Looking Back in Order to Look Ahead

When the credit crisis broke out in Q3 2007, we were reminded about the horrendous mistakes of the past as the real culprit behind the bubble - many of us blamed Mr Greenspan! Central banks vowed not to repeat those mistakes while handling the problem. But as we slipped deeper into the mess, the old mistakes got repeated - this time with much higher magnitude and wider geographical spread. Now that the panic levels are easing, it is time to look back in order to look ahead.

Old recipe, compounding problems

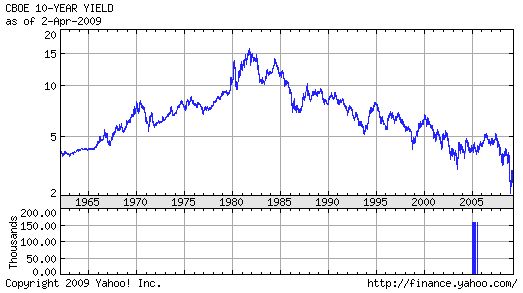

Post 1980s, after every crisis, the monetary base in US expanded and long term interest rates declined (see US 10 year yield below). Cheaper money and easier availability was used as savior in every downturn. This has kept compounding the problem and has led to where we are today. Let's examine political and economic reasons behind this irreversible trend.

In Bretton Woods (1944), the US agreed to exchange every US$35 into an ounce of gold whenever asked - getting acceptance of the US dollar as an alternative to gold and thus becoming the world's central currency. This was the time when Curopean behemoths were war-torn, had large debts and needed huge public spending to re-build. On the other hand, the US was growing quite rapidly, had large current account surplus, held about 60% of foreign exchange reserves in gold and was the largest creditor to the world. Acceptance of the dollar as reserve currency worked in the interest of the everyone as US attained financial supremacy (which it rightly deserved) and could give away dollars grants/loans in exchange for market access in new regions while rest of the world got money they needed desperately.

Since mid 1980s, US spending on wars, arms and development took a steep upturn as the world happily financed it by hoarding dollars. As a result US gross external debt which was about 33% of GDP in 1980s grew to about 75% now - a 10 fold increase in absolute value. This works out about $36000 per capita currently against about $4000 per capita in 1980s. A transition from largest creditor to largest debtor needed a few structural policy changes. A declining interest rate (in order to reduce the interest burden) and expanding monetary base (providing liquidity for the world to fund deficits) were supreme amongst those. So far as the US Dollar retains the centre stage while reserve currency and US economy runs trade, budgetary and fiscal deficits, the long term interest trend will continue to slope down. This would effectively mean repetition of old mistakes.

Money pipeline has expanded enormously

We have seen a crisis of record magnitude in terms of wealth destruction and reach. However, we can't ignore that the response from governments and central banks has also been quite aggressive and unprecedented. Estimates suggest that the total effect of discount window buying, TARP, TALF, CP programme, treasury buy-back programme and other smaller initiatives could end up expanding the US Fed balance sheet by $3.5 trillion. Combine this with quantitative easing programmes (modern name for printing money) in UK ($210b), Japan (additional bond buying of $4b per month) and Switzerland as Bank of Canada prepares to follow. Analysts put estimates of toxic assets losses at $1-2 trillion. Without a doubt, money released into the system is much larger than that taken away by the credit crisis. Money pipeline has gotten bigger, we are now awaiting for it to start flowing as credit loosens up.

Two plausible scenarios

Cycles will turn, sentiments will change, dawn will follow dusk - as usual. However, timing would remain the big unknown. One can see two possible scenarios as the economic picture changes.

Scenario one: In an attempt to undo its recent liberal policies, central banks may start aggressive rate hikes pre-empting an economic recovery (known as leaning against air). Besides, governments may hike taxes and recoveries to minimise holes in their balance-sheet. This may tame growth to low rates for several years. I do not subscribe to this scenario for few simple reasons. Firstly, it is too idealistic to know the turning points; central banks have been slow to put their act together. Secondly, we love growth even at the cost of inflation and therefore we delay anchoring it in our short-term interest. Thirdly, we have short memories and hence err over and again.

Scenario two: We extend our mistakes and enjoy another big wave of growth, prosperity and inflation. While doing so we compound the problem even more. While a large part of value of toxic assets would have been lost for ever, the new money printed to cover those up will eventually find ways to asset markets thus creating a possible big scare of inflation. Not fearful? Well, our children should be.

Inflation and dollar: ticking time-bombs

For the last 65 years, the fabric of financial system has been built around US dollar. However, the fundamentals that justified the US Dollar as a benchmark currency have gone through significant metamorphosis. The US has turned from largest creditor in 1940s to largest debtor, from trade surplus to huge trade deficit and is no more the biggest holder of foreign exchange reserves (excluding dollar). Hence, the premises on which dollar was accepted as reserve currency don't exist. The lopsided world economy - with the monetary printing press in the US and real physical production in others - cannot continue beyond a point. It is better that we realise the problem and address it before it becomes over-whelming. Time is ticking and the geniuses of the financial world are rightly seeing inflation of 1970s to return. The good news is that an even higher level of prosperity awaits as asset prices could soar. The bad news is that the next chaos could be even more dreadful with the whole fabric of currency regime closing to break-down.

Looking ahead

While road to recovery out of the current crisis is still bumpy, we seem to be more than half way through the tunnel. Low prices, falling growth and job-losses could still hog limelights, but the macro-fund managers are preparing for next big wave of falling dollar and rising alternate asset prices. Let's keep a close eye on discussions of alternate reserve currency; this has potential to put "Gulal" on every rule of the game.