全球化并未消亡,而是需要重置

https://赞助.bloomberg.com/article/sc/globalization-isn-t-dead-it-needs-a-reset

受到战争的困扰、供应链断裂的破坏、致命流行病的破坏以及快速通货膨胀的加剧——长期以来塑造我们世界的全球化力量面临着毁灭的危险。

一些政治家、经济学家和专家宣布全球化已死。 更多的人表明我们正在见证经济的快速下降。 随着世界从一场危机转向下一场危机,反对者的声音日益响亮,而去全球化言论塑造了全球媒体的叙事。

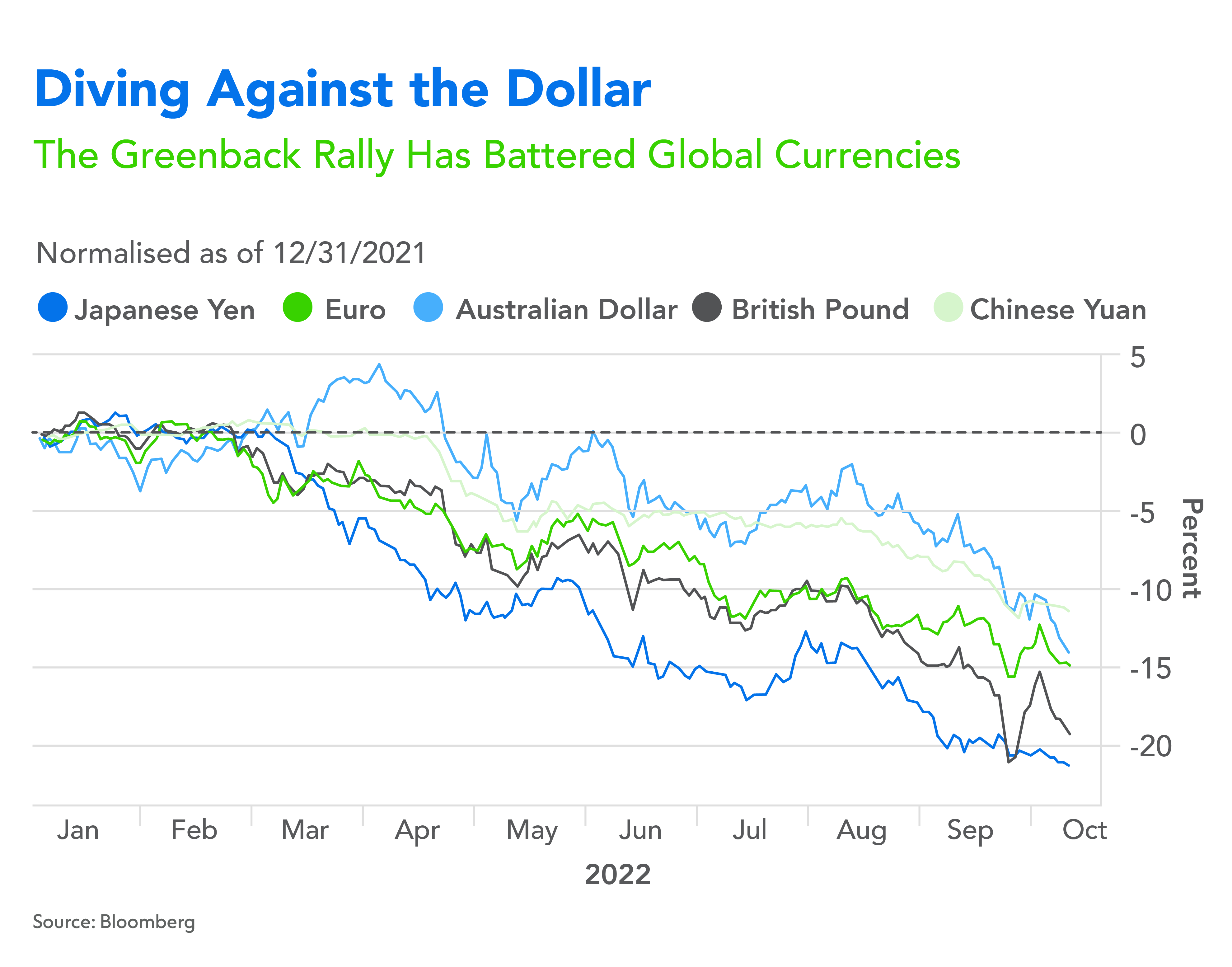

对于一些人来说,全球化的消亡并非不受欢迎。 它被指责造成经济发展不平衡、文化同质化、环境退化、剥削外国工人等等。 一波民族主义运动呼应了人们对现行多边体系日益增长的不满。 与此同时,近期美元的走强突显了经济一体化的危险,美元的上涨将世界各地的货币推入通胀背景下的恶性循环。

渣打银行集团董事长何塞·维纳尔斯在近期举行的一次早餐会上表示:“美联储的利率行动以及由此导致的美元走强给几个新兴市场的资本外流带来了挑战。” 渣打银行在华盛顿特区举行的国际货币基金组织和世界银行集团 2022 年年会上表示:“这使得外债水平较高的低收入国家的生活变得更加困难。”

然而,全球化有它的拥护者,这是有充分理由的。 它增加了全球资本流动,以更低的价格生产出更好的产品,先进的技术和创新,并改善了国际合作。 全球化也改善了数十亿人的生活。 1988年至2013年全球化快速发展时期,全球贫困人口比例从35%下降至10.7%。 [1]

维尼亚尔斯指出:“全球化被归咎于新冠病毒的迅速传播,但也被归咎于疫苗的开发和部署相对较快地得到解决。” “它因帮助数百万人摆脱贫困而受到推崇,但也因为收益分配不均而导致个人和国家陷入下行周期。 当然,全球化是有等级之分的,不能如此简单地、以如此鲜明的二分法来描述全球化。 确实需要重新调整全球化,使其更加公正、公平和可持续。 但改革或取代该系统的最佳方法是什么呢?”

在这里停留

首先也是最重要的一点,我们必须承认,过去几十年建立的许多关系太深厚,无法放松,带来的好处也太大,无法放弃。 贸易、数据和资本流动表明全球化将持续下去。

左起:渣打银行集团主席 José Viñals; Anne Applebaum,记者兼国际事务专家; 杰里米·西格尔 (Jeremy Siegel),宾夕法尼亚大学沃顿商学院金融学罗素·帕尔默 (Russell E. Palmer) 名誉教授

“国际贸易确实是许多文明成功的关键,”宾夕法尼亚大学沃顿商学院金融学名誉教授杰里米·西格尔 (Jeremy Siegel) 在早餐会上与维纳尔斯交谈时说道。 “回顾过去的一个世纪,大规模制造、转让技术以及创建能够在其他地方生产所有这些商品的基础设施的能力,无论是在经济上还是在社会上都是一项重大转变。 今天的问题是我们如何保持经济专业化和全球化带来的成果?”

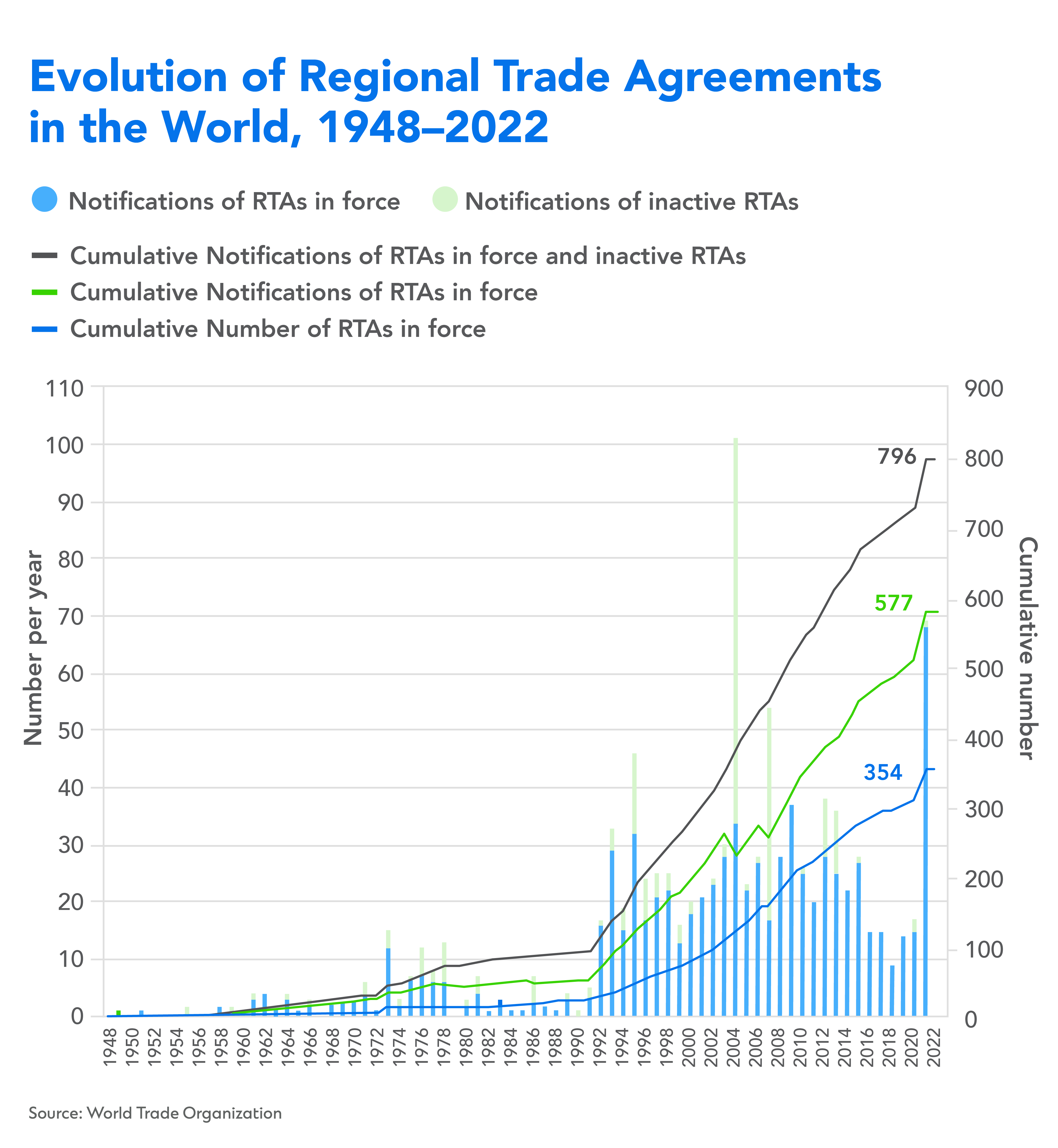

2021 年全球贸易额达到创纪录的 28.5 万亿美元,较 2019 年大流行前的水平增长 13%。 [2] 尽管经济增长放缓、通货膨胀和货币政策变化等因素综合作用,世界贸易组织 (WTO)、国际货币基金组织和经合组织预测未来贸易增长将减速,[3] 全球供应链和贸易走廊比以往任何时候都更加一体化。 例如,亚太地区经济体之间的贸易去年达到了三十年来的最高水平。[4] 世贸组织最近记录了生效的区域贸易协定 (RTA) 数量以及新的 RTA 通知的数量创纪录。[5]

消费者发挥着巨大的作用。 2020年,全球跨境电商订单达93亿笔。[6] 大约 60% 是洲际酒店。 保守估计表明,随着消费者习惯和偏好的变化,跨境电子商务的商品价值将从 2020 年的 3000 亿美元左右达到 2030 年的 1 万亿美元[7]。

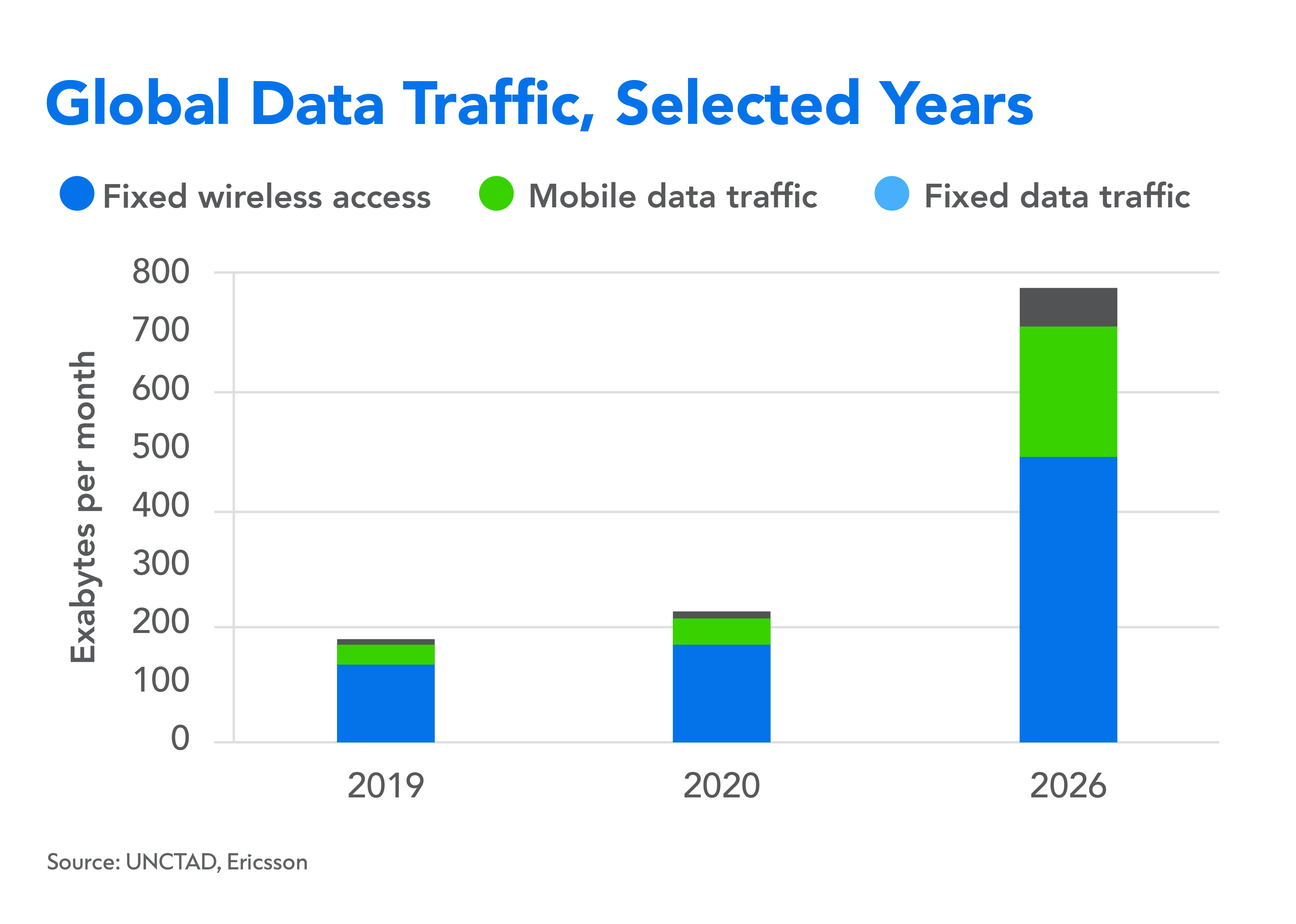

不断增长的数字连接支撑了这一趋势。 在新冠疫情大流行的头两年,全球上网人数增加了 7.82 亿人。[8] 数字化持续改变社会、经济以及人们互动的方式。 随着数字交互在我们的生活中变得越来越重要,每月的全球数据流量

预计 ffic 将从 2020 年的 230 艾字节增加到 2026 年的 780 艾字节,增加两倍以上。[9]

“文化、信息和政治思想的全球化正在以前所未有的速度和方式发生,”《纽约时报》畅销书作家、记者和国际事务专家安妮·阿普尔鲍姆在早餐会上说道。 “ 我们现在拥有全球化的互联网,其中基本上只有单一对话。 这意味着每个国家都需要思考它的运作方式以及如何理解它,不仅在国内,而且在国外。”

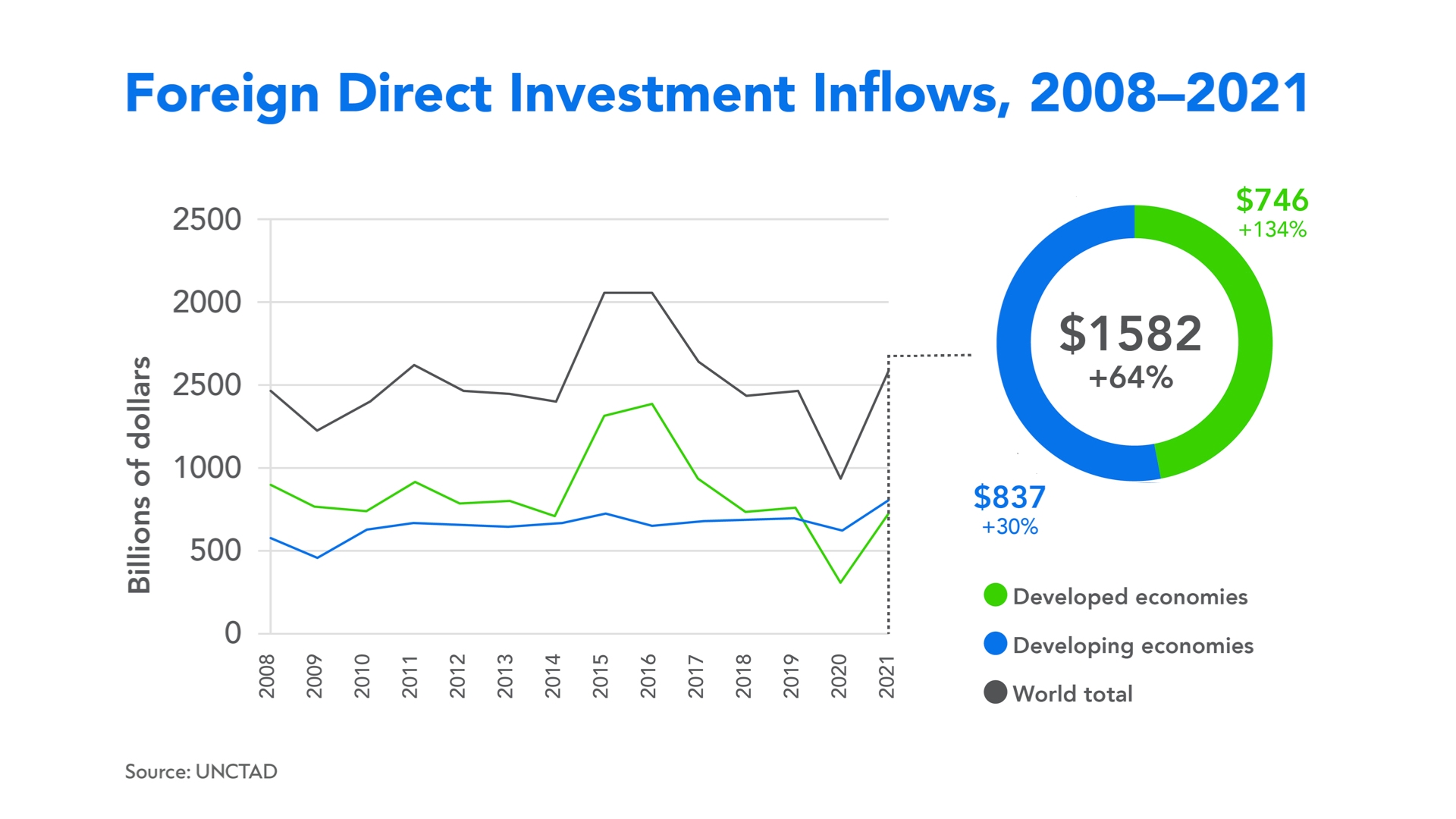

资本也继续跨境流动。 2021年,在并购以及国际项目融资快速增长的推动下,全球外国直接投资流量达到1.58万亿美元[10]。 经济逆风破坏了 2022 年大部分时间的势头,但资金跨境寻求机会的长期趋势仍然完好无损,并且在可预见的未来仍将如此。

重新调整全球化

虽然商品、数据和资本的流动表明,长期以来定义我们世界的联系将继续存在,但我们必须重新调整它们,以确保整个 21 世纪的公平和可持续增长。

维纳尔斯表示:“在新的数字平台和新兴技术的推动下,贸易已经从商品和服务的交换发生了根本性的变化,包括数据、想法和资本。” “我们现在需要一个能够解释这些变化并解决当前问题的全球贸易体系,使其变得更加容易获得和可持续。”

将欠发达市场和小企业纳入全球贸易至关重要。 中小企业 (SME) 约占全球企业的 90% 和就业人数的一半以上。[11] 它们还贡献了新兴经济体 GDP 的 40%。 [12] 全球化需要为中小企业提供参与全球供应链的机会。

技术可以提高全球贸易的参与度,在生产力、敏捷性、可见性、弹性等方面带来好处。 然而,疫情凸显了中小企业在采用技术方面面临的挑战。 全球只有 23% 的企业能够将资源投入到新的数字工具上,其中大多数人将融资和技能不足视为主要障碍。 [13]

当世界努力在本世纪中叶实现净零排放目标时,可持续性也必须始终放在首位。 这意味着解决从运输排放和商品驱动的森林砍伐到与供应链相关的环境破坏等各个方面长期存在的担忧。 成功需要制定全球治理标准和监管一致性以实现可持续发展。 渣打银行的可持续贸易融资提案[14]等私营部门举措也将发挥至关重要的作用,该提案旨在帮助企业在其生态系统和供应链中实施更可持续的做法。

各种数字贸易生态系统之间的互操作性也需要我们的关注,因为它是扩大数字贸易流量的必要条件——例如,涉及所有权转让和提单等流通票据的贸易流量。 为了实现公平增长,我们必须制定适合未来的政策和框架,确保不同发展阶段的市场、平台和企业之间的互操作性,连接实体和金融供应链,帮助创新获得更广泛的采用。

“我们需要明白,全球化确实是一股向善的力量,”维纳尔斯补充道。 “它使数亿人摆脱了贫困,为全球经济中许多市场的巨大一体化做出了贡献。 但同样,还有很多边缘需要打磨。 渣打银行所主张的事情之一就是重塑全球化,使其更加公平、更具包容性和更可持续。”

Globalisation Isn't Dead, It Needs a Reset

https://sponsored.bloomberg.com/article/sc/globalisation-isn-t-dead-it-needs-a-reset

Beset by war, upended by broken supply chains, ravaged by a deadly pandemic and exacerbated by rapid inflation–the globalising forces that have long shaped our world threaten to come undone.

Some politicians, economists and experts have pronounced globalisation dead. Many more suggest we’re witnessing a rapid decline. Day by day, the chorus of naysayers grows louder, while de-globalisation rhetoric shapes the global media narrative as the world lurches from one crisis to the next.

For some, globalisation’s demise would not be unwelcome. It has been blamed for uneven economic development, cultural homogenisation, environmental degradation, the exploitation of foreign workers and much more. A wave of nationalist movements echoes growing discontent with the prevailing multilateral system. Meanwhile, recent US Dollar strength underscores the perils of economic integration, with the greenback’s rally pushing currencies across the world into a spiral of doom against a backdrop of inflation.

“The Federal Reserve’s actions on interest rates and resulting dollar strength have created challenges in terms of capital outflows in several emerging markets,” José Viñals, Group Chairman of Standard Chartered said at a recent breakfast session on resetting globalisation in an era of uncertainty, hosted by Standard Chartered at the 2022 Annual Meetings of the International Monetary Fund and the World Bank Group in Washington, D.C. “This has made life more difficult in low-income countries with high levels of external debt.”

Yet, globalisation has its champions, and for good reason. It has increased the global flow of capital, yielded better products at lower prices, advanced technology and innovation and improved international collaboration. Globalisation also bettered billions of lives; in the period of rapid globalisation from 1988 to 2013, the global poverty headcount ratio declined from 35% to 10.7%.[1]

“Globalisation has been blamed for the rapid spread of Covid, but also for the comparatively quick resolution with the development and deployment of vaccines,” Viñals noted. “It is lionised for lifting millions out of poverty but also for the uneven distribution of gains that have trapped individuals and countries in a downward cycle. Surely, there are gradations, and globalisation cannot be described so simply and in such stark dichotomies. Recalibrating globalisation to make it more just, equitable and sustainable is surely called for. But is the best approach to reform or replace that system?”

Here to Stay

First and foremost, we must acknowledge that many of the relationships built over the past several decades are too deep to unwind and the benefits too great to relinquish. Trade, data and capital flows suggest globalisation is here to stay.

-medium.jpg) From left: José Viñals, Group Chairman of Standard Chartered; Anne Applebaum, journalist and international affairs expert; Jeremy Siegel, Russell E. Palmer Professor Emeritus of Finance at The Wharton School of the University of Pennsylvania

From left: José Viñals, Group Chairman of Standard Chartered; Anne Applebaum, journalist and international affairs expert; Jeremy Siegel, Russell E. Palmer Professor Emeritus of Finance at The Wharton School of the University of Pennsylvania

“International trade was really the key to success of so many civilisations,” Jeremy Siegel, Russell E. Palmer Professor Emeritus of Finance at The Wharton School of the University of Pennsylvania said during the breakfast, in conversation with Viñals. “Looking back at the past century, the ability to manufacture at scale, transfer technology and to create infrastructure that could produce all these goods elsewhere was a major shift both economically and socially. The question today is how do we keep the gains that economic specialisation and globalisation bring?”

Global trade reached a record $28.5 trillion in 2021, increasing 13% relative to pre-pandemic levels of 2019.[2] While a confluence of waning economic growth, inflation and changing monetary policy has the World Trade Organisation (WTO), IMF and OECD forecasting a deceleration in trade growth ahead,[3] global supply chains and trade corridors are more integrated than ever. Trade among APAC economies, for instance, reached its highest level in three decades last year.[4] And the WTO recently recorded a record number of Regional Trade Agreements (RTA) in force as well as new RTA notifications.[5]

Consumers play a huge role. In 2020, the world recorded 9.3 billion cross-border e-commerce orders.[6] Around 60% were intercontinental. Conservative estimates suggest cross-border e-commerce will reach $1 trillion in merchandise value by 2030 from around $300 billion in 2020[7] as consumer habits and preferences evolve.

Growing digital connectivity underpins that trend. An additional 782 million people came online globally in the first two years of the Covid pandemic.[8] Digitalisation continues to change society, the economy and the ways in which people interact. As digital interactions become increasingly central to our lives, monthly global data traffic is forecast to more than triple from 230 exabytes in 2020 to 780 exabytes by 2026.[9]

“The globalisation of culture, of information and of political ideas is happening much faster and in a different way than it had ever happened before,” Anne Applebaum, New York Times bestselling author, journalist and international affairs expert said at the breakfast. “ We now have a globalised internet, in which there's essentially a single conversation. And that means that every country needs to think about how it plays and how it's understood, not only at home, but also abroad.”

Capital continues to flow across borders, too. In 2021, global foreign direct investment flows reached $1.58 trillion,[10] driven by mergers and acquisitions as well as rapid growth in international project finance. Economic headwinds upended momentum for much of 2022, yet the long-term trend of money pursuing opportunity across borders remains intact and will for the foreseeable future.

Recalibrating Globalisation

While the flow of goods, data and capital indicate the connections that have long defined our world are here to stay, we must recalibrate them to ensure equitable and sustainable growth throughout the 21st century.

“Trade has changed fundamentally from the exchange of goods and services to include data, ideas and capital, facilitated by new digital platforms and emerging technologies,” Viñals said. “We now need a global trade system that accounts for these shifts and addresses current issues, to become more accessible and sustainable.”

Integrating less developed markets and small businesses into global trade will prove vital. Small and Medium-Sized Enterprises (SMEs) account for roughly 90% of businesses and more than half of employment worldwide.[11] They also contribute up to 40% of GDP in emerging economies.[12] Globalisation needs to give SMEs the opportunity to participate in global supply chains.

Technology can lift participation in global trade, yielding benefits across productivity, agility, visibility, resilience and more. Yet, the pandemic highlighted challenges that SMEs face with tech adoption. Only 23% globally were able to dedicate resources to new digital tools, with most citing inadequate financing and skills as key barriers.[13]

Sustainability must also remain front of mind as the world strives to achieve net-zero targets by the middle of this century. That means addressing longstanding concerns around everything from transport emissions and commodity-driven deforestation to supply-chain-linked environmental destruction. Success entails the development of global governance standards and regulatory coherence for sustainability. Private sector initiatives such as Standard Chartered’s Sustainable Trade Finance Proposition,[14] which is designed to help companies implement more sustainable practices across their ecosystems and supply chains, will also play a crucial role.

Interoperability between the various digital trade ecosystems also demands our attention as it is a requisite for the scale up of digital trade flows–for example, those involving transfer of title and negotiable instruments such as bills of lading. To achieve equitable growth, we must develop future-fit policies and frameworks that ensure interoperability across markets, platforms and businesses at different stages of advancement, linking physical and financial supply chains and helping innovations achieve wider adoption.

“We need to understand that globalisation has been really a force for good,” Viñals added. “It has lifted hundreds of millions of people out of poverty, it has contributed to tremendous integration of many markets in the global economy. But again, there are many edges that need to be polished. One of the things that Standard Chartered stands for is resetting globalisation to make it fairer, more inclusive and more sustainable.”