https://seekingalpha.com/article/4123633-s-and-p-500-snapshot-15_3-percent-2017

Nice perspective from 10,000 feet. I appreciate it.

By Jill Mislinski

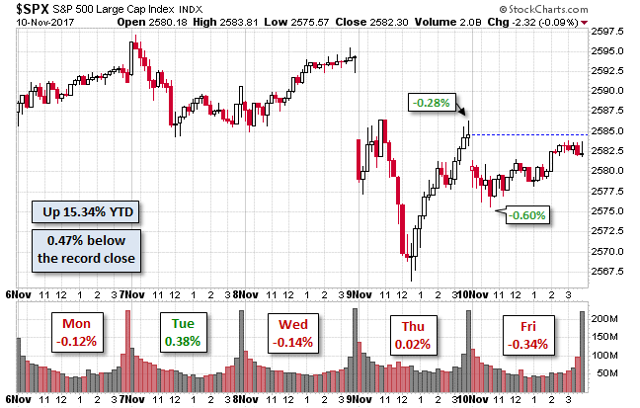

The S&P 500 opened Friday below yesterday's close and oscillated around a small range throughout the day, closing with a daily loss of 0.34% and a weekly loss of 0.21%. Year-to-date, the index is up 15.34%.

The U.S. Treasury puts the closing yield on the 10-year note at 2.40%.

Here is a daily chart of the S&P 500. Today's selling puts the volume at its 50-day moving average.

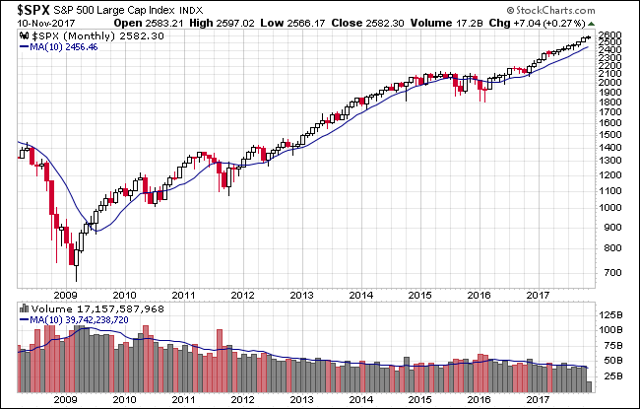

Here's a monthly snapshot of the index going back to December 2008:

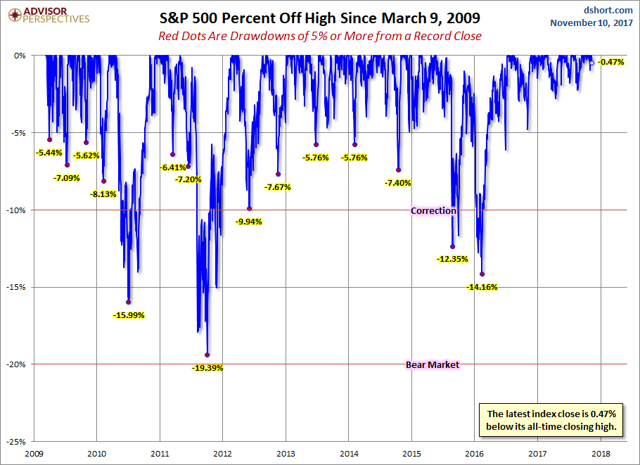

A Perspective on Drawdowns

Here's a snapshot of record highs and selloffs since the 2009 trough:

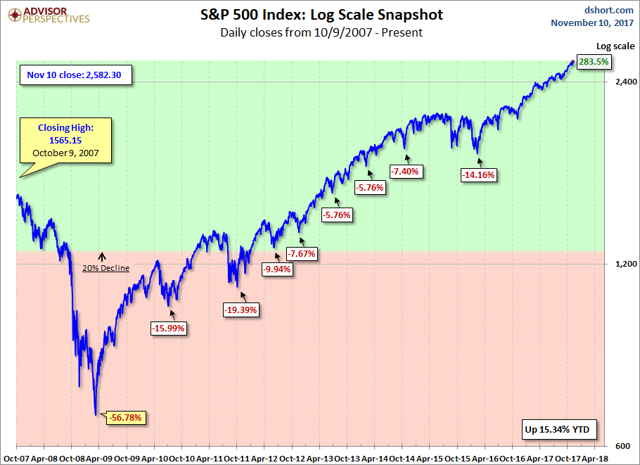

Here is a more conventional log-scale chart with drawdowns highlighted:

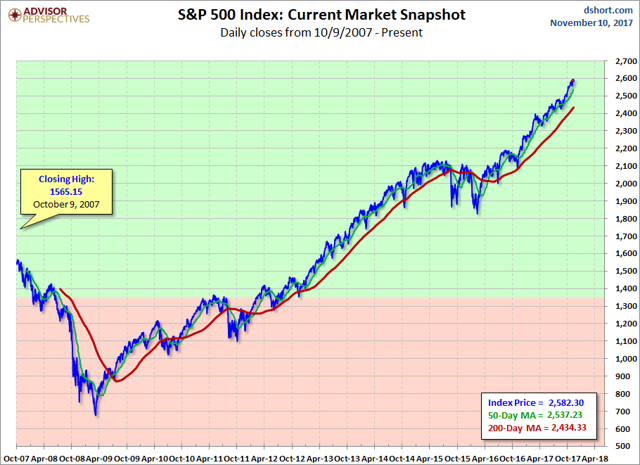

Here is a linear scale version of the same chart with the 50- and 200-day moving averages:

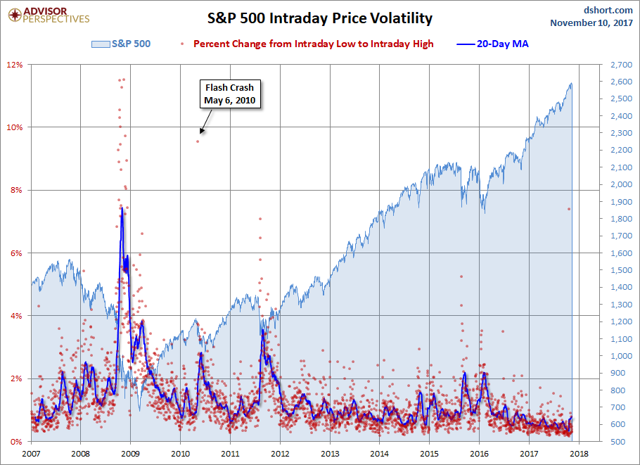

A Perspective on Volatility

For a sense of the correlation between the closing price and intraday volatility, the chart below overlays the S&P 500 since 2007 with the intraday price range. We've also included a 20-day moving average to help identify trends in volatility.