印度希望成为中国的顶级制造业替代品. 但首先它需要击败越南

佘诗曼·雅各布 2024 年 4 月 1 日

关键点

随着企业撤离中国,印度希望成为亚洲最大的制造商,但首先它需要取代越南。

分析人士指出,印度要想追平甚至超越越南的制造业实力,必须解决两个最大的问题——降低进口税和提高供应链效率。

尽管面临这些挑战,越南与中国的友好关系可能对印度来说是一个优势。

印度诺伊达 - 5 月 12 日:2020 年 5 月 12 日,印度诺伊达第 63 区的 Lava 手机制造工厂在放松封锁限制后恢复工作。 智能手机制造商 Lava 周六表示,在获得当局允许开始有限运营后,该公司诺伊达工厂已恢复生产。 该公司已开始运营,产能达20%。 目前,该公司拥有 3,500 名员工,其中有 600 名员工。

印度诺伊达 Lava 手机制造工厂的工人。印度斯坦时报| 印度斯坦时报| 盖蒂图片社

随着企业撤离中国,印度希望成为亚洲最大的制造商,但如果它想取代越南,首先需要降低税收并提高供应链效率。

随着与中国的竞争加剧,美国推行了“友好外包”议程。 拜登政府鼓励美国公司将电子和技术制造业务从中国转移到更友好的国家,特别是亚太地区的越南和印度。

“民主党和共和党都将中国视为挑战。 美国的每个董事会都在询问首席执行官他们的规避中国风险的战略是什么,”美印战略伙伴关系论坛主席兼首席执行官穆克什·阿吉(Mukesh Aghi)表示。

越南领先

印度和越南对于外国投资者和公司来说是有吸引力的制造替代品,部分原因是劳动力成本低廉。 然而,在两者之间,越南仍遥遥领先,2023 年出口总额为 969.9 亿美元,而印度为 756.5 亿美元。

“越南以其电子产品制造能力而闻名。 印度刚刚进入这场游戏,因此这为越南提供了竞争优势。”印度指数首席执行官兼沃格尔集团管理负责人萨米尔·卡帕迪亚 (Samir Kapadia) 表示。

虽然印度与美国的关系有所升温,特别是在印度总理纳伦德拉·莫迪 6 月对白宫进行国事访问之后,但越南自 2007 年以来一直与华盛顿达成贸易和投资协议。

战略家表示,下一个中国不是印度或越南,它仍然是中国

越南的另一个关键优势是与印度相比更简单,阿吉指出,印度有“29 个州,每个州都有可能不同的政策”。

软件公司 Coupa 供应链战略高级总监纳里·维斯瓦纳坦 (Nari Viswanathan) 表示:“越南在规模经济方面具有优势,制造业主要是体力劳动。”

维斯瓦纳坦指出,服装制造等需要密集体力劳动且利润率低的行业“不会对印度产生任何影响”。

美国科技巨头越来越多地将其部分供应链转移到这个南亚国家。 英国《金融时报》去年 12 月报道称,苹果公司告诉零部件供应商,它将从印度工厂为其即将推出的 iPhone 16 采购电池。自 2016 年首席执行官蒂姆·库克 (Tim Cook) 拜访印度总理纳伦德拉·莫迪 (Narendra Modi) 以来,该公司一直在考虑扩大在印度的业务。 谷歌还计划于第二季度开始在印度生产 Pixel 手机。

进口关税仍然居高不下

印度制造中心雄心壮志的障碍之一是该国对信息和通信技术征收 10% 的进口关税。 VinaCapital 首席投资官 Andy Ho 表示,这高于越南 5% 左右的平均进口关税。

印度的进口税旨在保护国内制造商,但降低这些关税将是政府吸引外国公司在该国制造商品的努力的一部分。

卡帕迪亚补充道:“2024 年,莫迪总理将逐步取消其中许多关税,但他将重点针对各个行业,而不是各个国家。”

例如,印度一月份将用于制造手机的某些金属和塑料部件的进口税从 15% 降低至 10%。 这有利于苹果和 Dixon Technologies 等公司,后者为小米、三星和摩托罗拉生产手机。

“鉴于越南在电子产品制造和向全球出口方面的强势地位,

在美国,随着印度试图夺取市场份额,我们将在早期看到最大的吸引力。 这包括各种塑料、金属部件和机械物品,”卡帕迪亚说。

印度蜂窝和电子协会主席 Pankaj Mahindroo 在 LinkedIn 上发帖称,去年 1 月至 9 月,印度对美国的电子产品出口额达到 66 亿美元,而 2022 年同期为 26 亿美元。

但 VinaCapital 的 Ho 警告称,降低进口关税“并不是长期吸引 FDI 投资的可持续优势的来源”。

“外国投资者往往更关心的是营商便利性问题,尤其是雇用和解雇工人的灵活性,而不是税收和关税。这是越南相对于印度的长期优势的主要来源 ,”何在一封电子邮件中告诉 CNBC。

效率是关键

尽管印度希望到2047年成为发达经济体,但其基础设施仍然缺乏,导致运输和公路运输时间漫长。

阿吉说:“新加坡的一艘船可以在八小时内卸货,然后用卡车运往未来的工厂,但印度的同一艘船将在海关仓库里滞留数天。”他警告说,这些延误降低了这个南亚国家对印度的吸引力。 外国公司。

“中国在基础设施方面可能领先印度10年,因此该国需要更加努力以确保基础设施继续建设,”他补充道。

印度临时预算估计,联邦政府将花费 2.55 万亿卢比(307 亿美元)来改善印度的铁路系统。

“印度在物流系统现代化以增强进口商和出口商的按需供应链模式方面进展顺利,这影响了各种新的道路和港口。 我认为这将是自动化之前的优先事项,”卡帕迪亚说。

越南与中国关系升温

然而,卡帕迪亚强调,越南与中国的友好关系为印度提供了关键优势。

“越南在很多方面都无法与中国如此接近。 我认为这将在未来 10 到 15 年里引起供应链管理者和美国企业的关注。”他警告说。

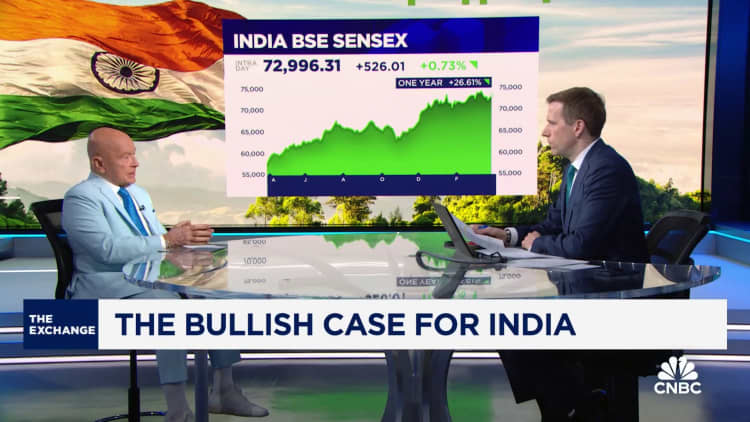

这就是资深投资者马克·莫比乌斯看好印度的原因

就在美国总统乔·拜登访问越南三个月后,中国国家主席习近平访问了越南,并与越南签署了基础设施、贸易和安全等领域的协议。

“(中国和越南)每次见面时都会不断地握手并互相赠送奖牌,”卡帕迪亚说。

他补充说:“我认为,较大的参与者将考虑到有关中国与越南关系的一些政治考量,并推迟决策,直到印度能够证明他们迄今为止确实可以在电子制造领域竞争。”

India wants to become the top manufacturing alternative to China. But first it needs to beat Vietnam

- India wants to be the top manufacturer in Asia as companies shift away from China, but first it needs to dethrone Vietnam.

- Analysts narrowed down the two biggest problems that must be solved for India to be on par or even overtake Vietnam’s manufacturing strength — lowering import taxes and improving supply chain efficiency.Â

- Despite these challenges, Vietnam’s warm relationship with China could be an advantage to India.

India wants to be the top manufacturer in Asia as companies shift away from China, but first it needs to lower taxes and improve supply chain efficiency if it wants to dethrone Vietnam.

The U.S. has pursued a “friendshoring” agenda as competition with China increases. The Biden administration has encouraged American companies to move electronics and technology manufacturing operations out of China and into friendlier countries, particularly Vietnam and India in Asia-Pacific.

“Both Democrats and Republicans see China as a challenge. And every boardroom in the U.S. is asking a CEO what their derisking strategy from China is,” said Mukesh Aghi, president and CEO of the U.S.-India Strategic Partnership Forum.Â

Vietnam's head start

India and Vietnam are attractive manufacturing alternatives for foreign investors and companies, due in part to low labor costs. Between the two, however, Vietnam is still way ahead with 2023 exports totaling $96.99 billion, compared with India’s $75.65 billion.

“Vietnam has been known for their ability to manufacture electronics. India is just getting into that game, so that provides Vietnam with a competitive advantage,” said Samir Kapadia, CEO of India Index and managing principal at Vogel Group.

While India’s relationship with the U.S. has warmed, especially after Prime Minister Narendra Modi’s state visit to the White House in June, Vietnam has had a trade and investment deal with Washington since 2007.

Another key advantage for Vietnam is a more simple proposition compared with India, which Aghi noted has “29 states and every state has a policy which may be different.”

“Vietnam has an upper hand when it comes to economies of scale manufacturing where its mostly manual labor,” Nari Viswanathan, senior director of supply chain strategy at software firm Coupa.Â

Sectors that require intensive manual labor and have low profit margins such as apparel manufacturing are “not going to move the needle” for India,” Viswanathan noted.

U.S. tech giants are increasingly bringing part of their supply chains to the South Asian country. The Financial Times reported in December that Apple told component suppliers it will source batteries from Indian factories for its upcoming iPhone 16. The company has weighed expanding operations in India since 2016, when CEO Tim Cook visited Indian Prime Minister Narendra Modi. Google is also set to begin Pixel phone production in India by the second quarter.

Import taxes remain high

One hurdle for India’s manufacturing hub ambitions is the country’s 10% import duty for information and communication technologies. This is higher than Vietnam’s average import duties of around 5%, according to Andy Ho, chief investment officer at VinaCapital.

India’s import taxes were intended to protect domestic manufacturers, but lowering those duties will be part of the government’s efforts to attract foreign firms to manufacture goods within the country.

“2024 will be a year of Prime Minister Modi winding down many of these tariffs, but he’s going to do it focused on an industry by industry basis, and not a country by country basis,” Kapadia added.Â

For example, India in January lowered import taxes for certain metal and plastic parts used in manufacturing mobile phones from 15% to 10%. That benefits companies like Apple and Dixon Technologies, which manufactures phones for Xiaomi, Samsung and Motorola.

“Given Vietnam’s stronghold over electronics manufacturing and exports to the United States, that’s where we will see the most traction early on as India attempts to take market share. This includes all kinds of plastics, metal componentry and mechanical items,” Kapadia said.

India’s electronics exports to the U.S. reached $6.6 billion between January and September last year compared with $2.6 billion for the same period in 2022, according to a LinkedIn post by Pankaj Mahindroo, chairman of the India Cellular and Electronics Association.

But VinaCapital’s Ho warned that lowering import duties is “not a source of sustainable advantage in attracting FDI investment over the long-term.”

“What foreign investors tend to be more concerned about is ease-of-doing business issues — especially the flexibility to hire and fire workers — than taxes and tariffs. This is Vietnam’s main source of long-term advantage over India,” Ho told CNBC in an email.

Efficiency is key

Although India wants to be a developed economy by 2047, its infrastructure is still lacking, leading to lengthy shipment and road delivery times.

“A ship in Singapore can be unloaded in eight hours and be on a truck to prospective factories, but the same ship in India will be stuck in a custom warehouse for days,” Aghi said, warning these delays lower the South Asian nation’s appeal to foreign companies.

“China is probably 10 years ahead of India on its infrastructure, so the country needs to work harder to make sure infrastructure continues to get built,” he added.

India’s interim budget estimated that the federal government is set to spend 2.55 trillion rupees ($30.7 billion) to improve India’s railway system.

“India is well on that path of modernizing systems in logistics to enhance on-demand supply chain models for importers and exporters and this factors in all kinds of new roads and ports. I think that will be a priority before automation,” Kapadia said.

Vietnam’s warming relations with China

Vietnam’s warm relationship with China, however, offers India a key advantage, Kapadia highlighted.

“Vietnam could not be closer to China in so many different ways. And I think that will concern supply chain managers and U.S. corporates for the next 10 to 15 years,” he warned.Â

China's President Xi Jinping visited Vietnam just three months after U.S. President Joe Biden did, signing agreements with Vietnam on areas like infrastructure, and trade and security.

″[China and Vietnam are] constantly shaking hands and handing each other medals every time they see each other,” Kapadia said.Â

“I think the bigger players are going to be factoring in some of the political calculus regarding China’s relationship with Vietnam, and holding back their decision making until India can prove that they can really compete in electronics manufacturing to date,” he added.