Direxion这几个ETFs上市之后,我观察了三天开始小量试水,so far感觉不错。如果你DT摸顶抄底胜算不低,这些ETFs可以比美trading indices option,而且经过两周市场的追捧,现在both volume/liquidity and price spreads都有了很大的improvement。昨天real time trading posts把FAZ卖在200,对我自己来说比赚钱更让人开心。。。

OK,言归正传。

Leverage has become a dirty word in the market. Over-leveraged hedge funds and banks have collapsed under the weight of their bad bets, and investors everywhere have learned to avoid any company that has the leverage taint. It\'s seems, then, that the timing couldn\'t be worse for an ETF company to release a new crop of leveraged ETFs, but Direxion pushed ahead with its Novemeber offerings eight of triple-leveraged long or short return ETFs.

What\'s surprising is the funds have turned out to be extremely popular so far. For example, the trading volume for BGU was 19063 on 11/5 and then quickly jumped up huge to 11.412m shares on 11/20, a whopping 600 fold volume hike in a matter of 11 trading days (I checked it out with a few old timers and none of them witnessed anything even close to it).

The new triple leveraged Direxion funds:

* (BGU) Bull 3x Shares Large Cap

* (TNA) Bull 3x Shares Small Cap

* (ERX) Bull 3x Shares Energy

* (FAS) Bull 3x Shares Financial

-----------------

* (BGZ) Bear 3x Shares Large Cap

* (TZA) Bear 3x Shares Small Cap

* (ERY) Bear 3x Shares Energy

* (FAZ) Bear 3x Shares Financial

These 3 beta ETFs are created for pros, sophisticated investors and active ST/DTers to hedge or leverage their trading power. Obviously, they are not made for the faint of heart due to the extreme price volatility.

****************************************************************************

Highly Volatile, New, Direxion Triple ETFs Could Revolution Day Trading

Bill Luby submits: I promised myself that once the new Direxion 3x and -3x ETFs started trading at least a million shares a day that I would take them out for a test drive. Well, I didn’t have to wait very long. Launched just last week, two of the eight new ETFs hit the million share mark last Thursday and a third missed only by a rounding error.

To recap for those who do not follow this space, Direxion is the first company to offer ETFs that have a targeted return which is leveraged to three times and minus three times that of the underlying indices. So far the biggest successes have been the large cap 3x bull (NYSEArca: BGU - News) and large cap -3x bear (NYSEArca: BGZ - News) ETFs, which are based on the Russell 1000 index. Also proving popular are the small cap 3x bull (NYSEArca: TNA - News) and small cap -3x bear (NYSEArca: TZA - News) ETFs, which follow the Russell 2000 index.

The sector ETFs are off to a slower start. These include the large cap 3x bull (NYSEArca: FAS - News) and large cap -3x bear (NYSEArca: FAZ - News) based on the Russell 1000 financial services index; and the large cap 3x bull (NYSEArca: ERX - News) and large cap bear (NYSEArca: ERY - News) based on the Russell 1000 energy index.

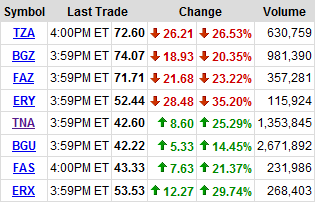

A look at the table below of Thursday’s results shows that these ETFs are like nuclear weapons when it comes to volatility. The average change in these eight ETFs Thursday was a 25% difference from the previous day’s close. ERY closed at 52.44 Thursday. Not only did it lose 28.48 points, but its intra-day range was 35.06 points. It is only a slight exaggeration to say that you can sneeze and miss your position losing ten points. Needless to say, these super-charged ETFs are not for everyone. If you like to go skydiving, keep a pet alligator in the bathtub, and dream of a winter king crab fishing in the Bering Strait, then you will be right at home with the Direxion ETFs.

As I traded these for the first time on Thursday, several interesting things happened. First, just entering a position was an adventure, almost like trying to jump in a Lamborghini while it sped by at 120 mph. I immediately went into position management mode, because the value of my ETF was changing so quickly that it required my full attention. Very quickly, I realized that one cannot trade these triple ETFs without finely honed trading rules and an iron will to act on them at all costs. In this world, there is no room for hoping. Any sort of “it will come back” thinking could quickly turn a 5% loss into a devastating 20% loss. Ironically, the high volatility of these ETFs forces the trader to rely on (or learn) tight trading discipline.

Retail investors might want to take these ETFs out for a test drive too, but be forewarned that there is a disaster scenario looming around every corner. For these very same reasons, I anticipate that hedge funds currently day trading options will find these ETFs to their liking, particularly as volume and liquidity improve. In a deleveraging world, this is one way to stock up on “off balance sheet leverage” and get the extra juice without having to commit to the extra margin.

Not that extra leverage is usually a good thing…

(November 16 By Bill Luby)

你再看看几天之后这量的变化:

****************************************************************************

哈哈。。。