如果中美彻底脱钩,中国能撑多久?

海外网友萨基姆的回答

The United States is clamoring to sever all relations with China, as if without the United States, China could do nothing. So ridiculous! These words sound more like the groans of a terminally ill person struggling, or the dreams of a drunken man.

美国叫嚣要断绝与中国的一切关系,好像没有美国,中国什么都做不了,这么可笑!这些话听起来更像是一个身患绝症的人挣扎的呻吟,或是一个醉汉的梦话。

Firstly, international relations are not a "small circle" issue among children. From a common sense perspective, the United States cannot completely sever its relationship with China. Even if the United States really intends to do so, to what extent can the two countries decouple? The relationship between Russia and the United States is so bad that they have not severed all ties. In contrast, China and the United States are much closer.

首先,国际关系不是儿童之间的“小圈子”游戏。从常识上讲,美国不可能完全断绝与中国的关系。即使美国真的打算这样做,两国能在多大程度上脱钩?俄罗斯和美国之间的关系如此糟糕,他们也没有断绝所有联系。相比之下,中国和美国要亲密得多。

From an economic perspective, the trade volume between China and the United States in 2022 was 759.427 billion US dollars, a record set during the ongoing trade war. Sino US trade saves an average of $850 per American household per year. In terms of personnel exchanges, before the outbreak of the epidemic, the number of personnel exchanges between China and the United States reached 5 million annually, with an average of 17000 people traveling between China and the United States every day. A flight takes off and lands every 17 minutes. Not to mention the large number of students and tourists traveling between China and the United States. Do you think all of this will disappear one day?

从经济上看,2022年中美贸易额为7594.27亿美元,这是在贸易战持续进行的情况下创下的纪录。中美贸易为每个美国家庭平均每年节省850美元。在人员往来方面,疫情爆发前,每年中美之间的人员往来达到500万人次,平均每天有1.7万人往来于中美之间,每17分钟就有一架航班起降。更不用说在中美之间往来的大量学生和游客了。你觉得有一天这一切都会消失吗?

From another perspective, I would like to know more about how long it can last if the United States severs all ties with China? Under the impact of the COVID-19, the highly globalized industrial chain appears fragile. As the most populous country in the world, China has an extremely large domestic market and a complete industrial chain. China was the only country to achieve economic growth during the pandemic, which fully reflects the resilience and resilience of the Chinese economy.

从另一个角度来看,我更想知道,如果美国切断与中国的所有联系,它能维持多久?在新冠肺炎疫情冲击下,高度全球化的产业链显得脆弱,而中国作为世界上人口最多的国家,拥有极其庞大的国内市场和完整的产业链。中国是疫情期间唯一实现经济增长的国家,这充分体现了中国经济的韧性和弹性。

For the United States, once it loses a major customer like China, it will be difficult to make up for it. For example, before the United States blacklisted Huawei China, Huawei placed nearly $12 billion in annual orders with American companies and is expected to purchase over $20 billion in goods from American companies by 2020, but all of this has been erased by restrictions imposed by the US government. Therefore, the US government's trade ban on Huawei has actually caused significant economic losses to American companies.

对美国来说,一旦失去像中国这样的大客户,将很难弥补。例如,在美国将中国华为列入黑名单之前,华为每年向美国公司下近120亿美元的订单,本来到2020年可以从美国公司购买超过200亿美元的商品,但这一切都被美国政府的限制抹去了。因此,美国政府对华为的贸易禁令实际上给美国企业造成了巨大的经济损失。

The current international trade system is no longer the pattern of the US Soviet Cold War, and it is unrealistic to deviate from the development of globalization. If the United States intends to completely sever its ties with China, it means it is gradually falling into a cocoon of ignorance. In short, decoupling from China is not the solution to the US dilemma. Cooperation between the two countries is the best path.

当前的国际贸易体制不再是美苏冷战时期的格局,要脱离全球化的发展是不现实的。如果美国打算彻底断绝与中国的联系,那就意味着它逐渐陷入了无知的茧中。简而言之,与中国“脱钩”并不是解决美国困境的办法。两国合作是最好的道路。

Perhaps this question should be said as follows: If China completely cuts off its ties with the United States, how long can Americans continue to do so?

也许,这个问题应该这样说:如果中国完全切断与美国的联系,美国人还能维持多久?

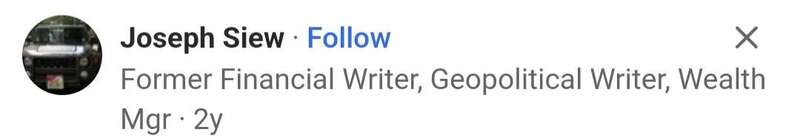

Because, as analyzed by AXIOS, Trump's trade war with China is a failure in any aspect. A report from the Oxford Institute of Economics supports his analysis, with some excerpts as follows:

因为,正如AXIOS的分析所说,特朗普对中国的贸易战在任何方面都是失败的。牛津经济研究院的一份报告支持了他的分析,以下是部分节选:

The United States benefits from trade and investment flows with China. The combination of bilateral trade, investment, and supply chain integration supports economic growth, consumer choices, and job creation. In 2019, exports to China provided 1.2 million jobs to the United States, and as of 2019, Chinese multinational corporations directly employed 197000 people in the United States.

美国从与中国的贸易和投资流动中受益。双边贸易、投资和供应链一体化的结合支持了经济增长、消费者选择和就业创业。2019年,对华出口为美国提供了120万个就业岗位,截至2019年,中国跨国公司在美国直接雇佣了19.7万人。

In 2019, American companies invested $105 billion in China, and the profits generated from these investments and their contribution to the competitiveness of American companies supported the US economy through research and development, domestic investment, and dividend payments. It is expected that China will drive about one-third of global economic growth in the next decade, and maintaining access to the Chinese market is becoming increasingly important for American companies to succeed globally.

2019年,美国企业在华投资1050亿美元,这些投资带来的利润及其对美国企业竞争力的贡献,通过研发、国内投资和股息支付,为美国经济提供了支撑。预计中国将在未来十年推动全球经济增长的三分之一左右,保持进入中国的市场对美国企业在全球取得成功越来越重要。

The trade war with China has damaged the US economy and failed to achieve the main policy goals outlined by the Trump administration. Not only did it not bring benefits to the economy, but it also reduced economic growth and employment in the United States, resulting in an estimated maximum loss of 245000 jobs. Despite the first phase of the trade agreement reached between the two countries in early 2020, tariff rates remain at their highest levels in decades.

•与中国的贸易战损害了美国经济,未能实现美国政府概述的主要政策目标。它不仅没有给经济带来好处,反而降低了美国的经济增长和就业,导致估计最高损失24.5万个工作岗位。尽管两国在2020年初达成了第一阶段贸易协定,但关税税率仍处于数十年来的高位。

Lowering tariffs may benefit the US economy and create job opportunities. Even a moderate reduction in tariffs may promote economic growth and stimulate employment growth. In our trade war downgrade scenario, the two governments are gradually reducing the average tariff rate to around 12% (currently around 19%), and the US economy will increase its real GDP by $160 billion over the next five years, adding 145000 jobs by 2025. Due to the increase in employment and income, as well as the decrease in prices, the income of each American household will increase by $460.

降低关税可能有利于美国经济并创造就业机会。即使是关税的适度回落也可能促进经济增长并刺激就业增长。在我们的贸易战降级情景下,两国政府逐渐将平均关税税率降至12%左右(目前约为19%),美国经济在未来5年实际GDP将增加1600亿美元,到2025年将增加14.5万就业岗位。由于就业和收入的增加以及价格的下降,每户美国家庭的收入将增加460美元。

The escalating trade tensions and severe decoupling from China will further damage the US economy and reduce employment. According to our scenario of escalating and decoupling trade wars, the real GDP of the United States will decrease by $1.6 trillion over the next five years, with 732000 job losses in 2022 and 320000 job losses in 2025. In addition to significant short-term impacts on economic output, the long-term impact will permanently reduce GDP, reflecting a decline in economic productivity. By the end of 2025, American households will lose approximately $6400 in real income.

•不断升级的贸易紧张局势和与中国的严重脱钩将进一步损害美国经济,并减少就业。根据我们的贸易战升级和脱钩情景,未来5年美国实际GDP将减少1.6万亿美元,2022年就业岗位将减少73.2万个,2025年就业岗位将减少32万个。除了短期内对经济产出的重大冲击外,长期影响将永久性地降低GDP,反映出经济生产率的下降。到2025年底,美国家庭实际收入将损失约6400美元。

Last November, China announced a record $75.43 billion trade surplus, driven by an unexpected 21.1% year-on-year surge in exports. The fastest growing is exports to the United States, which increased by 46.1% to $51.98 billion, also setting a record

去年11月,中国公布了创纪录的754.3亿美元的贸易顺差,这是受出口同比意外飙升21.1%的推动。增长最快的是对美国的出口,增长了46.1%,达到519.8亿美元,也创下了纪录。”

The Port of Los Angeles is the largest container cargo handling yard in the United States and the gateway to many Chinese goods. Here, containers carrying Chinese imported goods are stacked together like six story Lego blocks. Truck drivers crowded the parking lot, waiting for a few hours to pick up the goods and then transport them to various parts of the European continent.

洛杉矶港是美国最大的集装箱货物处理场,也是许多中国商品的门户。在这里,装载中国进口商品的集装箱像六层高的乐高积木一样堆叠在一起。卡车司机挤满了停车场,等待几个小时来取货,然后将货物运往欧洲大陆各地。

October was the busiest month in the port's 114 year history, and traffic remained high. Gene Seroka, the executive director of the port, said that on December 1st, dock workers were busy unloading 19 ships, while under normal circumstances, 10 to 12 ships were unloaded daily. He said that there are still 12 ships waiting at the port, and on average, these ships waited for about 48 hours after their scheduled arrival.

10月是该港口114年历史上最繁忙的一个月,交通量仍然很高。该港口的执行董事Gene Seroka说,12月1日,码头工人忙着卸载19艘船,而正常情况下每天卸载10到12艘船。他说,还有12艘船在港口等待,这些船平均在预定到达后等待了大约48小时。

Seroka said that we are going through a truly unprecedented period. You want to stuff 10 pounds of potatoes into a 5-pound bag. This order and replenishment scale is the largest we have ever seen, and it happens to be a holiday

Seroka说,我们正在经历一个真正前所未有的时期。“你想把10磅土豆塞进一个5磅重的袋子里。这种订货和补充的规模是我们见过有史以来最大的,而且现在恰逢假期。”

In the first two months of this year, China US trade increased by 81.3% year-on-year, reaching 109.8 billion US dollars, which is the fastest growing among all regions, including the European Union and ASEAN. During this period, China's exports to the United States increased by 87.3%, second only to New Zealand, and New Zealand's imports from China increased by 89.2%.

今年前两个月,中美贸易同比增长81.3%,达到1098亿美元,是包括欧盟和东盟在内的所有地区中增长最快的。在此期间,中国对美国的出口增长了87.3%,仅次于新西兰,新西兰从中国的进口增长了89.2%。

Tian Yun, Vice President of the Beijing Economic Operations Association and former economist at the National Economic Planning Agency, stated that the high growth rate reflects the rapid growth in demand after the US economic recovery and stimulus policies.

北京经济运行协会副会长、前国家经济规划机构经济学家田云表示,高增长率反映了美国经济复苏和刺激政策后需求的迅速增长。

海外网友布雷恩的回答

During the embargo period dominated by the United States, China has survived for more than 30 years. It has trade relations with only a few countries, and none of them is a Economic power. Today, China has political and economic connections with countries around the world. Some people estimate that China produces 40% of the total global consumption of goods. The latest final data on China's exports shows that exports to the United States only account for 19%. In addition, please remember that China also provides most of the components and raw materials to the countries that manufacture the final product.

在美国主导的禁运时期,中国存活了30多年,只与少数几个国家有贸易关系,而且没有一个是经济大国。今天的中国与全球各国都有政治和经济联系。一些人估计,中国生产的商品占全球消费总量的40%。中国出口的最新最终数据显示,对美出口只占19%。此外,请记住,中国还向制造最终产品的国家提供大部分零部件和原料。

More importantly, since most consumer goods come from China, and many of the components used for final product assembly also come from China, can the United States survive cutting off imports? Many economic sectors will collapse and need to be rebuilt from scratch. The main and most obvious will be wholesalers and retailers. Many well-known brands, such as Wal Mart and Target, as well as the whole wholesale and supply chain, will disappear or regenerate for those enterprises with sufficient financial resources.

更重要的是,由于大多数消费品来自中国,而且许多用于最终产品组装的零部件也来自中国,美国能否在切断进口后幸存下来?许多经济部门将崩溃,需要从头开始重建。主要的和最明显的将是批发商和零售商。许多知名品牌,如沃尔玛(Walmart)、塔吉特(Target)等,以及整个批发和供应链,对于那些财力足够雄厚的企业来说,将会消失或重生。

American consumers will see political inflation leading to soaring prices. Many people will directly fall into poverty. After all, when the main supply of a consumer economy is cut off and there are often no alternative sources for a long period of time, this is the expected result. Some companies, such as Intel, Qualcomm, and Boeing, generate 30% or more of their revenue from China. Think about how they will weather such a crisis safely.

美国消费者将看到政治引发的通货膨胀导致物价飞涨。许多人将直接陷入贫困。毕竟,当一个消费经济体的主要供应被切断,而且在很长一段时间内往往没有替代来源时,这就是预期的结果。一些公司,如英特尔、高通和波音,从中国获得了30%或更多的收入。想想看,他们将如何安然度过这样一场危机。

So, for everyone's happiness, please let go of these childish ideas. We all benefit from cooperation rather than confrontation.

所以,为了大家的幸福,请放下这些幼稚的想法。我们都受益于合作而不是对抗。

理查德•查克的回答

In the past, 70% of goods in international trade were manufactured goods, and now 70% are semi-finished products. Many people believe that this makes China, which is dominated by the manufacturing industry, more susceptible to the impact of raw materials and market cuts. But the fact is exactly the opposite.

过去国际贸易中70%的货物是制成品,现在70%是半成品。有很多人认为,这使得以制造业为主导的中国更容易受到原材料和市场削减的影响。可事实恰恰相反。

The first mistake was overestimating the reliability of the US dollar. People use dollars in the international market because they can purchase goods in dollars. If China, as an important participant in international trade, no longer uses the US dollar for settlement, then people will undoubtedly increase their demand for the euro and reduce their demand for the US dollar. The significant depreciation of the US dollar will ignite the debt problem of the US government and trigger a fiscal crisis. When everyone is rushing to sell dollar denominated assets, it will be the end of the US economy. The key to the problem lies in the US fiscal dependence on debt.

第一个错误是高估了美元的可靠性。人们在国际市场上使用美元,因为他们可以用美元购买商品。如果中国作为国际贸易的重要参与者,不再使用美元进行结算,那么人们无疑会增加对欧元的需求,减少对美元的需求。美元大幅贬值将点燃美国政府的债务问题,引发财政危机。当所有人都争相抛售美元计价资产时,这将是美国经济的末日。问题的关键在于美国财政对债务的依赖。

The second mistake is overestimating the affordability of American citizens. Due to the loss of the US market, Chinese people will lose some of their jobs. However, most Chinese people can return to labor-intensive industries that are about to disappear, and household savings will ensure a short-term quality of life. For heavily indebted American families, this will be a disaster. In this epidemic, even though the government paid people's living bills, there was still a huge riot in the United States.

第二个错误是高估了美国公民的负担能力。由于失去美国市场,中国人将失去一部分工作。然而,大多数中国人可以回归那些即将消失的劳动密集型产业,家庭储蓄将确保短时间内的生活质量。对于负债累累的美国家庭来说,这将是一场灾难。在这场疫情中,即使政府支付了人们的生活账单,美国仍然发生了巨大的骚乱。

The third mistake is underestimating China's potential. Comparing the economic growth rates of the two countries, it can be found that China still has a lot of room for growth, while the United States does not. The contribution rate of China's economic growth to world economic growth exceeds one-third, and may reach over half this year. As an investor, the Chinese market is far more attractive than the United States. Never test the loyalty of capital. The capital trapped in developed markets will lead to increasingly intensified conflicts between the United States and its allies.

第三个错误是低估了中国的潜力。对比两国的经济增长率可以发现,中国仍有很大的增长空间,而美国则没有。中国经济增长对世界经济增长的贡献率超过三分之一,今年可能达到一半以上。作为投资者,中国市场远比美国更具吸引力。永远不要试探资本的忠诚。而被困在发达市场的资本将导致美国与其盟友之间的冲突日益加剧。

The fourth mistake is underestimating the importance of China in the world economy. More semi-finished product trade will actually help China dominate the world economy. The key to the problem lies in scale. For upstream companies, China is the decisive buyer due to its market size. For downstream enterprises, China is also the decisive seller due to its production scale. That's why when China stopped its economic activities due to the epidemic, countries that were not affected by the epidemic also began to suspend work. Upstream enterprises shut down due to a lack of orders, while downstream enterprises shut down due to insufficient supply. The United States cannot bypass China to obtain enough goods.

第四个错误是低估了中国在世界经济中的重要性。更多的半成品贸易实际上会帮助中国主导世界经济。问题的关键在于规模。对于上游公司来说,由于其市场规模,中国是决定性的买家。对于下游企业来说,由于其生产规模,中国也是决定性的卖家。这就是为什么当中国因疫情停止经济活动时,未受疫情影响的国家也开始暂停工作。上游企业因缺乏订单而停产,下游企业因供应不足而停产。美国无法绕过中国获得足够的商品。

Therefore, the biggest mistake is to believe that US capital will allow the US to decouple from China.

因此,最大的错误是相信美国资本将允许美国与中国脱钩。

新加坡网友KokHin Thong的回答

This may harm the Chinese economy, but in the long run, the harm to the US economy will be multiple.

这可能会损害中国经济,但从长远来看,对美国经济的损害将是多重的。

Firstly, China is the world's largest market. China is the world's largest consumer of entertainment, automobiles, electronics, appliances, services, food, energy, technology, infrastructure, finance, and more! Removing China from the US economy means that China will retaliate and drive American companies out of China. You see, the growth of GDP in the United States is largely due to the growth of the stock market. When a large portion of revenue from Forbes 100 companies disappears overnight, it will mean an immediate recession!

首先,中国是世界上最大的市场。中国是全世界最大的娱乐、汽车、电子、电器、服务、食品、能源、技术、基础设施、金融等消费国!把中国从美国经济中剔除意味着中国将进行报复,把美国公司赶出中国。你看,美国GDP的增长很大程度上是由于股市的增长,当美国福布斯100强公司的一大块收入一夜之间消失时,这将意味着立即衰退!

Secondly, the United States will lose its international market share.

其次,美国将失去其国际市场份额。

The growth of American companies over the past 30 years is mainly attributed to the benefits brought by China's manufacturing industry. American companies have a huge business presence in China, while Chinese companies do not have the same footprint in the United States. They only produce products and then label them with American brands. This can represent a nearly 9-fold markup. Imagine if the United States withdrew from China and left their technology to the Chinese people. They can produce identical products. They can earn huge profits by establishing their own brand. They will surpass the United States internationally.

美国企业过去30年的增长,主要归功于中国制造业带来的好处。美国公司在中国有庞大的业务,而中国公司在美国没有同样的足迹。他们只是生产产品,然后在产品上贴上美国品牌的标签。这可代表近9倍的加价。想象一下,如果美国撤出中国,把他们的技术留给中国人。他们可以生产完全相同的产品。他们可以通过树立自己的品牌获得巨大的利润。他们将在国际上超越美国。

Thirdly, China has already achieved victory in terms of market share in emerging economies.

第三,中国在新兴经济体的市场份额方面已经取得了胜利。

If you have been to countries in Africa or Southeast Asia, you will find that Chinese brands dominate their consumer economy. American companies may have a much larger share in Wet market such as Europe and Japan. But this situation will not continue because once China has sufficient market share in these emerging markets, they will enter Europe and Japan. This has already happened in Latin America.

如果你去过非洲或东南亚国家,你就会发现中国品牌主导着他们的消费经济。美国公司在欧洲和日本等传统市场的份额可能会大得多。但这种情况不会持续下去,因为一旦中国在这些新兴市场拥有足够的市场份额,他们就会向欧洲和日本进军。这已经在拉丁美洲发生了。

So, the only solution is: learn to cooperate with Chinese people and find your own niche! Obviously, no country can do everything well. For example, Luxembourg's dental equipment is world-renowned. If you want to maintain competitiveness, then specialize and do your best.

所以,唯一的解决办法是:学会与中国人合作,找到自己的利基!显然,任何国家都不可能事事都好。例如,卢森堡的牙科设备世界闻名。如果你想保持竞争力,那就专攻并做到最好。