Understanding Preferred Stocks: A Primer

Preferred stocks can make a valuable contribution to any income-focused portfolio.

Understanding the terms and how they apply to preferred shares is important in selecting preferred shares for your portfolio.

Using the C Series of preferred shares from UMH, we show how to evaluate a preferred issue and to determine if an issue is a good fit.

Looking for a portfolio of ideas like this one? Members of High Dividend Opportunities get exclusive access to our model portfolio. Start your free trial today »

Co-produced with PendragonY, Treading Softly, and Beyond Saving for High Dividend Opportunities

Introduction

We are pleased to provide a basic report for our novice investors on preferred stocks and what they are about. As a reminder, we are currently recommending that our investors have a large allocation to preferred stocks, baby bonds and bonds. The recommended allocation is up to 35% of the overall portfolio. We hope that this report will help in order to understand and invest in our preferred stock portfolio. What's worth to note is that the higher allocation to preferred stocks has seen little price movement in the past week despite the market pullback. Preferred stocks have acted as a buffer, resulting in a low volatility for our portfolio, much lower than that of the S&P 500 index.

Introduction – The State of the Economy

Here at High Dividend Opportunities, we’ve been predicting a coming recession for over a year. Going against the grain, we suggest investors start to shift their portfolio to more defensive, high-yielding stocks. In doing so we’ve introduced many investors to baby bonds and preferred stocks. These stocks have lingo and jargon all of their own. This report is designed to educate readers on these terms and how to apply them to investing. I’d suggest members bookmark this report as it answers many common questions that frequently come up regarding preferred stocks.

Where has the economic outlook changed? The Federal Reserve went from forecasting multiple interest rate increases to holding the interest rate steady. Now many expect an interest rate cut. Just recently, President Trump called for the Federal Reserve to cut the interest rate by 1% and resume some level of quantitative easing via bond buying. While we do not aim to be political, these actions typically are by governments aiming to avoid or delay a recession or more importantly to reverse one. Preferred stocks offer investors a way to lock in a yield they desire from high-quality companies.

QuantumOnline is a valuable tool

There are a lot of websites with information on exchange traded debt, but we like QuantumOnline. While you do need to register to get full access, registration is free (contributions are encouraged but are entirely voluntary). We will be using screenshots from that website to illustrate this article.

There are a wide array of securities that investors can buy. These range from pure equity investments, like common stocks, to pure debt investments, like traditional bonds. Preferred shares fall between these two extremes.

Preferred stocks have a lot of parameters that distinguish between various issues, and we think the best way to explain all these parameters is with examples. Below we will explain the various parameters using screen shots from QuantumOnline. As an example, we will use a preferred issue that we have from UMH Property (UMH), a property REIT.

The best way to find preferred stocks is to find a company that you want to either own or lend money to. If the company isn’t one you are willing to invest in, we think you will likely be less than happy with the results of owning its preferred shares.

Compared to bonds, preferred shares will provide you better liquidity, generally more income, and often allow some participation in the growth of the company.

Compared to owning the common shares, preferred shares will give you:

- Less price volatility.

- Typically a higher dividend yield and more income.

- Typically a safer dividend payment.

- If the shares are redeemable, you also will get some assurance that at some point in the future you will get a predictable amount for the shares as well.

To find all the preferred stocks for a particular company, just go to quantum online (QuantumOnline.com Home Page). From there, you can search by “Ticker Symbol” or “CUSIP Number” if you know exactly which preferred issue you are looking for. If you want to search for all securities of a particular company, use the “Symbol Lookup” option. For example, after typing UMH in the search box using the symbol lookup option, the screen below comes up.

Figure 2 Source

This screen includes the listing of all exchange traded securities related to UMH. You can see the common stock and four preferred issues. Series A is no longer trading on the markets (it was called or redeemed by UMH some time ago).

Jargon

Besides identifying these securities as preferred stocks, the title contains some other basic information. A series identification, the coupon rate, and the words cumulative and redeemable are basic information about the preferred issue included in the security description. These terms allow investors to quickly identify key traits of a particular issue.

The coupon rate is a ratio of the yearly dividend divided by the liquidation or par value. This is the yield an investor would get if the shares were purchased at par value (more on what par value is below). The par value is usually $25.00 per share. Preferred shares often trade above or below par value, so the effective yield received by an investor could be higher or lower.

Preferred shares always collect their contracted dividend payment before any common share dividends are paid. However, the dividend still must be declared by the board and it can be suspended.

Preferred shares with cumulative payments must have all the dividends they are owed paid before any common share dividends can be paid. What this means is that if for some reason a company suspends dividend payments on its preferred shares, the amount owed to preferred shareholders continues to accumulate. No common share dividends can be paid till these suspended dividends are paid out.

With non-cumulative payments only the latest preferred dividend payment needs to be paid in order to resume common share dividend payments and preferred shareholders have no rights to undeclared dividends. Cumulative dividend payments can thus be a big benefit if a company runs into enough trouble that it suspends the dividends on preferred shares and then recovers.

Redeemable means that there's a mechanism where the issuing company buys all the preferred shares in the issue back at a predetermined price, called various names (redemption price, liquidation price or par). Some mechanisms are optional, some mandatory and some have penalties to the company or bonuses to the shareholder if they are not exercised.

Perpetual also is a word used here to describe an aspect of redemption. One of the mandatory mechanisms for redeeming preferred issues is a maturity date (much like a bond). Perpetual preferred issues do not have a maturity date.

Convertible is yet another word describing a redemption mechanism. What this means is that the preferred shares could be redeemed by being converted into another type of security. Most often they convert to common shares.

It's crucial that investors read the prospectus to understand when and under what circumstances an issue can be redeemed or converted. Often, preferred shares have conditions where redemption or conversion can be done at the option of the shareholders. When comparing two issues, the differences in redemption and/or conversion conditions will determine which is the superior investment.

The Details

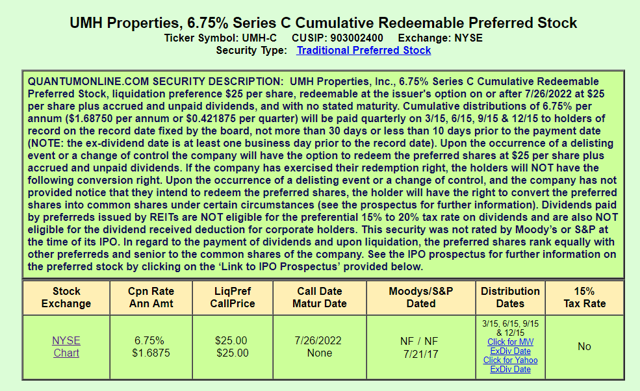

Figure 3 Source

You can drill down on any of the still trading securities in the first table, when we did that for the C-Series (which is the series in the HDO portfolio) we get the table above. New information presented in this table includes the ticker symbol (understand that there is no standard method for creating a ticker for preferred shares as different brokers and exchanges all use different methods, so this is just one possible ticker for this security), the CUSIP (which is a unique identifier for the security), the exchange the security trades on, and what type of security this is.

The text at the top of the table summarizes what's in the prospectus. It includes information on how much the dividend is and when it will be paid, what redemption mechanisms are attached to this issue and any special provisions. In this case it lists what happens when there's a change in control of the company or a delisting event. Also included is whether or not the dividend is eligible for the special qualified dividend rate (this issue is not).

The table below the text summarizes important information from the text. The Annual Amount is the dollar amount of dividends paid each year. The Coupon Rate is the ratio of this annual amount to the liquidation preference. The Liquidation Preference and the Call Price are the prices the company pays the shareholder (plus any accrued but unpaid dividends) when the shares are called or redeemed by some other mechanism. While there's no requirement that these two prices be identical, but it’s rare that they are not. In the rest of this document this will be referred to as the par price.

Next is the Call Date and the Maturity Date. The call date is the date after which the company has the option of redeeming the shares. Whether or when the company exercises this option depends on many factors, but it won’t happen unless doing so is of benefit to the company. When the company calls the shares, the investor will get paid the call price for each share plus any accrued but unpaid dividends.

The maturity date is the date the company is required to redeem the shares. A failure to do so results in a default. This UMH issue doesn’t have a maturity date, so in theory these may never be redeemed.

The next cell in the table contains the credit ratings from Moody’s and S&P. For the most part, preferred issues, when they are rated, are given a grade one or two levels lower than regular bonds from the same company. This is to take into account that the bonds are higher in the capital structure, which means they will be paid before the preferred shares in the event of a bankruptcy or liquidation.

The next to last cell in the table contains the Distribution Dates. These are the dates on which the dividend will be paid. There's also a link to a site where an investor can check when the next ex-dividend date is. You need to have purchased the shares before the ex-dividend date to get the next dividend payment (just like common stocks). The board has the option to suspend dividends, however since this issue is cumulative, the dividends owed to the preferred shareholders will accumulate on those dates if they are not paid.

The final cell indicates whether or not the dividends are eligible to be treated as qualified. This is important for US taxpayers as the rate on qualified dividends is much lower than on regular dividends. For non-US investors, this will mostly just affect valuation (as the lower tax rate won’t impact them, but will impact a large number of shareholders).

The first cell in the table contains a link to the quote page for this security, in this case (UMHC.PC), on the exchange it trades on. This can be used to look up the latest price. Just before open on Wednesday, Jan. 9, (UMHC.PC) was trading for $23.26.

QuantumOnline also has glossary of terms than can be found here. This linkleads to another page with some general information as well (much of it is covered above, but it never hurts to have another source of information).

A Plethora of Yields

1- Coupon Rate

The coupon rate is just the yield based on the annual dividend and the par price of the preferred stock. For (UMHC.PC) that's 6.75%. While useful in identifying different issues for the same company, unless the preferred shares are trading very near par, it’s not all that useful.

2- Current Yield

Current yield is the ratio of the annual dividend and the current market price of the preferred shares. Much like the current yield of dividend paying stocks, this will tell the investor how much dividends one can purchase with their investment dollars.

3- Yield to Maturity

Yield to maturity ('YTM') is the yield one will get holding the preferred shares to maturity taking into account any premium or discount to par (and of course only applies to issues that have a maturity date). The YTM is higher than the current yield if the stock is trading at a discount and lower than the current yield if it is trading at a premium. YTM also takes into account the amount of time left till the maturity date. The farther out the maturity date, the less impact the premium or discount to par will have on the rate, and eventually it will be little different than the coupon rate.

Say a preferred issue is trading at $26 ($1 above its par price) one year before maturity and pays an annual $2 dividend. When it matures the investor will have received $27 between the $2 of dividends and the $25 par at redemption. That will make the yield to maturity 4%. Had the shares been selling for $24 instead, the YTM would have been 12% ($2 in dividends plus $1 capital gains).

4- Yield to Call

Yield to call ('YTC') is very similar to YTM, except that this is the yield one will get if the shares are held until they are called. After the call date has passed this rate has little meaning. Since preferred share prices tend to move toward the par price based on length of time to the call date and likelihood of the issue being called, this rate doesn’t have a lot of meaning if the discount to par is very significant because that means the market sees little chance of the issue being called.

5- Yield to Worst

Yield to worst ('YTW') is the worst yield applicable to the preferred shares. With issues that have a maturity date, if the maturity date is many years away YTW is the yield to call if the market price is above the call price (because this gives the most weight to the lost premium). When the market price is below the call price, YTW is the yield to maturity because this gives the least weight to the gain created by the discount to par. If the issue has no maturity, then YTW is the lower of YTC and current yield. Generally, when comparing the yields from two preferred issues, this is the rate to use as it gives the best picture of the actual income return of the two securities.

6- Stripped Yield

Stripped yield and stripped price are terms one sometimes hears when talking about preferred shares. They carry over from bond investing where an investor in a bond pays not only the price of the bond but also any accrued but unpaid dividends. Investors that purchase preferred shares often buy these shares with implied accrued dividend (that means the market price includes the accrued but unpaid dividends). The stripped price is the market price minus accrued dividends. The stripped yield is the ratio of the annual dividend payment and the stripped price.

How to select an Issue when an issuer has several outstanding?

It’s fairly easy to decide what to do when you want to invest in a company’s preferred shares and it only has one outstanding issue. While that's the case for many companies, it's fairly common for a company to have more than one issue outstanding.

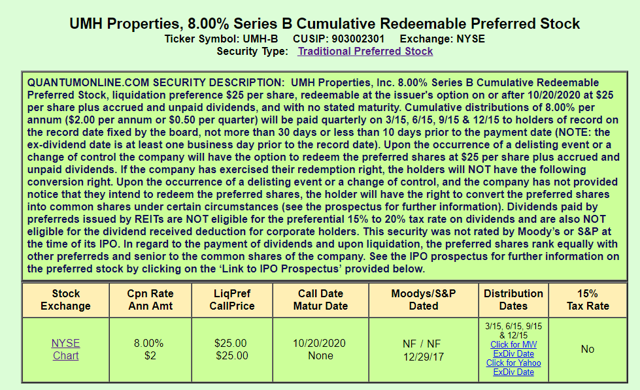

UMH Properties has three preferred shares outstanding. One might be tempted to pick the issue with the highest coupon rate, so let’s look at UMH Properties Preferred B Share (UMH.PB) with its 8% coupon.

Figure 4 Source

Looking at the B series issue, it looks very similar to the C series (At High Dividend Opportunities we are currently recommending the Preferred C of UMH). The main difference is the coupon rate and the call date. The call date for the B series is less than two years away, while the call date for the C series is almost two years later that the B series. The B series also pays a dividend of $2 a year, while the C series only pays $1.6875.

The B series will give you more income, right? Well, no, this is an example of why the coupon rate isn’t all that useful in determining which issues to buy. A look at the closing price from Tuesday January 8, shows that the price of the B series shares is $25.80. So that makes the current yield 7.75%. While the C series at the same time had a price of $23.26 and a current yield of 7.25%. Looking at YTW (yield to worst) the B series yield is ~6.25% vs. 7.25% for the C series.

With less than two years until the call date for the B series and with it trading above par, the best yield to compare the two issues is the yield to worst. On that measure, the C series is better. Since our outlook for interest rates is that they are now near their peak and could be decreasing in 2020, we think it likely that the B series will be called. With the market price above par, the market seems to think the same thing. We also think the longer time till the C series is called is better. Having two more years to find a good investment paying more than 7% gives us a much better chance of replacing this income in the event the shares are called.

Preferred Stock Tickers

Preferred stock tickers can be very confusing because there's not a universal one that is adopted by all brokers. The NYSE uses a system where the common stock ticker is followed by the letters PR and then followed, if needed by a letter to indicate a specific issue (xxxpx). If it's a preferred A stock, then the ticker would be xxxpa. This system is incompatible with listing on Nasdaq, where that same format can indicate securities that are not preferred shares.

NYSE Amex uses xxxpx, Yahoo uses xxx-px, Fidelity often uses xxxPRX and E*Trade often uses xxx.pr.x. Quantum Online has a whole page dedicated to this discussion.

| Quote Source | PreferredDesignator | Alabama Power5.20% Pfd Stk | ABC Bancorp9.00% Pfd Sec | Citigroup Capital IX6% TruPS |

| - | ALP-N | BHC- | C-S | |

| - | ALP-N | BHC- | C-S | |

| PR | ALPPRN | BHCPR | CPRS | |

| p | ALPpN | BHCp | CpS | |

| /P | ALP/PN | BHC/P | C/PS | |

| /PR+ | ALP/PRNALP+N | BHC/PRBHC+ | C/PRSC+S | |

| p | ALPpN | BHCp | CpS | |

| PR | ALPPRN | BHCPR | CPRS | |

| - | ALP-N | BHC- | C-S | |

| PR | ALP PRN | BHC PR | C PRS | |

| ' | ALP'N | BHC' | C'S | |

| .P | BHC.P | |||

| PR | ALP PRN | BHC PR | C PRS | |

| p | ALPpN | BHCp | CpS | |

| - | ALP-N | BHC- | C-S | |

| _p | ALP_pN | BHC_p | C_pS | |

| -p | ALP-pN | BHC-p | C-pS |

Now for something a little more complicated

Figure 5 Source

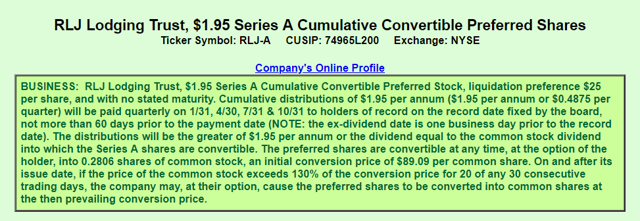

Above is a description of the attributes of the Series A preferred issue from RLJ Lodging Trust (RLJ.PA), which is on our recommended list. The first thing that's different is that rather than listing a coupon rate, it lists a dividend amount. The actual dividend paid is unusual for a couple of reasons.

The amount that will be paid is $1.95 or the dividend on the common shares, whichever is greater. Currently, the dividend on the common shares is only $1.32, so preferred shareholders will be paid $1.95. However, at some point in the future the holders of the Series A preferred could benefit from dividend growth.

Also unusual is that this preferred issue cannot be called and never matures. Holders can convert it to common shares, and under certain conditions the company can force such a conversion, but the shares are not redeemable for cash. Since this preferred issue was originally issued by a company that RLJ acquired, the conversion terms are unfavorable and the common share price needed for the company to force a conversion is several times the current price of the common shares, so conversions are unlikely.

One of the reasons we recommend this preferred issue is that RLJ is healthy enough that the preferred dividends are safe, there's the potential for those dividends to eventually increase and an investor has very little worry that the shares themselves will go away.

Variable Coupon

Now into the deeper end of the pool, take a look at a preferred issue we don’t like from a company we do like (and recommend).

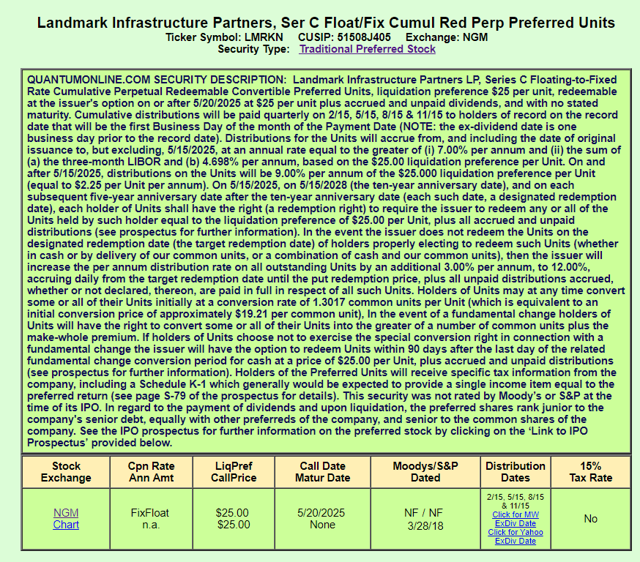

Figure 6 Source

Landmark Infrastructure Partners (LMRK) is a company we like and recommend (especially once it converts to a REIT). It issues several different series of preferred shares that we like, but the one above we do not like.

The sheer complexity of its provisions is one mark against it. It also currently pays a variable (or floating) coupon rate based on LIBOR with a floor of 7%. Given that we think interest rates are at or near their peak and likely to start decreasing in two years, we think fixed rates are a better choice at this time. Further the coupon rate rests to a fixed value of 9% in 2025. While that seems generous now, who knows what rates might be in 2025 (although we suspect that it is likely to be a good rate then too). Also note that the shares are callable starting five days after the rate switches to 9%. If at the time 9% is a high rate for preferred shares, expect Landmark to call the shares. If Landmark calls the shares as soon as it is able, investors won’t collect more than a few days or weeks at the 9% rate.

Some may note that there is yet another reset to higher coupon rates up to 12%. This higher rate would be the result of triggering a Failure to Redeem Clause. These clauses are both an incentive for the company to redeem preferred shares and a bonus to keep shareholders from selling the stock if temporary difficulties prevent the company from performing a redemption action on time. The shareholder should understand that this clause is increasing the rewards of ownership, but if it triggered the risks have increased as well.

Looking at the specific provisions for Landmark Preferred C (LMRKN), the 12% will kick in only if Landmark is unable to redeem all of the shares that shareholders indicated they wanted redeemed. This would only happen if Landmark was unable to borrow sufficient funds (combined with any cash on hand) at a 12% or lower interest rate. Not knowing where interest rates will stand in 2025, it’s possible that Landmark would see that as an attractive rate and choose not to redeem, but we think that's unlikely. The most likely reason for this clause to be invoked would be if Landmark is in significant financial or operating difficulty.

At this time, we think this clause being invoked would be more bad than good. While the current yield on LMRKN is 7.2%, we see LMRKP, with a yield of 7.82% and a fixed coupon of 8%, as a less risky choice. That LMRKN trades at a bigger discount to par than does LMRKP tells us the market sees it the same way.

Using Preferred Stocks for Dividend Growth

Many investors want to have the income their portfolio generates increase over time. While preferred shares mostly offer a fixed dividend, it’s easy to increase the dividends that a position pays over time. Given the generally higher yield one gets from a preferred share than from a common share, one can take the extra and use it to buy more shares. Over time that will produce more dividends from the position, allowing one to maintain purchasing power or even grow purchasing power depending on how much of the dividend is used to buy new shares. Personally, I like very much to invest in high-yield preferred stocks. The high yields are offered by many preferred stocks are much higher than those offered by most "dividend growth" stocks. Dividend growth stocks tend to trade based on high valuations and the yields are not very juicy. So by re-investing part or the whole dividend from preferred stocks, income investors can achieve a better dividend growth portfolio than just by investing in dividend growth stocks. This is one of the reasons we offer to our investors (members of “High Dividend Opportunities” our Preferred Stock Portfolio that includes over 50 of the best preferred stock that conservative income investors can choose from. The portfolio currently yields 7% with many opportunities well over 8% yield). Our criteria is to target mispriced preferred with a high yield so that our investors can generate a high level of income for both spending money or for re-investment.

Final Thoughts

- Preferred shares offer one of the safest way for income investors and retirees to generate recurrent income.

- While an investment in preferred shares isn’t quite as much safe as buying bonds, the investor gets better liquidity, lower purchase costs, higher yields, and limited participation in capital gains growth.

- While an investment in preferred shares doesn’t offer as much opportunity for capital gains and dividend growth, the investor gains lower share price volatility, higher yields, and in most cases the likelihood that they will get their money back.

- Common stocks are not the only way to generate dividend growth. Since many preferred stocks offer yields that are much higher than their respective common stock, income investors can generate dividend growth by re-investing part or all of the dividends.

- Understanding preferred shares will allow investors to select preferred stocks that will add a solid income base to their portfolios.

- HDO offers a full preferred stock and bond portfolio as well as our core portfolio has a large number of preferred stocks.

Thanks for reading! If you liked this article, please scroll up and click "Follow" next to my name to receive future updates.

High Dividend Opportunities, The #1 Service for Income Investors and Retirees

We are the largest community of income investors and retirees with over 2400 members. Our aim is to generate immediate high income. We recently launched our all-Preferred Stock & Bond portfolio for safe high-yields ahead of a weaker economy and market volatility.

Join us today and get instant access to our model portfolio targeting 9-10% yield, our preferred stock portfolio, and income tracking tools. You also get access to our report entitled "Our Favorite Picks for 2019"

START YOUR FREE TRIAL HERE

Disclosure: I am/we are long LMRKN, RLJ.PA, UMH.PC. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Understanding Preferred Stocks: A Primer

Preferred stocks can make a valuable contribution to any income-focused portfolio.

Understanding the terms and how they apply to preferred shares is important in selecting preferred shares for your portfolio.

Using the C Series of preferred shares from UMH, we show how to evaluate a preferred issue and to determine if an issue is a good fit.

Looking for a portfolio of ideas like this one? Members of High Dividend Opportunities get exclusive access to our model portfolio. Start your free trial today »

Co-produced with PendragonY, Treading Softly, and Beyond Saving for High Dividend Opportunities

Introduction

We are pleased to provide a basic report for our novice investors on preferred stocks and what they are about. As a reminder, we are currently recommending that our investors have a large allocation to preferred stocks, baby bonds and bonds. The recommended allocation is up to 35% of the overall portfolio. We hope that this report will help in order to understand and invest in our preferred stock portfolio. What's worth to note is that the higher allocation to preferred stocks has seen little price movement in the past week despite the market pullback. Preferred stocks have acted as a buffer, resulting in a low volatility for our portfolio, much lower than that of the S&P 500 index.

Introduction – The State of the Economy

Here at High Dividend Opportunities, we’ve been predicting a coming recession for over a year. Going against the grain, we suggest investors start to shift their portfolio to more defensive, high-yielding stocks. In doing so we’ve introduced many investors to baby bonds and preferred stocks. These stocks have lingo and jargon all of their own. This report is designed to educate readers on these terms and how to apply them to investing. I’d suggest members bookmark this report as it answers many common questions that frequently come up regarding preferred stocks.

Where has the economic outlook changed? The Federal Reserve went from forecasting multiple interest rate increases to holding the interest rate steady. Now many expect an interest rate cut. Just recently, President Trump called for the Federal Reserve to cut the interest rate by 1% and resume some level of quantitative easing via bond buying. While we do not aim to be political, these actions typically are by governments aiming to avoid or delay a recession or more importantly to reverse one. Preferred stocks offer investors a way to lock in a yield they desire from high-quality companies.

QuantumOnline is a valuable tool

There are a lot of websites with information on exchange traded debt, but we like QuantumOnline. While you do need to register to get full access, registration is free (contributions are encouraged but are entirely voluntary). We will be using screenshots from that website to illustrate this article.

There are a wide array of securities that investors can buy. These range from pure equity investments, like common stocks, to pure debt investments, like traditional bonds. Preferred shares fall between these two extremes.

Preferred stocks have a lot of parameters that distinguish between various issues, and we think the best way to explain all these parameters is with examples. Below we will explain the various parameters using screen shots from QuantumOnline. As an example, we will use a preferred issue that we have from UMH Property (UMH), a property REIT.

The best way to find preferred stocks is to find a company that you want to either own or lend money to. If the company isn’t one you are willing to invest in, we think you will likely be less than happy with the results of owning its preferred shares.

Compared to bonds, preferred shares will provide you better liquidity, generally more income, and often allow some participation in the growth of the company.

Compared to owning the common shares, preferred shares will give you:

- Less price volatility.

- Typically a higher dividend yield and more income.

- Typically a safer dividend payment.

- If the shares are redeemable, you also will get some assurance that at some point in the future you will get a predictable amount for the shares as well.

To find all the preferred stocks for a particular company, just go to quantum online (QuantumOnline.com Home Page). From there, you can search by “Ticker Symbol” or “CUSIP Number” if you know exactly which preferred issue you are looking for. If you want to search for all securities of a particular company, use the “Symbol Lookup” option. For example, after typing UMH in the search box using the symbol lookup option, the screen below comes up.

Figure 2 Source

This screen includes the listing of all exchange traded securities related to UMH. You can see the common stock and four preferred issues. Series A is no longer trading on the markets (it was called or redeemed by UMH some time ago).

Jargon

Besides identifying these securities as preferred stocks, the title contains some other basic information. A series identification, the coupon rate, and the words cumulative and redeemable are basic information about the preferred issue included in the security description. These terms allow investors to quickly identify key traits of a particular issue.

The coupon rate is a ratio of the yearly dividend divided by the liquidation or par value. This is the yield an investor would get if the shares were purchased at par value (more on what par value is below). The par value is usually $25.00 per share. Preferred shares often trade above or below par value, so the effective yield received by an investor could be higher or lower.

Preferred shares always collect their contracted dividend payment before any common share dividends are paid. However, the dividend still must be declared by the board and it can be suspended.

Preferred shares with cumulative payments must have all the dividends they are owed paid before any common share dividends can be paid. What this means is that if for some reason a company suspends dividend payments on its preferred shares, the amount owed to preferred shareholders continues to accumulate. No common share dividends can be paid till these suspended dividends are paid out.

With non-cumulative payments only the latest preferred dividend payment needs to be paid in order to resume common share dividend payments and preferred shareholders have no rights to undeclared dividends. Cumulative dividend payments can thus be a big benefit if a company runs into enough trouble that it suspends the dividends on preferred shares and then recovers.

Redeemable means that there's a mechanism where the issuing company buys all the preferred shares in the issue back at a predetermined price, called various names (redemption price, liquidation price or par). Some mechanisms are optional, some mandatory and some have penalties to the company or bonuses to the shareholder if they are not exercised.

Perpetual also is a word used here to describe an aspect of redemption. One of the mandatory mechanisms for redeeming preferred issues is a maturity date (much like a bond). Perpetual preferred issues do not have a maturity date.

Convertible is yet another word describing a redemption mechanism. What this means is that the preferred shares could be redeemed by being converted into another type of security. Most often they convert to common shares.

It's crucial that investors read the prospectus to understand when and under what circumstances an issue can be redeemed or converted. Often, preferred shares have conditions where redemption or conversion can be done at the option of the shareholders. When comparing two issues, the differences in redemption and/or conversion conditions will determine which is the superior investment.

The Details

Figure 3 Source

You can drill down on any of the still trading securities in the first table, when we did that for the C-Series (which is the series in the HDO portfolio) we get the table above. New information presented in this table includes the ticker symbol (understand that there is no standard method for creating a ticker for preferred shares as different brokers and exchanges all use different methods, so this is just one possible ticker for this security), the CUSIP (which is a unique identifier for the security), the exchange the security trades on, and what type of security this is.

The text at the top of the table summarizes what's in the prospectus. It includes information on how much the dividend is and when it will be paid, what redemption mechanisms are attached to this issue and any special provisions. In this case it lists what happens when there's a change in control of the company or a delisting event. Also included is whether or not the dividend is eligible for the special qualified dividend rate (this issue is not).

The table below the text summarizes important information from the text. The Annual Amount is the dollar amount of dividends paid each year. The Coupon Rate is the ratio of this annual amount to the liquidation preference. The Liquidation Preference and the Call Price are the prices the company pays the shareholder (plus any accrued but unpaid dividends) when the shares are called or redeemed by some other mechanism. While there's no requirement that these two prices be identical, but it’s rare that they are not. In the rest of this document this will be referred to as the par price.

Next is the Call Date and the Maturity Date. The call date is the date after which the company has the option of redeeming the shares. Whether or when the company exercises this option depends on many factors, but it won’t happen unless doing so is of benefit to the company. When the company calls the shares, the investor will get paid the call price for each share plus any accrued but unpaid dividends.

The maturity date is the date the company is required to redeem the shares. A failure to do so results in a default. This UMH issue doesn’t have a maturity date, so in theory these may never be redeemed.

The next cell in the table contains the credit ratings from Moody’s and S&P. For the most part, preferred issues, when they are rated, are given a grade one or two levels lower than regular bonds from the same company. This is to take into account that the bonds are higher in the capital structure, which means they will be paid before the preferred shares in the event of a bankruptcy or liquidation.

The next to last cell in the table contains the Distribution Dates. These are the dates on which the dividend will be paid. There's also a link to a site where an investor can check when the next ex-dividend date is. You need to have purchased the shares before the ex-dividend date to get the next dividend payment (just like common stocks). The board has the option to suspend dividends, however since this issue is cumulative, the dividends owed to the preferred shareholders will accumulate on those dates if they are not paid.

The final cell indicates whether or not the dividends are eligible to be treated as qualified. This is important for US taxpayers as the rate on qualified dividends is much lower than on regular dividends. For non-US investors, this will mostly just affect valuation (as the lower tax rate won’t impact them, but will impact a large number of shareholders).

The first cell in the table contains a link to the quote page for this security, in this case (UMHC.PC), on the exchange it trades on. This can be used to look up the latest price. Just before open on Wednesday, Jan. 9, (UMHC.PC) was trading for $23.26.

QuantumOnline also has glossary of terms than can be found here. This linkleads to another page with some general information as well (much of it is covered above, but it never hurts to have another source of information).

A Plethora of Yields

1- Coupon Rate

The coupon rate is just the yield based on the annual dividend and the par price of the preferred stock. For (UMHC.PC) that's 6.75%. While useful in identifying different issues for the same company, unless the preferred shares are trading very near par, it’s not all that useful.

2- Current Yield

Current yield is the ratio of the annual dividend and the current market price of the preferred shares. Much like the current yield of dividend paying stocks, this will tell the investor how much dividends one can purchase with their investment dollars.

3- Yield to Maturity

Yield to maturity ('YTM') is the yield one will get holding the preferred shares to maturity taking into account any premium or discount to par (and of course only applies to issues that have a maturity date). The YTM is higher than the current yield if the stock is trading at a discount and lower than the current yield if it is trading at a premium. YTM also takes into account the amount of time left till the maturity date. The farther out the maturity date, the less impact the premium or discount to par will have on the rate, and eventually it will be little different than the coupon rate.

Say a preferred issue is trading at $26 ($1 above its par price) one year before maturity and pays an annual $2 dividend. When it matures the investor will have received $27 between the $2 of dividends and the $25 par at redemption. That will make the yield to maturity 4%. Had the shares been selling for $24 instead, the YTM would have been 12% ($2 in dividends plus $1 capital gains).

4- Yield to Call

Yield to call ('YTC') is very similar to YTM, except that this is the yield one will get if the shares are held until they are called. After the call date has passed this rate has little meaning. Since preferred share prices tend to move toward the par price based on length of time to the call date and likelihood of the issue being called, this rate doesn’t have a lot of meaning if the discount to par is very significant because that means the market sees little chance of the issue being called.

5- Yield to Worst

Yield to worst ('YTW') is the worst yield applicable to the preferred shares. With issues that have a maturity date, if the maturity date is many years away YTW is the yield to call if the market price is above the call price (because this gives the most weight to the lost premium). When the market price is below the call price, YTW is the yield to maturity because this gives the least weight to the gain created by the discount to par. If the issue has no maturity, then YTW is the lower of YTC and current yield. Generally, when comparing the yields from two preferred issues, this is the rate to use as it gives the best picture of the actual income return of the two securities.

6- Stripped Yield

Stripped yield and stripped price are terms one sometimes hears when talking about preferred shares. They carry over from bond investing where an investor in a bond pays not only the price of the bond but also any accrued but unpaid dividends. Investors that purchase preferred shares often buy these shares with implied accrued dividend (that means the market price includes the accrued but unpaid dividends). The stripped price is the market price minus accrued dividends. The stripped yield is the ratio of the annual dividend payment and the stripped price.

How to select an Issue when an issuer has several outstanding?

It’s fairly easy to decide what to do when you want to invest in a company’s preferred shares and it only has one outstanding issue. While that's the case for many companies, it's fairly common for a company to have more than one issue outstanding.

UMH Properties has three preferred shares outstanding. One might be tempted to pick the issue with the highest coupon rate, so let’s look at UMH Properties Preferred B Share (UMH.PB) with its 8% coupon.

Figure 4 Source

Looking at the B series issue, it looks very similar to the C series (At High Dividend Opportunities we are currently recommending the Preferred C of UMH). The main difference is the coupon rate and the call date. The call date for the B series is less than two years away, while the call date for the C series is almost two years later that the B series. The B series also pays a dividend of $2 a year, while the C series only pays $1.6875.

The B series will give you more income, right? Well, no, this is an example of why the coupon rate isn’t all that useful in determining which issues to buy. A look at the closing price from Tuesday January 8, shows that the price of the B series shares is $25.80. So that makes the current yield 7.75%. While the C series at the same time had a price of $23.26 and a current yield of 7.25%. Looking at YTW (yield to worst) the B series yield is ~6.25% vs. 7.25% for the C series.

With less than two years until the call date for the B series and with it trading above par, the best yield to compare the two issues is the yield to worst. On that measure, the C series is better. Since our outlook for interest rates is that they are now near their peak and could be decreasing in 2020, we think it likely that the B series will be called. With the market price above par, the market seems to think the same thing. We also think the longer time till the C series is called is better. Having two more years to find a good investment paying more than 7% gives us a much better chance of replacing this income in the event the shares are called.

Preferred Stock Tickers

Preferred stock tickers can be very confusing because there's not a universal one that is adopted by all brokers. The NYSE uses a system where the common stock ticker is followed by the letters PR and then followed, if needed by a letter to indicate a specific issue (xxxpx). If it's a preferred A stock, then the ticker would be xxxpa. This system is incompatible with listing on Nasdaq, where that same format can indicate securities that are not preferred shares.

NYSE Amex uses xxxpx, Yahoo uses xxx-px, Fidelity often uses xxxPRX and E*Trade often uses xxx.pr.x. Quantum Online has a whole page dedicated to this discussion.

| Quote Source | PreferredDesignator | Alabama Power5.20% Pfd Stk | ABC Bancorp9.00% Pfd Sec | Citigroup Capital IX6% TruPS |

| - | ALP-N | BHC- | C-S | |

| - | ALP-N | BHC- | C-S | |

| PR | ALPPRN | BHCPR | CPRS | |

| p | ALPpN | BHCp | CpS | |

| /P | ALP/PN | BHC/P | C/PS | |

| /PR+ | ALP/PRNALP+N | BHC/PRBHC+ | C/PRSC+S | |

| p | ALPpN | BHCp | CpS | |

| PR | ALPPRN | BHCPR | CPRS | |

| - | ALP-N | BHC- | C-S | |

| PR | ALP PRN | BHC PR | C PRS | |

| ' | ALP'N | BHC' | C'S | |

| .P | BHC.P | |||

| PR | ALP PRN | BHC PR | C PRS | |

| p | ALPpN | BHCp | CpS | |

| - | ALP-N | BHC- | C-S | |

| _p | ALP_pN | BHC_p | C_pS | |

| -p | ALP-pN | BHC-p | C-pS |

Now for something a little more complicated

Figure 5 Source

Above is a description of the attributes of the Series A preferred issue from RLJ Lodging Trust (RLJ.PA), which is on our recommended list. The first thing that's different is that rather than listing a coupon rate, it lists a dividend amount. The actual dividend paid is unusual for a couple of reasons.

The amount that will be paid is $1.95 or the dividend on the common shares, whichever is greater. Currently, the dividend on the common shares is only $1.32, so preferred shareholders will be paid $1.95. However, at some point in the future the holders of the Series A preferred could benefit from dividend growth.

Also unusual is that this preferred issue cannot be called and never matures. Holders can convert it to common shares, and under certain conditions the company can force such a conversion, but the shares are not redeemable for cash. Since this preferred issue was originally issued by a company that RLJ acquired, the conversion terms are unfavorable and the common share price needed for the company to force a conversion is several times the current price of the common shares, so conversions are unlikely.

One of the reasons we recommend this preferred issue is that RLJ is healthy enough that the preferred dividends are safe, there's the potential for those dividends to eventually increase and an investor has very little worry that the shares themselves will go away.

Variable Coupon

Now into the deeper end of the pool, take a look at a preferred issue we don’t like from a company we do like (and recommend).

Figure 6 Source

Landmark Infrastructure Partners (LMRK) is a company we like and recommend (especially once it converts to a REIT). It issues several different series of preferred shares that we like, but the one above we do not like.

The sheer complexity of its provisions is one mark against it. It also currently pays a variable (or floating) coupon rate based on LIBOR with a floor of 7%. Given that we think interest rates are at or near their peak and likely to start decreasing in two years, we think fixed rates are a better choice at this time. Further the coupon rate rests to a fixed value of 9% in 2025. While that seems generous now, who knows what rates might be in 2025 (although we suspect that it is likely to be a good rate then too). Also note that the shares are callable starting five days after the rate switches to 9%. If at the time 9% is a high rate for preferred shares, expect Landmark to call the shares. If Landmark calls the shares as soon as it is able, investors won’t collect more than a few days or weeks at the 9% rate.

Some may note that there is yet another reset to higher coupon rates up to 12%. This higher rate would be the result of triggering a Failure to Redeem Clause. These clauses are both an incentive for the company to redeem preferred shares and a bonus to keep shareholders from selling the stock if temporary difficulties prevent the company from performing a redemption action on time. The shareholder should understand that this clause is increasing the rewards of ownership, but if it triggered the risks have increased as well.

Looking at the specific provisions for Landmark Preferred C (LMRKN), the 12% will kick in only if Landmark is unable to redeem all of the shares that shareholders indicated they wanted redeemed. This would only happen if Landmark was unable to borrow sufficient funds (combined with any cash on hand) at a 12% or lower interest rate. Not knowing where interest rates will stand in 2025, it’s possible that Landmark would see that as an attractive rate and choose not to redeem, but we think that's unlikely. The most likely reason for this clause to be invoked would be if Landmark is in significant financial or operating difficulty.

At this time, we think this clause being invoked would be more bad than good. While the current yield on LMRKN is 7.2%, we see LMRKP, with a yield of 7.82% and a fixed coupon of 8%, as a less risky choice. That LMRKN trades at a bigger discount to par than does LMRKP tells us the market sees it the same way.

Using Preferred Stocks for Dividend Growth

Many investors want to have the income their portfolio generates increase over time. While preferred shares mostly offer a fixed dividend, it’s easy to increase the dividends that a position pays over time. Given the generally higher yield one gets from a preferred share than from a common share, one can take the extra and use it to buy more shares. Over time that will produce more dividends from the position, allowing one to maintain purchasing power or even grow purchasing power depending on how much of the dividend is used to buy new shares. Personally, I like very much to invest in high-yield preferred stocks. The high yields are offered by many preferred stocks are much higher than those offered by most "dividend growth" stocks. Dividend growth stocks tend to trade based on high valuations and the yields are not very juicy. So by re-investing part or the whole dividend from preferred stocks, income investors can achieve a better dividend growth portfolio than just by investing in dividend growth stocks. This is one of the reasons we offer to our investors (members of “High Dividend Opportunities” our Preferred Stock Portfolio that includes over 50 of the best preferred stock that conservative income investors can choose from. The portfolio currently yields 7% with many opportunities well over 8% yield). Our criteria is to target mispriced preferred with a high yield so that our investors can generate a high level of income for both spending money or for re-investment.

Final Thoughts

- Preferred shares offer one of the safest way for income investors and retirees to generate recurrent income.

- While an investment in preferred shares isn’t quite as much safe as buying bonds, the investor gets better liquidity, lower purchase costs, higher yields, and limited participation in capital gains growth.

- While an investment in preferred shares doesn’t offer as much opportunity for capital gains and dividend growth, the investor gains lower share price volatility, higher yields, and in most cases the likelihood that they will get their money back.

- Common stocks are not the only way to generate dividend growth. Since many preferred stocks offer yields that are much higher than their respective common stock, income investors can generate dividend growth by re-investing part or all of the dividends.

- Understanding preferred shares will allow investors to select preferred stocks that will add a solid income base to their portfolios.

- HDO offers a full preferred stock and bond portfolio as well as our core portfolio has a large number of preferred stocks.

Thanks for reading! If you liked this article, please scroll up and click "Follow" next to my name to receive future updates.

High Dividend Opportunities, The #1 Service for Income Investors and Retirees

We are the largest community of income investors and retirees with over 2400 members. Our aim is to generate immediate high income. We recently launched our all-Preferred Stock & Bond portfolio for safe high-yields ahead of a weaker economy and market volatility.

Join us today and get instant access to our model portfolio targeting 9-10% yield, our preferred stock portfolio, and income tracking tools. You also get access to our report entitled "Our Favorite Picks for 2019"

START YOUR FREE TRIAL HERE

Disclosure: I am/we are long LMRKN, RLJ.PA, UMH.PC. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.