I was recently invited by the Institute of Estate Agents (IEA) to be one of the panel judges for the Realtor of the Year award. Along with my fellow judges, I was given the sacred task of interviewing and identifying a suitable candidate who embodied the values of a model realtor. Apart from being top performers (in terms of commissioned earned), they also had to be professional in conduct and provide warm and personable service.

From the judging session, one thing I noted was how much these agents earned. As all of the shortlisted candidates were top achievers in their agencies, almost all of them earned commission amounting to more than several hundred thousands. Seeing this, one of my fellow judges even commented in jest that he should consider a career switch.

This got me thinking and I started to wonder – how much does a property agent really earn? We often hear or read about certain agents making million dollar commissions, but is that the exception or the norm? That peeped my curiosity.

Working out the average commission

Based on the caveats lodged with SLA in 2011, the number of private residential, commercial, industrial and resale HDB transactions were about (1) 32,903, (2) 1,411, (3) 2,241 and (4) 22,683 respectively. The total value transacted for residential, commercial, industrial and resale HDB amounted to about (1) S$50,448,013,709, (US$39,748,816,446) (2) S$4,087,529,191, ($US3,220,922,657) (3) S$4,528,320,789 (US$3,568,261,008) and (4) S$9,695,739,615 (US$7,642,197,042) respectively. Based on these figures, the total amount of property transactions for 2011 worked out to be about S$68.76 (US$54.22) billion.

If we work on the assumption that the commission for each HDB resale transaction is about 2 per cent and about 1 per cent for a private residential, commercial and industrial transaction, the total commission generated by the real estate industry would amount to about S$785 (US$619) million.

Based on this figure, what is the average commission each agent can expect to make? According to a Channel News Asia report, dated 30 Jan 2012, the number of agents in 2011 was 34,300. Assuming everyone gets an equal share, the average commission each agent would get is about S$22,873 (US$18,029) (or about S$1,906 (US$1,502) per month).

I admit that simply taking the average may not be very reflective of the actual situation and a more accurate form of approximation, such as the Pareto Distribution, should be applied.

Vilfredo Pareto was an Italian economist who lived in the early 1900s. Through his research, he discovered that 80 per cent of wealth was held by the top 20 per cent of the population. Over time, the 80-20 distribution was found to be highly accurate in approximating income distribution and it became an accepted economic principle, hence the “80-20” rule.

If we were to apply Pareto’s “80-20” rule to how the commissions are distributed, we find that the top 20 per cent of property agents would have made an average commission of about S$91,493 (US$72,122) annually (about S$7,624 (US$6, 011per month). In comparison, the majority would make an average of S$5,718 (US$4,508) annually (about S$477 (US$376 per month)

Based on MOM’s website, (http://www.mom.gov.sg/statistics-publications/national-labour-market-information/statistics/Pages/earnings-wages.aspx) the average employee made about S$4,334 (US$3,417) per month. Putting things into perspective, we can conclude that those who do well (i.e. within the top 20 per cent) do make a fairly comfortable living. On the other hand, those who are not doing as well would just be scraping by.

More importantly, this analysis also suggests that agents who make million-dollar commissions annually are likely to be exceptions. Even if they were able to do so for one year, it would be very difficult for them to sustain their performance, as there is simply not enough commission to go around. For the figures to add up, in order for all practicing realtors to make commissions of S$1 million (US$788, 475) or more every year, there can be no more than 785 agents, which is a small fraction of the total number of registered agents.

We often hear stories of top property agents making good income and walk away with the impression that there is easy money to be made in the real estate industry. This analysis shows that for every million-dollar property agent, there are many others who do not make it and eventually fall out of the game. Hence, it does not come as a surprise that the real estate industry has such a high turnover rate. Perhaps this is why about 3,700 (more than 10 per cent of the total agent population) decided not to renew their license and we are down to 30,600 agents in 2012.

Like any job, those who put in time and effort will do well and rise to the top. The ethics of hard work apply to the real estate market as well. For those who are thinking of making a career switch to become a property agent, you must be prepared to invest the effort to do well. Otherwise you may just add to the statistic of agents who eventually drop out of the realtor game.

Past Article featured on Yahoo! Property Blog

June 21st, 2012Are en-bloc deals still hot?

Many Singaporeans have long had a love affair with en-bloc property deals. Ever since the red hot en-bloc market in the mid-2000s, when we used to read about how some lucky property owners became millionaires overnight from en-bloc deals, some Singaporeans have been actively seeking out the next big en-bloc deal.

However, the Singapore property market has evolved significantly in the last few years. For those who are still on the lookout for the next big en-bloc deal, the question they should ask themselves is whether en-bloc deals are as profitable as they used to be?

Analyzing the En-bloc Transaction Volume

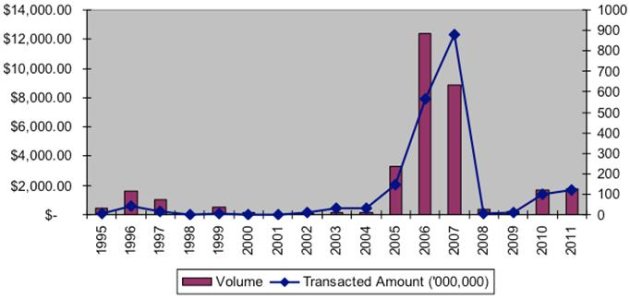

Some of you may recall that during 2006 and 2007, there were frequent media reports on en-bloc news transactions. On hindsight, the en-bloc market then was indeed very active. The high level of en-bloc activity could be seen from the high volume as well as amount transacted in 2006 and 2007 (see Figure 1).

Figure 1: Transacted Volume and Amount for En-bloc (1995- 2011)

Figure 1

Figure 1

Source: URA Realis and Ascendant Assets Pte Ltd

Due to the global financial crisis, the years that followed (i.e. 2008 and 2009) saw low en-bloc activity. The level of interest in en-bloc deals subsequently picked up again in 2010 and 2011. However, at a total transaction amount of around $2billion, the current market is a far cry from the peak of 2006 and 2007 (more than $8billion and $12billion respectively). More importantly, we can conclude thatthe en-bloc property market is not vibrant as it used to be and investors who are looking to find the next en-bloc deal would have to be more selective and not jump at any old development.

Location, Location Location! — Where is the hottest en-bloc location?

It is not surprising that en-bloc deals are not uniformly distributed across Singapore and some districts have more en-bloc transactions than others. However, what would be of interest to investors is where these hot en-bloc locations are.

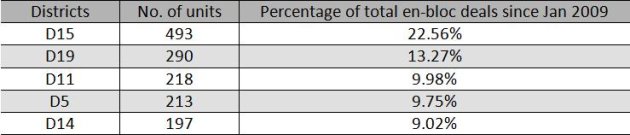

Looking at en-bloc transactions since 2009, my research team at Ascendant Assets found that the top 5 districts that had the highest number of en-bloc transactions are as follows.

Figure 2: Top 5 Districts that saw the highest number of en-bloc transactions (Jan 2009 to March 2012)

Figure 2

Figure 2

Source: URA Realis and Ascendant Assets Pte Ltd

Why are there more en-bloc deals in these 5 districts? To answer this question, we turn to the past Government Land Sales (GLS) transactions for the answer.

Land is a very important component in any property transaction. To acquire land for a project, property developers have two main sources to turn to. The first source is to buy public land from the government via GLS program. The second source is to purchase private land from existing owners via the en-bloc process. Hence, developers who wish to profit from housing demand in locations that have little (or no) public land for sale would have to turn to en-bloc deals.

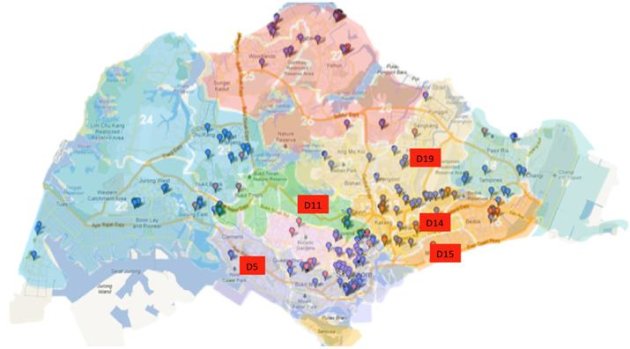

Figure 3: GLS around Singapore from 2000-2011

Figure 3

Figure 3

Source: URA and Ascendant Assets Pte Ltd

By visually analyzing the GLS map in Figure 3, it is observed that the top 5 en-bloc locations (highlighted in red) are districts that did not have much government land for sale. This seems to support our hypothesis that locations that have been en-bloc hotspots in 2009 to 2011 are up-and-coming areas that have limited public land for sale.

Age of the En-bloc Development

Apart from location, when it comes to en-bloc deals, we would intuitively think that an older development would generally stand a higher chance to be an en-bloc candidate. While that may be the case, have you wondered what is the average age of successful en-bloc deals?

From my company’s research, we found that the average age of successful en-bloc transactions is 22 years (from when the development was deemed to be completed to when it was sold collectively). Hence investors who wish to find suitable en-bloc candidates should potentially go for developments that are at least 20 years old.

Nonetheless, it does not mean that young developments do not stand a chance of being an en-bloc candidate. Based on caveats lodged with URA, the “youngest” development that was sold collectively was a 4-year old project called the Olivio (located in the Balestier). It was bought by the Sim Lian Group in 2006. However, older developments generally tend to be more viable en-bloc candidates.

Putting all these facts together, we can conclude that the en-bloc market is not as active as it once was. While going for en-bloc deals is not something that I would do right now, investors who are still keen to look at this market segment would have to be more selective in their purchase. Those of you who would like to have the full list of districts and their distribution of en-bloc transactions (as shown in Figure 2), do feel free to drop me an email at Research@AscendantAssets.com. I would be happy to share our findings. Who knows, using some of the information that we have provided here, perhaps you would be able to find the next en-bloc mega deal.

By Getty Goh, Director of Ascendant Assets, a real estate research and investment consultancy firm.Posted courtesy of www.Propwise.sg, a Singapore property blog dedicated to helping you understand the real estate market and make better decisions. Click here to get your free Property Beginner’s and Buyer’s Guide.

Past Article on Propwise (March 2011): Buy Right Property

June 15th, 2012

Introduction

I started writing this book almost immediately after my first book, Buy Bye Property: Mistakes You Want to Avoid in Property Investing was published. I received much positive feedback for the first book and I am happy to know that many people, especially those looking for their first property, have found the book very useful. The first book was intentionally written to be an easy read as I wanted to reach out to as many people as possible and not just to aspiring property investors. Some readers felt that topics like market timing, finding good locations and determining the property’s fair price could be addressed. This is what the second book is about. In the course of this book, I will focus on the nuts and bolts of property investing in Singapore, and address issues ranging from identifying the characteristics of the Singapore property market to finding value-for-money properties.

This book contains my observations of the property market over the past 7 years. Although the actual writing took only a few months, most of my time was spent on researching and understanding the Singapore property market. During the last few years, I was fortunate enough to witness the property recovery from 2005 to 2006, the property boom from 2007 to mid-2008, the property market crash from end-2008 to early-2009, and most recently the recovery of prices from 2009 to 2010. This gave me the opportunity to observe how property prices reacted during the different phases and how property investors behaved. As a result, I was able to validate my findings by investing in the market myself. In doing so, I was able to experience firsthand the mixed emotions of fear and greed that confronted property investors.

Why did I write this book?

Property, unlike other forms of investments, is something that most of us will come intocontact with. Based on Singapore’s Department of Statistics, home ownership rate for 2008 was more than 90%, which means that 9 out of every 10 Singaporean or Singapore Permanent Resident (PR) households own the property that they stay in. Hence, it is beneficial to learn how to spot good property deals as most of us will buy a property at least once in our lifetimes.

However, there are many sources of property information available, such as the newspapers, magazines and the internet. With more than 1,000 registered property agencies and an even larger number of property agents touting their views on whether it is a good time to buy, hold or sell, it is understandable why everyone seems to have an opinion of how the property market is performing. Over time, some of these views become “conventional wisdom” that some individuals may rely on to make their buying or selling decisions. Alas, more often than not, such “conventional wisdom” does not accurately reflect how the property market behaves.

Allow me to give you an illustration. If I told you that a yearly property cycle exists and made you guess the months that have the highest and lowest property transactions, what will your answer be? Many people believe that January has the highest level of property transactions as most employees receive their year-end bonuses in December. With the bonus, they will likely have sufficient cash to pay for the property down-payment. Many people also believe that August, being the Lunar Seventh Month, has the lowest level of property transaction activity as it is generally perceived to be an inauspicious month to buy properties. Do you share such similar views?

From my research, I found that this was not the case. Figure 1-1 shows the distribution of monthly transaction volume for the sale of owner-occupied non-landed properties.

To derive the figures, transaction volume for the respective months over the last 14 years was added together. For example, the number of transactions done in all the Januarys for the last 14 years amounted to 5,090. From the distribution, we can see that “conventional wisdom” does not accurately reflect the realities of the Singapore property market, and January is typically a low activity month while August is one of the highest transaction months.

How did this analysis help me in my own property investment journey? Back in January 2007, I owned a one-bedroom unit near the central area and I wanted to sell it to profit from the recovering property market. In early 2007, the Singapore property market was showing signs of recovery and there were constant media reports on how prices around Marina Bay and parts of Orchard were setting new records, with some properties transacted for as high as $3,000 per square foot (psf). Since my property was in town and within walking distance to amenities like restaurants and pubs, I thought that I would have no problems selling it for $1,250psf. I even foolishly thought that potential buyers would see it as a good deal and start a bidding war over my unit. However several weeks passed and my agent told me that she was unable to find a buyer to match my asking price. The highest offer then was only $1,100psf. This puzzled me.

How did this analysis help me in my own property investment journey? Back in January 2007, I owned a one-bedroom unit near the central area and I wanted to sell it to profit from the recovering property market. In early 2007, the Singapore property market was showing signs of recovery and there were constant media reports on how prices around Marina Bay and parts of Orchard were setting new records, with some properties transacted for as high as $3,000 per square foot (psf). Since my property was in town and within walking distance to amenities like restaurants and pubs, I thought that I would have no problems selling it for $1,250psf. I even foolishly thought that potential buyers would see it as a good deal and start a bidding war over my unit. However several weeks passed and my agent told me that she was unable to find a buyer to match my asking price. The highest offer then was only $1,100psf. This puzzled me.

Wasn’t the Singapore property market booming? Wasn’t the media constantly carrying articles on how well the property market was doing? Weren’t the property agents who were trying to sell my unit exhorting a property boom? If there was indeed a property boom, then why was I not able to sell my unit for the price I wanted? What could have been the reason behind the lack of buyers’ interest? Was the property market about to turn as a result of the bursting United States housing bubble (the issues of Collateralised Debt Obligations and US Financial Crisis had not surfaced in early 2007) or was I asking too much for my property? Could there be other reasons that I was not aware of?

At some point, I was worried that I would not be able to sell my property and I seriously considered lowering my asking price. Fortunately, I decided to do a bit more research and having some stock investing experience, I was aware that a monthly trend existed for the stock market. For example, the trading volume for the United States stock market tends to be lower during the summer months of June and July as traders will be away on vacation, while trading towards the end of the year is generally more active due to window dressing by financial institutions. Window dressing is a strategy used by fund managers near the end of the year or quarter to improve the appearance of the fund performance by selling stocks with large losses and purchasing good performing stocks before reporting them as part of the fund’s holdings. This made me wonder if there could be a trend for Singapore property as well. This was how I came up with the monthly distribution analysis for the Singapore property market. From the monthly volume analysis, I concluded that buying sentiments, represented by transaction volume, was generally low in the first few months of the year.

The findings assured me that the lack of buyers who were willing to meet my asking price was not necessarily due to changing market sentiments or to mis-pricing of my property. From my research, I also noticed that high transaction months generally lasted from April to August while low transaction months generally lasted from September to March the following year, thus a good point to lower my asking price would be from September onwards. If I could not sell my property during the high activity months, how likely was I able to sell it without lowering my asking price during the low activity months? In the end, I decided to hold on. As a result of that decision, I eventually sold my unit in May 2007 (one of the high volume months) at my asking price. This whole experience made me realise the importance of doing my own research before making any investment decision. Had I not done my due diligence, I would likely have succumbed to fear and greed, and sold my unit for much less. Now that you know such a trend exists, how does it affect your investment decision?

The findings assured me that the lack of buyers who were willing to meet my asking price was not necessarily due to changing market sentiments or to mis-pricing of my property. From my research, I also noticed that high transaction months generally lasted from April to August while low transaction months generally lasted from September to March the following year, thus a good point to lower my asking price would be from September onwards. If I could not sell my property during the high activity months, how likely was I able to sell it without lowering my asking price during the low activity months? In the end, I decided to hold on. As a result of that decision, I eventually sold my unit in May 2007 (one of the high volume months) at my asking price. This whole experience made me realise the importance of doing my own research before making any investment decision. Had I not done my due diligence, I would likely have succumbed to fear and greed, and sold my unit for much less. Now that you know such a trend exists, how does it affect your investment decision?

Using facts and figures, I intend to dispel some of the “conventional wisdom” surrounding the Singapore property market. I also hope to share a process to help buyers consistently find value-for-money properties. After all, buying a property is a hefty financial commitment, thus it is important for us to know what we are doing. If you recall, 1996 was one of the hottest years for the Singapore property market. It was just before the Asian Financial Crisis and the collapse of the Singapore property market. Of the properties that were purchased in 1996, more than 80% were sold for a loss, with the largest drop in value amounting to more than $1466psf. In other words, if the unit was 1,000 square feet in size, the total loss would have amounted to more than $1 million. This goes to show that the simple buy-and-hold strategy does not always work and properties are definitely not “sure-win” investments.

Who is this book for?

Through this book, I hope to help aspiring property investors and potential homeowners to better understand the Singapore property market. As the Singapore property market becomes more mature, it may not be enough to simply buy and hold and we will have to be more selective in order to maximise profits. Although I talk about finding good properties to buy, I would like to emphasise that this is not a get-rich-quick book. I personally believe that get-rich-quick schemes do not work as it takes time to master any discipline. What would you think if I told you that you could master swimming by simply reading a book (and without actually getting into the pool to swim)? By extension, it is not possible to master a complex subject like property investing by simply reading a book and not giving it an actual shot. Hence, I do not expect you to become an instant expert after reading this.

Instead, the purpose of this book is to help those unfamiliar with the topic to overcome this steep learning curve. I also intend to approach the topic of property investing in a more systematic manner. To do that, I will be sharing a proprietary selection process called the RIGHT approach. RIGHT is the acronym for Realities, Investment considerations, Goals, Hotspot and Target price, which are the 5 key considerations for any potential property buyer to think about before making a purchase. We will focus on the buying process and put less emphasis on the selling process as I believe that once you get the fundamentals right and buy value-for-money properties, it will not be very difficult to sell it for a good profit.

Conclusion

Understanding the Singapore property market is a continuous learning process as the property market is constantly evolving. Along the way, I have learnt that finding good property deals is dependent on both external and internal factors. External factors refer to things that are beyond our control such as market timing, location and price, while internal factors refer to things that stem from within us, such as risk appetite, investment horizon, investment objectives, emotions (e.g. fear of losing out, greed for more profit), etc.

I have come across buyers who focus excessively on one aspect at the expense of others. For example, some buyers are so adamant in making a quick profit that they end up taking unnecessary risks. While in theory, anyone with a sufficiently long investment horizon will almost certainly expect to make money from the real estate market, some let emotions cloud their judgment and they end up paying more than what the property is worth. They justify their action of paying excessively by mistakenly believing that if they wait long enough, prices will eventually go up. While that may be the case, have they accounted for the opportunity cost of the ownership? In other words, had they bought another property instead, they could have reaped the same returns in a much shorter time. To avoid such errors, you should take your time to weigh your options before proceeding. As the saying goes, “More haste, less speed”, which brings me to my second takeaway.

I believe that there are plenty of investment opportunities available. Buyers are sometimes pressured into jumping on to the bandwagon from fear that they would lose out. During hot property launches, some buyers even go to the extent of passing blank checks to property agents in order to book any unit. In reality, I believe that there are plenty of opportunities available, you just need to look a little harder. Let me share a personal investment story with you to illustrate the case.

In March 2010, the Singapore property market was on the road to recovery. If you recall, the media then was filled with news on how hot the property market was and the asking prices of some properties had even exceeded the peak price set in 2008. I had just sold my unit at Robertson Quay for a profit of $400,000 and was looking to reinvest my money. However, I was a little concerned whether I would be able to find a good deal as prices were increasing rapidly. I took my time to explore different possibilities and check out various sectors of the property market. Eventually I managed to secure a conservation shop house which had an indicative bank valuation of $1 million for about half the price. Had I decided to flip this deal, I would have made a handsome profit within a short period of time.

Some people commented that I was lucky to come across this deal and it was not likely to be repeated. Although I agree that such deals are not easy to find, it was the belief that these opportunities existed that motivated me to search relentlessly. More importantly, had I not taken proactive steps to seek these opportunities out, I would definitely not have come across such a deal. My purpose of illustrating this is simply to reinforce my point that plenty of opportunities abound even in a hot market. With more than 150,000 private apartments and condominiums units in Singapore (and more being constructed), there is ample choice for property buyers.

If we were to look at past property booms, there were always some “hot” properties of the time. In the 1980s, developments around the Bayshore location were very popular. In the 1990s, properties located at Tanjong Rhu and landed properties were highly sought after. In the 2000s, Marina Bay was considered the “it” place for property investors. Hence you can be assured that you are not missing the boat if you currently do not own a swanky apartment in the Marina Bay area as property market cycles come and go. I am certain another hotspot will emerge in the coming years; the only question is where and when. However this time round, after reading this book, you will be ready for it!

Happy reading.

Buy Right Property is available now in major bookstores such as MPH, Kinokuniya and Popular.

Past Article on Propwise (June 2011): Where Will the Singapore Property Market Go in the Next Few Months?

June 15th, 2012 Posted in General | No Comments » Roman Abramovich, a Russian billionaire and the 53rd richest person according to 2011 Forbes list, said: “investors have very short memories”. In today’s bullish climate it is hard to imagine that just about two years ago, there were genuine fears of a global financial meltdown. These days we are no longer concerned about our assets becoming worthless; instead we are more concerned about property prices escalating beyond what we can afford.

Roman Abramovich, a Russian billionaire and the 53rd richest person according to 2011 Forbes list, said: “investors have very short memories”. In today’s bullish climate it is hard to imagine that just about two years ago, there were genuine fears of a global financial meltdown. These days we are no longer concerned about our assets becoming worthless; instead we are more concerned about property prices escalating beyond what we can afford.

In view of this, some people may inevitably believe that this current “bull” run will last forever and make risky investments in fear of losing out. They attempt to rationalise that it is different this time round and that the spectacular market performance is due to the emergence of Asia as a new financial powerhouse.

John Templeton, a very prominent stock investor once commented,” the four most dangerous words in investing are ‘This time it’s different’.” According to the historical URA Private Property Price Index (PPPI), we can tell that the property market is cyclical and no trend lasts forever. In a blog post I wrote in July 2009, I mentioned then that the property market will not remain depressed indefinitely. In a similar vein, I am confident that the current price appreciation will not go unabated and it will correct in the near future.

The question is how can we tell when the Singapore property market is going to dip?

In my second book entitled Buy RIGHT Property – Taking the R.I.G.H.T. Approach to Property Investing in Singapore, I shared that my company has developed a proprietary index called the Ascendant Assets Index (AAI).

The basic premises of the AAI are (1) there is a lead-lag relationship between the stock and property market and (2) we are able to tell how the property market is performing by analysing the correlation between the stock and property market. For example, in bullish (or bearish) market conditions, we would expect the correlation between the stock and property market to be high as prices are increasing (or decreasing) in tandem. On the other hand, we would expect the correlation between the stock and property markets to be low during turning points as stock prices, being more liquid, would diverge from the less responsive property prices.

So how is the market like now? The graphic above shows the AAI for the recent quarter 2011Q1. From the figure, we can tell that the Singapore property market (shown in green colour) is presently in the strong growth stage with both STI and URA PPPI increasing in tandem. However, it is noteworthy that the AAI has dropped from over 90% to under 80%. Over the next few quarters, we expect the AAI to drop further. When the AAI falls below the 50% mark (represented by the dotted line), it signals a turning point as the stock market will be almost completely out of sync with the property market. It signals an overall change in underlying market sentiments and the property market would be expected to decline shortly after.

Conclusion

It is important to note that the AAI is only one tool to gauge how the property market is performing. There are other aspects to consider before making a buy or sell decision. Nonetheless, I have been asked by several prospective clients if it is a good time to buy properties. My personal view is that unless it is an essential purchase (e.g. buying a home to stay), I would stay out of the market right now. In fact, I had recently sold two properties to accumulate cash to prepare for the next market downturn.

As a parting shot, let me leave you with a quote by Warren Buffett that I often make reference to, “We simply attempt to be fearful when others are greedy and to be greedy when others are fearful”. With the URA PPPI reaching a new peak in the last quarter, I can’t help but to feel a slight sense of fear…

Past Article on Propwise (June 2011): Can new HDB flats be cheaper?

June 15th, 2012

Before I write further, I would like to highlight that, unlike the private property market, HDB does not release historical prices of new flats; the HDB website only releases information on the resale flat market. As such, there is no historical data to draw any direct conclusion from and much of my views are substantiated by circumstantial and anecdotal evidence extracted from press releases, annual reports, etc.

I would also like to emphasize that this article is not intended to criticise the housing policies we currently have in place. Singapore has one of the best public housing systems in the world and the HDB has helped many Singaporeans own their own home. The intent of this article is really to discuss the possibility of having lower HDB prices and the impact (if any) it will have on the property market. To start this article, let us first tackle the question…

Can increasing flat supply lower new flat prices?

In the recent months, the new Minister of National Development, Mr Khaw Boon Wan, has announced a series of new HDB launches to boost available supply of new flats in the market. Based on established economic principles, we would intuitively expect flat prices to drop when supply goes up. Conversely, we would expect the reverse to happen and prices to increase when supply is limited. However, if we were to look at how the Singapore private property market has done, we can tell that increasing supply does not necessarily lead to a decrease in price.

Since 2008, numerous analysts have raised the possibility of a housing crash due to an impending oversupply of private properties over the next few years. Based on URA figures on the available housing stock, the number increased from 236,903 in 2008Q1 to 260,108 in 2011Q1. This translates to an increase of 9.8% within 3 years. On the other hand, property prices saw a rapid recovery after the Global Financial Crisis and the URA PPPI has been on the rise since 2009Q2. Evidently, the property market did not adversely view the increase in supply and there was no damper on housing prices (see Figure 1). As a result of strong demand and high property prices, the URA PPPI even broke the previous peak of 181.4 set in 1996Q2.

Figure 1: URA PPPI and Private Property Supply Volume (2008Q1 to 2011Q1)

Source: URA Realis

This comparison suggests that property prices are influenced by myriad factors and supply is just one aspect to consider. Ultimately, increasing property supply will not automatically translate to lower property prices as prices can still remain high (or even increase) if developers do not feel the need to lower their launch prices and/or banks are prepared to accept high property valuation. By extension, launch prices of new flats are determined by HDB. As a result, increasing flat supply will almost have no impact if launch prices of new flats remain unchanged. This brings us to the next question…

How are HDB flats priced?

At present, HDB does not reveal how it works out the launch prices of new flats. However, if we were to look at some anecdotal examples from previous launches, one would inevitably wonder if there is scope for new HDB flats to be priced even lower.

When Pinnacle@Duxton was first launched in 2004, prices of 4-room flats started at $289,200 while 5-room flats were priced at up to $439,400. However, when the development was re-launched in 2008, the prices of 5-room flats were between $545,000 and $645,800. With a 24% to 47% price increase, one cannot help but to question HDB’s pricing strategy and whether the significant price increase was a true reflection of the increase in material and labour cost or whether it was a veiled attempt by HDB to build a financial surplus in a booming property market.

Based on figures extracted from the HDB annual reports, it is interesting to note that 2006/2007, 2007/2008 and 2009/2010 saw positive surpluses being generated (see Figure 2).

Figure 2: Annual Surpluses and Deficits extracted from HDB Annual Reports from 2005/2006 to 2009/2010

From these figures, does this mean that HDB is actually making profits from the sale of each new flat? And if HDB is making profits, wouldn’t it mean that new flats could be made affordable if the profit margin was lessened?

While surplus generated by HDB is not a bad thing as it could eventually be used to defray costs during the market downturns, I have always thought that HDB, being a statutory board whose main role was to provide affordable public housing,

was a cost centre instead of a profit generator. After all, the purpose of providing the housing grants of between $30,000 and $40,000 is intended to making housing more affordable for Singaporeans. Thus, could the fact that HDB has net surpluses imply that more could be done to make new flats more affordable?

That said, I do not think prices of new flats should be lowered for everyone who is eligible to buy a flat directly from HDB. Instead, any surpluses generated by HDB could be used to help first time home owners by giving them larger subsidies. While Singapore’s economy has evolved, the need for housing, especially for first time home buyers, remains unchanged. For many young Singaporeans, getting married, financing a home and building a family can be very financially taxing. Hence, giving first time flat buyers more subsidies would significantly help them out.

Conclusion

From this article, many questions, such as whether HDB should be profitable and whether more can be done to make new flats cheaper, have been raised. I am not the best person to answer them as I am not privy to some of the considerations that HDB has. Nonetheless, I would not be surprised if HDB already knows the various problems and is working on a solution. Given our government’s track record and effectiveness, I am confident that the HDB will not have any problem lowering the launch prices of new flats. What remains now is whether they will see it through.

Past Article on Propwise (July 2011): Buyers versus Sellers – Who will blink first?

June 15th, 2012

Some reasons behind my views are: (1) Private properties are very expensive right now and good deals are not as easy to find as compared to several quarters ago. (2) Government intervention measures put in place have increased the opportunity and investment cost of owning private properties and they are not as worthwhile as before. (3) Property prices will eventually turn and those who bought at peak prices would be caught with a loss-sustaining asset when property market sentiments cool.

Interestingly, Singapore private property prices have been continuously on the rise and market observers have come up with many explanations on why this is happening. Some reasons range from the increase in foreign buyers to the low interest rate environment. I think most of them are valid assessments.

However, if I were to attribute it to a single factor, I assess that high prices are a result of an abundance of liquidity in the Singapore market. My company uses savings and other deposits as a proxy for liquidity within the real estate market as they represent monies that can be used for property deposits. They are also used as an indication of interest rates as there is an inverse relationship between liquidity and interest rates – the more liquidity the economy has, the lower the interest rates will be

Figure 1: Extract of Finance Report from Monetary Authority of Singapore

Source: www.singstat.gov.sg

In an interview I did with Mr. Propwise for his book Secrets of Singapore Property Gurus, I raised the point that liquidity is going to be a key driver in determining how theSingapore property market will behave in the coming months. To illustrate my point, the extract from the Monetary Authority of Singapore (MAS) in Figure 1 shows that the savings and other deposits (including current account deposits) as at 2008 was more than S$100 billion. This was twice the amount that Singapore had in 1998, after the Asian Financial Crisis. In 2009, this amount increased by about 20% to S$120 billion.

So who will blink first?

As for the question, ”Who will blink first?”, I opined that as long as buyers have money for the high downpayments and access to financing for their properties, properties will continue to be bought and sold at a price premium. From a cash-rich investor’s perspective, it still makes sense to buy a property for rental right now. As even though the yield could be as low as 2%, interest rates that banks are currently giving for cash deposits are comparatively much lower.

Meanwhile, sellers will have to price their units higher to account for the additional charges brought about by the anti-speculation measures that were supposed to keep the escalation of property prices in check. In another words, as long as there is abundance of liquidity and buyers are prepared to pay, there is no incentive for developers and property owners to lower their high asking prices.

I recently had a discussion with a friend who worked as an editor with The Economist and he wondered if high property prices will be the new norm. Seeing how some new HDB flats were almost launched at S$880,000, the environment of high property prices looks set to stay.

However, I have to constantly remind myself that the property market is cyclical. Hence the real issue is not whether property prices will eventually fall, but when it will actually happen. And when it does happen, it will likely be brought about by changing financing conditions rather than increasing transaction fees or controlling ownership.

Past Article on Propwise (July 2011): When is the Best Time to Buy a New BTO Flat?

June 15th, 2012 Posted in General | No Comments »In one of my previous blogs, I wrote about why I thought HDB flats could be made cheaper for first time buyers. Serendipitously, the DBSS debacle occurred shortly after my blog was published and the public outcry over the S$880,000 price tag for a new DBSS flat seemed to reinforce the point that many Singaporeans are presently frustrated at how expensive public housing has become. In view of that, I thought it would be timely for me to write a blog to explore the pricing mechanism for new BTO flats and talk about when would be a good time to buy new flats.

Once again, I must qualify and state that this is not intended to disparage the Ministries that are tackling this issue. It is always easier for people to poke holes at existing policies than to come up with a workable plan. So this article is not intended to poke holes at the policies we currently have in place, but simply to provide a different perspective. In addition, I would like to highlight that there is not much historical data available from HDB on new BTO flats, thus much of my conclusions are drawn from circumstantial and anecdotal evidence extracted from press releases, annual reports, etc. With that said, here goes…

Pegging new BTO prices to resale HDB prices

HDB does not officially reveal how new HDB flats are priced. However, from time to time, we are able to get a sense of how the pricing mechanism works from interviews and press releases from the relevant stakeholders. In a recent Straits Times article dated 18 Jul 11, Minister of National Development, Mr Khaw Boon Wan shared that “the prices of HDB’s new flats are typically pegged to prevailing resale prices but are discounted.”

As opposed to fixing new flat prices or even tagging them to things like median income, pegging new flats to resale flat prices seems like a logical thing to do as it offers a like-to-like comparison. While there is no doubt that the government has complete control over how new flats are being priced, one would expect the authorities to also have some influence over the HDB resale market for the pricing mechanism cited by the Minister to work.

Allow me to illustrate. Assuming the government wants to lower new flat prices without tweaking the housing grants and land cost, it can do so by launching more BTO flats. By flooding the market with excess supply, we should, in theory, expect resale flat prices to drop as well (due to the overall increase in public housing supply). Since new flats are pegged to prevailing resale prices (at a discount), HDB would then be able to lower new flat prices correspondingly. Conversely, if the government wants to increase new BTO prices, it could do the direct opposite and limit the supply of new BTO flats. While this may seem to be a fairly round-about approach, it is plausible as it allows HDB to indirectly set new BTO prices by influencing the overall resale market price without varying the other essential factors (e.g. HDB housing grant and land cost).

In the ideal world, the situation painted in the preceding paragraph would proceed like clockwork and new BTO prices can be controlled by simply adjusting supply of new units being released into the market. Alas, the resale HDB market does not behave like that in reality. Based on a comparison between the URA and HDB resale index, it was found that the HDB resale market and the private property market behaved very similarly. This is clearly seen from the high correlation of 88.4% as well as the 2 markets moving almost in tandem with each other (see Figure 1). In other words, even though HDB can launch record number of BTO units, it would likely have little impact on resale prices as there are larger economic forces at work. In view of that, it does not come as a surprise that the COV continues to remain high despite HDB launching many new BTO projects in the recent months.

Figure 1: Comparing URA and HDB price trends (1990Q1 to 2011Q1)

Source: URA and HDB website

The risks of pegging new flats to resale market prices

Conceptually, the private property market has always been known to be volatile and susceptible to market fluctuations. Volatility in that market segment arises from fewer restrictions, until quite recently, to buy or sell a private residential unit. Moreover, the acquisition of land for private residential developments is done either through competitive bidding via the Government Land Sales (GLS) scheme or the en-bloc process, which are affected by prevailing market conditions. Therefore, by pegging new BTO prices to the resale market, which is highly correlated to the private property market, are we not exposing many of our first time home owners to similar market risks?

At this point, I must concede that what I have written is purely postulation on my end and I could be totally wrong. However, given the lack of HDB data, there is really no way for me to confirm or refute HDB’s pricing strategy for new BTO flats. Nonetheless, if the private residential market is anything to go by, the principle of pegging new HDB flat to market prices may have considerable risks. In 1996, at the peak of the 1990s property boom, there were about 15,000 non-landed residential transactions (based on caveats lodged). As at 2009 (before the recent boom), about 41% of the 15,000 had sold their units off while the rest were still holding on to their units. Of the 41% who had sold their properties, about 78% sold it for a loss.

So what does this mean to you? Ultimately, by pegging new BTO prices to the resale market, new flats are not insulated from the cyclical effects of the property market. Just like resale HDB or even private properties, you could be overpaying for your new flat when the economy is doing well. On the other hand, this finding seems to suggest that an ideal time to buy a new HDB is when the overall property market is depressed. Whether or not public housing should be heavily subsidised and sold at a fixed price is really beyond the scope of this blog. Nonetheless, if you think it is fair for a statutory board to increase prices of public housing during a hot property market, you may wish to ask those who are presently priced out of the market and let me know what they think.