|

Even the smart contrarians are confused by our predicament

Paul B. Farrell, one of my favorite economics writers at MarketWatch, published 17 reasons America needs a recessiontoday to make the case, "Yes, America needs a recession. Bernanke andPaulson won't admit it. And investors hate them. We're all trapped inoutdated 1990s wishful thinking about a "new economy" and "perpetualgrowth."

While I appreciate the sentiment and have expressed similar views such as in Upside Down to Right Side Up,fact is the U.S. cannot have the kind of recession Farrell describesthis time around because the antecedents preclude it. The problem isrooted in both the source of our current economic challenges and thepolitical mandate to mitigate them that far predates the 1990s. Themoral hazard of reflation became embedded in U.S. economic policy afterThe Great Depression; the mandate became "No more Great Depressions."

The Fed, Treasury, and Congress have been fighting the recession weforecast last fall as due to start in Q4 2007, led by the housingmarket correction. Throwing the dollar under the bus to briefly boostexports and bring plane loads of tourists into the U.S. has helpedavert a far more blatent recession from occurring than the subtle onewe're already in. With inflation rising as quickly as the U.S. economyis slowing, picking the exact month or quarter when the real(inflation-adjusted) GDP growth recession starts–or started–will not bepossible until after the inevitably revised GDP and inflation figurescome in. We expect to see confirmation June 2008 at the earliest.

As for the kind of recession Farrell is talking about, the kind that"cleanses the system" with debt defaults, bankruptcies, and highunemployment–well, that's coming, too. Sort of. But it won't go the wayFarrell thinks.

In many ways, the next recession will be worse for the U.S. as the 2001recession. It will happen, but it will not bring about the benefitsFarrell hopes for.

1. Purge the excesses of the housing boomYou don't need a recession to see housing bubble excessespurged. It's happening before the recession. In fact, the correction inthe housing market is the primary cause of the recession we forecast ayear ago to start this quarter.

No, it's not heartless. Not like wartime calculations of "acceptablecollateral damage." Yes, The Economist admits "the economic and socialcosts of recession are painful: unemployment, lower wages and profits,and bankruptcy." But we can't reverse Greenspan's excessive rate cutsthat created the housing/credit crisis. It'll be painful for everyone,especially millions of unlucky, mislead homeowners who must bear thebrunt of Wall Street's greed and Washington's policy failures.

The housing market is highly correlated to employment. Regional homeprices rarely if ever fall during periods of high or rising employment,and home prices have not fallen nationally even during nationalrecessions since the Great Depression. Since 2006, national home priceshave been declining even as the economy expanded and the labor marketwas relatively strong. What's going to happen to the real estate marketwhen the U.S. goes into recession? The U.S. economic policy makers arenot eager to find out, especially in an election year, so first theyare going to try to prevent one happening, first using dollardepreciation and doling out of short term loans at the Fed's DiscountWindow, then later with rate cuts, then deeper Federal deficitspending, then state deficit spending (yes, the laws will be changed),and on and on. Think post bubble Japan except inflationary versusdeflationary.

2. U.S. dollar wake-up callIn our floating exchange rate currency system, relativeeconomic performance is the main determinant of currency values. A U.S.recession will only lead to dollar strengthening if the economies ofU.S. trade partners contract even faster than the U.S. economy does. Wehave since 2005 forecast the next U.S. recession to be U.S. centric,meaning more severe in the U.S. than among some U.S. trade partnerswith lesser internal and external liabilities. You don't have toswallow the whole global decoupling theory hook, line, and sinker tosee that. All you have to do is note the USA's external liabilitiesrelative to its trade partners and ask how U.S. creditors are likely torespond when U.S. national income drops. Think the dollar is tankingtoday? Wait until the U.S. goes into the next recession. It'll be adollar wake-up call alright.

Reverse the dollar's free fall and reviveour global credibility. Warnings from China, France, Iran, Venezuelaand supermodel Gisele haven't fazed Washington. Recession will.

3. Write-offsAgree whole heartedly with the sentiment. A market is onlyas good as the market institutions that support it, includingregulators and credit rating agencies. U.S. regulatory and ratinginstitutions have recently revealed themselves to be less effectivethan those in many third world countries. However, according to oursources, including Martin Mayer and Peter Warburton–who are arguablythe most credible experts on the topic of credit derivatives–the marketfor these instruments will be gone for years, and when it comes back itwill be nothing like it is today. Asking for these to be written offall at once is like asking a vet to shoot a sick dog. The dog is goingto be out for a long while as it is.

Expose Wall Street's shadow-banking system. They're playing with $300trillion in derivatives and still hiding over $100 billion of toxicoff-balance sheet asset-backed securities, plus another $300 billionhidden worldwide. A lack of transparency is killing our internationalcredibility. Write it all off, now!

4. BudgetingThe exact opposite is true. Washington is filled withbrave talking free market economists during boom times but they quicklymorph into Keynesian softies during busts. It has always been thus:

Force fiscal restraint back intogovernment. America has been living way beyond its means for years: Arecession will cut back revenues at all levels of government andcutbacks will encourage balanced budgeting.

1%-OffIn other words, the Democrats figured the stimulus of theRepublican tax cut was going to help prevent a recession from occurringafter the stock market crashed. If they opposed it and no tax cutpassed, the economy was sure to go into recession and they'd win theupcoming elections. Good for the Democrats but bad for the nation.

TIME Magazine

Nov. 25, 1929

On the day last week's stockmarketplunked to the bottom President Hoover let his Secretary of theTreasury, Andrew William Mellon, make an announcement which thePresident had been saving up as the Big-News-Item for his own firstmessage to Congress next month, an announcement of immediate taxreduction.

... into the Treasury trooped SenatorsSmoot, Reed, Simmons, Harrison—potent majority and minority members ofthe Senate Finance Committee. At their heels followed SpeakerLongworth, Chairman Hawley of the Ways & Means Committee.

Already tardy, [Treasury] SecretaryMellon hurried off to keep a dinner engagement at his home with NewYork bankers. Into the hands of eager pressmen went the Mellonannouncement:

"The Secretary of the Treasury considersthe [Budget] estimates have reached the point where tax reductionshould be recommended to the Congress at the coming session. . . ."

Democrats in Congress dropped their planfor a $300,000,000 tax reduction to join with Republicans in promisesto pass the Mellon proposal, if possible, before Christmas. EvenChairman Smoot of the Finance Committee, long an outspoken opponent ofimmediate tax reduction, swung into line, pledged prompt action.

Declared Congressman Garner, chiefDemocratic member of the House Ways & Means Committee and minorityleader of the House: "I look at the proposal from the point of view ofthe good of the country and I shall support it. . . . Even though abusiness crash might aid in placing the Democratic party in power, theprice would be too great to pay for party success."

As it turns out, even though Congress was right on the case the monthafter the stock market crash, tax cuts didn't help much because taxrates were already so low the stimulus from cutting them didn't makemuch difference.

Point is, recessions bring on less fiscal restraint, not more. U.S.economic policy makers should have been raising taxes along withinterest rates during the 2003 to 2006 recovery to balance the budget.They didn't so now we head into this next recession with huge deficits,a hangover from the last reflation. Soon we will have plummeting taxrevenues. This will not encourage balanced budgeting. SubstitutePaulson for Mellon and you see how little things change.

5. OverconfidenceIt's not a recession but the financial market crash thatleads to the recession that takes the speculators out of the stockmarket, just as the collapsing housing bubble has taken the houseflippers out and is causing this recession. However, since Keynesianrecession-fighting reflation policies are a sure bet, speculators willmove the party to a new arena, to whatever asset class reflationbubbles up.

A recession will wake up short-terminvestors playing the market. In bull markets traders ride the risingtide, gaining false confidence that they're financial geniuses.Downturns bruise egos but encourage rational long-term strategies.

In 2001 we figured one beneficiary of 2001 recession reflation would becommodities, including gold. (We missed predicting the housing bubble.Call us stupid, but real estate bubbles are notoriously dangerous tothe macro economy, banking system, and financial markets, so we assumedthe Fed was going to stick to the program they followed in the 1970sand 1980s when they came down hard with rate hikes and regulatoryaction to stop housing froth. Silly us.) Most of the increase incommodity prices was due at first to dollar depreciation. That wasfollowed by coordinated global central bank currency depreciation.

Besides currency depreciation, other reflation efforts included creditexpansion. Most of the credit creation that was needed to peel theeconomy off the floor after the year 2000 stock market crash wasdeveloped using sales of credit derivatives to foreign pension fundsand central banks. By keeping credit creation off the balance sheets ofcommercial banks, the money supply that fueled the housing bubble didnot show up in traditional measures of the money supply, and thus werenot commodity inflationary, although they were properly asset priceinflationary.

That game is over. Am I sure? When's the last time you heard of a bigprivate equity deal closing? Not since the summer when the CLO machinebroke that had been feeding the LBO bubble. Without the fancy creditmachine to create the credit to inflate these assets, what's left toexpand credit and money but the good old fashioned printing press? Isit any wonder that gold prices are rising? The investment banks mayhave something else up their sleeve. I'll let you know if I find outwhat because if they do, it may be time to lighten up on the reflationhedges.

6. RatingsOur contacts tell us they're getting shaken up quite welleven without a recession, thank you very much. A recession might makematters worse but only marginally.

Rating agencies have massive conflictsof interest; they aren't doing their job. They're supposed to representthe investors, but favor Corporate America, which pays for the reports.Shake them up.

7. ChinaThis is already happening.

Trigger an internal recession in China. Make it realize America'snot going into debt forever to finance China's domestic growth andmilitary war machine. A recession will also slow recycling theirreserves through sovereign funds to our equities.

The alarm bells begin to ring in ChinaBut why asume a recession worse for China than for theU.S.? China has repeatedly stated a desire to diversity out of, thatis, sell U.S. financial assets and government debt. The only reasonthey have not is because U.S. consumers are buying Chinese exports. AsU.S. consumers stop, the deal isn't so good for them.

Nov. 21, 2007 (Times Online)

The Pollyanna economists think it is alldifferent now, a view espoused by the World Bank in its most recentreport on East Asian economic growth. China is creating its own demand,“decoupling” from the US economy, it says.

Only a day after the World Bank releasedits fug of warm air, Beijing’s Commerce Ministry raised the alarm,giving warning that things had reached a “turning point” and Chineseexporters could be “devastated” if US demand continues to fall.

Exports account for a third of China’sgrowth and America is the destination for a fifth of the stuff. “Therisks of economic slowdown in the US . . . plague our exportprospects,” the Commerce Ministry said.

About 30% of China's export trade comes from the U.S. Can China take amajor hit in U.S. export trade income? Yes, but not without the economyslowing and the CCP experiencing political challenges. Can the U.S.take a big a cut in China's lending? Yes, but not without economic andpolitical consequences. The U.S. will have to find an alternate,someone else to grab the hot potato.

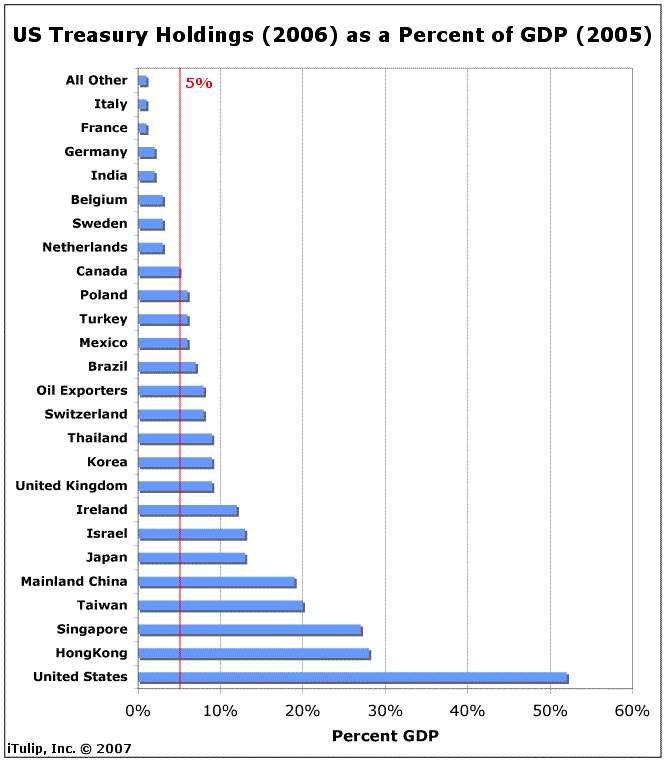

As you can see from the above, not all U.S. trade partners are "pullingtheir weight" buying U.S. debt. With treasury purchases scaled to thesize of each county's economy, you can see that countries that eitherneed U.S. military support or U.S. consumer demand for their exportsbuy the most significant dollar volumes of U.S. debt. China surelydoesn't need our military "protection." If we don't import Chinese leadcovered toys and pesticide infused ginger, what motive does China haveto buy U.S. financial assets?

I'm confused by Farrell's assertion that the U.S. funds China'smilitary by borrowing from China. That's backwards. China is divertingnational savings into reserves that might otherwise be used to buildits military. From China's perspective:

US-China relations are influenced by a wide array of issues from Taiwanto trade relations and human rights. More recently, the nexus of therelationship has centered on the so-called "Bretton Woods II"arrangement, a continuation by other means of the dollar-centeredinternational order that prevailed in the postwar decades. Thismonetary status quo, based on structural current account deficits inthe U.S. and structural current account surpluses in Asia, in whichAsian current account surpluses are recycled to provide cheap financingfor the US current account deficits, largely explains why the US dollarhas not collapsed despite the country's increasingly parlous debtbuild-up. It has been characterized by PIMCO's Paul McCulley as a"stable disequilibrium".We coined the term Economic Mutually Assured Destruction.Whatever you want to call it, a recession helps China's position morethan the U.S. position. In a global recession, the net goods exporterstend to weather the storm better than the net financial assetsexporters.

But Bretton Woods II is increasinglybeset with internal contradictions: the Chinese have in effectinitiated a dollar reserve accumulation policy that acts as a quasi oilreserve, given that oil is priced in dollars. But in so doing, theyhave helped to fund an increasingly confrontational and militaristicUS, which in turn threatens China's energy security. How long beforethis circular relationship, which underpins the stability of today'sglobal markets, breaks down?

China's Dollars Versus America's Guns

Japan Policy Research Institute - Marshall Auerback - February 2007

8. OilRecession will have the opposite result unless Farrell isexpecting, as we are, that the dollar will fall even faster than oildemand. That means the U.S. may find itself with 2/3 of pre-recessionoil import demand but each unit of demand will be inflated by another50% reduction in the value of the monetary unit, the dollar. As energyprices rise and the energy purchasing power of income falls, cars willget a whole lot smaller. (The same result is achieved in Europe viataxation.)

Force the energy and auto industries to get serious about emission standards and reducing oil dependency.

9. InflationHow will recession expose the "core inflation" farce?Reflation, which is inevitable, will make inflation worse, and don'texpect the analysis and reporting to improve if the facts are againstthe house.

Expose the "core inflation" farce Washington uses to sugarcoat reality.

10. Moral hazardWhen the U.S. goes into recession, the Fed will cut rates.The only way to keep the Fed from bailing out speculators is for theFed to not allow speculators to get into the position of needing to getbailed out. Too late for that.

Slow the Fed from cutting interest rates to bail out speculators.

11. War costsWhat Enron did wrong was report debt as operating income. Here in the USA, we depend on foreign borrowing for GDP growth.

Force Washington to get honest abouthow it's going to pay for our wars, other than supplemental bills thatare worse than Enron-style debt financing.

Besides, here we are, no recession yet, and Congress can't even cutspending without the economic impact threats coming out of the Pentagon.

Pentagon Warns of Civilian Layoffs If Congress Delays War FundingDon't forget. Recession preceded by credit booms can haveunpleasant unintended consequences. If a country can't spend its wayout of recession peacefully, it may do so militarily.

Nov. 21, 2007 (Jonathan Weisman and Ann Scott Tyson - Washington Post)

Democrats Are Firm on Link to Troop Withdrawals From Iraq

The Defense Department warned yesterdaythat as many as 200,000 contractors and civilian employees will beginreceiving layoff warnings by Christmas unless Congress acts onPresident Bush's $196 billion war request, but senior Democrats said nowar funds will be approved until Bush accepts a shift in his Iraqpolicy.

12. CEO payIt's already overexposed. What's missing is the will to doanything about it. That's up to shareholders. When the DOW is tradingeither nominally or in real terms near half where it is today,shareholders may get more militant. As long as inflation via sharebuy-backs, balance sheet engineering and other tricks supports shareprices, shareholders will remain tolerant of this nonsense.

Further expose CEO compensation that's now about five hundred times thesalaries of workers, compared with about 40 times a generation ago.

13. PrivatizationRecession means more deficit spending means more pork means more privatization not less.

Stop the privatization of our federal government to no-bid contractors and high-priced mercenary armies fighting our wars.

14. EntitlementsRecessions put further burdens on government not less.

Force Congress to get serious about thecoming Social Security/Medicare disaster. With boomers now retiring,this problem can only get worse: A recession now could avoid adepression later.

15. ConsumersI'll say.

Yes, we're all living way beyond ourmeans, piling up excessive credit-card debt, encouraged by governmentleaders who tell us "deficits don't matter." Recessions will pressureindividuals to reduce spending and increase savings.

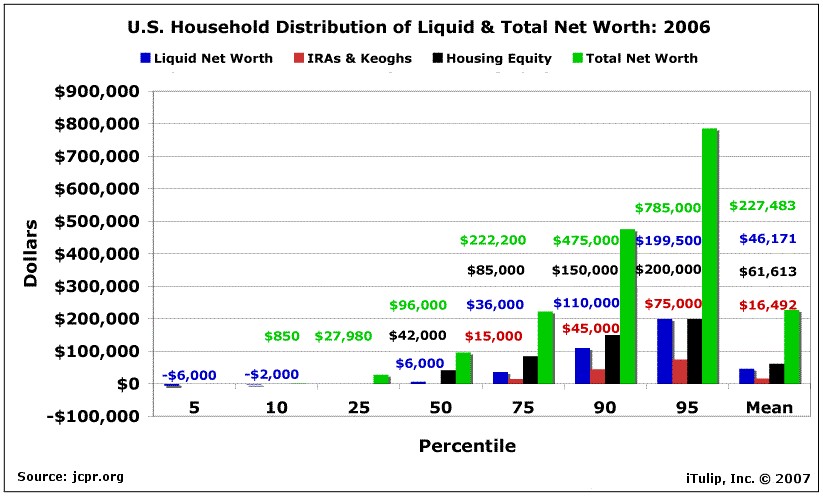

The majority of Americans (read: voters) do not have enough liquid networth to fund expenses without increasing debt or selling assets.Median duration of unemployment has increased from seven to nine monthsthis year. With little liquid savings, demand for credit is rising. Atthe same time, secured credit (mortgage and HELOC) conditions aretightening. What does that leave?

We have been surveying a group of coin and jewelry dealers across theU.S. since 1999. For the past six months in particular it's been a taleof two markets. Working families are selling to raise money; coincollections and jewelry are being hawked to raise cash. At the sametime high net worth families have been buying gold and rare coins. As aresult, the spread between bullion and rare gold coins prices hasincreased from around $20 where it had been for years to over $80 inthe past few months. Prices of very rare coins are going through theroof.

Credit card debt is also rising and, like everything else, it is not soevenly distributed. Average household debt was 91% of net worth for themiddle 20% wealth group, 10% of wealth for the top 10% group.

Families in the top net worth groups don't have much debt so whenrecessions come around, the ratio of debt to net worth hardly changes.As you can see above, that is not the case for the bottom 40%. Notethat during recessions accompanied by tight credit, such as during theearly 1980s and in 2001, debts are paid off and savings increase. Inthe early 1980s, debt to wealth ratio for the bottom 40% dropping inline with the top 10%. Meanwhile, the top 40% was relativelyunaffected.

The U.S. economy has built up not only historic wealth inequality since2001 but massive disparities of liquid net worth and debt. In arecession, these will create a political nightmare as unemploymentrises and credit tightens. A recession will be bad for the rich andmiddle class, but will hammer the poor and push segments of the middleclass into the ranks of the poor. We've long expected a politicalreflex to these circumstances in our Ka-Poom Theory. If the U.S. evergets another populist, socialistic president it will follow from of thekind of recession Farrell is hoping for.

If you can afford to hedge inflation, you do. For everyone else, there's Mastercard.

16. RegulationFor economic reasons, trade needs to be unrestrainedduring periods of recession, more managed during expansions. Of course,politics usually forces the opposite to happen.

Lobbyists have replaced regulation. Extreme theories of unrestrainedfree trade plus zero regulation just don't work; proven by our creditcrisis, hedge funds' nondisclosures, private-equity taxation, ratingagencies failures, junk home mortgages, and more. Get real, folks.

|

17. SacrificeI'll respond to this one with a comment made to our interview with James Scurlock.

"We have not seen a nationwide declinein housing like this since the Great Depression," says Wells Fargo CEOJohn Stumpf. As individuals and as a nation Americans have alwaysperformed best in crises, like the Depression or WWII, times when we'reall asked to make sacrifices. Pampering us with interest-rate cuts andtax cuts during the Iraq and Afghan wars may have stimulated theeconomy temporarily, but they delayed the real damage of the '90s stockbubble while setting the stage for this new subprime/credit crisis.

"Did you guys know, the bankrupcy laws changed? You cannot declarebankrupcy anymore. In the near future, we may have debtors prisons.When we have a war with Iran, Syria, Russia, and China, you know whowill be recruited. They will give you a choice, pay off your debts orwe will throw you in prison. If you don't want to go to jail, you jointhe military for 8 years."We'll get a recession alright, but it won't improve anything. There will be nothing romantic about or cleansing about it.