Why is China's economy doing so well and why is that a good thing?

https://iacenter.org/2024/04/06/why-is-chinas-economy-doing-so-well-and-why-is-that-a-good-thing/ By Marc Vandepitte April 4, 2024

为什么中国经济表现如此出色?而为什么这又是好事情?

● 马克·范德皮特 2024-04-19 09:23

国际行动中心(The International Action Center)在比利时政治分析家马克·范德皮特(Marc Vandepitte)的许可下发表了以下文章,该文章针对生活在欧洲的人们。他强烈反对美国和欧洲的统治阶级即使与中国建立经济合作关系确实大有好处、仍煽动民众反对中国的行为。在范德皮特写“我们”的地方,他指的是普通欧洲人。

这种对华友好的论点应用于美国经济和美国工人阶级时就更加必要了,美国工人阶级没有兴趣敌视中国人民,相反,他们只会从与这个亚洲国家的友好关系中获益。此外,反对美国政府任何可能导致与中国发生战争的举动也符合美国工人及其组织的利益。

本文原载国际行动中心网站,原文为英文。翻译:郝俊龙。

中国经济长达数十年的惊人增长,其秘诀到底是什么?为什么这是一件大好事,而欧洲应对的最佳方式又是什么?

西方媒体对中国独特的叙事框架

《经济学人》的标题是“为什么中国经济不会妥善恢复和发展”。

美国有线电视新闻网(CNN)商业新闻频道曾表示,“中国经济经受了悲惨的一年。2024年可能会更糟。”

如果你相信这些主流媒体的鬼话,那中国的状况确实就糟糕了:据说经济发展的动力正停滞不前,或者情况要更糟糕,经济正处于螺旋式的下降。

奇怪的是,国际货币基金组织预计中国今年的经济增长率为4.6%。

这几乎是欧洲的五倍之多,也是堪比美国的三倍规模。

西方媒体显然正在与中国的增长奇迹作斗争,因此他们关注的是问题和挑战。由于专注于进展不佳的事情,他们忽视了中国具有强大优势的领域。

当然,中国经济正面临一些重大挑战,但尽管人口老龄化以及西方在投资和贸易方面的敌意日益增加,中国仍然实现了欧洲梦寐以求的增长率。

在本文中,我们将探讨这种长达数十年的惊人增长的原因。我们还研究了为什么这是一件大好事,以及欧洲应对的最佳方式是什么。

马拉松式的漫长发展之路

让我们从基本的事实开始。75年前,中华人民共和国成立时,中国是世界上最贫穷的国家之一。这是一个农业不发达的国家,在整个世界经济中微不足道。其人均GDP是非洲的一半,是拉丁美洲GDP的六分之一。

从那时起,该国开始了一系列增长冲刺,逐渐演变成了一场经济发展的长跑。过去四十年的经济增长是世界历史上最大、也是持续时间最长的一次。在此期间,人均GDP增长了惊人的50倍,即每年增长10%。最近,中国公民的平均财富已经超过了欧洲人(也包括欧洲大陆的南部和东部地区)。

1949年,中国经济占世界生产总值的4.5%。目前,这一比例为19%(以购买力平价美元表示),比美国高出4个百分点。如果大家看一下工业生产,情况会变得更加令人印象深刻。

1990年,中国在全球工业生产中所占份额为2.5%。今天,这一比例为35%,相当于排在中国之后十大工业经济体的总和。

就未来的绿色工业生产而言,中国是绝对的领先者。

2021年,中国新增的海上风能装机容量超过了世界其他地区前五年的总和。

它使所有国家在太阳能电池板生产方面都远远落后,到2030年,该国生产的电池数量将是所有其他国家总和的两倍多。

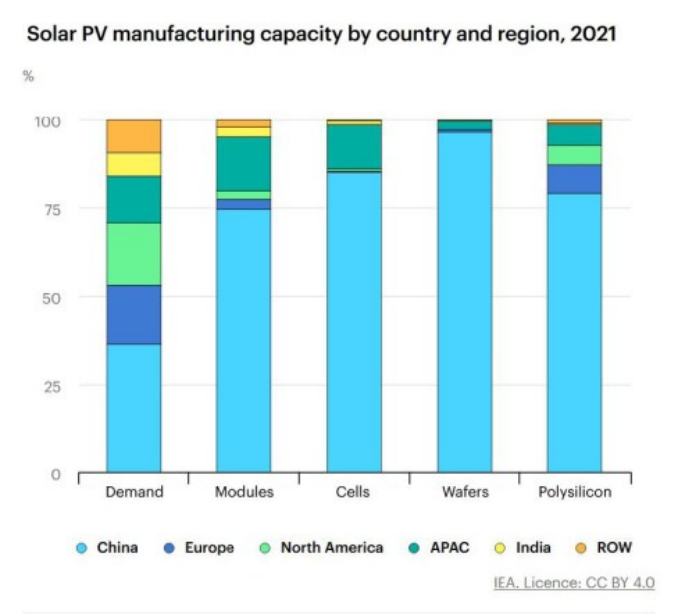

每个国家和地区对太阳能电池板的需求和太阳能生产能力。

在过去的25年里,该国还设法维持了经济的有效运转:1997年的亚洲金融危机,2001年的互联网危机,国内的SARS病毒危机,2008年的金融危机以及最近的COVID-19新冠危机。关于2008年的危机,英国《金融时报》前记者理查德·麦格雷戈(Richard McGregor)写道,“中国比世界上任何国家都更有能力应对突然发生的经济衰退。(援引:McGregor R., The Party. The Secret World of China’s Communist Rulers, New York 2010, p. 12)

这种增长不仅是量的表现,而且是品质上的进步。技术和科学取得了巨大的飞跃。如今,中国企业在5G电信设备、高速列车、高压输电线路、可再生能源、新能源汽车、数字支付、人工智能等诸多领域被公认为世界的领先者,或已经走在各国前列。

好事连桩

这种经济的扩展也在全球范围内有所表现。中国是世界经济的主要驱动力,占去年总增长的35%。包括欧洲和美国在内的许多国家都受益于这样的火车头推动作用。

2023年,中国是约120个国家最重要的贸易伙伴,也是许多国家首选和最后必选的资金款项借贷国。

当然,还有“一带一路”倡议,即新丝绸之路,它代表了数百项投资、贷款、贸易协定和数十个经济特区,价值9000亿美元。

它们分布在72个国家和地区,总人口约为50亿,占世界人口的65%。

此外,在“金砖+”背景下,与全球南方国家的合作日益增多。在这个联盟内,通过以当地货币进行贸易交易来摆脱美元主导地位的实验正在如火如荼地进行。

对于全球南方国家来说,这样的经济扩张是重大利好。这使他们有机会摆脱西方的统治地位,并最终与殖民主义决裂,而这一次是在经济的层面做到这一点。西方占主导地位的金融和经济参与者都对此感到沮丧,这就是为什么他们对中国越来越敌视的原因(见下文)。

尽管如此,中国经济的崛起对北半球的发达国家来说也是一件好事。廉价的中国产品使通货膨胀保持在较低水平,[欧洲国家]可以向这个亚洲巨人巨大的销售市场出售大量商品和投资。

中国的秘诀

中国增长奇迹的关键要素如下:

1.农业。 革命初期,大量土地所有权被废除,农业用地以长期贷款的形式发放给农民。此外,还建立了个人登记制度(户口)。这避免了大多数第三世界国家常见的混乱的农村人口外流,那会导致大量非正规和非生产性劳动力的出现。

2.社会政策。从一开始,在教育、医疗和社会保障方面投入了相对大量的资金。这确保了健康和熟练的劳动力,从而提高了生产力。工资很大程度上跟随生产率的提高,一方面带来劳工环境下的社会和谐关系,另一方面也创造了一个庞大而充满活力的内部市场。

3. 基础设施、技术和研发。中国坚决致力于基础设施的发展,“科研发展”和尖端技术的发展。这些是任何经济赖以进步的基本条件。2018年,中国在科学出版物数量上超过了西方,而到了2019年,专利数量也反超他们。如今,中国STEM领域(科学、技术、工程、数学)专业毕业生人数是美国的四倍。

4.开放性。与其他新兴国家相比,自1978年以来,对外国投资和对外贸易非常开放。庞大且相对便宜的劳动力市场吸引了许多外国投资者,他们(暂时)受益于较低的劳动力成本和广泛的内部市场。

外国投资和对外贸易本身都不是目标,而是起到了国家经济目标和国内发展的功能,例如技术转让。

今天,新丝绸之路也为经济扩展做出了贡献。

5.稳定的政策。与全球南方的许多其他国家相比,中国的政治和经济政策一直保持相对稳定。这增强了国内外投资者的信心。

6.地缘政治。除了在与印度接壤的边境上发生了几起小事件外,该国几十年来没有卷入暴力的国际冲突。这在投资和贸易方面都改善了经济环境。此外,与苏联不同,中国没有与美国进行昂贵的军备竞赛。

7.计划与控制。中国的经济发展模式主要由国家主导,国家是一个多头实体(见下一条)。经济的关键部门掌握在中央或地方政府手中。此外,政府间接控制了大多数其他部门,例如,共产党在大多数大中型公司中都有一定的控制权。

五年计划为强有力的产业政策创造了一个有利的框架,帮助中国向高附加值制造业迈进。该模式还包括国有银行向战略性行业提供优惠贷款。

这种管理和规划使该国的生产者能够有效地行动起来并实现战略目标。因此,中央政府发布了一项计划和严格的指导方针,以优先考虑太阳能产业。几年后,中国主导了这一领域。目前正在部署这支动员力量来开发半导体,以抵消该领域的抵制和制裁。

8. 权力下放和市场力量。与中国是中央计划经济的想法相反,中国实际上拥有世界上最去中心化的制度之一。地方政府拥有相当程度的自主权,管理着政府总支出的85%。

在经济合作与发展组织(OECD)国家,这一比例平均仅为33%。

这种权力下放刺激了各省和大城市之间的竞争,这是第一个竞争领域。此外,公司在内部和与世界其他地区也有市场竞争,这是第二个领域。由于这种双重竞争体系,公司不仅在不断发展,而且在经济格局中也有很大的活力。

例如,一个省或另一个省定期实施一项被证明非常有效的新政策,使他们比其他地区更具优势,之后该倡议又被其他地区复制采纳。

中央政府的作用主要在于制定宽泛的目标和管理人力资源。后者非常实用,因为地方官员知道,如果他们比同僚做得更好,他们就会走上中央政府提拔的路径。

换言之,在这种模式下,在一个明确的市场体系中,有相当多的私人主动性空间。请注意,只要不妨碍联合长期规划的经济和社会目标,市场机制就会容忍和鼓励。或者正如2023年8月14日《金融时报》主编拉娜·福鲁哈尔(Rana Foroohar)所说:“自由市场总是为国家服务,而不是反过来。”

在这方面,中国模式明显不同于苏联模式。在那里,一切都得计划到最后一个细节,几乎所有的生产都掌握在政府手中,几乎谈不上什么竞争。

当然,苏联在其前六十年中取得的经济成就也是无与伦比的。但是,由于市场机制的消除,几乎没有经济激励来鼓励生产者进行经济的、有利可图或高质量的生产。而在中国,这个问题已经被克服了。

9. 灵活性。中国共产党人对经济政策的态度是务实的。他们能够灵活地应对不断变化的环境。自1970年代末以来,生产力的扩大和现代化一直是中心目标。当时,该模式基于出口以及对重工业、建筑、制造业和基础设施的投资。

这十余年来,新模式的驱动一直是增加繁荣(国内市场),增加服务业,并通过攀登更高的技术阶梯来创造更大的附加值。

西方彻底的误判

中国发展的妙招与资本主义国家的举措形成鲜明对比。在后者那里,跨国公司和金融资本占据了主导地位。在那里,短期利润是压倒一切的目标。在那里,政府专注于通过储蓄(减少对工人的社会服务)来消除财政赤字。

中国方法的特点是他们以惊人的方式应对了2008-2009年的金融危机。中国政府启动了占GDP为12.5%的刺激计划,这可能是和平时期有史以来规模最大的计划。中国经济几乎没有动摇,而欧洲经济则在十年内失去动力。

欧洲中心主义和持续的自满情绪导致西方完全误解了中国的经济和社会。

2001年,当美国和其他西方国家允许中国加入世界贸易组织时,人们认为中国会变得像我们一样。

通过将其纳入世界市场,[他们以为]中国将放弃社会主义,拥抱资本主义。

但情况似乎恰恰相反。中国坚持其社会主义道路,并成功地使我们的经济更像他们的模式。欧洲(《绿色协议》)和美国(《降低通胀法案》)都放弃了自由放任的做法,并在几年前转向了真正的产业政策,其特点是发放数千亿美元的补贴。我们却一直指责中国这种做法。事态可能会有所转变。...

欧洲将何去何从?

不过情况并不止于模仿。今天,美国正在竭尽全力破坏中国的经济进步。

他们不仅拒绝中国获得某些技术,还试图破坏整个行业,包括阻止向中国出口高科技芯片。

例如,国家安全顾问杰克·沙利文(Jake Sullivan)在一次演讲中(whitehouse.gov,2022年9月16日)表示,他的政府希望阻碍中国在人工智能、生物技术和清洁能源技术等基础技术方面的能力,以使自身能够在气候变化方面保持最大领先优势。

华盛顿正试图将西方盟友拖入这场经济战争。但实际上这不会理所当然地任其发生。西方经济与中国经济紧密相连,在许多领域,西方更需要中国。例如,没有中国,欧洲就不可能实现其气候目标。

贸易战的代价可能非常高。如果没有中国的廉价出口和生产,工业国家将面临巨大的通胀压力,特别是在向清洁技术过渡方面。

根据国际货币基金组织(IMF)的数据,与中国经济“脱钩”和选择保护主义的代价可能达到世界GDP的7%,这惊人的7%相当于今天每年超过7万亿美元。这是官方发展援助总额的35倍,是实现能源转型每年所需援助的3.5倍。

与中国的贸易战将不可避免地招致报复措施。除了因对华出口损失而可能造成的巨大经济损失外,该国还拥有我们严重依赖的必需品。

例如,电动汽车发动机、风力涡轮发电机和导弹制导系统所需的90%专用磁体都是在中国生产。此外,中国加工了全球72%的钴和61%的锂,这两种矿物是生产电动汽车的重要矿物。

最后,制裁很有可能产生与华盛顿当局完全相反的效果,实际上反而会鼓励中国加速发展其战略产业。现在,这种情况正在半导体和芯片领域上演。

整个问题在于,欧洲是否会被卷入这种新的冷战逻辑,从而搬起石头砸自己的脚。在经济上,欧洲比美国更受中国的影响。例如,中国是德国最大的贸易伙伴,也是德国产业公司的重要市场。全球经济的重心正日益向亚洲转移,而中国则是火车头。对于欧洲来说,错过这种增长势头是非常不明智的。

欧洲正站在一个重要的历史十字路口。它会让自己拖入美国发起的破坏性贸易战,还是会成功地制定自身的自主路线,并在互惠互利的基础上与中国开展建设性的经济关系?这事关重大。

参考文献:

Yifu Lin J., Demystifying the Chinese Economy, Cambridge 2012

Hsueh R., China’s Regulatory State. A New Strategy for Globalization, London 2011Herrera R. & Zhiming Long., La Chine est-elle capitaliste ?, Paris 2019Marsh C., Unparalleled Reforms. China’s Rise, Russia’s Fall, and the Interdependence of Transition, Lanham 2005Dickson B., Ted Capitalists in China. The Party, Private Entrepreneurs and Prospects for Political Chance, Cambridge 2003Minqi Li, The Rise of China and the Demise of the Capitalist World Economy, New York 2008Minqi Li, China and the 21st Century Crisis, London 2016Delaunay J., Les Trajectoires chinoises de modernisation et de développement. De l’Empire agro-militaire à l’état-Nation et au socialism, Paris 2018Bickers R., Out of China. How the Chinese Ended the Era of Western Domination, London 2017Ross J., China’s Great Road. Lessons for Marxist theory and socialist practices. Articles 2010-21, New York 2021Larcy N., The State Strikes Back. The End of Economic Reform in China? Washington 2019Mahbubani K., Has China Won? The Chinese Challenge to American Primacy, New York 2020

Why is China's economy doing so well and why is that a good thing?

https://iacenter.org/2024/04/06/why-is-chinas-economy-doing-so-well-and-why-is-that-a-good-thing/

By Marc Vandepitte April 4, 2024

The International Action Center publishes the following article with the permission of the Belgian political analyst Marc Vandepitte, who addresses people living in Europe. He makes a strong argument opposing the efforts of the U.S. and European ruling class to turn the population against China, despite the advantages of having cooperative economic relations with China. In places where Vandepitte writes “we” or “us,” he is referring to ordinary Europeans.

This argument for friendship toward China is even more necessary when applied to the U.S. economy and to the U.S. working class, which has no interest in hostility toward Peoples China and which, on the contrary, can only gain from friendly relations with the Asian country. In addition, it is in the interest of U.S. workers and their organizations to oppose any moves of the U.S. government that could lead to a war with China.

What is the secret of the decades-long spectacular growth of the Chinese economy, why is that a good thing, and what is the best way for Europe to respond to it?

Peculiar media framing

The Economist headline was “Why China’s economy won’t be fixed.” CNN Business had “China’s economy had a miserable year. 2024 might be even worse.”

If you believe the mainstream media, China is in bad shape: the economic engine is said to be sputtering, or worse, the economy is in a downward spiral. Bizarre, as the IMF expects economic growth of 4.6 percent in China this year. That is almost five times as much as in Europe and more than three times as much as in the U.S.

The Western media are apparently struggling with China’s growth miracle, and so they focus on the problems and challenges. By concentrating on what is going less well, they miss what China is very strong at.

Certainly, the Chinese economy is facing some significant challenges, but despite an aging population and increasing hostility from the West, both in terms of investment and trade, the country is still achieving growth rates that Europe can only dream of.

In this article, we are exploring the reasons for this decades-long spectacular growth. We also look at why this is a good thing and what is the best way for Europe to respond.

Development marathon

Let’s start with the facts. 75 years ago, when the People’s Republic was founded, China was one of the poorest countries in the world. It was an agricultural, underdeveloped country, insignificant in the world economy. Its GDP per capita was half that of Africa’s and one-sixth of Latin America’s GDP.

Since then, the country has embarked on a series of growth sprints growing into a development long distance run. The economic growth over the past forty years was the largest and longest-lasting in world history. During that period, GDP per capita rose by a staggering factor of 50, which is an increase of 10 percent per year. Recently, the average wealth of a Chinese citizen has surpassed that of a European (when also including the southern and eastern regions of mainland Europe).

In 1949, the Chinese economy accounted for 4.5 percent of world product. Currently that is 19 percent (expressed in PPP dollars), or 4 percentage points more than the U.S. If you look at industrial production, things get even more impressive. In 1990, China’s share of global industrial production was 2.5 percent. Today that is 35 percent, as much as the next ten industrial economies combined.

In terms of industrial production of the future — green production — China is the absolute leader. In 2021, it added more offshore wind energy capacity than the rest of the world in the previous five years combined. It leaves all countries far behind in the production of solar panels (see graph), and by 2030 the country will produce more than twice as many electric batteries as all other countries combined.

The demand for solar panels and the production capacity for solar energy per country and region.

The country has also managed to keep its economy afloat in the storms of the last 25 years: the Asian financial crisis in 1997, the dot-com crisis in 2001, the SARS crisis at home, the great financial crisis of 2008 and recently the COVID-19 crisis. In relation to the 2008 crisis, former Financial Times journalist Richard McGregor wrote that, “China was better equipped than just about anywhere in the world to handle the sudden downturn.” [McGregor R., The Party. The Secret World of China’s Communist Rulers, New York 2010, p. 12]

The growth is not only quantitative but also qualitative. Great leaps forward have been made in technology and science. Today, Chinese companies are widely recognized as world leaders, or as being at the cutting-edge, in 5G telecommunications equipment, high-speed trains, high-voltage transmission lines, renewable energy sources, new energy vehicles, digital payments, artificial intelligence and many other areas.

Good thing

This economic expansion is also manifesting itself globally. China is the main driving force of the world economy, accounting for 35 percent of total growth last year. Many countries, including in Europe and the U.S., benefit from this locomotive function. In 2023, China was the most important trading partner of about 120 countries and the lender of first and last resort for many.

And of course there is the Belt and Road Initiative, the new Silk Road, which represents hundreds of investments, loans, trade agreements and dozens of Special Economic Zones, worth $900 billion. They are spread over 72 countries, with a total population of approximately 5 billion people or 65 percent of the world’s population.

In addition, there is an increasing cooperation with countries from the Global South in the context of BRICS plus. Within this alliance, experiments are in full swing to move away from the dominance of the dollar by conducting trade transactions in local currencies.

For the countries of the Global South, economic expansion is a very good thing. It gives them the opportunity to get rid of Western dominance and finally break with colonialism, this time economically. The dominant financial and economic players in the West are watching this with dismay, which is why they are growing more hostile towards China (see below).

Nevertheless, China’s economic rise is also a good thing for the countries of the North. Cheap Chinese products keep inflation low and [European countries] can sell a lot of [their] goods and investments to the Asian giant’s huge sales market.

Recipe

The key ingredients of the Chinese growth miracle are the following:

1. Agriculture. At the beginning of the revolution, large land ownership was abolished, and agricultural land was given on long term loans to the peasants. In addition, a system of personal registration (Hukou) was set up. This has avoided the typical chaotic rural exodus known in most Third World countries, resulting in massive informal and unproductive labor.

2. Social policy. From the start, a relatively large amount has been invested in education, health care and social security. This ensures a healthy and skilled workforce, which improves productivity.

Wages largely follow productivity increases, which on the one hand leads to social peace in the workplace and on the other hand has created a large and dynamic internal market.

3. Infrastructure, technology and R&D. China is fully committed to the development of infrastructure, “Research & Development” and the development of cutting-edge technology. These are basic conditions for any economic progress. In 2018, China overtook them in terms of the number of scientific publications and in 2019, the same was true for the number of patents. Today, four times as many students graduate in STEM fields [Science, Technology, Engineering, Mathematics] in China as in the U.S.

4. Openness. Compared to other emerging countries, there has been great openness to foreign investment and foreign trade since 1978. The large and relatively cheap labor market has attracted many foreign investors who benefit from (temporarily) lower labor costs and an extensive internal market.

Neither foreign investments nor foreign trade are goals in themselves but are functions of national economic goals and domestic development, see for example technology transfer. Today, the new Silk Road also contributes to economic expansion.

5. Stable policy. Compared to many other countries in the Global South, China has maintained relatively stable political and economic policies. This has contributed to the confidence of both domestic and foreign investors.

6. Geopolitics. Apart from a few minor incidents on the border with India, the country has not been involved in violent international conflict for decades. This improves the economic climate in terms of both investments and trade. In addition, unlike the Soviet Union, China has not embarked on an expensive arms race with the U.S.

7. Planning and control. China’s economic development model is largely led by the state, which is a many-headed entity (see next item). The key sectors of the economy are in the hands of the government, centrally or locally. In addition, the government indirectly controls most of the other sectors, e.g., through the controlling presence of the Communist Party in most medium and large companies.

A five-year plan creates a favorable framework for a robust industrial policy that helps China move up to higher value-added manufacturing. The model also includes state-owned banks providing favorable loans to strategic industries.

This management and planning allow effective mobilization of the country’s producers for strategic objectives. Thus, a plan and strict guidelines were issued by the central government to prioritize the solar industry. A few years later, China dominated this sector. This mobilizing force is currently being deployed for the development of semiconductors to offset the boycott and sanctions in this sector.

8. Decentralization and market forces. Contrary to the idea that China is a centrally planned economy, the country actually has one of the most decentralized systems in the world. Local governments have a remarkable degree of autonomy, managing 85 percent of total government expenditure. In the OECD [Organisation for Economic Co-operation and Development] countries, this is on average only 33 percent.

This decentralization stimulates competition between provinces and large cities, which is a first sphere of competition. In addition, companies compete in the market, both internally and with the rest of the world, which is the second sphere. Due to this dual system of competition, companies are not only constantly evolving, but there is also great dynamism in the economic landscape.

For example, regularly one province or another implements a new policy that proves to be very effective, giving them an advantage over other regions, after which the initiative is copied by those others.

The role of the central government lies mainly in setting broad objectives and managing human resources. The latter is very functional, because local officials know that if they do better than their colleagues, they are on track for promotion by the central government.

In other words, in this model there is room for quite a lot of private initiative within a well-defined market system. Please note that the market mechanism is tolerated and encouraged as long as it does not hinder the economic and social objectives of the joint long-term planning. Or as Rana Foroohar, editor-in-chief of the Aug. 14, 2023, Financial Times, puts it: “The free market is always in service to the state, not the other way around.”

In this respect, the Chinese model clearly differs from that of the Soviet Union. There, everything was planned down to the last detail, almost all production was in the hands of the government, and there was little or no competition.

Certainly, what the Soviet Union achieved economically in its first sixty years is unparalleled. But due to the elimination of the market mechanism, there was almost no economic incentive to encourage producers to produce economically, profitably or with high quality. In China this problem has been overcome.

9. Flexibility. The Chinese communists have a pragmatic and down-to-earth attitude towards economic policy. They respond flexibly to changing circumstances. Since the end of the 1970s, the expansion and modernization of the productive forces has been the central objective. At the time, the model was based on exports and on investments in heavy industry, construction, manufacturing and infrastructure.

Since Xi Jinping took office about ten years ago, the driving force of the new model has been increasing prosperity (domestic market), increasing the service sector and creating greater added value by climbing higher up the technological ladder.

Completely misjudged

The Chinese recipe is in stark contrast to that of capitalist countries. There, multinationals and finance capital hold sway. There, short-term profit is the overriding goal. And there, governments are fixated on eliminating fiscal deficits through savings [which decrease social services for workers].

Characteristic of the Chinese approach is the spectacular way in which they tackled the financial crisis of 2008-2009. The Chinese government launched a stimulus program of 12.5 percent of GDP, probably the largest peacetime program ever. The Chinese economy barely budged while Europe’s was out of steam for a decade.

Eurocentrism and persistent complacency have caused the West to completely misunderstand the Chinese economy and society. When the U.S. and other Western countries allowed China to join the World Trade Organization in 2001, it was assumed that China would become like us. By integrating it into the world market, [they believed] China would abandon socialism and embrace capitalism.

But the opposite seems to be happening. China has stuck to its socialist course and has also succeeded in making our economies more like theirs. Both Europe (Green Deal) and the United States (Inflation Reduction Act) have dropped their laissez-faire approach and a few years ago switched to a real industrial policy, characterized by handing out hundreds of billions in subsidies, something we have always blamed the Chinese for. Things may change. …

Quo vadis Europe?

But things don’t stop at imitation. Today, the United States is doing everything it can to sabotage Chinese economic progress. Not only do they deny China access to certain technologies, they also try to undermine entire industries, including by preventing the export of high-tech chips to China.

For example, National Security Advisor Jake Sullivan said in a speech (whitehouse.gov, Sept. 16, 2022) that his administration wanted to hamper China’s capabilities in foundational technologies such as artificial intelligence, biotechnology and clean energy technologies, in order to enable them to maintain the greatest possible lead on climate change.

Washington is trying to drag Western allies into this economic war. But that won’t happen as a matter of course. Western economies are closely intertwined with the Chinese economy, and in many areas the West needs China more than the other way around. For example, Europe cannot possibly achieve its climate goals without China.

The costs of a trade war may be very high. Without cheap exports and production from China, there will be significant inflationary pressures in industrialized countries, especially regarding the transition to cleaner technologies.

According to the IMF, the costs of economic ‘decoupling’ from China and the choice of protectionism could amount to an alarming 7 percent of world GDP, which would amount to more than $7 trillion annually today. That is 35 times the total official development assistance and 3.5 times as much as what is needed annually to achieve the energy transition.

A trade war with China will inevitably lead to retaliatory measures. Apart from potentially large financial losses due to loss of exports to China, the country also possesses essential goods on which we are heavily dependent.

For example, 90 percent of the specialized magnets needed in electric vehicle engines, wind turbine generators and missile guidance systems are produced in China. In addition, China processes 72 percent of the world’s cobalt and 61 percent of lithium, two essential minerals for the production of electric cars.

Finally, there is a high probability that sanctions will have exactly the opposite effect of what Washington had in mind and will actually encourage China to accelerate the development of its strategic industries. This is now happening in the field of semiconductors and chips.

The whole question is whether Europe will be drawn into this new Cold War logic and thus shoot itself in the foot. Economically, Europe is more exposed to China than the U.S. For instance, China is Germany’s largest trading partner and a crucial market for German industrial companies. The center of gravity of the global economy is increasingly shifting towards Asia, with China as the locomotive. For Europe, it would be very unwise to miss out on this growth momentum.

Europe stands at an important crossroads in history. Will it allow itself to be dragged into a destructive trade war initiated by the U.S., or will it succeed in charting its own autonomous course and building a constructive economic relationship with China, based on mutual benefit? The stakes are high.

Sources:

Yifu Lin J., Demystifying the Chinese Economy, Cambridge 2012

Hsueh R., China’s Regulatory State. A New Strategy for Globalization, London 2011

Herrera R. & Zhiming Long., La Chine est-elle capitaliste ?, Paris 2019

Marsh C., Unparalleled Reforms. China’s Rise, Russia’s Fall, and the Interdependence of Transition, Lanham 2005

Dickson B., Ted Capitalists in China. The Party, Private Entrepreneurs and Prospects for Political Chance, Cambridge 2003

Minqi Li, The Rise of China and the Demise of the Capitalist World Economy, New York 2008

Minqi Li, China and the 21st Century Crisis, London 2016

Delaunay J., Les Trajectoires chinoises de modernisation et de développement. De l’Empire agro-militaire à l’État-Nation et au socialism, Paris 2018

Bickers R., Out of China. How the Chinese Ended the Era of Western Domination, London 2017

Ross J., China’s Great Road. Lessons for Marxist theory and socialist practices. Articles 2010-21, New York 2021

Larcy N., The State Strikes Back. The End of Economic Reform in China? Washington 2019

Mahbubani K., Has China Won? The Chinese Challenge to American Primacy, New York 2020