sense. If we give money to the world’s 6Bn poor people, they’re only going to go and buy bread (or dare I say cake) and maybe shoes or clean shirts and mostly they will buy them at Wal-Mart (WMT) or, even worse, make it themselves and there’s little profit for us in that. By keeping the vast global wealth "in the family," so to speak, we can sell iPods and Hummers and luxury homes and diamonds and gold and other high-margin, unnecessary items to each other that allow the corporations we invest in to make obscene profits which, in turn, makes us even richer! Isn’t that fantastic?

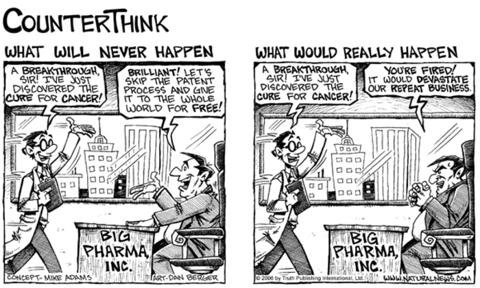

So let’s not kid ourselves that anything in this country is being done for the benefit of the 90% who serve us. We provide the basics and there are even many fine companies who can make money selling those basics like Coca Cola (KO), McDonald's (MCD), Johnson & Johnson (JNJ), Wal Mart etc. that we can invest in. One of the big issues we had been facing the past few years is that the damned poor people kept dying because they didn’t have adequate health care as they squandered their meager wages on cheap Chinese treats from the dollar store or whatever it is poor people do when you let them have money. Now we have taken a great step towards mandating that a portion of their meager wages goes towards health care and, in doing so, we have created 40M new patients for our wonderful medical industry to exploit.

Back on August 10th, we had discussed IHI (medical equipment) as a great growth ETF to play in this space. They have done well, up 20% so far and I still like them. The components I had also picked at the time: Intuitive Surgical (ISRG) (which was a Fall favorite of ours and up over 200% since our pick), Medtronic (MDT) (11.8%), Thermo Fisher Scientific (TMO) (7.5%), Boston Scientific (BSX) (7.3%), St. Jude Medical (STJ) (7%) and Stryker (SYK) (6.1%) with BSX and STJ acting as the laggards of the group. I still like BSX but can do without STJ now. We are expecting a possible pullback now that we’ve hit $53 as this is our goal for now.

Back on August 10th, we had discussed IHI (medical equipment) as a great growth ETF to play in this space. They have done well, up 20% so far and I still like them. The components I had also picked at the time: Intuitive Surgical (ISRG) (which was a Fall favorite of ours and up over 200% since our pick), Medtronic (MDT) (11.8%), Thermo Fisher Scientific (TMO) (7.5%), Boston Scientific (BSX) (7.3%), St. Jude Medical (STJ) (7%) and Stryker (SYK) (6.1%) with BSX and STJ acting as the laggards of the group. I still like BSX but can do without STJ now. We are expecting a possible pullback now that we’ve hit $53 as this is our goal for now.

What I had said on August 10th was:

If the ETF does make it over $47.50, then it will likely fill the gap at $53, which would make a nice 50% (on our option play) or better profit on the bull side.

General Electric (GE) is also big on medical devices and also infrastructure plays that should do well next year. Big Pharma (Merck (MRK), Pfizer (PFE)) should do well with 40M new patients coming on line and we always like Biotech like Celgene (CELG) and Amgen (AMGN) and let’s not forget the actual hospitals like Universal Healthcare (UHS) and Tenet Healthcare (THC), which have millions of new patients to take care of. It’s hard to get a grip on how big the impact of national health care is without understanding that the bottom 90% of this country has no disposable income at all and now, through a government mandate, we have now enabled them to buy hundreds of billions of dollars in medical care - what a country!

I don’t think there was a single play in our August 8th selection of Pharmboy’s Phavorites that didn’t pay off other than OncoGenex (OGXI), which I said was my least favorite. We’ll be doing a lot of these articles in the coming year as health care looks to be the most exciting sector for long-term growth, especially with the aging baby boomers lining up to join the poor to be diagnosed and medicated in the second decade of the century.

The 295,000,000 that share 28% of this nation’s wealth in 95M households are normally supported by about 140M non-farm jobs but that was down to just 120M jobs as of Nov 17th so, as a group, we’re sure not going to be counting on the poor to be splurging next year as even record job growth (6M) would only replace about 1/3 of all jobs lost. What do the poor do when times are hard? Mainly they shift their spending so we can expect more money spent at McDonald's and Burger King (BKC) with less money spent on "casual dining." We can expect pasta and bread to do well and meat to do worse because those items depend on large numbers of buyers.

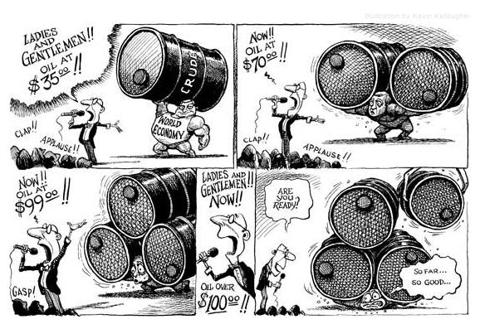

The disposable income of the poor this year will depend very much on the price of oil and other commodities and that’s going to be one of the year’s trickier issues. To some extent, the price of oil is based on consumption but, since speculators took over the market, it’s been fairly disconnected from reality and speculation is a rich man’s game so it’s really a question of how much pain can be inflicted on the working classes before they change their habits so much that it spurs actual price competition among the oil producers - something that is also avoided through the formation of cartels. Consumption of oil fell 5% this year yet the price of oil is up nearly 100% from last winter - go figure.

While the commodity pushers can charge us (the top 10%) whatever they wish for oil, gold, copper, food and lumber - it seems they have already squeezed the bottom 90% to the breaking point. The $3.5 trillion that was overcharged for commodities in the last few years was withdrawn from household wealth. Without an expansion of household values, increases in lending or (gasp) higher wages - I just don’t see that they have any room to push the commodity train. Even inflation and dollar devaluation doesn’t work until you get those dollars into the hands of the bottom 90% so they can trade them for gas or bread. That’s the great joke about the inflation pundits - they seem to think it can magically appear just because the banks are hoarding our increased money supply. Unless the banks start buying a few million barrels of oil per week, we’re going to have to wait for the citizens to catch up.

And keep in mind that our poor people are the richest poor people in the world. Over 4Bn people in this world get by on less than $2,000 a year while our welfare recipients get a whopping $12,000 a year - enough to be considered upper class in many of the World’s nations. So our nation’s poor can actually afford to eat cake, as well as many other foods loaded with delicious and relatively inexpensive polyunsaturated fats (that are leading to those health problems that are killing them).

Keep in mind that, in the above chart, you are looking at the percentage of the average US household but imagine how that changes for households on the bottom half of that $48,000 average income, especially for the 34M homes that make less than $20,000 a year yet still need to eat as much as the average family of 4 and probably still want things like heat, clothing and maybe a bed to sleep in - it simply doesn’t leave a lot of room for "other."

So forget those people - they are simply not going to be customers of much next year. Let’s concentrate on the people who have money - us! With 71% of the nation’s net worth and 66% of its annual income, the top 10% are the real customers for U.S. business. Unfortunately, it’s just 10M households with 30M people so we need to focus on things that can be sold to relatively few people at high margins. That’s going to rule out cars (other than Porsche or BMW), mid-priced homes (but look for luxury home sales to come back) and mid-priced merchandise as the middle class is a vanishing myth, which is going to leave the merchants who try to service them out in the cold.

So forget those people - they are simply not going to be customers of much next year. Let’s concentrate on the people who have money - us! With 71% of the nation’s net worth and 66% of its annual income, the top 10% are the real customers for U.S. business. Unfortunately, it’s just 10M households with 30M people so we need to focus on things that can be sold to relatively few people at high margins. That’s going to rule out cars (other than Porsche or BMW), mid-priced homes (but look for luxury home sales to come back) and mid-priced merchandise as the middle class is a vanishing myth, which is going to leave the merchants who try to service them out in the cold.

Financial services will do well as we shuffle our money around through various investments but don’t look for banks who rely on lending to the masses as they are all tied too tightly together to separate the good from the bad. That makes the whole sector a bit too dodgy, although we continue to like XLF and UYG as the sector in general should recover over time.

Another problem with the banking sector is the probable end to the free money train that’s been supporting them since last November. While there are 30M of us who are ready, willing and able to borrow money for our various endeavors, banks need volume and it’s not very likely the other 275M Americans will be filling out successful loan applications in 2010. That limits the amounts of homes that can be bought and the total volume of credit that can be extended and also runs up the risk of default as we are now spreading our risk over a smaller borrowing pool.

With global debt piling up at a rate of over $10Bn a day, we are rapidly reaching the end of the game where we pretend interest rates can stay this low (especially if the economy really does heat up and creates a demand for money) and that brings us back to our favorite ETF: TBT, the ultra-short on the value of a 20-year treasury note. The higher rates go, the lower the value of the fixed-rate notes that suckers have been buying for less than 3% interest this past year. We’ve been in TBT since the low 40s but we are very confident rates have only one way to go in 2010, good for another 20% from the current 50 at least.

Travel should do well next year as many of us put off vacations while waiting to see how the economy shakes out. As we get more confident the world is not ending in 2010. Priceline (PCLN) is out of control but I still like Orbitz (OWW) as a value play and Carnival (CCL) should perform well long-term as high fuel prices are not likely to return as fast as passengers. Continental (CAL) is still an airline stock I like and Marriott (MAR) is the place to stay as business travelers once again venture out of the office. Intercontinental (IHG) is also a good pick in the luxury travel area.

Travel should do well next year as many of us put off vacations while waiting to see how the economy shakes out. As we get more confident the world is not ending in 2010. Priceline (PCLN) is out of control but I still like Orbitz (OWW) as a value play and Carnival (CCL) should perform well long-term as high fuel prices are not likely to return as fast as passengers. Continental (CAL) is still an airline stock I like and Marriott (MAR) is the place to stay as business travelers once again venture out of the office. Intercontinental (IHG) is also a good pick in the luxury travel area.

I mentioned that GE should do well on infrastructure building. My big concern with them remains Commercial Real Estate but no one else seems worried about that sector. GE is also big on solar projects, which should do well and my favorite pure play on Solar remains Sun Power (SPWRA), who are the quality leader but I also like Suntech (STP) and, of course, MEMC (WFR) on the chip side. Also in the chip space is Applied Materials (AMAT) and Intel (INTC) while Corning (GLW) should have a great year supplying glass for all the new electronic devices us top 10%’ers love to buy.

I wouldn’t go so far as to stick my neck out on luxury retail as some of that is affected by aspirational buyers, of which there are far fewer these days as aspirations have been crushed into dust by the latest downturn. My main concern for the U.S. and the global economy is that rising rates and other credit risks, reflected in various CDS rates, will begin to bring down some of the marginal global economies like Spain, Greece and anything ending in "stan" or "ia." Also, 20M unemployed in the U.S. and 400M globally is nothing to sneeze at. Will we, the top 10%, bear the cost of taking care of them or shall we, like old Scrooge, wish them to die quickly and help decrease the surplus population?

The year 2010 is going to be an interesting one. It seems the majority of investors believes that we can keep living on this harshly divided planet and keep squeezing productivity gains out of the working masses even as we continue to hold wages down and drive the cost of their basic necessities higher. Even the slave owners had to provide food, clothing, shelter and medical care to their workers although I suppose we can feel good about the fact that slave owners outlawed education while we simply provide a very poor quality one - not enough for true upward mobility but certainly enough to hammer home the message that all they need is a dollar and that great American dream.

As long as we can keep the peasants from revolting we can keep partying like it’s 1999 but I do have reservations (obviously) and we will continue to exercise a degree of caution in our investing. History has taught us that the rich can indeed get richer and we have plenty of good places to focus our bullish attention as we begin this century’s second decade.