Summary

Short volatility ETPs were outperformers in 2017.

2018 has been devastating for short volatility products.

SVXY still remains after the collapse of the short volatility strategy.

What can be said about the above other than, "Wow, what an ugly chart"? This is the six month view of the ProShares Short VIX Short-Term Futures ETF (SVXY). SVXY, along with its now defunct cousin the VelocityShares VIX Short Volatility ETN or XIV, were the poster children for the "Volmageddon" event that took place in early February.

What can be said about the above other than, "Wow, what an ugly chart"? This is the six month view of the ProShares Short VIX Short-Term Futures ETF (SVXY). SVXY, along with its now defunct cousin the VelocityShares VIX Short Volatility ETN or XIV, were the poster children for the "Volmageddon" event that took place in early February.

Over the following days and weeks, many pundits declared that volatility ETPs were the root of all evil in the market. They were the reason that the ever increasing S&P 500 was hit with its biggest drawdown in years. If it wasn't for the short vol traders, the equity market would have continued on its non-stop upward trajectory. No one wanted to acknowledge that there might be pockets of excessive risk in the market because that might detract from their unstoppable equity rocket ship narrative.

I'm not going to get into the complicated math behind the risk mismatch between VIX futures contracts and S&P 500 options to explain the collapse of some short volatility ETPs. This has been covered by others who are much more technically competent than I am. Suffice it to say that the popularity (or greed) behind the short volatility trade led to an overcrowded situation on one side of the trade where there was no easy way out (in other words, there was insufficient short term liquidity) in the event of a large single day S&P decline. And, while considered a tail risk event by many, it inevitably happened.

On February 5, the S&P fell by just over 4% for the day leading to a spiraling upward move in front month VIX futures as shorts were massively squeezed and forced to fill at whatever price they could. This was the risk that those holding short VIX ETPs were being payed for. Unfortunately for many, they did not realize this was why they were getting such "easy money" returns. I mentioned the downside risk in several of my previous articles where I generally compared the short volatility strategy to picking up pennies in front of a steamroller.

The short volatility play was a great money maker while it lasted. Just take a look at the six months that preceded the volatility spike.

That was the type of upward trend for the short volatility trade for over 2 years. Many stories have been written about day traders who quit their jobs and quickly became rich following the short volatility strategy. Recently, there have been some articles about those who were crushed by the February volatility spike. This was a case of extreme mean reversion where the last person holding the soon to be toxic asset was wiped out.

Since February, the short volatility strategy has been less popular. Trading volumes in VIX related options and futures have fallen off substantially. This is not really a surprise as a number of funds have disappeared, become less popular among investors and/or have changed their investment strategies. The short volatility play has not been the same since February as seen in the below chart of SVXY.

You could look at this as generally a sideways move as the equity market has churned between its 50 and 200 day moving averages. But you also have to take into account that SVXY has changed its daily tracking parameter from an inverse 1 to 1 move with front and second month VIX futures to an inverse 1 to 2 move. Now that it only tracks half of the inverse change in VIX futures, SVXY's performance has become predictably less volatile.

You could look at this as generally a sideways move as the equity market has churned between its 50 and 200 day moving averages. But you also have to take into account that SVXY has changed its daily tracking parameter from an inverse 1 to 1 move with front and second month VIX futures to an inverse 1 to 2 move. Now that it only tracks half of the inverse change in VIX futures, SVXY's performance has become predictably less volatile.

Recent developments in the volatility space lead to two questions regarding SVXY. First, is SVXY still an appropriate product for putting on a short volatility strategy now that it has halved its inverse relationship with volatility futures? And second, does a short volatility strategy (using SVXY or not) make sense in the current equity market environment?

The answer to the first question depends on the investor. If you are happy with the 50% inverse tracking relationship between SVXY and the front two month volatility futures, then this might make sense. But, if you are like those investors who are interested in a short volatility product that has more "horsepower", SVXY is a fairly watered down version of what it was. Many investors thought SVXY was a bit tame for them before the February collapse. These short volatility players were more interested in shorting leveraged VIX related ETPs such as the VelocityShares Daily 2x VIX Short-Term ETN (TVIX) and the ProShares Ultra VIX Short-Term Futures ETF (UVXY). For those looking for this sort of leveraged play, SVXY would not fit the bill at all.

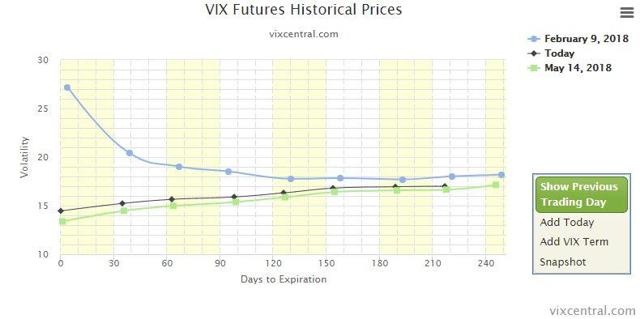

For the second question, I do not believe that now would be a particularly good time to add a short volatility position. Whether looking at SVXY or some other ETP, a VIX options strategy or VIX futures positioning, the volatility complex has already declined significantly from its recent highs. As seen in the chart below, the volatility complex shifted from backwardation in February to its more historically usual contango condition that is seen today.

Aside from the decline of front month VIX futures over the past few months, I believe that implied volatility as seen in the VIX futures complex is currently undervalued relative to realized equity volatility. I wrote a recent article about this that you can find here. Besides there being a relative pricing mismatch, I believe that current equity market fundamentals, rising interest rates and geopolitical considerations are at a point that would be better suited for a long volatility strategy at present.

Aside from the decline of front month VIX futures over the past few months, I believe that implied volatility as seen in the VIX futures complex is currently undervalued relative to realized equity volatility. I wrote a recent article about this that you can find here. Besides there being a relative pricing mismatch, I believe that current equity market fundamentals, rising interest rates and geopolitical considerations are at a point that would be better suited for a long volatility strategy at present.

As time moves on, an increase in volatility futures or a spike in the VIX would make me look again at a short volatility strategy. But, I would likely not consider SVXY as a fit for my short volatility position. Just as a personal preference, I would look for an investment that more closely tracks the volatility complex. I probably would not be bold enough to short a leveraged long volatility ETP, but I might consider options or futures as a good fit.

As always, I strongly urge anyone considering this type of investment to fully investigate the performance characteristics of any security they are planning to use before implementing any trading strategy. This article is just my opinion, and I encourage all readers to decide for themselves whether they find the contents relevant to their own situation. If you find my articles interesting, informative and useful, please follow me by clicking on the follow button at the top of the article. To view my past articles, you can look here. Thank you for reading.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Comments 8

It's been a good strategy since February, but who knows going forward?