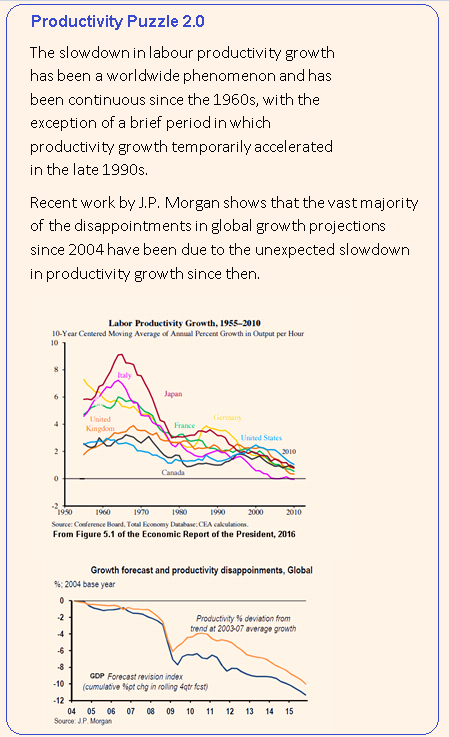

上次在美国经济的心病里说起美国经济效率一事,美国的经济效率增长缓慢已经多年了,但为何,大家也说不清。

《金融时报》网站有一博文收集了这一专题上几乎所有的(经济)论文集(32篇),有意思。

【后记】2016.04.03

这是一篇新的

Gavyn Davies:The internet and the productivity slump

Productivity and innovation stagnation, past and future: an epic compendium of recent views

Maybe you’re aware that productivity growth has been abysmal in recent years.

Maybe you’ve even read Robert Gordon’s new book — or just one of the many summaries and critical reviews — and you worry gravely about what this means for future living standards.

And maybe you’re also at least somewhat aware of the endless arguments about whether productivity growth is measured appropriately, whether all the “low-hanging fruit has been picked”, whether anyone understands the relationship between total-factor productivity growth and investment, and (of course) whether automation will destroy or bolster the labour market of the future.

But you have a social life. Who has time to read, in addition to the 750 pages of Gordon’s book, all of these arguments? You need some nerd to compile all the takes in one place. Such a futile and stupid gesture should be done on somebody’s part.

I’m just the guy to do it.

Just one comment about the compilation of studies and ideas that follows: If you read all these points and emerge thinking you understand productivity growth and its drivers, you might be smarter than a lot of very smart people, but more likely you haven’t given enough thought to the issue.

What environments are most conducive to meaningful innovation? Are these ecosystems defined by institutions that can be copied or by mysterious, unidentifiable factors (endogeneity vs exogeneity)? How do new inventions lead to faster economic growth? What’s the best way to translate abstract ideas about living standards and technological progress into stuff we can count? All of these questions remain subject to vigorous debate.

Economists lack a coherent theory for what generates or stifles total-factor productivity growth. Some public policies and environmental conditions during past productivity booms and slumps appear correlated and suggestive, which is a useful starting point for any discussion. But as with the related debates about automation and labour, the history from which to draw lessons is short and the lessons themselves aren’t clear.

That’s not a reason to be nihilistic about our ability to ever understand anything about productivity. It’s just that we might have to continue stumbling our way toward a better understanding rather than arriving at it smoothly and with any justifiable conviction.

And we should be especially careful to avoid simply extrapolating from the recent past. One day we might all suddenly awake in a different world and wonder how we failed to realise the ground had been shifting beneath our feet all along.

———————————

———————————

The list is US-centric, though many of the views presented below also apply to the wider global trend. The best way to read it is probably to skim the excerpts in bold in search of arguments you haven’t before seen, and then read those passages in full or click through the links. And as you read, keep in mind the difference between overall labour productivity growth and its subcomponent total-factor productivity growth. Entries about both are included.

In alphabetical order, by last name of original source or writer:

1. “Perhaps what enabled the United States to become more innovative than all other countries in the 19th century and then come to dominate technology, paving the way to the second industrial revolution, were its policies and the institutional structure lying behind these,” write Daron Acemoglu, Jacob Moscona, and James A Robinson. “If so, it is plausible that the potential for growth of the American economy in the next several decades will also depend not just on exogenous technological constraints, but on these institutions. We do not get answers to these critical questions from Gordon.” The most important of these early institutions was the Post Office, primarily because of its role in helping Americans secure intellectual and physical property rights. (Acemoglu, Moscona, Robinson)

——

2. For mismeasurement to be a useful explanation of the slowdown in productivity growth, the specific mismeasurements of the present must be worse (in the same direction on net) than those of the past. They’re not, according to the economists David Byrne, John G Fernald, and Marshall B Reinsdorf in a Brookings paper. (Byrne, Fernald, Reinsdorf)

——

3. Young, innovative startups are struggling to grow into large companies, though the reasons why are unclear. Ben Casselman looks at research by economists Scott Stern and Jorge Guzman and writes: “Startups as a whole may be declining, they find, but the kind of entrepreneurship that economists care the most about — fast-growing, innovative companies like Amazon — hasn’t shown the same downward trend; in fact, in the past few years, those kinds of startups have surged in number. But all is not well. Stern and Guzman find that fewer of those ambitious startups are successfully becoming big companies. Put another way, the U.S. may have as many would-be Bezoses as ever, but it’s getting fewer Amazons.” (Ben Casselman, citing Scott Stern and Jorge Guzman)

——

4. Pessimists about future total factor productivity growth “are concerned that manufacturing’s contribution to overall TFP growth will decline as the sector’s nominal share of output continues to shrink, while rising demand for services with little measured TFP growth, such as health care, will exert an additional drag on aggregate TFP”, writes the the Congressional Budget Office in a mostly neutral summary. And optimists might respond that “recent innovations in information technology, communications, medicine, and elsewhere may yield substantial growth well into the future. They also note that, over the long term, TFP growth is limited only by the ability of innovators to develop new technologies, and that a larger population—especially a larger global population—makes possible a larger pool of talent to be devoted to research, and thus opens up more potential for innovation.” (Congressional Budget Office)

——

5. A useful caveat, also from the CBO: “It bears emphasis that measured TFP growth applies only to the growth of measured output, which is at best a poor proxy measure of improvements in well-being resulting from economic progress. Indeed, innovations could continue to provide significant growth in human welfare—for example, further decreases in mortality—without enhancing conventional measures of TFP. Conversely, it would be possible for innovations to contribute to measured TFP growth but to be offset by other developments, such as environmental deterioration, that are not measured in the NIPAs.” (Congressional Budget Office)

——

6. A pessimistic outlook on future productivity growth is likely the result of a failure of imagination, writes Tyler Cowen. Don’t forget that “thanks to greater political and economic freedom all over the world, more individual geniuses have the potential to contribute to global innovation than ever before. … It’s also worth remembering that many past advances came as complete surprises. Although the advents of automobiles, spaceships, and robots were widely anticipated, few foretold the arrival of x-rays, radio, lasers, superconductors, nuclear energy, quantum mechanics, or transistors.” (Tyler Cowen)

——

7. Diane Coyle looks at research that investigates the links “between the microeconomics of corporate behaviour and the macroeconomic aggregates” and writes that we have much to learn about the role of global supply chains in generating economic growth. She concludes:

Gross domestic product does not capture increasing supply-chain participation, or the range of intermediate goods being produced and the character of the cross-border networks of businesses involved.

The moral is that discussion of the productivity puzzle is missing some key questions. While much research has analysed the macroeconomic relationships, and some (like this by NIESR) has looked at performance at the level of individual companies, the link between flat productivity in recent years and the geography and complexity of supply-chain networks needs to be explored.

——

8. Whatever the accuracy of current measures, over time the ability to measure productivity growth will improve, writes Citi GPS. Some of the improvements will be applied retroactively. The authors point to the changes made to the national accounting statistics in 2013, when spending on certain intangibles were recategorised as investment, adding:

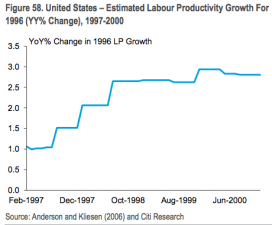

In this context, it is worth noting that measures of GDP and productivity growth in the mid-1990s were revised up, sometimes substantially, as time went on. For instance, Figure 58 shows that LP growth for 1996 was revised up from roughly 1% originally to close to 3% eventually.

(Citi GPS)

——

9. We normally think of competition as a spur to innovation, but Chris Dillow writes that it can also be an obstacle to investment. “The fear of competition from future new technologies can inhibit investment today: no firm will spend £10m on robots if they fear a rival will buy better ones for £5m soon afterwards. As someone said, it is the second mouse that gets the cheese.” (Chris Dillow, also here)

——

10. The socio-organisational changes required to transform new technologies into faster productivity growth have yet to materialise. Dillow again: “IT should make it easier to communicate knowledge, but this only raises productivity if it is accompanied by a breaking down of silos and methods to facilitate co-operation and the exchnage of ideas within companies. It also should facilitate working from home, which could increase aggregate productivity by reducing house prices thus shifting spending away from a sclerotic sector of the economy towards more dynamic ones.” (Chris Dillow)

——

11. The economy’s digitisation means that reorganizing the economy’s workflows to accommodate new innovations no longer requires much labour to install them and integrate them into the way that companies and organisations operate. (Barry Eichengreen at Project Syndicate)

——

12. Look to the possible range of application when considering the economic potential of new innovations, writes Barry Eichengreen. “Optimists point to the fact that currently promising innovations include new tools (quantum computers), materials (graphene) and processes (genetic modification) which, by their nature, would seem to have a broad range of potential applications. They point to the scope for robotics to supplement human brain- and muscle-power in a wide range of activities. They point to the Internet of Things as promising to connect embedded devices across the economy.” (Barry Eichengreen in Secular Stagnation: the Long View)

——

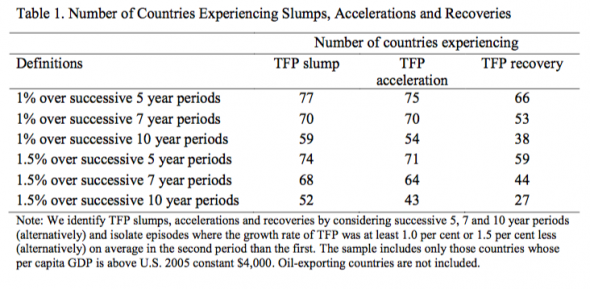

13. That total-factor productivity growth has slowed in advanced economies is well-known. But Barry Eichengreen, Donghyun Park, and Kwanho Shin find that the TFP slowdown has been global. Having looked at dozens of prior episodes of TFP slumps, they identify factors that correlate positively and negatively with such slowdowns, but do not necessarily explain them. “We find a negative association between the incidence of TFP slumps and educational attainment as measured by average years of schooling”, they write. “Countries with stronger political systems as measured by their Polity2 scores are less susceptible to TFP slumps.” (Eichengreen, Park, Shin in The Global Productivity Slump: Common and Country-Specific Factors)

——

14. Furthermore, the “nature of productivity slumps is likely to differ across countries at different income levels,” write Eichengreen, Park, and Shin. “For example, in middle-income countries slower TFP growth is likely to be associated with the process of reallocation of labor from agriculture to manufacturing having run its course. Productivity slumps in high-income countries, in contrast, are likely to be associated with the transition to services, where productivity gains are more difficult to achieve.” (Eichengreen, Park, Shin)

——

15. A counterintuitive point, also from Eichengreen, Park, and Shin: “In contrast, countries with high investment shares of GDP are more susceptible to [Total Factor Productivity] slumps, consistent with a tradeoff between extensive and intensive growth that places a priority on, respectively, capacity expansion and productivity growth.” A potential explanation is that high TFP growth often leads investment in addition to following it. Firms react to new ideas and inventions, not wanting to fall behind competitors. And when investment does follow as a response to new innovations, then either it will be exuberantly wasteful (and thus lead to slower TFP growth), or some of it might be useful require a lag before it pays off, introducing sudden changes to the prevailing ways of doing business. (Eichengreen, Park, Shin)

——

16. Finally, in addition to slumps there have also been dozens of historical instances of total-factor productivity growth recoveries (slumps followed by accelerations):

——

17. Restrictive land-use regulations have led to unaffordable housing in dense urban areas, preventing the agglomeration effects that translate into accelerating productivity growth. (Jason Furman, citing Chang-Tai Hsieh and Enrico Moretti)

——

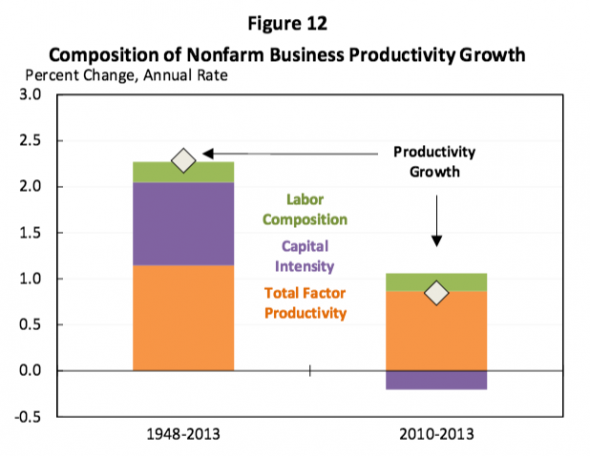

18. Recent pessimism about future productivity growth is unjustified because “averages over longer windows are better predictors of productivity growth than averages over shorter windows,” writes Jason Furman. He adds that the recent slowdown in productivity growth can be largely blamed on a shortfall in capital investment rather than the underlying pace of innovation:

Figure 12 shows that the principal shortfall between labor productivity growth in this recovery and the historical average has been a reduction in the increase of capital intensity, or business investment, not total factor productivity growth (TFP).

This is important because there is good reason to believe that the relatively slow investment was the result of crisis-induced deleveraging, a capital overhang in the wake of the reductions in output, and the implications of a standard accelerator model for investment. As such, it would not be something one would want to extrapolate forward over the next decade or two, while TFP may be more of a gauge of the underlying ability of the U.S. economy to innovate.

——

19. “Transformative innovation really is happening on the Internet,” writes Greg Ip. “It’s just not happening elsewhere.” Ip highlights research by the economist Michael Mandel, runs through examples of disappointments (such as the deterioration of quality in air travel), and adds:

There’s no simple explanation for why innovative breakthroughs outside technology have been so elusive.

One reason may be that industry must devote more of its innovative efforts to ensuring its products are safer and less environmentally harmful, which is good for society but doesn’t raise [measured] productivity.

Mr. Mandel notes that in 2000, the Food and Drug Administration had 12 employees for every 1,000 in the industries it oversees; now, it has 18. He thinks the FDA could spur innovation by considering how much more efficiently a new therapy can be administered, not simply its efficacy relative to one already on the market.

Another explanation is that as knowledge accumulates, truly transformative discoveries become harder. A 2012 article in Nature Reviews Drug Discovery found that the number of new drugs approved per $1 billion spent on research and development had halved roughly every nine years since 1950.

(Greg Ip)

——

20. In the United States, Big Data is becoming an increasingly important part of the economy, but the Bureau of Economic Analysis doesn’t count spending on it as part of GDP (under investment). This ommission is hard to reconcile with the fact that spending on R&D does qualify as investment. The economist Michael Mandel writes that “the BEA does not include investment in big data in GDP: The tech equipment and the programming, yes, but not the actual labor and costs necessary to collect and clean the data. For example, when a hospital employs medical coders to clean up their electronic patient records, that coder’s salary is recorded as an expense, but not as a contribution to GDP. Similarly, the costs of converting from paper to electronic records is not being counted a part of GDP.” (Michael Mandel in Why GDP and productivity growth may be underestimated)

——

21. Furthermore, “the government does a terrible job measuring cross-border data flows,” adds Michael Mandel, “because many of them do not leave a monetary footprint. To the extent that the US holds a commanding position in cross-border data trade, this omission may be important for GDP and productivity growth.” (Michael Mandel in Why GDP and productivity growth may be underestimated)

——

22. Michael Mandel also finds that innovation leads investment in the US. Mandel estimated the domestic investments of non-financial companies and found the top category was “telecom and cable providers, followed by energy production companies, and then technology and Internet companies”. He adds:

The rise of wireless and broadband, energy production innovations such as hydraulic fracturing and horizontal drilling, and the mobile app/Internet boom are creating new markets and new investment opportunities. Would energy companies be spending so much money drilling in the U.S. if it wasn’t for new production technique that made domestic oil and gas production more profitable? Would the telecom companies be spending so much on expanding old analog wired networks?

Conversely, the broad investment drought may be linked to “uneven innovation”—that is, rapid innovation in some areas is combined with a lack of commercially successful breakthroughs in other areas such as material sciences and healthcare.

(Michael Mandel in US Investment Heroes of 2015: Why Innovation Drives Investment)

——

23. In the Journal of Economic Perspectives, Joel Mokyr, Chris Vickers, and Nicolas L Ziebarth write:

[We] are skeptical for a number reasons that a horizon is relatively near—say, within a few decades—either for technological progress or for the widespread satiation of consumer demand.

First, we do not foresee humanity running out of pressing technological problems anytime soon. In many cases, these problems are an outgrowth of previous technological advances. For example, the need for clean energy generation is due to industrialization and its resulting greenhouse gases in the first place. Another striking example is the need for new antibiotics to the treat the bacteria that have become resistant to the first-generation of such wonder-drugs as penicillin and sulfa.

We also expect that competition between firms, nations, and major trading blocs will stimulate continued efforts at technological gains. Even 18th-century British writers (such as Mildmay quoted earlier) who were suspicious about the effects of technological change for workers felt compelled to accept the innovations if only to ensure that Britain did not fall behind.

Finally, there is an underappreciated growth in the tools available for science and technology researchers. Across the sciences, extraordinary large amounts of data can now be stored and searched. New findings can rapidly be transmitted across the global networks of science and research…One field that has been particularly affected by the development of new tools is genetics, particularly the polymerase chain reaction, which has seen the cost of sequencing a single human genome decline from $3 billion spent by the Human Genome Project to close to $5,000 in 2013 (Hayden 2014).

——

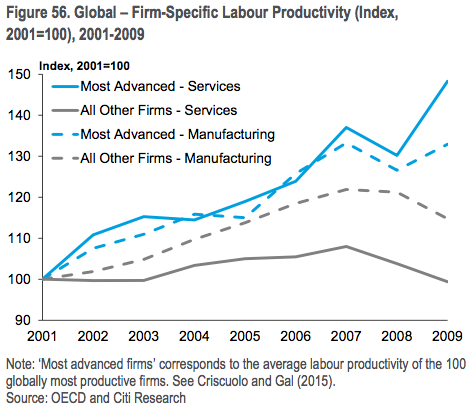

24. Globally, in both the manufacturing and services sectors, productivity growth has remained impressive for frontier firms (the 100 firms in each sector with the fastest productivity growth) throughout the 2000s. But according to an important OECD report from last year, productivity growth for all other firms weakened severely, suggesting that productivity-boosting innovations at the frontier remain possible, but these innovations are not diffusing through the economy.

Here’s a chart from Citi based on the OECD report:

(OECD, chart from Citi GPS)

(OECD, chart from Citi GPS)

——

25. The problem of diffusion is especially acute in the services sector, “partly due to low competitive pressures which blunt the incentives to adopt best practices. This partly reflects policy weaknesses and productivity problems in the services sector will become increasingly costly for two reasons. First, the weight of services in our economies will continue to rise. Second, it may hinder the effective functioning of [Global Value Chains] since logistics, finance and communication are the oil that greases the wheels of globalization.” (OECD)

——

26. As for what can be done to accelerate diffusion:

First, global connections, via trade, FDI, participation in GVCs and the international mobility of skilled labour.

Second, experimentation by firms – especially new entrants – with new ideas, technologies and business models.

Third, the efficient reallocation of scarce resources to underpin the growth of innovative firms.

Fourth, synergic investments in R&D, skills and organisational know-how – particularly managerial capital – that enable economies to absorb, adapt and reap the full benefits of new technologies.

But OECD countries differ significantly in these four areas, implying that diffusion comes easier to firms in some economies rather than others.

(OECD)

——

27. The productivity growth rate of US hospitals has been underestimated by the official data, which fail to properly adjust for the severity of patient illness, according to a study by John A Romley, Dana P Goldman, and Neeraj Sood. The findings offer tentative counterevidence to the theory of Buamol’s cost disease, writes Austan Frakt. (Romley, Goldman, Sood and Austin Frakt)

——

28. Martin Sandbu argues that if we just look around, we’ll find an astounding amount of waste in the organisational processes of individual companies — notably in the UK, where productivity growth has been especially abysmal in recent years. Quite a lot of suppressed productivity growth would be unleashed if companies did a better job of “tweaking” their way to improvement. And he finds an academic paper in the American Economic Journal that supports the idea:

Igal Hendel and Yossi Spiegel studied the detailed production records of a single US steel mill, with a simple product and straightforward technology – the sort of industry where you would think any available efficiency gains would have been exhausted. Not so: after accounting for some additional investment and remuneration changes, the researchers found a large and steady rise in output per worker. In their own words: “Learning by experimentation, or tweaking, seems to be behind the continual and gradual process of productivity growth.”

There are some deep lessons to draw for policy thinking from the importance of “tweaking”. One is that “capacity is not well defined”, as Hendel and Spiegel write. Another is that productivity gains may rely on protecting or putting in place conditions where workers themselves can and want to figure out how to do things better. This complements the conjecture that labour market flexibility may be behind the UK’s poor productivity growth.

(Martin Sandbu’s Free Lunch, citing Igal Hendal and Yossi Spiegel)

——

29. Why can’t mismeasurement account for a substantial part of the productivity growth slowdown? From the abstract to a new paper by Chad Syverson:

First, the productivity slowdown has occurred in dozens of countries, and its size is unrelated to measures of the countries’ consumption or production intensities of information and communication technologies (ICTs, the type of goods most often cited as sources of mismeasurement).

Second, estimates from the existing research literature of the surplus created by internet-linked digital technologies fall far short of the $2.7 trillion or more of “missing output” resulting from the productivity growth slowdown. The largest—by some distance—is less than one-third of the purportedly mismeasured GDP.

Third, if measurement problems were to account for even a modest share of this missing output, the properly measured output and productivity growth rates of industries that produce and service ICTs would have to have been multiples of their measured growth in the data.

Fourth, while measured gross domestic income has been on average higher than measured gross domestic product since 2004—perhaps indicating workers are being paid to make products that are given away for free or at highly discounted prices—this trend actually began before the productivity slowdown and moreover reflects unusually high capital income rather than labor income (i.e., profits are unusually high).

——

30. Innovation slows in the wake of a deep recession and the corresponding shortfall in demand, as businesses are fighting for survival and don’t spend much money and time on inventive ideas for the long-term, says Martin Wolf. “I would argue — and this is very much in keeping with the way many Keynesians thought in the 1950s and 1960s — that actual supply and potential supply converge, and that actual supply is driven in the short to medium term by demand.” Lack of investment now leads to shrinking potential supply, and shrinking potential supply feeds back into less investment now, a vicious circle. (Martin Wolf on Alphachatterbox)

——

31. “Recent evidence on technology diffusion patterns points to a mixed picture,” conclude the authors of the World Intellectual Property Report. “On the one hand, it suggests that more recent technological innovations have diffused more rapidly to low- and middle-income countries. On the other hand, it also suggests that more recent innovations have seen a greater gap in how intensively economies use technology.” In other words, innovations that originate in the advanced economies at the technological frontier spread quickly to other economies, but these new innovations are absorbed at differing speeds across countries. (World Intellectual Property Organization)

——

32. Acknowledging the conventional pessimistic arguments, the World Intellectual Property Report also lists three reasons for optimism about future innovation:

- “Never before has the world invested so many resources in pushing the global knowledge frontier. While the financial crisis has left a mark in some countries, R&D spending was far less affected than economic output. Moreover, the emergence of China as an innovator – along with the rapid growth of R&D expenditure in the Republic of Korea – has increased the diversity of the global innovation landscape.”

- “There still appears to be significant potential for innovation to generate productivity gains and trans- form economic structures. ICTs have already made important contributions to growth. However, if his- tory is any guide, there is more to come. The growth contributions of major technological breakthroughs have only occurred with decades-long delays. The next generation of ICT innovations – centered on artificial intelligence – holds plenty of promise.”

- “There are numerous other fields of innovation that hold potential to spur future growth. … For example, the growing use of 3D printers and intelligent robots may well prompt the reorganization of supply chains in many sectors, with possibly sizeable growth effects. Other innovation fields showing significant promise include genetic engineering, new materials and various forms of renewable energy. New technologies have also dramatically improved the research tools that drive the process of scientific discovery. In particular, ICT-driven techniques such as big data analysis and complex simulations have opened new doors for research advances across many areas of technology.”