https://www.physicianonfire.com/fidelity-backdoor-roth/

Backdoor Roth IRA 2023: A Step by Step Guide with Fidelity

In 2023, I made my eleventh pair of “backdoor Roth” IRA contributions.

It’s a great way for high-income professionals to contribute to a Roth IRA when earning “too much” to contribute directly to a Roth IRA.

I like to get our backdoor Roth contributions and conversions done early in the year to start the tax-free earnings as soon as possible, but you have until Tax Day in mid-April, 2023 to complete a 2022 Backdoor Roth contribution (and until April, 2024 to make your 2023 contribution).

This post will give you a brief overview of the backdoor Roth, precise step-by-step instructions on how to do this yourself at Fidelity, and a link to a backdoor Roth FAQ that should answer any lingering questions you have. If you’re looking for instructions for Vanguard, check out our Vanguard Backdoor Roth tutorial.

Backdoor Roth IRA: An Overview

Money contributed to Roth accounts does not result in a tax deduction, unlike contributions to tax-deferred accounts. Both Roth and tax-deferred accounts benefit from tax-free growth, unlike a taxable account that is subject to tax drag (which can be minimized). The Roth dollars, unlike tax-deferred dollars, will not be taxed when withdrawn.

One of the first world problems of earning a solid income is the inability to contribute directly to a Roth IRA or a tax-deductible IRA.

A modified adjusted gross income (MAGI) of $228,000 for a couple filing jointly, or $153,000 for an individual makes you ineligible to contribute to a Roth IRA in 2023. Phaseout ranges where you can make a smaller Roth contribution (less than $6,500) start at $218,000 and $138,000 for couples who are married filing jointly and single filers, respectively.

Many physicians are thus excluded from making either deductible IRA contributions or direct Roth IRA contributions.

If there’s even a tiny chance your income might put you into or above those phaseout ranges, you’re better off using the backdoor, just in case. There’s nothing wrong with making your Roth contribution the hard way and finding out later that you didn’t need to take the extra steps. You won’t have to change a thing.

Now, understand that a high income doesn’t mean you can’t contribute directly to a Roth account of some kind. You may have a Roth option within your 401(k) or similar account, although I would argue you’re probably better off with the tax deduction offered by making tax-deferred 401(k) contributions if you’re in the 32% or higher tax bracket.

Another important distinction is that a high income does not currently prevent you from making Roth conversions. The income limits were lifted in 2010, and I took advantage by making a Mega Roth conversion when it was believed the income limits would be reinstated. However, there are still no income limits, and hence, the backdoor remains wide open.

The income limits for the ability to make a traditional tax-deferred IRA contribution are even lower than the Roth contribution limits. If you participate in a workplace retirement plan, you won’t be eligible to contribute as an individual earning more than $83,000 or as a couple earning more than $136,000 in 2023. The deduction actually begins to phase out at a MAGI of $73,000 for single filers and $116,000 for married couples filing jointly.

Before Attempting a Backdoor Roth

While income limits are a non-issue for the backdoor, there exists one important prerequisite to be able to properly execute the backdoor Roth.

You cannot have tax-deferred money in a traditional IRA, SEP IRA, or SIMPLE IRA in your name.

The list includes traditional IRA, SEP IRA, and SIMPLE IRA, but does not include 401(k), 403(b) or similar accounts. If you do hold tax-deferred IRA dollars on 12/31 of the calendar year in which you made the Roth conversion, you’ll be subject to taxes when making your conversion per the pro-rata rule.

If you do have these types of accounts, you’re not hosed, but you need to have a strategy to move that money elsewhere or you can forget about the backdoor Roth. Note that inherited IRAs are a non-issue.

If the balances in your IRA or IRAs are small and you can afford the taxes on the conversion, you can convert it all to Roth and just pay tax on the conversion. This could be a good idea for those in lower tax brackets — residents and students, for example.

Another option for employees may be to roll the IRA into an employer’s 401(k) plan. Not all plans accept rollovers, but mine does, and this was the route I chose with my SEP-IRA a few years ago. Fortunately, my 401(k) offers institutional Vanguard index funds. If I had lousy options, a rollover might not have been worthwhile.

It might also a good idea to avoid having a SEP IRA in the first place by putting your independent contractor earnings into a solo 401(k) instead. The White Coat Investor covers some of the advantages in this article.

One way employees without a business of their own create one is by obtaining an EIN for a survey-answering business. Earning just a little 1099 money on the side qualifies you as a business owner, and you can open an individual 401(k) a.k.a. solo 401(k) for the business.

As long as the plan accepts rollovers (many do), you’ll be able to roll over traditional IRA, SEP and SIMPLE IRA money into it to circumvent the pro-rata rule and associated taxation when attempting the backdoor Roth.

For healthcare professionals, I’ve found that the simplest side business is one in which you answer medical surveys for dollars. I’ve got a great overview of a handful of survey companies here.

Fidelity Step by Step

Open A Traditional IRA

The first step in the process is opening a traditional IRA with Fidelity if you don’t already have one. This works like opening any other Fidelity account. You’ll also want to open a Roth IRA, too. You need both for this transaction.

Once your IRA accounts are open, you’ll see them both listed among your accounts on the left navigation bar.

You’ll next need to make an initial contribution of $6,500 for 2023 (or the higher catch-up amount if you are old enough to be eligible) to your traditional IRA.

Use the Transfer link in the black bar at the top of the screen to start your traditional IRA contribution.

Then, transfer the funds. In the “Which account do you want to move money from?” section, choose the account that has the funds. For some folks contributing new money from an external bank account, a five-day waiting period may be required in order to ensure the funds transfer clears. If you have an existing Fidelity brokerage account from which you’ll transfer the money, there won’t be a wait time for the funds to clear — they just need to post overnight before you can perform the conversion steps outlined in the next section.

Be sure to select the traditional IRA in the “Where will the money be transferred to?” section, and then select the correct contribution year for this transaction. At the bottom, enter the amount of the contribution; the amounts Fidelity refers to are accurate for your overall IRA contribution eligibility across brokerage houses, but Fidelity does not know how much you have contributed (or not contributed) elsewhere, so if you have multiple IRAs in multiple places, make sure you’re contributing only the amount you are eligible to contribute.

Then click Continue to make the transfer.

Once your initial Roth conversion is complete, you will leave the traditional IRA account open, with a zero balance, forever. Don’t be alarmed at having the account just sitting there empty. Fidelity is perfectly happy with this, as you should be, too, as there is no fee or minimum you’ll be charged.

Each subsequent year after the initial opening year, you can re-use the account by adding a non-deductible contribution of whatever the maximum is per regulation for that tax year and then performing the Roth conversion process outlined in the next section.

Fund the Roth IRA

As mentioned, you’ll need to wait at least a day for the funds contributed to your traditional IRA to post. You’ll also have to wait for them to clear if you transferred them in from an external bank and did not use money already living at Fidelity. If you proceed with the next steps and receive errors about funds not being available, this is likely the reason.

When it’s time to convert, then at the top of your screen, click Transfer in the black bar.

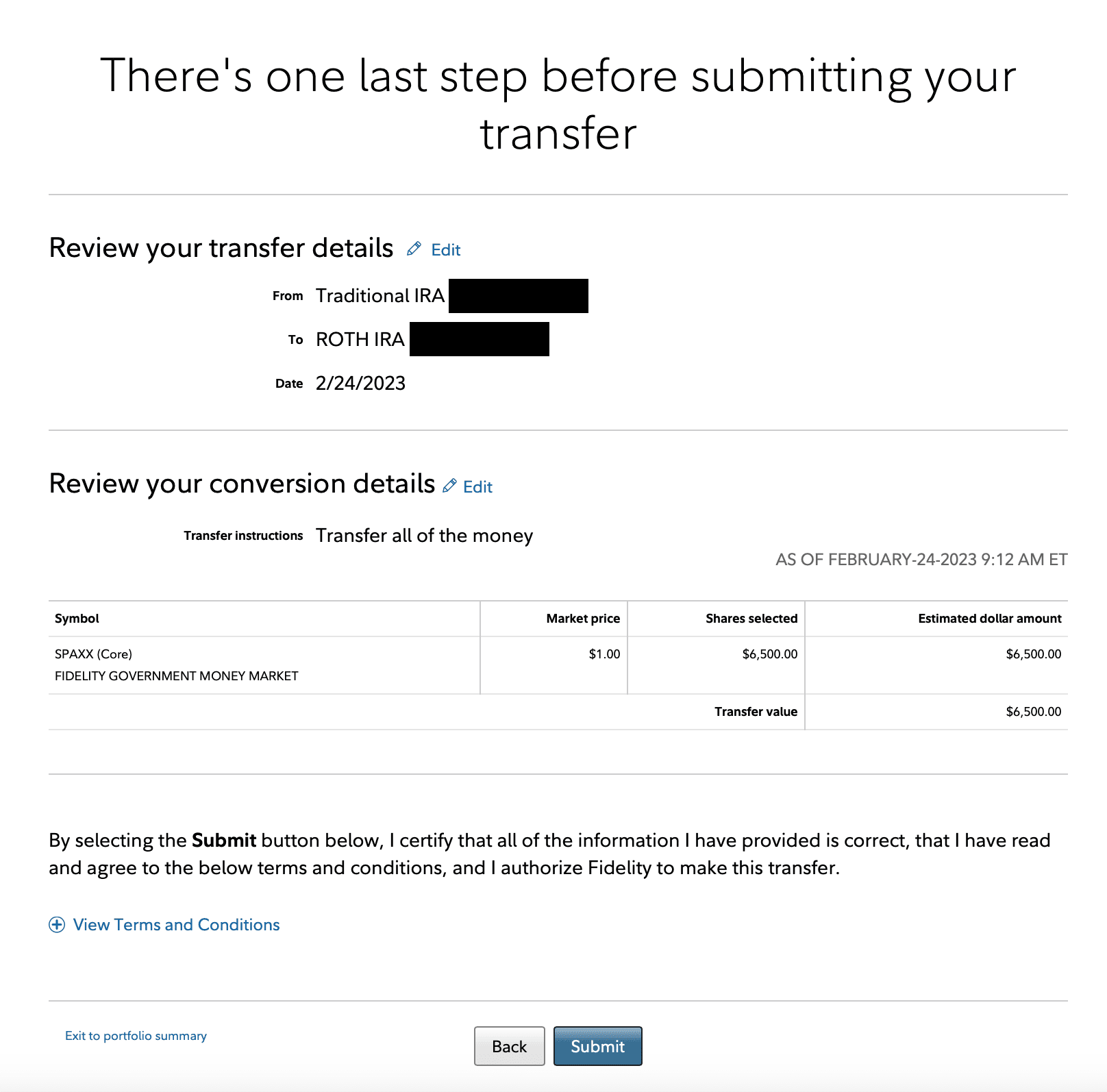

You’ll be brought to the transfer page. A Roth conversion at Fidelity is nothing more than a funds transfer with a couple of extra options. In “Which account do you want to move money from?” select your traditional IRA. In “Where will the money be transferred to,” select your Roth IRA account.

Check the box next to “I understand that I’ll likely have to pay taxes later.” A Roth conversion is indeed a taxable event, but as you are not deducting your contribution to your traditional IRA (since presumably you’ve already paid, or will pay, taxes on the money later when you file your return), there are no taxes due as a result of the conversion.

Click continue.

Here, tell Fidelity to transfer all of your account (which should have just $6,500, or your catch-up contribution amount, whichever is higher, in it) to your Roth. Choose the “Keep this account open” option so you don’t have to open a new traditional IRA next year. Then click Continue.

On the next screen, verify everything looks good, and then click Submit.

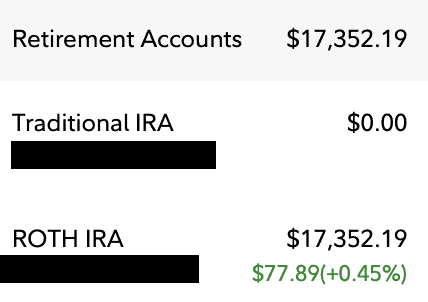

That’s it! When you exit to the portfolio summary, you’ll see your Roth IRA has the new converted amount and your traditional IRA is empty.

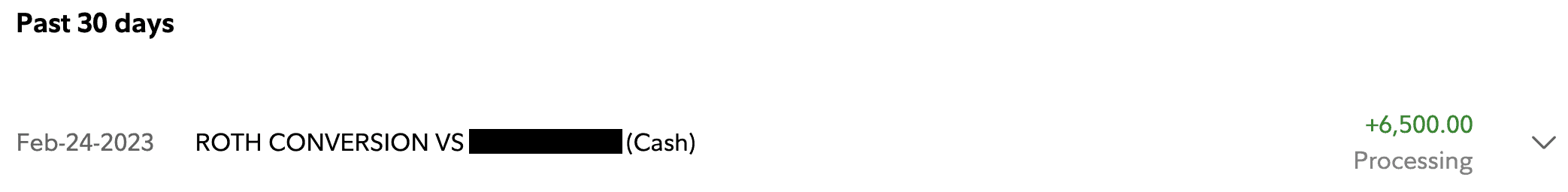

And if you click into Activity & Orders in your Roth IRA, you’ll see the conversion is correctly noted as a processing transaction.

And that’s how you do it at Fidelity.

Spousal Roth IRA

If you’re married, your spouse can also do the backdoor Roth, even if he or she has no earned income.

You must have at least $13,000 of earned income between the two of you (or $14,000 or $15,000 if one or both of you is at least 50 years old), but all of the income can come from one person.

Note that for pro rata rule issues, your IRA accounts don’t affect your spouse’s ability to do the backdoor Roth, and your spouse’s IRAs don’t affect yours.

Fill out Form 8606 in your 1040

At tax time, you will report these moves in IRS From 8606.

The IRS has instructions here and the form here. I see no need to repeat them. If you use tax software, instructions on filling them out with TurboTax and others can be found on the Backdoor Roth FAQ.

Additional Resources

If you have additional questions, your question is almost certainly among the 40+ questions answered in the all-encompassing Backdoor Roth FAQ. I strongly encourage you to check there first before asking a question below.

Looking for additional investment opportunities now that you’re maxing out your tax-advantaged space? Look to my Real Estate Investing Resources.

For more information, be sure to check out additional articles on the Backdoor Roth:

- Vanguard Backdoor Roth: a Step by Step Guide

- The Marginal Value of the Backdoor Roth. Is it Worth the Trouble?

- Calculating the Value of Your Backdoor Roth Contributions

- The Backdoor Roth Point / Counterpoint: A Must-Do or Meh?

- The Backdoor Roth FAQ