为什么以及如何需要改革资本主义

https://www.linkedin.com/pulse/why-how-capitalism-needs-reformed-parts-1-2-ray-dalio/?published=t

Ray Dalio 创始人、CIO 导师、Bridgewater 董事会成员 2019 年 4 月 5 日

概括

我很幸运,在一个中产阶级家庭长大,父母很照顾我,能上好的公立学校,并进入一个为我提供平等机会的就业市场。 我从小就相信,拥有平等的机会获得基本护理、良好的教育和就业是公平的,也是最有利于我们集体福祉的。 拥有这些东西并用它们来建设美好的生活就是实现美国梦的意义。

12岁时,有人可能会说我成为了一名资本家,因为那时我把自己做各种工作赚来的钱,比如送报纸、割草坪、当球童,在股市火爆的时候投入股市。 这让我迷上了经济投资游戏,过去 50 年的大部分时间我都在玩这个游戏。 为了在这场游戏中取得成功,我需要对经济和市场如何运作有实际的了解。 多年来我对大多数国家大多数经济体系的接触告诉我,赚钱、储蓄并将其转化为资本(即资本主义)的能力是人们提高人民生活水平的最有效的激励因素和资源配置因素 。 多年来,我还看到资本主义的发展方式对大多数美国人来说效果不佳,因为它为富人带来自我强化的螺旋式上升,为穷人带来螺旋式下降。 这造成了不断扩大的收入/财富/机会差距,对美国构成了生存威胁,因为这些差距带来了破坏性的国内和国际冲突并削弱了美国的状况。

我认为大多数资本家不知道如何很好地分配经济蛋糕,大多数社会主义者也不知道如何很好地做大经济蛋糕,但我们现在正处于一个关键时刻:a)不同意识形态倾向的人们将共同努力 巧妙地重新设计系统,使蛋糕既能被分割,又能很好地成长,否则b)我们将发生巨大的冲突和某种形式的革命,这将伤害大多数人并使蛋糕缩小。

我相信所有美好的事物走向极端都可能会自我毁灭,一切都必须进化或消亡。 对于资本主义来说现在也是如此。 在这份报告中,我阐述了为什么我认为资本主义现在对大多数美国人不起作用,我诊断了为什么它产生了这些不充分的结果,并就如何改革它提出了一些建议。 由于这个报告比较长,我分两部分来介绍:第一部分概述问题,第二部分提出我的诊断和改革建议。

为什么以及如何需要改革资本主义

在解释为什么我认为资本主义需要改革之前,我将解释一下我来自哪里,这塑造了我的观点。 然后,我将展示一些指标,让我清楚地知道资本主义所产生的结果与我认为的我们的目标不一致。 然后,我将给出我的诊断,解释为什么资本主义会产生这些不充分的结果,并通过提供一些关于如何对其进行改革以产生更好的结果的想法作为结论。

第1部分

我从哪里来

我很幸运,成长在一个中产阶级家庭,父母很关心我,在一所好的公立学校接受教育,并能够进入一个为我提供平等机会的就业市场。 有人可能会说我实现了美国梦。 当时,我和我周围的大多数人都相信,我们作为一个社会必须努力为每个人提供这些基本的东西(特别是平等的教育和平等的工作机会)。 这就是机会均等的概念,大多数人认为它既公平又富有成效。

我想我在 12 岁时就成为了一名资本家,因为那时我把做各种工作(比如送报纸、割草坪、当球童)赚来的钱投入到了 20 世纪 60 年代股市火爆的股票市场。 这让我迷上了投资游戏。 尽管我没有足够的钱支付学费,但我还是上了大学和研究生院,因为我可以从政府学生贷款计划中借钱。 然后我进入了一个为我提供平等机会的就业市场,我就上路了。

因为我喜欢玩市场,所以我选择成为一名全球宏观投资者,这也是我大约 50 年的职业生涯。 这要求我对经济和市场如何运作有实际的了解。 这些年来,我接触过大多数国家的各种经济体系,并逐渐理解为什么赚钱、储蓄并将其投入资本(即资本主义)的能力是人们和人们的有效激励因素。 提高人民生活水平的资源配置者。 这是一个效果

它是人们的有效激励者,因为它用金钱奖励人们的生产活动,这些金钱可以用来获得金钱可以买到的一切。 它是资源的有效配置者,因为创造利润要求所创造的产出比创造它的资源更有价值。 富有成效会导致人们赚钱,从而导致他们获得资本(这是他们在投资工具中的储蓄),这既可以通过在以后需要时提供资金来保护储蓄者,也可以为那些能够将其与他们的想法结合起来的人提供资本资源 并将其转化为提高我们生活水平的利润和生产力。 这就是资本主义制度。

多年来,我看到了共产主义的来来去去,也看到了所有经济运行良好的国家,包括“共产主义中国”,都因为这些原因而将资本主义作为其制度的一个组成部分。 共产主义“各尽所能、按需分配”的理念被证明是天真的,因为如果没有得到相应的回报,人们就没有动力去努力工作,繁荣就会受到影响。 资本主义将薪酬与生产力联系起来,创造了高效的资本市场,促进储蓄和购买力的可用性,从而提高人们的生产力,效果要好得多。

我还从机械的角度而不是意识形态的角度研究了国家成功和失败的原因,因为我以实际方式处理经济和市场的能力就是我的得分标准。 如果您想查看我的研究摘要,了解各国成功和失败的因素,请点击这里(链接)。 简而言之,不良的教育、不良的文化(阻碍人们有效地共同运作的文化)、落后的基础设施和过多的债务会导致糟糕的经济结果。 当以下条件多而不是少时,就会出现最好的结果:a) 教育和工作机会均等,b) 整个高中时期良好的家庭或类似家庭的教育,c) 大多数人认为在一个系统内的文明行为 公平,以及 d) 自由且监管良好的商品、服务、劳动力和资本市场,为大多数人提供激励、储蓄和融资机会。

当然,这些年来我一直在密切关注各国的这些事情,尤其是在美国。 我现在将展示我们的体系正在产生的结果,这些结果使我相信资本主义对大多数美国人来说效果不佳。

为什么我相信资本主义对大多数美国人来说效果不佳

在本节中,我将向您展示大量描绘情况的统计数据和图表。 也许有太多不适合您的口味。 如果你觉得你已经过了收益递减的阶段,我建议你要么通过阅读粗体句子来快速浏览其余部分,要么跳到下一节,这解释了为什么我认为不改革资本主义将是一个错误。 对美国的生存威胁。

首先,我想向您展示富人和穷人之间存在的差异。 由于这些差异隐藏在平均值中,我将经济分为收入最高的 40% 和收入最低的 60%。[1] 这样我们就可以看到底层 60%(即大多数)的生活是什么样的,并可以将他们与顶层 40% 的生活进行比较。 我的发现显示在这项研究中。 虽然我建议您阅读它,但我会很快给您提供一些统计数据来描述这里的情况。

几十年来,大多数人的实际收入几乎没有增长,甚至没有增长。 如下左图所示,自 1980 年以来,处于底层 60% 的黄金年龄工人的实际收入(即经通胀调整后)没有增长。而当时顶层 10% 的人的收入翻了一番,并且 [i] 如右图所示,长大后收入高于父母的儿童比例已从 1970 年的 90% 下降到如今的 50%。 这是针对全体人口的。 对于大多数 60% 以下的人来说,前景更糟。

[二]

[三]

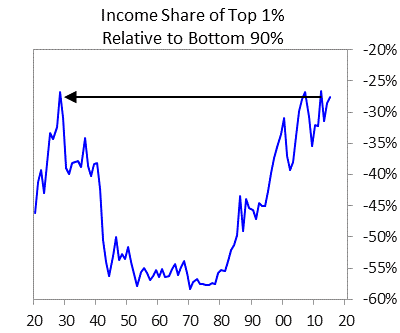

如下图所示,收入差距与以往一样高,贫富差距达到 20 世纪 30 年代末以来的最高水平。 如今,最富有的 1% 人口的财富超过了最底层 90% 人口的财富总和,这与 1935-40 年间(这一时期开启了一个时代)存在的贫富差距是一样的。 对于大多数国家来说,都存在巨大的内部和外部冲突)。 现在,收入最高 40% 的人拥有的财富平均是收入最低 60% 的人的 10 倍以上。[iv] 这一数字比 1980 年的六倍有所增加。

没有为此图像提供替代文本

[v]

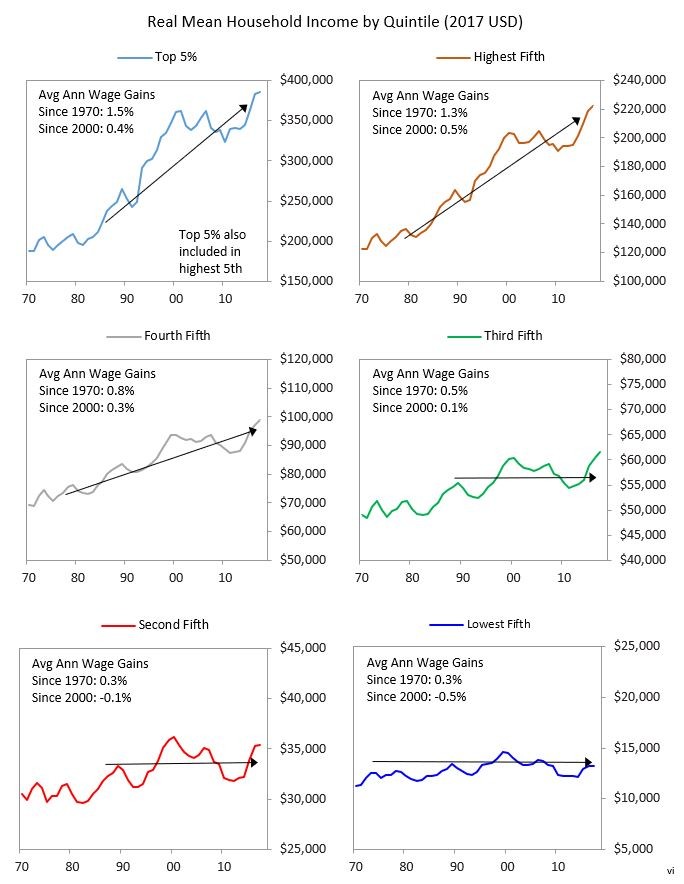

下面的图表显示了自 1970 年以来总人口五分之一的实际收入增长情况。问问自己,你属于哪一个。这可能已经给了你你的观点。 我的目标是向您展示更广阔的视角。

没有为此图像提供替代文本

大多数人在

底层 60% 是穷人。 例如,底层 60% 的人中只有大约三分之一将其收入保存为现金或金融资产。[vii] 根据美联储最近的一项研究,40% 的美国人在紧急情况下很难筹集 400 美元 .[八]

他们越来越陷入贫困。 下图显示了在 10 年内处于底部五分之一的人晋升到中间五分之一或更高的几率。 这些几率从 1990 年的约 23% 下降到 2011 年的 14%。

[九]

虽然大多数美国人认为美国是一个经济流动性和机会都很大的国家,但其经济流动性目前是发达国家底层最差的国家之一。 如下图所示,在美国,收入最低四分之一的人有 40% 的机会拥有收入最低四分之一的人(在父亲收入最高的年份),而收入最高四分之一的人只有约 8% 的机会拥有收入最低四分之一的人。 一位父亲排在最后四分之一,表明晋升的平均概率只有一半,也是所分析国家中概率最低的之一。 在一个机会均等的国家,这种情况是不存在的。

[X]

一个人的收入增长源于一个人的生产力增长,而生产力的增长又源于一个人的个人发展。 那么让我们看看我们如何培养人才。 让我们从孩子开始吧。

对我来说,最无法忍受的情况是我们的系统无法照顾好这么多的孩子。 正如我将要展示的那样,他们中的许多人贫穷、营养不良(身体上和精神上)并且受教育程度低。 进一步来说:

美国的儿童贫困率目前为 17.5%,并且几十年来一直没有明显改善。[xi]2017 年在美国,约 17% 的儿童生活在粮食不安全的家庭中,其中至少一名家庭成员无法获得足够的食物 [xii] 联合国儿童基金会报告称,美国生活在粮食不安全家庭的儿童比例低于平均水平(美国的情况比波兰、希腊和智利更差)。[xiii] ]

这些情况的多米诺骨牌效应代价高昂。 收入低、学校资金不足、家庭对孩子的支持薄弱,导致学业成绩不佳,进而导致人们生产力低下、收入低下,成为社会的经济负担。

尽管美国教育体系中有一些亮点,例如我们为数不多的几所优秀大学,但在特定教育水平的标准化考试中,美国人口的整体得分相对于其他发达国家来说非常差。 进一步来说:

从最受尊敬的 PISA 测试成绩来看,美国目前在发达国家中排名倒数第 15 个百分点。 如下所示,美国的得分几乎低于意大利和希腊以外的所有发达国家。 这阻碍了许多人获得足够的生活水平和美国的竞争力。

[十四]

这些分数的差异与贫困程度有关,即高度贫困学校(以有资格获得免费/减价午餐的学生比例来衡量)的 PISA 测试成绩比贫困程度最低的学校低约 25%。

[十五]

在发达国家(即经合组织)国家中,美国的优势学校和劣势学校之间的师资短缺差异排名第三。

[十六]

统计数据显示,与大多数其他国家相比,美国在满足贫困学生的需求方面做得很差。 这里还有一些:

与经合组织国家的平均水平相比,美国接受过至少一年学前教育的弱势学生比例较低。[xvii]

在经合组织国家中,截至 2008 年,美国的儿童贫困率在没有工作的单亲家庭中排名第二——这是社会安全网的失败。[xviii]

这些糟糕的教育结果导致很大一部分学生对工作准备不足,并出现情绪问题,这些问题在破坏性行为中表现出来。 与大多数其他发达国家相比,美国的弱势学生更有可能报告社交和/或情感问题,包括在学校无法融入社会、严重的考试焦虑和对生活的满意度较低。

[十九]

34% 的高贫困学校经历了学生长期缺课的情况,而高收入学校的这一比例仅为 10%。 [xx] 即使在人均收入最富裕的州之一康涅狄格州,也有 22% 的青少年缺课(即缺课)。 ,每年旷课超过 25 天,两门或两门以上课程不及格,或多次停学)或失联(未入学且没有高中学位的年轻人)。[xxi] 康涅狄格州失联的青少年有 5 名 最终被监禁的可能性高出 33%,遭受药物滥用的可能性高出 33%(完整报告链接在此)。

将康涅狄格州学区的高中毕业率与儿童贫困率进行比较,显示出全州范围内的紧密关系:

儿童贫困率提高 1% 相当于毕业率降低约 1%。

[二十二]

在各州,每个学生的支出与教育成果之间存在着密切的关系。

美国各州教育支出和成果的分散情况

[二十三]

美国最近的研究表明,获得食品券的 5 岁以下儿童获得了更好的健康和教育成果——高中毕业率估计提高了 18%——这使得他们依赖其他福利计划的可能性大大降低 在以后的生活中。[xxiv]

来自贫困家庭并试图上大学的学生准备不足。 例如,来自收入低于 20,000 美元家庭的学生在 SAT 考试中的平均成绩比来自收入 200,000 美元以上家庭的学生差 260 分(满分 1600 分),而且差距还在扩大。 根据 2011 年的一项研究,目前处于收入分配顶部和底部的儿童数量估计比 20 世纪 40 年代初高出 75%。 [xxvi]

然而,生活在较贫困社区的儿童平均每名学生获得的州和地方资助比较富裕社区的儿童少约 1,000 美元。[xxvii] 尽管联邦政府(根据其第一章资助公式)假设其成本 学区每年增加 40% 的资金来教育低收入学生达到与典型学生相同的标准。[xxviii] 因此,低收入地区的学校通常严重资金不足。 平均而言,公立学校 94% 的教师必须自掏腰包购买用品(通常包括基本清洁用品),而在最贫困的公立学校情况更糟。 [xxix]

一个相关的问题是,许多必须应对这些压力条件的教师工资过低且不受尊重。 在我的成长过程中,医生、律师和教师是最受尊敬的职业。 现在,教师的收入仅为其他大学毕业生收入的 68%,这比其他 OECD 发达国家的收入要低得多。 [xxx] 即使考虑周收入来调整学年长度并控制其他因素, 根据影响工资(如年龄和经验年限),2017 年教师的收入比同等工作者低 19%,而 1994 年仅低 2%。[xxxi] 更糟糕的是,他们没有得到应有的尊重。

收入/教育/财富/机会差距加剧了收入/教育/财富/机会差距:

富裕社区的公立学校往往比贫困社区资金充足得多,这加剧了收入/财富/机会差距。 造成这种资金缺口的主要原因之一是宪法将教育列为州问题,大多数州将地方学校主要由当地资助,因此富裕的城镇拥有资金充足的公立学校,而贫困的城镇则拥有资金不足的公立学校。 更具体地说,大约 45% 的学校经费来自地方政府,主要通过财产税,而只有大约 8% 来自联邦政府,其余来自州政府。 [xxxii] 因此,学校经费可能存在巨大差异。 各个社区的财富/收入。 此外,收入最高的 40% 的人在孩子的教育上的支出几乎是收入最低的 60% 的人的五倍,而收入最高的 20% 的人在孩子的教育上的支出大约是收入最低的 20% 的人的六倍。 .[xxxiii]

资金不足的公立学校质量受到影响。 例如,PISA 数据显示,师资严重短缺的美国学校的学生在测试中的成绩比师资不短缺的学校的学生低 10.5%。 同样,实验室设备短缺与学生成绩下降 16.7% 相关,图书馆资料短缺与学生成绩下降 15.1% 相关。 [xxxiv]

相比之下,私立学校在学生身上的平均支出要高得多,而且成绩也更好。 美国私立学校的每位学生支出比公立学校多约 70%,2016 年私立学校每位学生的平均支出约为 23,000 美元,而公立学校的平均支出约为 14,000 美元。[xxxv] 这种更高的支出意味着更高的考试 分数:在上一轮PISA测试中,美国私立学校学生在数学、阅读和科学考试中的平均成绩比公立学校学生高出4.3%。 自 2009 年以来的三项 PISA 调查中,私立学校学生的平均得分高出 6.9%。[xxxvi]

毫不奇怪,如今美国人对公立学校的信心比过去五年中的任何时候都要低得多。 如今,只有 29% 的美国人对公共教育系统抱有“很大”或“相当大”的信任。 1975 年,62% 的美国人信任公立学校。[xxxvii]

对我来说,让这么多孩子陷入贫困而不给他们提供良好的教育就相当于虐待儿童,而且这在经济上是愚蠢的。

家庭的弱化和父母的良好引导

也产生了重要的不利影响:

以下是一些统计数据,反映了家庭单位多年来的变化:

1960年,73%的儿童与两个从未离婚的已婚父母生活在一起,13%的儿童生活在没有两个已婚父母的家庭中。 [2] 2014年,生活在没有两个已婚父母的家庭中的儿童比例为38%(现在只有不到一半的儿童生活在有两个父母第一次婚姻的家庭中)。 这些统计数据适用于美国所有家庭的平均水平。 低教育、低收入家庭的家庭支持要少得多。 大约 60% 的父母文化程度低于高中的孩子不生活在有两个已婚父母的家庭中,而只有 14% 的父母大学毕业的孩子生活在这样的家庭中。 [xxxviii]

被监禁的概率与教育水平密切相关:在 28-33 岁的美国人中,35% 的高中辍学男性曾被监禁,而高中毕业生的男性比例约为 10%,大学毕业生的这一比例仅为 2%。 [xxxix]

1991 年至 2007 年间,有父母一方在州或联邦监狱服刑的儿童数量增加了 80%。[xl] 如今,美国估计有 270 万儿童有一方在监狱或看守所,即每 28 名儿童中就有 1 人 ( 占所有儿童的 3.6%)。[xli]

不良的儿童保育和不良教育会导致成年人行为不良,从而导致更高的犯罪率,给社会带来可怕的代价:

美国的监禁率几乎是其他发达国家平均水平的五倍,是新兴国家平均水平的三倍。[xlii] 将人们监禁在监狱中的直接成本是惊人的,并且增长迅速:国家惩教成本在过去二十年里翻了两番 现在每年超过 500 亿美元,消耗每 15 美元普通基金中就有 1 美元。[xliii]

这种糟糕的循环会持续下去,因为犯罪/逮捕记录使找工作变得更加困难,从而降低了收入。 服役时间,即使是相对较短的时期,也会使男性的时薪减少约 11%,每年雇用时间减少 9 周,年收入减少 40%。[xliv]

低教育程度和贫困造成的健康后果和经济成本是可怕的:

例如,对于收入最低 60% 的人来说,自 2000 年以来,过早死亡人数增加了约 20%。[xlv] 来自收入分配最低 20% 的男性的预期寿命比来自收入最高 20% 的男性少约 10 年。 [四十六]

美国几乎是唯一一个过早死亡率持平/略有上升的主要工业化国家。 造成这一变化的最大因素是药物/中毒死亡人数的增加(自 2000 年以来增加了一倍多)和自杀人数的增加(自 2000 年以来增加了 50% 以上)。 [xlvii]

自 1990 年以来,表示去年因费用原因而推迟接受严重疾病治疗的美国人比例大约翻了一番,从 1991 年的 11% 增加到今天的 19%。[xlviii]

失业者或年收入低于 35,000 美元的人健康状况较差,每组中有 20% 的人报告健康状况不佳,大约是其他人群的三倍。[xlix]

据估计,仅美国儿童贫困的影响就会使医疗支出增加 GDP 的 1.2%。[L]

这些情况对美国构成了生存风险。

前面描述的收入/财富/机会差距及其表现对美国构成了生存威胁,因为这些情况削弱了美国的经济,有可能带来痛苦和适得其反的国内冲突,并削弱美国相对于全球竞争对手的实力 。

这些差距削弱了我们的经济实力,因为:

它们减缓了我们的经济增长,因为富人的边际消费倾向远低于缺钱人的边际消费倾向。

它们导致人才发展不理想,并导致大部分人从事破坏性活动而不是贡献性活动。

除了社会和经济方面的不良后果外,收入/财富/机会差距还导致危险的社会和政治分歧,威胁到我们的凝聚力结构和资本主义本身。

我认为,作为一个原则,如果共享预算的人们的经济条件存在很大差距,并且出现经济衰退,那么发生严重冲突的风险就很高。 财富的不平等,特别是当伴随着价值观的差异时,会导致冲突加剧,而在政府中,这会以左翼民粹主义和右翼民粹主义的形式表现出来,并且常常表现为某种类型的革命。 出于这个原因,我担心下一次经济衰退会是什么样子,特别是央行扭转经济衰退的能力有限,而且我们有如此多的政治极性和民粹主义。

问题在于,资本家通常不知道如何很好地分配蛋糕,而社会主义者通常不知道如何很好地做大蛋糕。 虽然人们可能希望当

在这种经济两极分化和恶劣条件存在的情况下,领导人会齐心协力改革体制,既要瓜分经济蛋糕,又要让它做得更好(这当然是可行的,也是最好的路径),他们通常会变得越来越极端,斗争多于合作 。

为了理解民粹主义现象,两年前我做了一个研究,看了14个标志性案例,观察了它们背后的模式和力量。 如果您对此感兴趣,可以在这里阅读。 简而言之,我了解到,当右翼或左翼的强大战士/领导人寻求与反对派作战并击败反对派时,民粹主义就会出现,他们上台并升级与反对派的冲突,这通常会激发相对强大/好斗的领导人周围的冲突。 民粹主义发展最重要的是如何处理冲突,对立势力能否共存共进,还是越来越多地“开战”,互相阻挠、互相伤害,造成僵局。 在最坏的情况下,这种冲突会导致经济问题(例如,通过瘫痪的罢工和示威),甚至可能导致从民主领导转向独裁领导,正如 20 世纪 30 年代许多国家所发生的那样。

我们现在看到世界各地左翼民粹主义者和右翼民粹主义者之间的冲突日益加剧,其方式与 20 世纪 30 年代的情况大致相同,当时收入和财富差距相当大。 在美国,意识形态的两极分化比以往任何时候都更加严重,妥协的意愿也比以往任何时候都少。 左图显示了自 1900 年以来共和党参议员和代表的保守程度以及民主党参议员和代表的自由程度。如您所见,他们都比以往任何时候都更加极端,分歧也更大。 右图显示了自 1790 年以来按党派投票的比例,这是目前历史上最高的一次。 换句话说,他们的极端立场更加极端,而且这些立场比以往任何时候都更加坚定。 我们即将进入总统选举年。 我们可以期待一场地狱般的战斗。

没有为此图像提供替代文本

[李]

不需要天才就能知道,当一个体系产生的结果与其目标如此不一致时,它就需要改革。 在下一部分中,我将探讨为什么它会产生这些不合格的结果,以及我认为应该采取哪些措施来对其进行改革。

第2部分

我对为什么资本主义现在不适用于大多数人的诊断

我相信现实就像一台机器,具有产生结果的因果关系,当结果达不到目标时,人们需要诊断机器工作不充分的原因,然后对其进行改革。 我还相信,大多数事情在历史中一次又一次地发生,通过观察和思考这些模式,人们可以更好地理解现实是如何运作的,并获得永恒和普遍的原则来更好地处理它。 我认为前面所呈现的结果是不可接受的,所以我们首先要看看经济机器是如何产生这些结果的,然后再思考如何对其进行改革。

与左翼民粹主义者和右翼民粹主义者所说的相反,这些不可接受的结果并不是由于 a) 邪恶的富人对穷人做坏事,或者 b) 懒惰的穷人和官僚效率低下,尽管它们确实如此 由于资本主义制度现在的运作方式。

我相信,所有美好的事物走向极端都会变得自我毁灭,一切都必须进化或死亡,这些原则现在适用于资本主义。 虽然对利润的追求通常是创造生产力和为那些有生产力的人提供购买力的有效动力和资源分配器,但它现在正在产生一个自我强化的反馈循环,扩大收入/财富/机会差距,以至于 资本主义和美国梦正处于危险之中。 这是因为资本主义现在的运作方式是,个人和公司发现制定政策和制造技术来降低人力成本是有利可图的,从而减少了人口在社会资源中所占的很大比例。 那些更富有的公司和个人拥有更大的购买力,这会激励那些寻求利润的人将资源转移到生产富人想要的东西(相对于穷人想要的东西),其中包括基本必需的东西,例如为富人提供良好的照顾和教育 -不是孩子。 我们刚刚在大学招生作弊丑闻中看到了这一点。

这种动态的结果是,该体系正在为富人产生自我强化的螺旋式上升,为穷人产生螺旋式下降,从而导致顶层有害的过度行为和底层有害的剥夺。 更具体地说,我相信:

追求利润和集团

食客效率导致了取代人类的新技术的发明,这使得公司运营更加高效,奖励了那些发明这些技术的人,并伤害了那些被这些技术取代的人。 这股力量在未来几年将会加速,目前还没有计划能够很好地应对。

对更大利润和更高公司效率的追求也导致公司在其他国家生产,并用具有成本效益的外国工人取代美国工人,这对这些公司的利润和效率有利,但对美国工人的收入不利。 当然,这种全球化也使得更便宜、或许质量更好的外国商品进入美国,这对外国卖家和美国买家来说都是好事,但对与之竞争的美国公司和工人来说则不利。

由于这两种力量,用于利润的收入份额相对于用于工人的份额有所增加。 下图显示了自 1929 年以来企业收入转化为利润的百分比以及转化为员工薪酬的百分比。

没有为此图像提供替代文本

3. 央行印钞和购买金融资产(这是应对2008年债务危机和刺激经济增长所必需的)推高了金融资产的价格,这有助于使拥有金融资产的人相对于其他人变得更富有 谁不拥有它们。 当美联储(和大多数其他中央银行)购买金融资产以将资金投入经济以刺激经济时,这些金融资产的卖家(他们足够富有,拥有金融资产)a)变得更富有,因为金融资产 资产价格上涨,b)更有可能购买金融资产而不是购买商品和服务,这使得富人变得更富有,并拥有充足的货币和信贷,而大多数穷人则得不到货币和信贷,因为他们的收入较少 信誉良好。 从我从事投资行业的经历来看,在大多数人都极度缺钱的同时,却有大量的投资资金在追逐投资。 换句话说,钱被堵塞在顶层,因为如果你是那些有钱或有赚钱好主意的人之一,你可能会拥有比你需要的更多的钱,因为贷款人会自由地借给你,而投资者会竞相借给你。 把它给你。 另一方面,如果你的财务状况不佳,没有人会借钱给你或投资你,政府也不会提供实质性帮助,因为政府不这样做。

4. 政策制定者过多关注相对于投资回报的预算。 例如,从预算角度来看,不花钱让孩子教育好可能是件好事,但从投资角度来看,这确实是愚蠢的。 从预算角度看待资金并不会导致人们考虑到总体经济状况,例如,它没有考虑到因教育程度低而给社会带来的总体成本。 虽然财政保守派通常会关注预算,但财政自由派通常会借入太多资金,但无法明智地使用这些资金来产生偿还其所承担债务所需的经济回报,因此他们经常以失败告终。 应对债务危机。 预算鹰派保守派和支持支出/借贷的自由派很难集中精力、共同努力并实现良好的“双底线”投资回报(即既产生良好社会回报又产生良好经济回报的投资)。

我认为应该做的事

由于前面解释的原因,我认为资本主义是一个从根本上健全的制度,但现在对大多数人来说效果不佳,因此必须对其进行改革,以提供更多平等的机会并提高生产力。 为了进行更改,我认为需要进行以下操作。

来自高层的领导。 我有一个原则,你不会影响改变,除非你影响那些掌握权力杠杆的人,让他们按照你希望他们改变的方式改变事情。 因此,国家高层需要强大的力量,宣布收入/财富/机会差距为国家紧急状态,并承担起重新设计系统的责任,使其更好地运作。

两党和熟练的政策制定者共同努力重新设计该系统,使其运作得更好。 我相信我们将以两党合作且熟练的方式做到这一点,否则我们会互相伤害。 因此,我认为领导层应该成立一个两党委员会,将来自不同社区的技术人员聚集在一起,制定一项计划,重新设计系统,以同时更好地划分和扩大经济蛋糕。 该计划将展示如何筹集资金并妥善使用/投资以生产良好的产品

双底线回报

清晰的指标可用于判断成功并让负责人对实现目标负责。 在运行我运行的事物时,我喜欢有明确的指标来显示那些负责事物的人正在做什么,并根据这些指标的变化给予奖励和惩罚。 拥有这些将产生实现成功所需的问责制和反馈循环。 在可能的情况下,我会将这种责任落实到个人层面,以鼓励一种责任文化,在这种文化中,个人意识到自己是社会的净贡献者还是净损害者,并且个人和社会努力 让他们成为净贡献者。

资源的重新分配将改善绝大多数人的福祉和生产力。 作为一名经济工程师,我自然会考虑如何从税收、借贷、企业和慈善事业中获得资金,以及资金如何流动以影响价格和经济。 例如,我考虑个人税率的变化可能如何发生,个人税率相对于公司税率的变化将如何影响资金的流动方式,以及一个地点相对于另一地点的税率变化将如何推动资金流动和结果 在他们中。 我还思考了很多关于筹集到的资金将如何使用的问题,例如,有多少资金将用于改善社会和经济成果的项目,以及有多少资金将用于再分配。 当然,此类决定将由两党委员会的人员和领导层来决定,而且对于我来说,这是一项过于复杂的工程工作,无法在这里发表意见。 不过,我可以给出我的总体倾向。 最重要的是,我希望取得良好的双底线结果。 为此,我会:

A。 建立公私合作伙伴关系(包括政府、慈善家和公司),共同审查和投资双底线项目,并根据相对于明确指标的社会和经济绩效结果来判断这些项目。 这既会增加项目的资金,也会提高项目的质量,因为那些必须自己掏钱的人将对项目负责。 (示例请参见附录。)

b. 通过考虑社会的总体成本,以改善条件和提高经济生产力的方式筹集资金(例如,我将对污染和造成健康状况不佳的各种原因征税,这些因素会给社会带来相当大的经济成本)。

C。 通过税收从上层筹集更多资金,这些税收将被设计为不会对生产率产生破坏性影响,并且将专门用于帮助中层和底层人民,主要以提高经济整体生产率水平的方式,以便用于 这些方案的费用主要来自于它们所节省的成本和增加的收入。 话虽如此,我也认为社会必须建立最低标准的医疗保健和教育,为那些无法照顾自己的人提供服务。

5.货币政策和财政政策的协调。 由于资金被堵塞在顶层,而且央行放松货币政策以扭转下一次经济衰退的能力有限,财政政策必须与货币政策更加协调,而这可以在保持美联储独立性的同时实现。 如果做得好,这既可以刺激经济增长,又可以通过将货币和信贷从储蓄和消费倾向较高的人转移到消费倾向较高的人手中,减少量化宽松对贫富差距扩大的影响。 从那些需要较少的人到那些需要更多的人。

展望未来

在评估我们所处的位置时,我们可以考虑因果关系和历史比较。 导致我们所看到的影响的最相关原因是:

导致 2008 年债务危机的高债务水平(此后不断增加)导致……

央行大量印钞并购买金融资产,推高资产价格并压低利率。 这使那些拥有金融资产的人(即富人)受益,并使央行刺激经济的权力减弱。

这些因素和新技术造成了非常大的收入/财富/机会和价值观差距,预计这些差距将会扩大并导致……

左翼民粹主义和右翼民粹主义的加剧,同时引发了更大的国内和国际冲突……

一个崛起的大国(中国)将与现有的世界霸主(美国)竞争,这将导致经济、意识形态和军事方面的竞争,并将由两个大国的相对技能和技术能力决定 。 这场竞赛将确定新的世界秩序将会是什么样子

剩下的世界

上一次出现这种影响格局是在20世纪30年代末,当时发生了巨大的冲突,经济和政治制度被推翻。 出于前面解释的根本原因,我认为我们正处于这样一个关键时刻,其中最大的问题将是我们如何处理彼此,而不是任何其他限制。

有足够的资源来处理风险问题,并创造更多平等的机会,并提高生产力,从而扩大蛋糕。 我最担心的是,双方在立场上都会顽固不化,这样资本主义要么a)被放弃,要么b)不被改革,因为右翼会争取保持现状,而左翼会反对它 。 因此,对我来说,最大的问题是:a)右翼民粹主义者或左翼民粹主义者是否会获得控制权和/或发生会对政府运作、经济和国际关系产生不利影响的冲突,或者 b)是否明智和熟练 各方人士可以共同努力,改革这个制度,让这个制度为大多数人服务。

我们很快就会更多地了解哪些路径最有可能,因为未来两年美国、英国、意大利、西班牙、法国、德国和欧洲议会都将举行决定性的选举。 结果如何将对如何处理本报告中提出的冲突产生重大影响,这将影响资金在人民、市场、国家和国家之间的流动方式,并将决定大多数人民和国家的相对优势。 我将密切关注这一切,并随时向您通报情况。

附录:我对双重底线投资的看法

我觉得我应该举一些良好的双底线投资的例子,这就是本附录的内容。 在我的慈善工作中,我一直看到巨大的双底线投资,但我只看到其中的一小部分,所以我知道还有更多。 由于我和我的妻子特别关注教育和小额信贷,因此我在这些领域的关注度比其他领域更多,尽管我们在医疗保健、刑事司法系统改革、环境保护等其他领域也接触过很多领域。例如 ,我遇到的一些好的双底线投资是:

当考虑到学生和社会的终生利益时,幼儿教育项目以政府节省成本的形式产生约 10-15% 的年回报率。 这是因为它们可以带来更好的学习成绩、更高的收入和更低的犯罪几率,所有这些都为社会带来直接的经济效益。[liii]

相对便宜的干预措施可以降低 8 年级和 9 年级高中辍学率,其成本可以达到数倍。 如果做得好,让这些年轻学生接受实用的高等教育或从事贸易工作是非常划算的。 例如,大学毕业生的终生收入比高中辍学者高出 100 万美元以上。[liv]

学校财务改革表明,每名学生的支出增加 10% 可以对低收入学生的教育成果产生有意义的影响,比高收入学生的支出产生更高的投资回报率。 总体而言,研究人员发现额外的学校支出的 IRR 约为 10%。[lv]

小额信贷。 每捐赠/投资 1 美元,大约有 12 美元会被借出、偿还,并在未来 10 年内再次借给弱势群体来创办和建立自己的企业。[lvi]

许多基础设施支出计划可以促进贸易并提高生产力/效率。 根据 33 项基础设施投资投资回报率研究,估计智能基础设施项目在增加经济活动方面的回报率为 10-20%,这使得政府借钱投资基础设施成为一项不错的交易 .[lvii]

公共卫生/预防性医疗干预措施也可以产生非常积极的投资回报率。 根据 52 项研究预防性健康计划投资回报率的研究(涵盖各种计划类型,包括疫苗、家庭血压监测、戒烟等),这些计划平均每 1 美元的成本创造 14 美元的收益。 第五十三]

由于这些领域对国家来说是巨大的双底线投资,如果在政府的支持下扩大这些领域的规模,那就太好了。 我相信慈善机构、政府和企业之间针对此类投资的合作关系是强大的,因为它们既可以增加资金数额,又可以更好地审查项目和计划。 我知道我看到了很多好的交易,我希望最大限度地提供资金,这对于政府、其他慈善家和企业来说支持成本效益高。 例如,我的妻子和我们的慈善团队目前正在制定一项协议,如果康涅狄格州捐赠 1 亿美元,并且康涅狄格州的其他慈善家和企业也捐赠 1 亿美元,达利奥慈善基金会将向康涅狄格州资金最不足的学区和小额信贷项目捐赠 1 亿美元 。 这将为我们的康涅狄格州社区带来更多的资金、更好的尽职调查、更多的合作伙伴关系,以及积极的预期净财务回报(考虑到没有很好地教育和支持我们的孩子的成本之后),从而造福于该州。

Why and How Capitalism Needs to Be Reformed

https://www.linkedin.com/pulse/why-how-capitalism-needs-reformed-parts-1-2-ray-dalio/?published=t

I was fortunate enough to be raised in a middle-class family by parents who took good care of me, to go to good public schools, and to come into a job market that offered me equal opportunity. I was raised with the belief that having equal opportunity to have basic care, good education, and employment is what is fair and best for our collective well-being. To have these things and use them to build a great life is what was meant by living the American Dream.

At age 12 one might say that I became a capitalist because that’s when I took the money I earned doing various jobs, like delivering newspapers, mowing lawns, and caddying and put it in the stock market when the stock market was hot. That got me hooked on the economic investing game which I’ve played for most of the last 50 years. To succeed at this game I needed to gain a practical understanding of how economies and markets work. My exposure to most economic systems in most countries over many years taught me that the ability to make money, save it, and put it into capital (i.e., capitalism) is the most effective motivator of people and allocator of resources to raise people’s living standards. Over these many years I have also seen capitalism evolve in a way that it is not working well for the majority of Americans because it’s producing self-reinforcing spirals up for the haves and down for the have-nots. This is creating widening income/wealth/opportunity gaps that pose existential threats to the United States because these gaps are bringing about damaging domestic and international conflicts and weakening America’s condition.

I think that most capitalists don’t know how to divide the economic pie well and most socialists don’t know how to grow it well, yet we are now at a juncture in which either a) people of different ideological inclinations will work together to skillfully re-engineer the system so that the pie is both divided and grown well or b) we will have great conflict and some form of revolution that will hurt most everyone and will shrink the pie.

I believe that all good things taken to an extreme can be self-destructive and that everything must evolve or die. This is now true for capitalism. In this report I show why I believe that capitalism is now not working for the majority of Americans, I diagnose why it is producing these inadequate results, and I offer some suggestions for what can be done to reform it. Because this report is rather long, I will present it in two parts: part one outlining the problem and part two offering my diagnosis of it and some suggestions for reform.

Why and How Capitalism Needs to Be Reformed

Before I explain why I believe that capitalism needs to be reformed, I will explain where I’m coming from, which has shaped my perspective. I will then show the indicators that make it clear to me that the outcomes capitalism is producing are inconsistent with what I believe our goals are. Then I will give my diagnosis of why capitalism is producing these inadequate outcomes and conclude by offering some thoughts about how it can be reformed to produce better outcomes.

Part 1

Where I’m Coming From

I was lucky enough to grow up in a middle-class family raised by parents who cared for me, to be educated in a good public school, and to be able to go into a job market that offered me equal opportunity. One might say that I lived the American Dream. At the time, I and most everyone around me believed that we as a society had to strive to provide these basic things (especially equal education and equal job opportunity) to everyone. That was the concept of equal opportunity, which most people believed to be both fair and productive.

I suppose I became a capitalist at age 12 because that’s when I took the money I earned from doing various jobs like delivering newspapers, mowing lawns, and caddying, and put it in the stock market when the stock market was hot in the 1960s. That got me hooked on the investing game. I went to college and graduate school even though I didn’t have enough money to pay the tuitions because I could borrow the money from a government student loan program. Then I entered a job market that provided me equal opportunity, and I was on my way.

Because I loved playing the markets I chose to be a global macro investor, which is what I’ve been for about 50 years. That required me to gain a practical understanding of how economies and markets work. Over those years, I’ve had exposure to all sorts of economic systems in most countries and have come to understand why the ability to make money, save it, and put it into capital (i.e., capitalism) is an effective motivator of people and allocator of resources that raises people’s living standards. It is an effective motivator of people because it rewards people for their productive activities with money that can be used to get all that money can buy. And it is an effective allocator of resources because the creation of profit requires that the output created is more valuable than the resources that go into creating it. Being productive leads people to make money, which leads them to acquire capital (which is their savings in investment vehicles), which both protects the saver by providing money when it is later needed and provides capital resources to those who can combine them with their ideas and convert them into the profits and productivities that raise our living standards. That is the capitalist system.

Over those many years, I have seen communism come and go and have seen that all countries that made their economies work well, including “communist China,” have made capitalism an integral part of their systems for these reasons. Communism’s philosophy of “from each according to his ability, to each according to his needs” turned out to be naïve because people were not motivated to work hard if they didn’t get commensurately rewarded, so prosperity suffered. Capitalism, which connects pay to productivity and creates efficient capital markets that facilitate savings and the availability of buying power to fuel people’s productivity, worked much better.

I’ve also studied what makes countries succeed and fail by taking a mechanistic perspective rather than an ideological one because my ability to deal with economies and markets in a practical way is what I have been scored on. If you’d like to see a summary of my research that shows what makes countries succeed and fail, it’s here (link). In a nutshell, poor education, a poor culture (one that impedes people from operating effectively together), poor infrastructure, and too much debt cause bad economic results. The best results come when there is more rather than less of: a) equal opportunity in education and in work, b) good family or family-like upbringing through the high school years, c) civilized behavior within a system that most people believe is fair, and d) free and well-regulated markets for goods, services, labor, and capital that provide incentives, savings, and financing opportunities to most people.

Naturally, I have watched these things closely over the years in all countries, especially in the US. I will now show the results that our system is producing that have led me to believe capitalism isn’t working well for most Americans.

Why I Believe That Capitalism Is Not Working Well for Most Americans

In this section, I will show you a large batch of stats and charts that paint the picture. Perhaps there are too many for your taste. If you feel that you’re getting past the point of diminishing returns, I suggest that you either quickly scan the rest by just reading the sentences in bold or skip ahead to the next section which explains why I think that not reforming capitalism would be an existential threat to the US.

To begin, I’d like to show you the differences that exist between the haves and the have-nots. Because these differences are hidden in the averages, I broke the economy into the top 40% and the bottom 60% of income earners.[1] That way we could see what the lives of the bottom 60% (i.e., the majority) look like and could compare them with those of the top 40%. What I found is shown in this study. While I suggest that you read it, I will quickly give you a bunch of stats that paint the picture here.

There has been little or no real income growth for most people for decades. As shown in the chart below on the left, prime-age workers in the bottom 60% have had no real (i.e., inflation-adjusted) income growth since 1980. That was at a time when incomes for the top 10% have doubled and those of the top 1% have tripled.[i] As shown in the chart to the right, the percentage of children who grow up to earn more than their parents has fallen from 90% in 1970 to 50% today. That’s for the population as a whole. For most of those in the lower 60%, the prospects are worse.

![[ii]](https://media.licdn.com/dms/image/C4D12AQEyA5mRGGGnqQ/article-inline_image-shrink_400_744/0/1554468748233?e=1718841600&v=beta&t=bC3kQ4KpDaRPtM3-X-dooeNNETmRBPhrGiw3w2xoS_k)

![[iii]](https://media.licdn.com/dms/image/C4D12AQEh-Al3WTCo9Q/article-inline_image-shrink_400_744/0/1554468755547?e=1718841600&v=beta&t=VOkoIUtlDMuslDC3j45QYD12UAjp_RoQMaHhZ-RLSQw)

As shown below, the income gap is about as high as ever and the wealth gap is the highest since the late 1930s. Today, the wealth of the top 1% of the population is more than that of the bottom 90% of the population combined, which is the same sort of wealth gap that existed during the 1935-40 period (a period that brought in an era of great internal and external conflicts for most countries). Those in the top 40% now have on average more than 10 times as much wealth as those in the bottom 60%.[iv] That is up from six times in 1980.

![[v]](https://media.licdn.com/dms/image/C4D12AQEhWv8wXxgx9Q/article-inline_image-shrink_400_744/0/1554468868932?e=1718841600&v=beta&t=zOApJokG_5-v4dkPH1QyRFfnfHQGWc0rJJKglxwmH8A)

The following charts show real income growth by quintiles for the overall population since 1970. Ask yourself which one you’re in. That probably has given you your perspective. My objective is to show you the broader perspective.

Most people in the bottom 60% are poor. For example, only about a third of the bottom 60% save any of their income in cash or financial assets.[vii] According to a recent Federal Reserve study, 40% of all Americans would struggle to raise $400 in the event of an emergency.[viii]

And they are increasingly getting stuck being poor. The following chart shows the odds of someone in the bottom quintile moving up to the middle quintile or higher in a 10-year period. Those odds declined from about 23% in 1990 to only 14% as of 2011.

![[ix]](https://media.licdn.com/dms/image/C4D12AQG2fZ_mZQfeUA/article-inline_image-shrink_400_744/0/1554469082717?e=1718841600&v=beta&t=8mGbCXPompP-rAcsC-w0Ok2xF8bcwqvD1IblLfry9oI)

While most Americans think of the US as being a country of great economic mobility and opportunity, its economic mobility rate is now one of the worst in the developed world for the bottom. As shown below, in the US, people in the bottom income quartile have a 40% chance of having a father in the bottom quartile (in the father’s prime earning years) and people in the top quartile have only about an 8% chance of having a father in the bottom quartile, suggesting half of the average probability of moving up and one of the worst probabilities of the countries analyzed. In a country of equal opportunity, that would not exist.

![[x]](https://media.licdn.com/dms/image/C4D12AQHFZ-YyNaFPrw/article-inline_image-shrink_1000_1488/0/1554471323042?e=1718841600&v=beta&t=CAFK7xH3n7oQKqLCEI6KVaTfmzvZP4IspfVgkQHCHnI)

One’s income growth results from one’s productivity growth, which results from one’s personal development. So let’s look at how we are developing people. Let’s start with children.

To me, the most intolerable situation is how our system fails to take good care of so many of our children. As I will show, a large number of them are poor, malnourished (physically and mentally), and poorly educated. More specifically:

- The childhood poverty rate in the US is now 17.5% and has not meaningfully improved for decades.[xi] In the US in 2017, around 17% of children lived in food-insecure homes where at least one family member was unable to acquire adequate food due to insufficient money or other resources.[xii] Unicef reports that the US is worse than average in the percent of children living in a food-insecure household (with the US faring worse than Poland, Greece, and Chile).[xiii]

The domino effects of these conditions are costly. Low incomes, poorly funded schools, and weak family support for children lead to poor academic achievement, which leads to low productivity and low incomes of people who become economic burdens on the society.

Though there are bright spots in the American education system such as our few great universities, the US population as a whole scores very poorly relative to the rest of the developed world in standardized tests for a given education level. More specifically:

- Looking at the most respected (PISA) test scores, the US is currently around the bottom 15th percentile of the developed world. As shown below, the US scores lower than virtually all developed countries other than Italy and Greece. That stands in the way of many people having adequate living standards and of US competitiveness.

![[xiv]](https://media.licdn.com/dms/image/C4D12AQGqKRvzQ_mHhA/article-inline_image-shrink_1000_1488/0/1554469241413?e=1718841600&v=beta&t=B8w3fZxPPsLtMAsSMDgD43-U7OF9vb66wXgjOEQ-LLk)

Differences in these scores are tied to poverty levels—i.e., high-poverty schools (measured by the share of students eligible for free/reduced-price lunch) have PISA test scores around 25% lower than schools with the lowest levels of poverty.

![[xv]](https://media.licdn.com/dms/image/C4D12AQHwDx-3Gr49Cw/article-inline_image-shrink_1000_1488/0/1554469275057?e=1718841600&v=beta&t=KspCd3Mtrs6FtQFbUhxAHvigohzzZrItf-UMI2ElOss)

- Among developed (i.e., OECD) countries, the US has the third-worst difference in shortages of teaching staff between advantaged and disadvantaged schools.

![[xvi]](https://media.licdn.com/dms/image/C4D12AQG-508I_23xUw/article-inline_image-shrink_1000_1488/0/1554469333951?e=1718841600&v=beta&t=XwjjGu33F0yozePJB3h0T5iL10SzNBpo7iV2Zyj__b4)

The stats that show that the US does a poor job of tending to the needs of its poor students relative to how most other countries do it are never-ending. Here are a few more:

- The proportion of disadvantaged students who have at least a year of pre-primary education is lower in the US compared to the average OECD country.[xvii]

- Among OECD countries, the US has the second-worst child poverty rate as of 2008 among single-parent households who aren’t working—a failure of the social safety net.[xviii]

These poor educational results lead to a high percentage of students being inadequately prepared for work and having emotional problems that become manifest in damaging behaviors. Disadvantaged students in the US are far more likely to report social and/or emotional issues than in most other developed countries, including not being socially integrated at school, severe test anxiety, and low satisfaction with life.

![[xix]](https://media.licdn.com/dms/image/C4D12AQE6utv4HS9-HA/article-inline_image-shrink_1000_1488/0/1554469470906?e=1718841600&v=beta&t=xdNm9-zcOwyzaIUEcFfEG--kEfqy4MW7ozZne6-aApw)

- 34% of high-poverty schools experienced high levels of chronic student absence, versus only 10% of high-income schools.[xx] Even in Connecticut, one of the wealthiest states by per capita income, 22% of youth are disengaged (i.e., either missing more than 25 days of school a year, failing two or more courses, or being suspended multiple times) or disconnected (young people not enrolled in school and without a high school degree).[xxi] Disconnected youth in Connecticut are five times more likely to end up incarcerated and 33% more likely to be struggling with substance abuse (full report linked here).

- Comparing the high school graduation rates of Connecticut school districts to child poverty rates shows a tight relationship across the state: a 1% higher child poverty rate equates to about 1% lower graduation rates.

![[xxii]](https://media.licdn.com/dms/image/C4D12AQGCJwd57TABJw/article-inline_image-shrink_1000_1488/0/1554469642742?e=1718841600&v=beta&t=6eYaYeV1Z3eJJJPFElojZSPzIHYXLewS2igCqYM_BLo)

- Across states, there is a strong relationship between spending per student and educational outcomes.

Scatters of Educational Spending and Outcomes for US States

![[xxiii]](https://media.licdn.com/dms/image/C4D12AQFx2vx_59QEQg/article-inline_image-shrink_400_744/0/1554469677602?e=1718841600&v=beta&t=Snl1fE8nRghpAhuTSlNjeUoDhPK7UiKxfI0ISLmLxtk)

- Recent research for the US suggests that children under age 5 who were granted access to food stamps experienced better health and education outcomes—an estimated 18% increase in high school graduation rates—which led them to be much less likely to rely on other welfare programs later in life.[xxiv]

- Students who come from poor families and try to go to college are less well prepared. For example, those who come from families earning less than $20,000 score on average 260 points (out of 1600) worse on the SAT than students from families earning $200,000+ do, and the gap is increasing.[xxv] The gap in test scores between children at the top and bottom of the income distribution is estimated to be 75% higher today than it was in the early 1940s, according to a 2011 study.[xxvi]

- Yet children living in poorer neighborhoods on average receive about $1,000 less state and local funding per student than those in the more prosperous neighborhoods.[xxvii] This is despite the fact that the federal government (according to its Title I funding formula) assumes it costs a district 40% more per year to educate lower-income students to the same standard as typical students.[xxviii] As a result, schools in low-income areas are typically severely underfunded. On average, in public schools 94% of teachers have to pay for supplies with their own money—often including basic cleaning supplies—and it is worse in the poorest public schools.[xxix]

- A related problem is that many teachers who have to deal with these stressful conditions are underpaid and under-respected. When I was growing up, doctors, lawyers, and teachers were the most respected professions. Now, teachers make only 68% of what other university graduates make, which is significantly less than they make in other OECD developed countries.[xxx] Even looking at weekly earnings to adjust for the length of the school year and controlling for other things that impact pay (like age and years of experience), teachers earned 19% less than comparable workers in 2017, versus only 2% less in 1994.[xxxi] Even worse, they don’t get the respect that they deserve.

The income/education/wealth/opportunity gap reinforces the income/education/wealth/opportunity gap:

- Richer communities tend to have public schools that are far better funded than poorer communities, which reinforces the income/wealth/opportunity gap. One of the main reasons for this funding gap is that the Constitution made education a state issue, and most states made local schools primarily locally funded so that rich towns have well-funded public schools and poor towns have poorly funded public schools. More specifically, around 45% of school funding comes from local governments, primarily through property taxes, while only around 8% comes from the federal government, and the rest is from state governments.[xxxii] Thus, there can be enormous variations in the wealth/income of individual communities. Also, the top 40% of income earners spend almost five times as much on their children’s education as the bottom 60% of income earners do, while those in the top 20% spend about six times as much as those in the bottom 20% do.[xxxiii]

- Underfunded public schools are suffering in quality. For instance, PISA data shows that students at US schools with significant teaching staff shortages score 10.5% worse on testing than students at schools with no teacher shortages. Similarly, a shortage of lab equipment is associated with a 16.7% drop in student scores, and shortages of library materials are associated with a 15.1% drop in student scores.[xxxiv]

- By comparison, private schools on average both spend considerably more on students and produce better outcomes. Private schools in the US spend about 70% more per student than public schools do, with the median private school spending about $23,000 per student in 2016, compared to about $14,000 for the average public school.[xxxv] This higher spending translates to higher test scores: in the last round of PISA testing, US private school students scored on average 4.3% higher than public school students across math, reading, and science exams. Over the three PISA surveys since 2009, private school students have scored on average 6.9% higher.[xxxvi]

- Not surprisingly, Americans have much less confidence in public schools today than they have had at any point over the last five decades. Today, only 29% of Americans have a “great deal” or “quite a lot” of trust in the public education system. In 1975, 62% of Americans trusted public schools.[xxxvii]

To me, leaving so many children in poverty and not educating them well is the equivalent of child abuse, and it is economically stupid.

The weakening of the family and good parental guidance has also been an important adverse influence:

Here are a few stats that convey how the family unit has changed over the years:

- In 1960, 73% of children lived with two married parents who had never been divorced, and 13% lived in a household without two married parents.[2] In 2014, the share of children living in a household without two married parents was 38% (and now less than half live in households with two parents in a first marriage). Those stats are for the average of all households in the US. The family support for those in low-education, low-income households is much less. Around 60% of children of parents with less than high school education don’t live in households with two married parents, while only 14% of children of parents who graduated college are in such households.[xxxviii]

- The probability of being incarcerated is closely related to education levels: among Americans aged 28-33, 35% of male high school dropouts have been incarcerated versus around 10% of male high school graduates and only 2% of male college graduates.[xxxix]

- Between 1991 and 2007, the number of children with a parent in state or federal prison grew 80%.[xl] Today, an estimated 2.7 million children in the US have a parent in prison or jail—that is 1 in every 28 children (3.6% of all children).[xli]

Bad childcare and bad education lead to badly behaved adults hence higher crime rates that inflict terrible costs on the society:

- The United States’ incarceration rate is nearly five times the average of other developed countries and three times that of emerging countries.[xlii] The direct cost of keeping people incarcerated is staggering and has grown rapidly: state correctional costs quadrupled over the past two decades and now top $50 billion a year, consuming 1 in every 15 general fund dollars.[xliii]

- This bad cycle perpetuates itself as criminal/arrest records make it much more difficult to find a job, which depresses earnings. Serving time, even relatively brief periods, reduces hourly wages for men by approximately 11%, the time employed by 9 weeks per year, and annual earnings by 40%.[xliv]

The health consequences and economic costs of low education and poverty are terrible:

- For example, for those in the bottom 60% premature deaths are up by about 20% since 2000.[xlv] Men from the lowest 20% of the income distribution can expect to live about 10 fewer years than men from the top 20%.[xlvi]

- The US is just about the only major industrialized country with flat/slightly rising premature death rates. The biggest contributors to that change are an increase in deaths by drugs/poisoning (having more than doubled since 2000) and an increase in suicides (up over 50% since 2000).[xlvii]

- Since 1990, the share of Americans who say that in the last year they put off medical treatment for a serious condition because of cost has roughly doubled, from 11% in 1991 to 19% today.[xlviii]

- Those who are unemployed or those making less than $35,000 per year have worse health, with 20% of each group reporting poor health, about three times the rate for the rest of the population.[xlix]

- The impacts of childhood poverty alone in the US are estimated to increase health expenditures by 1.2% of GDP.[L]

These conditions pose an existential risk for the US.

The previously described income/wealth/opportunity gap and its manifestations pose existential threats to the US because these conditions weaken the US economically, threaten to bring about painful and counterproductive domestic conflict, and undermine the United States’ strength relative to that of its global competitors.

These gaps weaken us economically because:

- They slow our economic growth because the marginal propensity to spend of wealthy people is much less than the marginal propensity to spend of people who are short of money.

- They result in suboptimal talent development and lead to a large percentage of the population undertaking damaging activities rather than contributing activities.

In addition to social and economic bad consequences, the income/wealth/opportunity gap is leading to dangerous social and political divisions that threaten our cohesive fabric and capitalism itself.

I believe that, as a principle, if there is a very big gap in the economic conditions of people who share a budget and there is an economic downturn, there is a high risk of bad conflict. Disparity in wealth, especially when accompanied by disparity in values, leads to increasing conflict and, in the government, that manifests itself in the form of populism of the left and populism of the right and often in revolutions of one sort or another. For that reason, I am worried what the next economic downturn will be like, especially as central banks have limited ability to reverse it and we have so much political polarity and populism.

The problem is that capitalists typically don’t know how to divide the pie well and socialists typically don’t know how to grow it well. While one might hope that when such economic polarity and poor conditions exist, leaders would pull together to reform the system to both divide the economic pie and make it grow better (which is certainly doable and the best path), they typically become progressively more extreme and fight more than cooperate.

In order to understand the phenomenon of populism, two years ago I did a study of it in which I looked at 14 iconic cases and observed the patterns and the forces behind them. If you are interested in it, you can read it here. In brief, I learned that populism arises when strong fighters/leaders of the right or of the left who are looking to fight and defeat the opposition come to power and escalate their conflict with the opposition, which typically galvanizes around comparably strong/fighting leaders. The most important thing to watch as populism develops is how conflict is handled—whether the opposing forces can coexist to make progress or whether they increasingly “go to war” to block and hurt each other and cause gridlock. In the worst cases, this conflict causes economic problems (e.g., via paralyzing strikes and demonstrations) and can even lead to moves from democratic leadership to autocratic leadership as happened in a number of countries in the 1930s.

We are now seeing conflicts between populists of the left and populists of the right increasing around the world in much the same way as they did in the 1930s when the income and wealth gaps were comparably large. In the US, the ideological polarity is greater than it has ever been and the willingness to compromise is less than it’s ever been. The chart on the left shows how conservative Republican senators and representatives have been and how liberal Democratic senators and representatives have been going back to 1900. As you can see, they are each more extreme and they are more divided than ever before. The chart on the right shows what percentage of them have voted along party lines going back to 1790, which is now the greatest ever. In other words, they have more polar extreme positions and they are more solidified in those positions than ever. And we are coming into a presidential election year. We can expect a hell of a battle.

![[li]](https://media.licdn.com/dms/image/C4D12AQE4RdKbeVSihg/article-inline_image-shrink_400_744/0/1554470664927?e=1718841600&v=beta&t=BtVAEc97h0gx6gTibwINB-12DpIwMrj2C4J_Foc4P2M)

It doesn’t take a genius to know that when a system is producing outcomes that are so inconsistent with its goals, it needs to be reformed. In the next part, I will explore why it is producing these substandard outcomes and what I think should be done to reform it.

Part 2

My Diagnosis of Why Capitalism Is Now Not Working Well for the Majority of People

I believe that reality works like a machine with cause/effect relationships that produce outcomes, and that when the outcomes fall short of the goals one needs to diagnose why the machine is working inadequately and then reform it. I also believe that most everything happens over and over again through history, and by observing and thinking through these patterns one can better understand how reality works and acquire timeless and universal principles for dealing with it better. I believe that the previously shown outcomes are unacceptable, so that we first need to look at how the economic machine is producing these outcomes and then think about how to reform it.

Contrary to what populists of the left and populists of the right are saying, these unacceptable outcomes aren’t due to either a) evil rich people doing bad things to poor people or b) lazy poor people and bureaucratic inefficiencies, as much as they are due to how the capitalist system is now working.

I believe that all good things taken to an extreme become self-destructive and everything must evolve or die, and that these principles now apply to capitalism. While the pursuit of profit is usually an effective motivator and resource allocator for creating productivity and for providing those who are productive with buying power, it is now producing a self-reinforcing feedback loop that widens the income/wealth/opportunity gap to the point that capitalism and the American Dream are in jeopardy. That is because capitalism is now working in a way in which people and companies find it profitable to have policies and make technologies that lessen their people costs, which lessens a large percentage of the population’s share of society’s resources. Those companies and people who are richer have greater buying power, which motivates those who seek profit to shift their resources to produce what the haves want relative to what the have-nots want, which includes fundamentally required things like good care and education for the have-not children. We just saw this exemplified in the college admissions cheating scandal.

As a result of this dynamic, the system is producing self-reinforcing spirals up for the haves and down for the have-nots, which are leading to harmful excesses at the top and harmful deprivations at the bottom. More specifically, I believe that:

- The pursuit of profit and greater efficiencies has led to the invention of new technologies that replace people, which has made companies run more efficiently, rewarded those who invented these technologies, and hurt those who were replaced by them. This force will accelerate over the next several years, and there is no plan to deal with it well.

- The pursuit of greater profits and greater company efficiencies has also led companies to produce in other countries and to replace American workers with cost-effective foreign workers, which was good for these companies’ profits and efficiencies but bad for the American workers’ incomes. Of course, this globalization also allowed less expensive and perhaps better quality foreign goods to come into the US, which has been good for both the foreign sellers and the American buyers of them and bad for the American companies and workers who compete with them.

Because of these two forces, the share of revenue that has gone to profits has increased relative to the share that has gone to the worker. The charts below show the percentage of corporate revenue that has gone to profits and the percentage that has gone to employee compensation since 1929.

![[lii]](https://media.licdn.com/dms/image/C4D12AQGIKgvbZmaycg/article-inline_image-shrink_400_744/0/1554470835568?e=1718841600&v=beta&t=Wtcq0DbJHAZ7amn1_OwcL5IngV_U8MWVuHri2aDMOXc)

3. Central banks’ printing of money and buying of financial assets (which were necessary to deal with the 2008 debt crisis and to stimulate economic growth) drove up the prices of financial assets, which helped make people who own financial assets richer relative to those who don’t own them. When the Federal Reserve (and most other central banks) buys financial assets to put money in the economy in order to stimulate the economy, the sellers of those financial assets (who are rich enough to have financial assets) a) get richer because the financial asset prices rise and b) are more likely to buy financial assets than to buy goods and services, which makes the rich richer and flush with money and credit while the majority of people who are poor don’t get money and credit because they are less creditworthy. From being in the investment business, I see that there is a glut of investment money chasing investments at the same time as there is an extreme shortage of money among most people. In other words, money is clogged at the top because if you’re one of those who has money or good ideas of how to make money you can have more money than you need because lenders will freely lend it to you and investors will compete to give it to you. On the other hand, if you’re not in financially good shape nobody will lend to you or invest in you and the government doesn’t help materially because the government doesn’t do that.

4. Policy makers pay too much attention to budgets relative to returns on investments. For example, not spending money on educating our children well might be good from a budget perspective, but it’s really stupid from an investment perspective. Looking at the funding through a budget lens doesn’t lead one to take into consideration the all-in economic picture—e.g., it doesn’t take into consideration the all-in costs to the society of having poorly educated people. While focusing on the budget is what fiscal conservatives typically do, fiscal liberals have typically shown themselves to borrow too much money and fail to spend it wisely to produce the economic returns that are required to service the debts they have taken on, so they often end up with debt crises. The budget hawk conservatives and the pro-spending/borrowing liberals have trouble focusing on, working together for, and achieving good “double bottom line” return on investments (i.e., investments that produce both good social returns and good economic returns).

What I Think Should Be Done

For the previously explained reasons, I believe that capitalism is a fundamentally sound system that is now not working well for the majority of people, so it must be reformed to provide many more equal opportunities and to be more productive. To make the changes, I believe something like the following is needed.

- Leadership from the top. I have a principle that you will not effect change unless you affect the people who have their hands on the levers of power so that they move them to change things the way you want them to change. So there need to be powerful forces from the top of the country that proclaim the income/wealth/opportunity gap to be a national emergency and take on the responsibility for reengineering the system so that it works better.

- Bipartisan and skilled shapers of policy working together to redesign the system so it works better. I believe that we will do this in a bipartisan and skilled way or we will hurt each other. So I believe the leadership should create a bipartisan commission to bring together skilled people from different communities to come up with a plan to reengineer the system to simultaneously divide and increase the economic pie better. That plan will show how to raise money and spend/invest it well to produce good double bottom line returns.

- Clear metrics that can be used to judge success and hold the people in charge accountable for achieving it. In running the things I run, I like to have clear metrics that show how those who are responsible for things are doing and have rewards and punishments that are based on how these metrics change. Having these would produce the accountability and feedback loop that are required to achieve success. To the extent possible, I’d bring that sort of accountability down to the individual level to encourage an accountability culture in which individuals are aware of whether they are net contributors or net detractors to the society, and the individuals and the society make attempts to make them net contributors.

- Redistribution of resources that will improve both the well-beings and the productivities of the vast majority of people. As an economic engineer, naturally I think about how money might be obtained from taxes, borrowing, businesses, and philanthropy, and how it would flow to affect prices and economies. For example, I think about how a change in personal tax rates might occur and how changes in them relative to corporate tax rates would affect how money would flow, and how changes in tax rates in one location relative to another location would drive flows and outcomes in them. I also think a lot about how the money raised will be spent—e.g., how much will be spent on programs that will improve both social and economic outcomes, and how much will be redistributive. Such decisions would of course be up to the people on the bipartisan commission and the leadership to decide and are way too complicated an engineering exercise for me to opine on here. I can, however, give my big picture inclinations. Above all else, I’d want to achieve good double bottom line results. To do that I’d:

a. Create private-public partnerships (including governments, philanthropists, and companies) that would jointly vet and invest in double bottom line projects that would be judged on the basis of their social and economic performance results relative to clear metrics. That would both increase the funding for and the quality of projects because people who have to put their own money on the line would be responsible for them. (For examples, see the Appendix.)

b. Raise money in ways that both improve conditions and improve the economy’s productivity by taking into consideration the all-in costs for the society (e.g., I’d tax pollution and various causes of bad health that have sizable economic costs for the society).

c. Raise more from the top via taxes that would be engineered to not have disruptive effects on productivity and that would be earmarked to help those in the middle and the bottom primarily in ways that also improve the economy’s overall level of productivity, so that the spending on these programs is largely paid for by the cost savings and income improvements that they create. Having said that, I also believe that the society has to establish minimum standards of healthcare and education that are provided to those who are unable to take care of themselves.

5. Coordination of monetary and fiscal policies. Because money is clogged at the top and because the capacity of central banks to ease enough to reverse the next economic downturn is limited, fiscal policy will have to be more coordinated with monetary policy, which can happen while maintaining the Federal Reserve’s independence. If done well, this will both stimulate economic growth and reduce the effects that quantitative easing has on increasing the wealth gap by shifting money and credit into the hands of those who have a higher propensity to spend from those who have a higher propensity to save and from those who need it less to those who need it more.

Looking Ahead

In assessing the position we are in, we can look at both cause-effect relationships and historical comparisons. The most relevant causes that are leading to the effects we are seeing are:

- The high debt levels that led to the 2008 debt crisis (and have since increased) led to…

- Central banks printing a lot of money and buying financial assets, which pushed asset prices up and pushed interest rates down. This has benefited those with financial assets (i.e., the haves) and has left central banks with less power to stimulate the economy.

- These factors and new technologies created very wide income/wealth/opportunity and values gaps, which are expected to increase and are leading to…

- Increased populism of the left and populism of the right that are causing greater domestic and international conflicts at the same time as…

- There is a rising power (China) to compete with the existing dominant world power (the United States), which will lead to competitions that will be economic, ideological, and military and will be determined by the two powers' relative skills and technological abilities. This competition will establish what the new world order will be like vis-à-vis the rest of the world.

The last time that this configuration of influences existed was in the late 1930s when there were great conflicts and economic and political systems were overturned. For the fundamental reasons explained earlier, I believe that we are at the sort of critical juncture in which the biggest issue will be how we deal with each other rather than any other constraints.

There are enough resources to go around to deal with the risky issues and produce much more equal opportunity plus improved productivity that will grow the pie. My big worry is that the sides will be intransigent in their positions so that capitalism will either a) be abandoned or b) not be reformed because those on the right will fight for keeping it as it is and those on the left will fight against it. So to me, the biggest questions are a) whether populists of the right or populists of the left will gain control and/or have conflicts that will adversely affect the operations of government, the economy, and international relations or b) whether sensible and skilled people from all sides can work together to reform the system so it works well for the majority of people.

We will soon know a lot more about which paths are most likely because over the next two years there will be defining elections in the US, the UK, Italy, Spain, France, Germany, and the European Parliament. How they turn out will have significant effects on how the conflicts raised in this report will be dealt with, which will influence how money will flow between people, markets, states, and countries and will determine the relative strengths of most people and countries. I will be paying close attention to all this and will keep you informed.

Appendix: My Perspective On Double Bottom Line Investing

I felt that I should give some examples of good double bottom line investing so that’s what this appendix is about. From doing my philanthropic work, I see great double bottom line investments all the time, and I only see a small percentage of them so I know that there are vastly more. Since my wife and I focus especially in education and microfinance, my window is more in these areas than elsewhere though we have been exposed to many in other areas such as healthcare, the reform of the criminal justice system, environmental protection, etc. For example, a few of the good double bottom line investments that I came across are:

- Early childhood education programs that produce returns of about 10-15% annualized in the form of cost savings for the government when one accounts for the lifetime benefits for the students and society. That is because they lead to better school performance, higher earnings, and lower odds of committing crimes, all of which have direct economic benefits for society.[liii]

- Relatively inexpensive interventions that lead to lower high school dropout rates in grades 8 and 9 can pay for themselves many times over. Moving these young students into practical higher education or trade jobs when done well is highly cost-effective. For example, the lifetime earnings of a college graduate are over $1 million higher than those of a high school dropout.[liv]

- School finance reforms show that a 10% increase in per-pupil spending can have a meaningful impact on educational outcomes for low-income students, producing a higher ROI than spending on higher-income students. Overall, researchers have found that additional school spending has an IRR of roughly 10%.[lv]

- Microfinance. For every dollar donated/invested in this, approximately $12 is lent, paid back, and lent again over the next 10 years to disadvantaged people to start and build their businesses.[lvi]

- Numerous infrastructure spending plans that can facilitate trade and improve productivity/efficiency. From 33 studies that looked at the ROI of infrastructure investment, it is estimated that smart infrastructure programs have a 10-20% rate of return in terms of increased economic activity, making it a good trade for the government to borrow money and invest in infrastructure.[lvii]

- Public health/preventative healthcare interventions also can have very positive ROIs. From 52 studies that looked at the ROI of preventative health programs (covering a variety of program types, including vaccines, home blood pressure monitoring, smoking cessation, etc.), on average the programs created $14 of benefit for every $1 of cost.[lviii]

Since these areas are great double bottom line investments for the country, it would be great if they were brought to scale with government support. I believe that partnerships between philanthropy, government, and business for these types of investments are powerful because they would both increase the amount of funding and result in better vetting of the projects and programs. I know that I see plenty of good deals that I’d love to maximize the funding for that would be cost-effective for governments, other philanthropists, and businesses to support. For example, my wife and our philanthropy team are now working on an agreement in which the Dalio Philanthropies will donate $100 million to programs for the most underfunded school districts and for microfinance in Connecticut if the state donates $100 million and if other philanthropists and businesses in Connecticut also donate another $100 million. That will bring more money, better due diligence, more partnership to our Connecticut community, and positive expected net financial returns (after considering the costs of not educating and supporting our children well) for the benefit of the state.

[1] Actually, we broke it into many other subcategories and then aggregated them into these two groups for simplicity in presenting the results.

[i] https://wir2018.wid.world/part-2.html

[ii] Based on data from the Current Population Survey. https://cps.ipums.org/cps/

[iii] http://www.equality-of-opportunity.org/papers/abs_mobility_paper.pdf, 34.

[iv] As of 2016; based on data from Survey of Consumer Finances.

[v] Income chart (on left) shows fiscal income shares. Data from World Inequality Database. (https://wid.world/country/usa/)

[vi] Data from Census Bureau

[vii] As of 2016; based on data from Survey of Consumer Finances.

[viii] Survey of Consumer Finances (https://www.federalreserve.gov/publications/files/2017-report-economic-well-being-us-households-201805.pdf)

[ix] https://www.minneapolisfed.org/institute/working-papers/17-06.pdf

[x] https://www.oecd.org/social/soc/Social-mobility-2018-Overview-MainFindings.pdf; estimates for China based on Kelly Labar, “Intergenerational Mobility in China”, (https://halshs.archives-ouvertes.fr/halshs-00556982/document). Note that methodologies varied between countries in the OECD study.

[xi] US Census Bureau, Current Population Survey, 1960 to 2018 Annual Social and Economic Supplements, History Poverty Tables, Table 3.(https://www.census.gov/data/tables/time-series/demo/income-poverty/historical-poverty-people.html)

[xii] https://www.ers.usda.gov/webdocs/publications/90023/err-256.pdf, 10.

[xiii] https://www.weforum.org/agenda/2017/06/these-rich-countries-have-high-levels-of-child-poverty/

[xiv] http://www.oecd.org/pisa/data/

[xv] http://www.oecd.org/pisa/data/

[xvi] OECD (2016), PISA 2015 Results (Volume I): Excellence and Equity in Education, PISA, OECD Publishing, Paris, 231.

[xvii] OECD (2017), Educational Opportunity for All: Overcoming Inequality throughout the Life Course, OECD Publishing, Paris, 46.

http://dx.doi.org/10.1787/9789264287457-en

[xviii] OECD (2017), Educational Opportunity for All: Overcoming Inequality throughout the Life Course, OECD Publishing, Paris, 60.

[xx] http://new.every1graduates.org/wp-content/uploads/2018/09/Data-Matters_083118_FINAL-2.pdf

[xxiii] Poverty data from Census Bureau SAIPE School District Estimates (https://www.census.gov/data/datasets/2013/demo/saipe/2013-school-districts.html); graduation rates from Hechinger Report (https://hechingerreport.org/the-gradation-rates-from-every-school-district-in-one-map/)

[xxiv] Note: Spending data is from the US Census Bureau and is current as of 2016. Test scores and proficiency data are from “National Report Card” assessments and are meant to be comparable across states. Data is from 2013. Only a limited sample of states have data for this Grade 12 assessment.

[xxiv] https://www.cbpp.org/research/food-assistance/snap-is-linked-with-improved-nutritional-outcomes-and-lower-health-care

[xxv] https://blogs.wsj.com/economics/2014/10/07/sat-scores-and-income-inequality-how-wealthier-kids-rank-higher/

[xxvi] https://cepa.stanford.edu/sites/default/files/reardon%20whither%20opportunity%20-%20chapter%205.pdf , 8.

[xxvii] https://edtrust.org/wp-content/uploads/2014/09/FundingGapReport_2018_FINAL.pdf, 4.

[xxviii] https://edtrust.org/wp-content/uploads/2014/09/FundingGapReport_2018_FINAL.pdf, 7.

[xxix] https://www.usatoday.com/story/money/personalfinance/2018/05/15/nearly-all-teachers-spend-own-money-school-needs-study/610542002/

[xxx] OECD (2017), "D3.2a. Teachers' actual salaries relative to wages of tertiary-educated workers (2015)", in The Learning Environment and Organisation of Schools, OECD Publishing, Paris, https://doi.org/10.1787/eag-2017-table196-en.

[xxxi] https://www.epi.org/publication/teacher-pay-gap-2018/

[xxxii] https://nces.ed.gov/programs/coe/indicator_cma.asp

[xxxiii] Data based on Consumer Expenditure Survey

[xxxiv] http://www.oecd.org/pisa/data/

[xxxv] Private school spending data from: https://www.nais.org/statistics/pages/nais-independent-school-facts-at-a-glance/ ; Public school spending data from: https://www.statista.com/statistics/203118/expenditures-per-pupil-in-public-schools-in-the-us-since-1990/

[xxxvi] http://www.oecd.org/pisa/data/

[xxxvii] https://news.gallup.com/poll/1612/education.aspx

[2] The remaining 14% lived with two parents in remarriages.

[xxxviii] http://www.pewsocialtrends.org/2015/12/17/1-the-american-family-today/

[xxxix] https://www.brookings.edu/research/twelve-facts-about-incarceration-and-prisoner-reentry/, 10

[xli] The Pew Charitable Trusts, Collateral Costs: Incarceration’s Effect on Economic Mobility, https://www.pewtrusts.org/~/media/legacy/uploadedfiles/pcs_assets/2010/collateralcosts1pdf.pdf, 4.

[xlii] Calculations based on data from “World Prison Brief Database.” (http://www.prisonstudies.org/highest-to-lowest/prison_population_rate?field_region_taxonomy_tid=All)

[xliii] https://www.pewtrusts.org/~/media/legacy/uploadedfiles/pcs_assets/2010/collateralcosts1pdf.pdf, 2.

[xliv] https://www.pewtrusts.org/~/media/legacy/uploadedfiles/pcs_assets/2010/collateralcosts1pdf.pdf, 4.

[xlv] As of 2015; Bridgewater analysis, based on data from the CDC (https://www.cdc.gov/nchs/data_access/VitalStatsOnline.htm#Mortality_Multiple)

[xlvi] Chetty, Raj, et al., “The Association Between Income and Life Expectancy in the United States, 2001-2014”, Journal of the American Medical Association, 2016.

[xlvii] As of 2015; Bridgewater analysis, based on data from the CDC (https://www.cdc.gov/nchs/data_access/VitalStatsOnline.htm#Mortality_Multiple)

[xlviii] https://news.gallup.com/poll/4708/healthcare-system.aspx

[xlix] https://ftp.cdc.gov/pub/Health_Statistics/NCHS/NHIS/SHS/2014_SHS_Table_A-11.pdf

[l] https://www.americanprogress.org/issues/poverty/reports/2007/01/24/2450/the-economic-costs-of-poverty/

[li] https://voteview.com/data

[lii] Based on data from the Bureau of Economic Analysis

[liii] https://heckmanequation.org/resource/research-summary-lifecycle-benefits-influential-early-childhood-program/

[liv] http://cdn.ey.com/parthenon/pdf/perspectives/Parthenon-EY_Untapped-Potential_Dalio-Report_final_092016_web.pdf

[lv] For the purposes of this study, “low-income” students were defined as students whose family income was below 2x the poverty line at any point during their childhood. The study’s projections are based on comparing the life outcomes of children that were impacted by major school finance reforms in 28 states between 1971 and 2010 with those of similar children who were unaffected by the reforms. See https://academic.oup.com/qje/article/131/1/157/2461148

[lvi] Sourced from Grameen America standard 26-week loan amortization schedule, assuming full reinvestment of principal repayments over 5 years

[lvii] https://www.epi.org/publication/the-potential-macroeconomic-benefits-from-increasing-infrastructure-investment/

[lviii] https://www.ncbi.nlm.nih.gov/pmc/articles/PMC5537512/