The Fed Will Soon Face Its First True Volcker Test: Continuing To Hike Into A Full-Blown Recession

By Simon White, Bloomberg Markets Live reporter and strategist

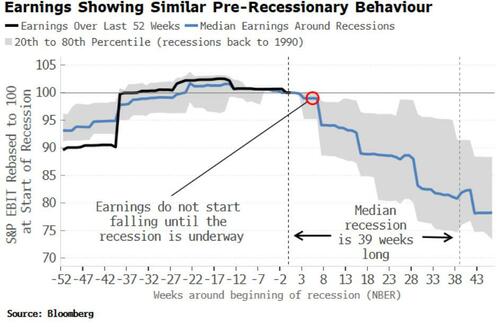

US equity earnings are behaving similarly to the run-up to previous recessions, tallying with multiple leading indicators showing the US is on track for an economic slump.

Earnings season gathers paces next week, with the big US banks announcing results. Earnings growth has slowed sharply in recent months as the economy feels the impact of higher rates. The ISM, global exports and earnings surprises all give reliable leading relationships for S&P earnings growth, and all point to weakness in coming months.

If we do get a recession, then the deceleration in earnings will intensify. Profit margins and P/E multiples are already a net drag for equity returns.

Unfortunately earnings, and earnings expectations, by themselves won’t help you gauge whether a recession is on the way, as both tend to lag the cycle. But if you combine them with other leading data, the case for a recession becomes much stronger.

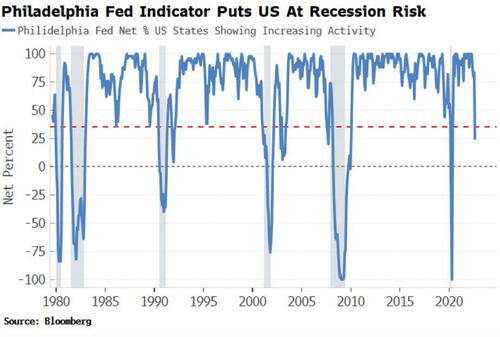

Recessions are regime shifts and tend to happen quickly or not at all. That’s why economists often miss them. No one indicator is 100% reliable, but any high-quality ones will exhibit this regime-shift behaviour. One such is the Philadelphia Fed State Coincident Diffusion Index. It has currently dropped to a level that is only seen prior to recessions.

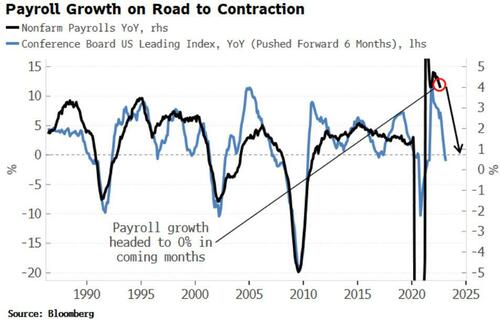

The Fed has insisted it is laser-focused on inflation and would prefer to over-tighten than under-tighten. That’s easier said when the jobs market is still tight, and unemployment back at multi-decade lows.

Payrolls today did not betray any signs of weakness, coming in ahead of expectations, but the path is clear: payrolls growth is set to drop sharply in the coming months and soon contract.

Unless inflation is substantially lower by then (it should fall, but not enough to give confidence it has returned to a low and stable regime), the Fed will face its first true Volcker test: continuing to raise rates into a recessionary economy.

My money’s on that infamous pivot being realized, or the early demise of QT, boosting liquidity and offering an excellent opportunity to replenish risk.