2016.1.11-2019.1.11 TD的投资总回报是49%。

怎么可能股市投资有回报呢?

不是股市大跌了吗?

现在不是熊市吗?现在不是最可以嘲笑股市投资者的时候吗?

2016.1.11-2019.1.11 49.28%

2015.1.11-2018.1.11 57.97%

2014.1.11-2017.1.11 53.85%

2013.1.11-2016.1.11 40.26%

2012.1.11-2015.1.11 52.14%

2011.1.11-2014.1.11 46.99%

2010.1.11-2013.1.11 41.38%

2009.1.11-2012.1.11 91.45%

2008.1.11-2011.1.11 22.03%

2007.1.11-2010.1.11 4.96%

2006.1.11-2009.1.11 -17.08%

2005.1.11-2008.1.11 53.27%

2004.1.11-2007.1.11 74.09%

2003.1.11-2006.1.11 91.22%

2002.1.11-2005.1.11 26.27%

2001.1.11-2004.1.11 8.12%

2000.1.11-2003.1.11 11.81%

1999.1.11-2002.1.11 56.25%

1998.1.11-2001.1.11 78.99%

1997.1.11-2000.1.11 27.79%

1996.1.11-1999.1.11 38.15%

1995.1.11-1998.1.11 52.16%

在二十次中,有19次盈利,其中盈利在40%以上的是14次。

我知道有不少人会说,这是运气,因为日期中有三个1。

今天的日期又是有三个1,TD的市场估值比历史均值低了25%,那么今天买入TD股票,到2022.1.11时,有多大的概率可以盈利呢?又有多大的概率可以盈利50%以上呢?

这里对未来盈利增长估值是6%左右,是TD银行长期均值的一半。

在加拿大多伦多十年前买房子能挣不少,五年前也不错,三年前不太好说了,今天买,你得好好想想。1%Rule在多伦多是天方夜谭,长期持有不是那么容易的。

十年前投资TD可以挣钱,五年前也可以,三年前也可以,今天也可以,而且今天的TD比三年前更便宜。

对于加国大多数工薪族家庭,将所有的可投资资产投资TD银行股票,并使用一倍金融杠杆(有些人说我们股市投资者不知道金融杠杆,我觉得至少TD银行会知道。),持有三年,然后卖出一半,基本上可以实现资本投资收入大于工资收入。

这样的投资策略你可以在20年前做,也可以是十年前,五年前也可以,三年前也可以,今天也可以。当然这里有一个诀窍,你必须选择一个好日期,比如1月11号,2月22号,6月6号,8月8号,11月11号,因为投资是靠运气的?!

To get what you want, you have to deserve what you want.

The world is not yet a crazy enough place to reward a whole bunch of undeserving people. - 芒格

这样的投资策略在美股上可不可以呢?我曾经在大千讨论过Parker-Hannifin Corporation (PH)。

关于PH,一位大千的网友曾经写过一篇投资分析文章,有兴趣可以看一看。有些人应该不知道股市投资做决定前还需要研究分析。

旧贴:

目前美国市场长期优秀蓝筹股市场估值性价比较高的股票有一大把,Parker-Hannifin Corporation (PH)是其中之一。

之所以想谈谈PH,因为几年以前就多次谈论过,而且有一位大千的网友在我的建议下写过一篇完整的投资分析,我曾经多次转贴过该篇投资分析。因为这是我们大千的网友写的,所以我们有一个更好的理由来探讨。

首先,过去5年,10年,20年,30年投资PH,都可以取得非常好的投资回报。参考老朽开始投资房产的时间,10万本金到今天大约是250万,要是每次金融危机时加一倍金融杠杆,现在也可以有1000万,理论上这个机会是存在的,在市场低迷时使用一倍金融杠杆的风险要小于出租房平均财务杠杆的风险。

Stock Analysis -- Parker-Hannifin Corporation (NYSE:PH)

大千网友的投资分析文章是写在2015年4月6号,在之后的2016年1月市场波动中(石油价格波动),PH与整体市场都出现了一个投资机会,在市场上涨过程中,PH的涨幅超过了100%,即使是到今天也有70%的涨幅。

目前PH的估值比长期均值水平低许多,已经显示了相当不错的性价比,在未来的市场波动中,很有可能再次出现入2016年1月这样级别的投资机会。

2011年,老巴印度之行的谈话

“If you look at the typical stock on the New York Stock Exchange, its high will be, perhaps, for the last 12 months will be 150 percent of its low so they’re bobbing all over the place. All you have to do is sit there and wait until something is really attractive that you understand.”

“There’s almost nothing where the game is stacked more in your favor like the stock market”

“What happens is people start listening to everybody talk on television or whatever it may be or read the paper, and they take what is a fundamental advantage and turn it into a disadvantage. There’s no easier game than stocks. You have to be sure you don’t play it too often”

在大千网友发表PH的投资文章之后,这是第2次市场出现投资机会,所以平均是1.5年一次重大投资机会,如果查看过去20年的股价波动,可以看出平均每二年有一次重大机会。房地产投资能够每二年出现一次重大投资机会吗?(至少50%的涨幅。),在今后二十年里,大致依然是每2年一次重大投资机会,房地产的投资机会能够达到相同的频率吗?PH有未来20年上涨10-20倍的潜质,房价从今天的价格上涨10-20倍的可能性有多大。

“There’s almost nothing where the game is stacked more in your favor like the stock market”

在现实中,有许多人更适合做房地产投资,但是一个合格的股市投资者是没有任何理由去羡慕出租房生意的。

我要再强调一次,有许多人更适合做房地产投资,这是客观事实,不要浪费精力探究股市房产哪个更好,对个人而言,最适合的只有一个。

PH在过去二十年出现了多次的好的投资机会,在今后二十年也将出现多次的投资机会,但是我们只可能在实战中把握其中的2,3机会,但是已经足够了,这是查理芒格的投资经验总结。

It's not given to human beings to have such talent that they can just know everything about everything all the time. But it is given to human beings who work hard at it ? who look and sift the world for a mispriced be that they can occasionally find one. And the wise ones bet heavily when the world offers them that opportunity. They bet big when they have the odds. And the rest of the time, they don't. It's just that simple.

That is a very simple concept. And to me it's obviously right based on experience not only from the pari-mutuel system, but everywhere else. And yet, in investment management, practically nobody operates that way. We operate that way ? I'm talking about Buffett and Munger. And we're not alone in the world. But a huge majority of people have some other crazy construct in their heads And instead of waiting for a near cinch and loading up, they apparently ascribe to the theory that if they work a little harder or hire more business school students, they'll come to know everything about everything all the time. To me, that's totally insane.

The way to win is to work, work, work, work and hope to have a few insights.

How many insights do you need? Well, I'd argue: that you don't need many in a lifetime. If you look at Berkshire Hathaway and all of its accumulated billions, the top ten insights account for most of it. And that's with a very brilliant man Warren's a lot more able than I am and very disciplined devoting his lifetime to it. I don't mean to say that he's only had ten insights. I'm just saying, that most of the money came from ten insights. So you can get very remarkable investment results if you think more like a winning pari-mutuel player. Just think of it as a heavy odds against game full of craziness with an occasional mispriced something or other. And you're probably not going to be smart enough to find thousands in a lifetime. And when you get a few, you really load up. It's just that simple.

这里我使用了投资TD银行一样的投资思想和策略,所以我投资加国市场可以成功,如果我投资美国市场也可以用同样的方法取得同样的成功,就是到了A股市场,也是一样的结果。

因为“There’s almost nothing where the game is stacked more in your favor like the stock market”

长期投资中的复利投资

(2017-03-14 13:24:24)下一个

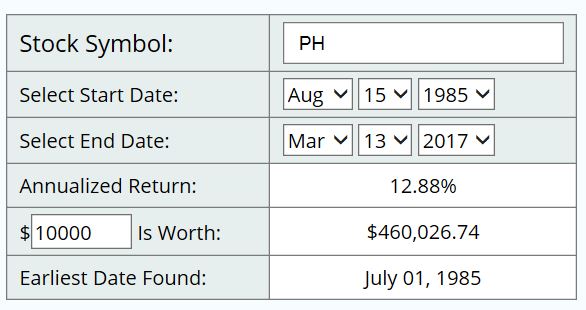

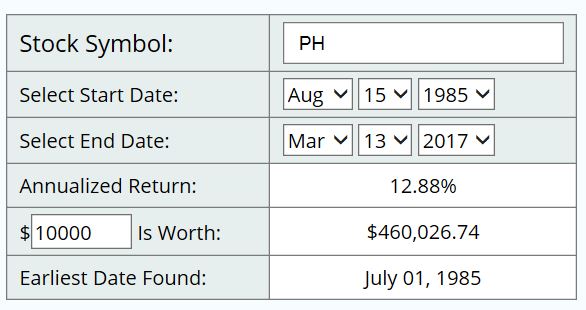

Parker-Hannifin Corporation是美国的著名长期红利蓝筹股,从1985年至今,年均回报是12.88%。如果只是单独的看12.88%的回报,是非常普通的,大约是每个月1%, 这比起不少人一天或几分钟的百分之几十的回报,实在是微不足道,但是一个普通的投资者如果能有机会坚持长期的投资于这样一个投资回报微不足道的股票,却可以得到非常理想的结果,这里就体现了复利在长期投资中的威力。老巴的长期投资成绩是年均20%多一些,这个成绩已经可以使他问鼎世界首富了。

像PH这样成功的长期红利蓝筹股在美国市场是很多。

这里的网友bigcatwx曾经在二年前在我的提议写过一篇关于PH的分析文章,当时他提出的投资价位是105-110之间。

Stock Analysis -- Parker-Hannifin Corporation (NYSE:PH)

Parker (NYSE:

PH) is a global leader in motion and control technologies, providing precision-engineered solutions for a wide variety of mobile, industrial and aerospace markets. Parker can be found on and around everything that moves, including aerospace, climate control, electromechanical, filtration, fluid and gas handling, hydraulics, pneumatics, process control, sealing and shielding.

PH's Industrial business makes valves, pumps, filters, seals and hydraulic components for a broad range of industries, as well as pneumatic and electromechanical components and systems. It has two segments -- Industrial North America (43% of FY 2014 sales and 51% of operating profits) and Industrial International (40% and 33%). Sales through distributors account for about half of PH's total industrial business.

The third segment is Aerospace (17% of sales and 15% of segment operating profits) which primarily makes hydraulic, pneumatic and fuel equipment used in civilian and military airframes and jet engines.

It is noticeable that for Parker, replacement part sales are generally more profitable than original equipment sales.

A friend asked me to do an analysis of this stock, I look into the company and immediately attracted by its strong cash flow, healthy earnings per share, and organic dividend growth. As usual, I'll use

my stock purchase criteria as the analysis basis.

PH is one of

David Fish's dividend champion, with 58 consecutive years of higher dividends. Facing looming economic environment due to oil & gas low prices and strong US dollars, people tended to worried about dividend payment prospect of companies at large. As for PH,

Chairman of the Board Donald Washkewicz re-assured investors with the company's top priority as to

maintain their dividend increases. Here is what Mr. Washkewicz said at the recent earnings call:-

Our capital allocation priorities remain the same, as they have been in the past, with our top priority to maintain our dividend increases. As you know, our dividends have been raised for 58 consecutive years. We have increased the dividend 31% this year. We announced that last quarter. And we've raised dividends 150% in the last five years. So you can see that the priority that we've put on dividends is significant.

S&P Capital IQ quality ranking is a favorable "A", and Morning Star offers an above-average 3-star rating. Analysts' risk assessment at S&P Capital IQ is "Medium" with below comments:-

Our risk assessment reflects the highly cyclical nature of the company's industrial and aviation markets, volatile energy and materials costs, and a competitive environment. This is offset by our view of PH's favorable earnings and dividend track record, as indicated by its well-above-average S&P Quality Ranking of A.

PH's beta is 1.69, reflecting its highly cyclical nature of the company's industry. It is also seen from below stock price history that PH is much more volatile than its competitor Honeywell (NYSE: HON), not to mention compared to S&P 500. After analyzing key regional market trends and segment trends,

Chairman of the Board Donald Washkewicz is optimistic about Parker's outlook by saying, "yes, there is some headwinds that we have, but the nice thing is, as Parker is so broad based in so many different market segments, there's some nice tailwinds as well that are offsetting some of the headwinds that we are seeing."

(Data based on Google data)

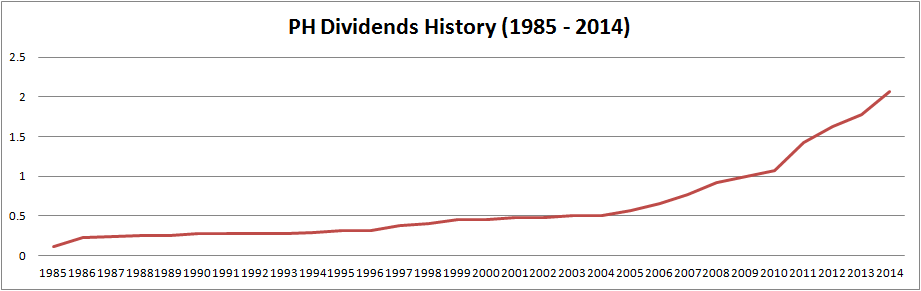

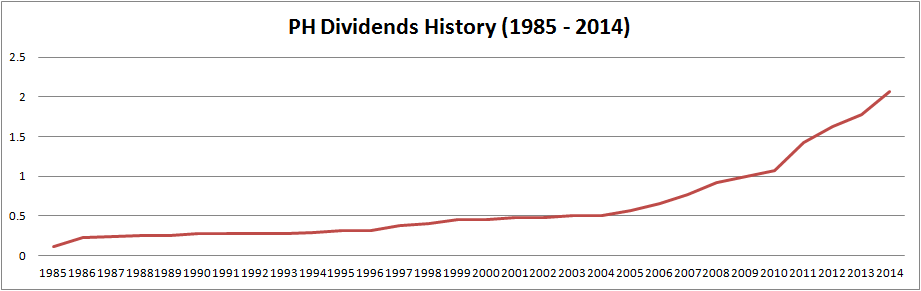

Parker's current dividend yield is 2.10%, lower than my 3% criterion. However, PH's dividend growth rate (DGI) is pretty high, with 10-year average DGI at 15.1%, and 5-year average at 15.7%. At these fast average growth speeds, it will take PH around 12 years to reach annual return 10%. With such high DGI, Chowder number is attractively calculated at 17.8%.

Currently PH's dividend payout ratio is only 28.50%, which leaves a large room for further dividend increases.

(Data based on Yahoo data)

Parker's EPS growth is healthy and stable, well above dividend payments. Free cash flow remain healthy and strong, from the Q2 earnings release, Mr.

Washkewicz made these impressive comments regarding free cash flow, "We expect fiscal 2015 to be our 14th consecutive fiscal year, where cash flows exceed 10% of sales and we're very pleased with that record performance as well. In addition, this is also expected to be our 14th consecutive fiscal year, where free cash flow is greater than net income."

(Data based on MorningStar)

Parker is very aggressive at share buyback program. In last October PH announced a new authorization for the purchase of $2 billion to $3 billion in shares over two years. Until the second quarter ended in Dec, the company has purchased a total of $1.2 billion shares since the October announcement. The average price that they paid for the $1.2 billion was $126.5. And the ending share count at the end of the quarter was 148.7 million.

While they continue to look for strategic acquisitions going forward, $2 billion is their committed minimum amount for the share repurchases, as confirmed by the newly elected CEO Thomas Williams. If we review the history, PH's outstanding shares has dropped from 180 mil shares in 2005 to 150 mil shares TTM.

It is noticeable that Parker issued $1.5 billion long-term bond in November; proceeds from the bond issuance were used to fully repay commercial paper outstanding in the amount of $702 million. The additional incremental stock buybacks will mainly be funded through operating cash flow. Given current long-term debt to equity ratio at 47% (MorningStar data), I am not too worried about this bond issuance.

The fact I like PH most is about its business model & products character that "replacement part sales are generally more profitable than original equipment sales." This gives PH a lot of resilience no matter the macro economy is going upwards or downwards. On the one hand, if economy goes up to north, new OEM projects and net sales will be surely expected. On the other hand, even if economy goes towards south, the company's replacement part sales will instead increase compared to regular says and a certain profit level is kind of warranted.

S&P Capital gives PH the 12-month target price at $153, fair value price at $131.90, and a "buy" recommendation. The analysts believe $153 target price is warranted given their view of PH's operating leverage potential and strong free cash flow generation track record. Yahoo's 1 year target price on this stock is $130. Current market price is $118 (on 04/02/15), which is about 9.2% discount. I would plan to add in some PH shares when market price reaches around $110, which offers me comfortable safety margin and decent upward cushion.

http://moneyunbinding.blogspot.ca/2015/04/stock-analysis-parker-hannifin.html

回复 '离离源上草' 的评论 : SP500是很好的选择。个股投资有个股的特点,我在加拿大,过去十年,TD的投资回报是加国指数的三倍。我们考虑的市场不太一样。

非常赞同你的观点,过去十年我以投资房地产为主,成绩还不错,出租房会一直持有,也但现在加拿大房价太高,投资收益越来越低,而且房产投资的区域性很强。相对于房产投资,股票市场提供的舞台更大,机会更多,操作难度更高,对操作者自身的知识,素质以及意志品质的要求也更高。

回复 'Teddyh' 的评论 : TD在美国上市。美国投资者应该在美股中寻找机会,美股的机会是加股的十倍以上,加股有的,美股都有,加股没有的,美股也有。