Intel is laying off over 15,000 employees and will stop 'non-essential work’

Aug 1, 2024

The full memo from CEO of Intel Pat Gelsinger

英特尔首席执行官帕特·基辛格的完整备忘录

团队,

在财报电话会议之后,我们将全公司会议移至今天,因为我们将宣布降低成本的重大措施。我们计划在2025年实现100亿美元的成本节约,其中包括裁员约 15,000人,占员工总数的15%。这些措施大部分将在今年年底前完成。

这对我来说是一个痛苦的消息。我知道这对你们来说会更加难以接受。对于英特尔来说,这是极其艰难的一天,因为我们正在进行公司历史上一些最重要的变革。几个小时后我们开会时,我会谈谈我们这样做的原因以及未来几周你们可以期待什么。在此之前,我想先预览一下我的想法。

简而言之,我们必须将成本结构与新的运营模式相结合,从根本上改变我们的运营方式。我们的收入没有像预期的那样增长——而且我们尚未充分受益于人工智能等强大的趋势。我们的成本太高,利润太低。我们需要采取更大胆的行动来解决这两个问题——尤其是考虑到我们的财务业绩和 2024 年下半年的前景,这比之前预期的要艰难。

这些决定对我的内心构成了挑战,这是我职业生涯中最艰难的事情。我向你们保证,在未来几周和几个月里,我们将优先考虑诚实、透明和尊重的文化。

下周,我们将宣布一项针对符合条件的员工的全公司增强型退休计划,并广泛提供自愿离职的申请计划。我相信,我们如何实施这些变化与变化本身同样重要,我们将在整个过程中坚持英特尔的价值观。

为什么是现在?

自从推出新的运营模式以来,我们就对业务进行了全新的审视,并根据高绩效代工厂、无晶圆厂产品公司和公司职能部门的基准对自己进行了评估。这项工作清楚地表明,我们的成本结构不具竞争力。

例如,2020 年我们的年收入比去年高出约 240 亿美元,但我们目前的员工人数实际上比当时增加了 10%。造成这种情况的原因有很多,但这不是一条可持续的前进道路。

除了成本之外,我们还需要改变运营方式——在我们的员工体验调查中,你们中的许多人都分享了这一点。流程太复杂了,所以我们需要自动化和简化流程。决策需要很长时间,所以我们需要消除官僚主义。系统中效率太低,所以我们需要加快工作流程。

关键优先事项

我们正在采取的行动将使英特尔成为一家更精简、更简单、更敏捷的公司。让我强调一下我们的重点领域:

降低运营成本:我们将推动全公司的运营和成本效率,包括上述成本节约和员工人数减少。

简化我们的产品组合:我们将在本月完成简化业务的行动。每个业务部门都在进行产品组合审查,并确定表现不佳的产品。我们还将关键软件资产整合到我们的业务部门中,以便我们加快向基于系统的解决方案的转变。我们将把孵化重点缩小到更少、更有影响力的项目上。

消除复杂性:我们将减少层级,消除重叠的责任领域,停止非必要工作,并培养一种更大的主人翁意识和责任感的文化。例如,我们将把客户成功整合到销售、营销和传播集团,以简化我们的上市流程。

降低资本和其他成本:随着我们历史性的四年五个节点路线图的完成,我们将审查所有活跃的项目和设备,以便我们开始将重点转向资本效率和更正常的支出水平。这将使我们 2024 年的资本支出减少 20% 以上,我们计划在 2025 年将非变动销售成本减少约 10 亿美元。

暂停派息:我们将从下个季度开始暂停派息,以优先投资业务并实现更持续的盈利。

保持增长投资:我们的 IDM2.0 战略保持不变。在努力重建创新引擎之后,我们将继续对工艺技术和核心产品领导地位进行关键投资。

未来

我并不幻想我们面前的道路会一帆风顺。你也不应该这样。今天对我们所有人来说都是艰难的一天,未来还会有更多艰难的日子。但尽管这一切都很困难,我们正在做出必要的改变,以巩固我们的进步并迎来一个新的增长时代。

当我们开始这段旅程时,我们志存高远,知道英特尔是一个伟大创意诞生的地方,可能性的力量战胜了现状。毕竟,我们的使命是创造改变世界的技术,

证明地球上每个人的生活。我们尽最大努力,比世界上任何一家公司都更能体现这些理想。

为了实现这一使命,我们必须继续推动我们的 IDM 2.0 战略,该战略保持不变:重新确立工艺技术领导地位;通过扩大美国和欧盟的制造能力,投资大规模、全球弹性供应链;成为内部和外部客户的世界级、前沿代工厂;重建产品组合领导地位;实现无处不在的人工智能。

在过去几年中,我们重建了一个可持续的创新引擎,该引擎基本到位并步入正轨。现在是时候专注于构建推动我们业绩所需的可持续财务引擎了。我们必须提高执行力,适应新的市场现实,并以更敏捷的方式运营。这就是我们采取行动的精神——我们知道,我们今天做出的选择,尽管很困难,但将增强我们服务客户和未来几年发展业务的能力。

在我们踏上征程的下一步时,我们不要忘记,我们所做的事情从未像现在这样迫切。世界将越来越多地依靠硅片运转——世界需要一个健康而充满活力的英特尔。这就是我们所做工作如此重要的原因。我们不仅要重塑一家伟大的公司,而且还要创造技术和制造能力,这将在未来几十年重塑世界。这是我们在追求目标的过程中永远不应忽视的事情。

几个小时后我们会继续讨论。请带着您的问题来,以便我们能够就下一步进行公开而坦诚的讨论。

Intel is laying off over 15,000 employees and will stop 'non-essential work’

After losses, the chipmaker is cutting $10 billion in costs.

By Sean Hollister, a senior editor and founding member of The Verge who covers gadgets, games, and toys. He spent 15 years editing the likes of CNET, Gizmodo, and Engadget.

Aug 1, 2024, 4:14 PM EDT

Intel’s on a long, long road to recovery, and over 15,000 workers will no longer be coming along for the ride. The chipmaker just announced it’s downsizing its workforce by over 15 percent as part of a new $10 billion cost savings plan for 2025, which will mean a headcount reduction of greater than 15,000 roles, Intel tells The Verge. The company currently employs over 125,000 workers, so layoffs could be as many as 19,000 people.

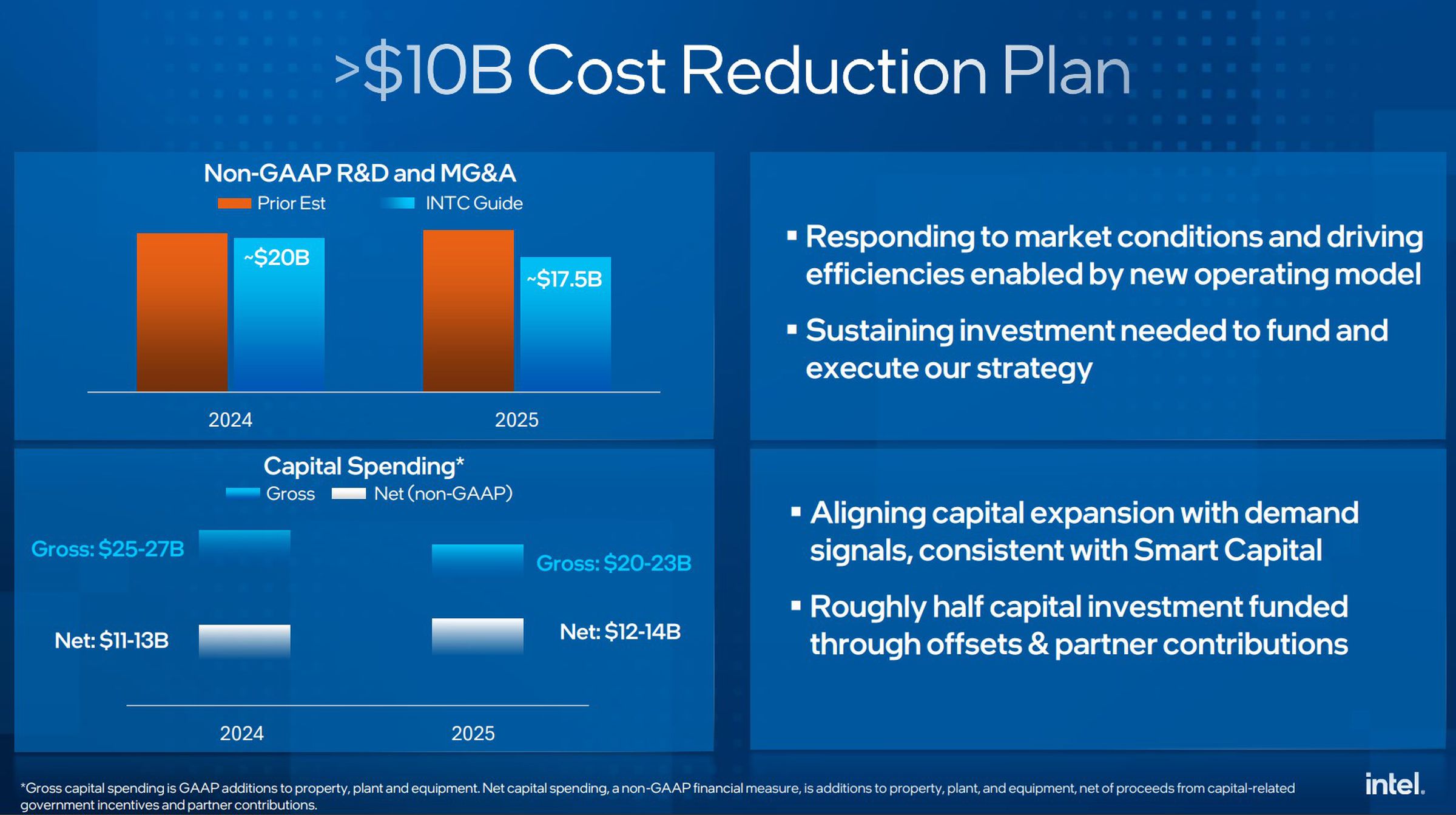

Intel will reduce its R&D and marketing spend by billions each year through 2026; it will reduce capital expenditures by more than 20 percent this year; it will restructure to “stop non-essential work,” and it’ll review “all active projects and equipment” to make sure it’s not spending too much.

“This is painful news for me to share. I know it will be even more difficult for you to read,” reads part of a memo from Intel CEO Pat Gelsinger to staff, which you can also read in full at the bottom of this post.

“We will reduce layers, eliminate overlapping areas of responsibility, stop non-essential work...”

The company just reported a loss of $1.6 billion for Q2 2024, substantially more than the $437 million it lost last quarter. “Our Q2 financial performance was disappointing, even as we hit key product and process technology milestones,” admitted Gelsinger in the company’s press release. “Our revenues have not grown as expected — and we’ve yet to fully benefit from powerful trends, like AI,” he writes in his employee memo.

Second quarter revenue was $12.8 billion, down just 1 percent year over year, and it’s not like all of Intel’s businesses are failing. While Intel has absolutely been losing money on its chipmaking Foundry business as it invests in new factories and extreme ultraviolet (EUV) lithography, to the tune of $7 billion in operating losses in 2023 and another $2.8 billion this quarter, the company’s products themselves aren’t unprofitable.

Almost all the losses this quarter and last quarter came from Foundry, while its sales continue to stay relatively stable and its PC and server businesses stay profitable. (The PC sales slump ended earlier this year.) The company is also set to receive up to $8.5 billion in US government funding from the CHIPS Act.

But investors didn’t seem happy that the company kept itself on a knife’s edge: over the past two years, before this quarterly loss, it had continued to swing between losses and profits overall, for just $1.1 billion in cumulative profit between Q2 2022 and Q1 2024. “Intel is now the worst-performing tech stock in the S&P 500 this year,” CNBC wrote in April.

Related

-

This is Lunar Lake — Intel’s utterly overhauled AI laptop chip

-

There is no fix for Intel’s crashing 13th and 14th Gen CPUs — any damage is permanent

From a tech leadership perspective, Intel’s not yet a big player in AI server chips like Nvidia (maybe not even a notable small one like AMD), its relatively recent entry into graphics has yet to impress, and it had to overhaul its flagship laptop chips significantly to address the existential threat of Arm chips from the likes of Qualcomm and Apple, which can offer more battery life than Intel. Like competitors, the company now partially relies on TSMC, not just its own foundries, to help produce some of its most advanced chips.

Microsoft recently followed Apple’s lead in ditching Intel chips for its latest slate of consumer hardware, including the Surface Laptop and Surface Pro, and launched its Copilot Plus PC initiative exclusively with Qualcomm, without waiting for Intel (or AMD)’s new flagship laptop chips to join them. Intel is currently dealing with two generations of potentially defective desktop CPUs, though the company currently believes it can mitigate the issue with a software update and doesn’t currently plan recalls.

On the company’s earnings call today, Intel CFO David Zinsner just suggested that the company’s next flagship AI laptop chip, Lunar Lake, won’t be enough by itself to turn things around.

While he says “the AI PC is a big winner for the company,” and Intel plans to “ramp that product significantly next year to meet market demand,” he also described Lunar Lake as a “narrow targeted product” that relies on “external wafers” (read: manufactured by TSMC, not Intel). Intel also needs to buy the memory it’s including on each chip, as Lunar Lake laptops don’t have separate memory sticks.

Those are reasons why Lunar Lake will only modestly improve the company’s situation in 2025, he says.

“The good news is the follow-on product, Panther Lake, is internally sourced on [Intel’s own process] 18A and has a much-improved cost structure,” says Zinsner. Lunar Lake is coming as soon as this September. Panther Lake will start ramping in the second half of 2025, but the “huge volume benefits” of that chip won’t come until 2026, says Gelsinger.

On server chips, Gelsinger says Intel is “having to fight to win sockets” away from AI chipmakers but that Intel’s own Granite Rapids Xeon server processors are looking “very positive.”

Intel plans to reduce spend by billions each year. Here’s how it’ll begin.

Image: Intel

Intel previously had a big round of layoffs in October 2022, when it also announced it would cut between $8 billion and $10 billion in costs every year through 2025. But the company didn’t shrink all that much as a result. While headcount dipped roughly 5 percent in 2023 (from 131,900 employees to 124,800 employees), Intel hired its way back to 130,700 employees as of March 30th, 2024, its financial records show.

Intel says it’ll complete the majority of the layoffs it’s announcing today by the end of 2024, and spokesperson Penelope Bruce confirms that they are new layoffs — the 4 percent dip from 130,700 employees in March to 125,300 employees in June is not included in the total.

Gelsinger writes that Intel will offer a “companywide enhanced retirement offering for eligible employees” and let employees broadly apply for voluntary layoffs starting next week — not every employee departure will come as a painful surprise.

Intel says it’s now restructuring, suspending its dividend, and spending less, period, but will “maintain its core investments to execute its strategy and build a resilient and sustainable semiconductor supply chain in the U.S. and around the world.”

Here's the full memo from Gelsinger:

Team,

We have moved our All Company Meeting to today, following our earnings call, as we are announcing significant actions to reduce our costs. We plan to deliver $10 billion in cost savings in 2025, and this includes reducing our head count by roughly 15,000 roles, or 15% of our workforce. The majority of these actions will be completed by the end of this year.

This is painful news for me to share. I know it will be even more difficult for you to read. This is an incredibly hard day for Intel as we are making some of the most consequential changes in our company’s history. When we meet in a few hours, I’ll talk about why we’re doing this and what you can expect in the coming weeks. In advance of that, I wanted to preview some of what’s on my mind.

Simply put, we must align our cost structure with our new operating model and fundamentally change the way we operate. Our revenues have not grown as expected – and we’ve yet to fully benefit from powerful trends, like AI. Our costs are too high, our margins are too low. We need bolder actions to address both – particularly given our financial results and outlook for the second half of 2024, which is tougher than previously expected.

These decisions have challenged me to my core, and this is the hardest thing I’ve done in my career. My pledge to you is that we will prioritize a culture of honesty, transparency and respect in the weeks and months to come.

Next week, we’ll announce a companywide enhanced retirement offering for eligible employees and broadly offer an application program for voluntary departures. I believe that how we implement these changes is just as important as the changes themselves, and we will adhere to Intel values throughout this process.

Why Now?

Since introducing our new operating model, we have taken a clean-sheet view of the business and assessed ourselves against benchmarks for high-performing foundries, fabless product companies and corporate functions. This work made it clear our cost structure is not competitive.

For example, our annual revenue in 2020 was about $24 billion higher than it was last year, yet our current workforce is actually 10% larger now than it was then. There are a lot of reasons for this, but it’s not a sustainable path forward.

Beyond our costs, we need to change the way we operate – something many of you shared as part of our Employee Experience Survey. There’s too much complexity, so we need to both automate and simplify processes. It takes too long for decisions to be made, so we need to eliminate bureaucracy. And there’s too much inefficiency in the system, so we need to expedite workflows.

Key Priorities

The actions we are taking will make Intel a leaner, simpler and more agile company. Let me highlight our areas of focus:

Reducing Operational Costs: We will drive companywide operational and cost efficiencies, including the cost savings and head count reductions mentioned above.

Simplifying Our Portfolio: We will complete actions this month to simplify our businesses. Each business unit is conducting a portfolio review and identifying underperforming products. We are also integrating key software assets into our business units so we accelerate our shift to systems-based solutions. And we will narrow our incubation focus on fewer, more impactful projects.

Eliminating Complexity: We will reduce layers, eliminate overlapping areas of responsibility, stop non-essential work, and foster a culture of greater ownership and accountability. For example, we will consolidate Customer Success into the Sales, Marketing and Communications Group to streamline our go-to-market motions.

Reducing Capital and Other Costs: With the completion of our historic five-nodes-in-four-years roadmap clearly in sight, we will review all active projects and equipment so we begin to shift our focus toward capital efficiency and more normalized spending levels. This will reduce our 2024 capital expenditures by more than 20%, and we plan to reduce our non-variable cost of goods sold by roughly $1 billion in 2025.

Suspending Our Dividend: We will suspend our stock dividend beginning next quarter to prioritize investments in the business and drive more sustained profitability.

Maintaining Growth Investments: Our IDM2.0 strategy is unchanged. Having fought hard to reestablish our innovation engine, we will maintain the key investments in our process technology and core product leadership.

The Future

I have no illusions that the path in front of us will be easy. You shouldn’t either. This is a tough day for all of us and there will be more tough days ahead. But as difficult as all of this is, we are making the changes necessary to build on our progress and usher in a new era of growth.

When we began this journey, we set our sights high, knowing that Intel is a place where big ideas are born and the power of what’s possible triumphs over the status quo. After all, our mission is to create world-changing technologies that improve the lives of every person on the planet. And at our best, we have exemplified these ideals more than any company in the world.

To live up to this mission, we must continue to drive our IDM 2.0 strategy, which remains the same: re-establish process technology leadership; invest in at-scale, globally resilient supply chain by expanding manufacturing capacity in the U.S. and EU; become a world-class, leading-edge foundry for internal and external customers; rebuild product portfolio leadership; and deliver AI Everywhere.

Over the past few years, we have rebuilt a sustainable innovation engine that is largely in place and on track. It’s now time to focus on building the sustainable financial engine needed to drive our performance. We must improve our execution, adapt to new market realities and operate as a more agile company. That’s the spirit of the actions we are taking – knowing that the choices we make today, as difficult as they are, will strengthen our ability to serve our customers and grow our business for years to come.

As we take these next steps in our journey, let’s not forget that there has never been a greater need for what we do. The world will increasingly run on silicon – and the world needs a healthy and vibrant Intel. That’s why the work we are doing is so consequential. Not only are we remaking a great company, but we are also creating technology and manufacturing capabilities that will reshape the world for decades to come. And this is something we should never lose sight of as we push forward in pursuit of our goals.

We’ll talk more in a few hours. Please come with your questions so we can have an open and honest discussion about what comes next.

Update, August 1st: Added more details from the earnings call about Intel’s expectations for its upcoming Lunar Lake and Panther Lake chips.